================================================

In the complex and volatile world of modern markets, risk-averse quantitative trading has become an essential discipline for both retail and institutional investors. Traders and portfolio managers are increasingly turning to quantitative methods that prioritize risk control without sacrificing long-term profitability. This guide provides a comprehensive framework for practicing risk-averse strategies, blending professional insights, proven techniques, and the latest industry developments.

Understanding Risk-Averse Quantitative Trading

What Does Risk-Averse Mean in Trading?

Being risk-averse in trading does not mean avoiding risks altogether—it means minimizing unnecessary exposure while still participating in market opportunities. Risk-averse traders use data-driven strategies, hedging techniques, and systematic controls to protect capital.

Why Choose Risk-Averse Quantitative Methods

The crypto and equity markets are notoriously volatile, and even skilled traders can face devastating losses without risk management. By implementing risk-averse quantitative strategies, investors:

- Reduce downside exposure.

- Smooth portfolio volatility.

- Improve the probability of consistent returns.

For traders asking why are risk-averse strategies important in trading, the answer is clear: they help preserve capital, ensuring longevity and resilience in the market.

Key Principles of Practicing Risk-Averse Quantitative Trading

1. Prioritizing Capital Preservation

Capital preservation is the foundation of any risk-averse system. Every decision—from position sizing to stop-loss placement—must protect the core portfolio value.

2. Incorporating Diversification

Diversification across assets, sectors, and even strategies helps mitigate correlated risks. For instance, balancing exposure between equities, bonds, and cryptocurrencies can reduce volatility.

3. Using Data-Driven Models

Quantitative tools allow for systematic evaluation of risks. Models incorporate volatility measures, Value-at-Risk (VaR), and expected shortfall to anticipate potential drawdowns.

4. Applying Stop-Loss and Drawdown Limits

Automated execution platforms can enforce strict stop-losses and maximum drawdown limits, ensuring discipline even under emotional stress.

Two Main Strategies for Risk-Averse Quantitative Trading

Strategy 1: Low-Volatility Factor Investing

Overview

Low-volatility factor investing involves targeting assets with historically lower volatility, reducing portfolio drawdowns while maintaining competitive returns.

Advantages

- Provides smoother performance during market downturns.

- Ideal for long-term investors with moderate return expectations.

Disadvantages

- May underperform in aggressive bull markets.

- Relies heavily on historical volatility patterns, which may shift.

Strategy 2: Hedging with Options and Futures

Overview

Risk-averse traders often use derivatives to hedge positions. For example, buying protective puts or shorting futures against long positions creates downside protection.

Advantages

- Reduces exposure to sudden adverse price movements.

- Flexible—can be tailored to specific portfolio needs.

Disadvantages

- Hedging costs reduce net profits.

- Requires advanced knowledge and precise execution.

Comparing the Two Approaches

- Low-Volatility Factor Investing is simple and effective for passive investors and institutions seeking consistent risk-adjusted returns.

- Hedging with Derivatives is more complex but offers precision and flexibility for professionals and hedge funds.

A balanced approach often involves combining both: stable low-volatility assets with derivative-based hedges for unexpected shocks.

Practical Steps for Practicing Risk-Averse Quantitative Trading

Step 1: Define Risk Tolerance

Before building models, traders must define maximum acceptable drawdowns and volatility levels.

Step 2: Build Diversified Strategies

Blend low-risk assets with hedging overlays.

Step 3: Backtest Thoroughly

Run simulations across different market conditions to test the robustness of strategies.

Step 4: Monitor Continuously

Markets evolve. Traders must adapt models regularly to maintain performance.

Step 5: Use Automated Execution

Automation enforces discipline, ensuring strategies remain consistent with risk parameters.

Industry Trends in Risk-Averse Quantitative Practices

- AI-Powered Risk Management – Machine learning models can identify early warning signals of market stress.

- Scenario-Based Stress Testing – Traders now model portfolio behavior under extreme events (e.g., 2008 crash scenarios).

- Integration of ESG Factors – Sustainable investing adds another layer of risk aversion, mitigating reputational and regulatory risks.

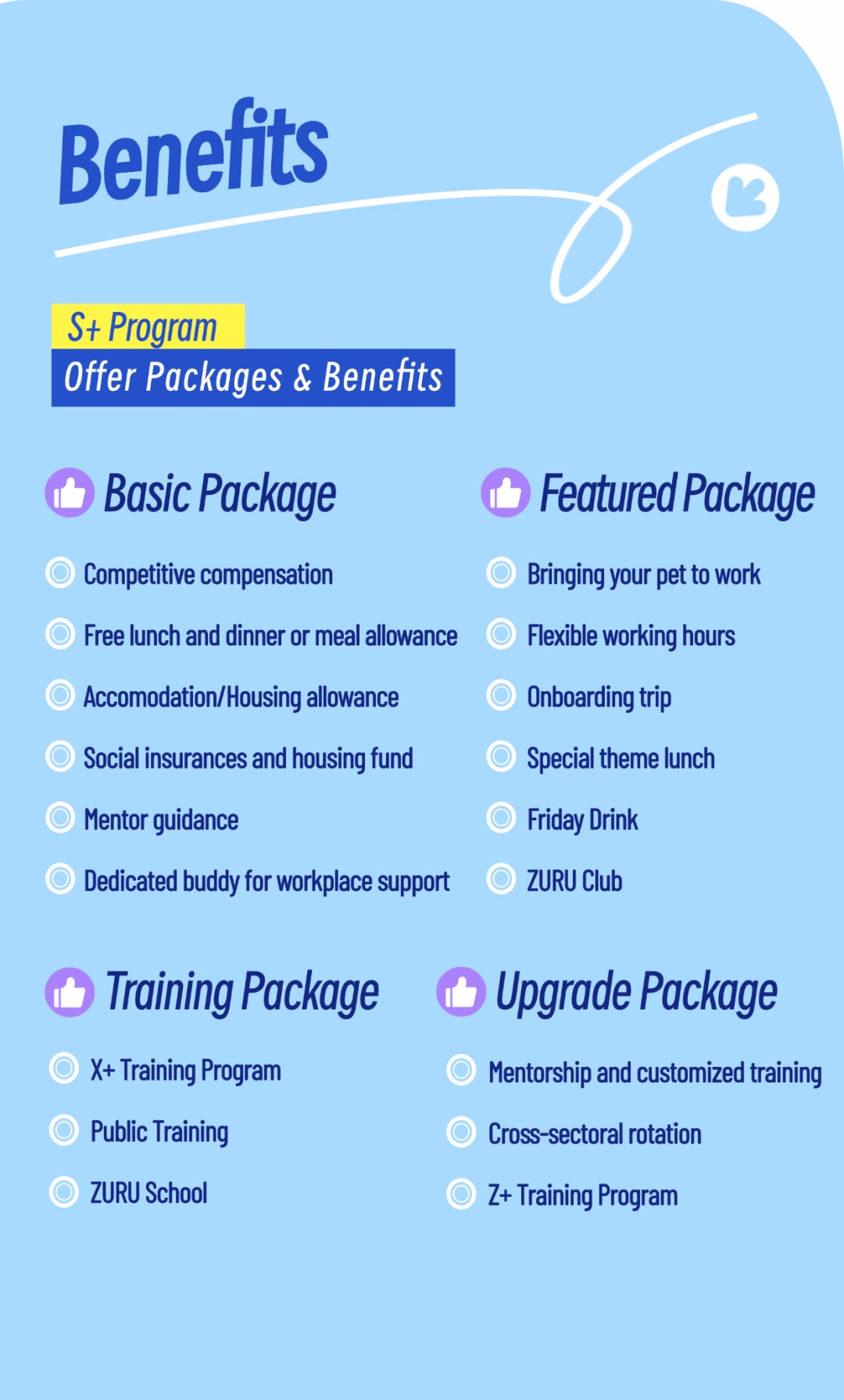

Images for Better Understanding

Risk-averse quantitative trading process

Comparison of low-volatility investing vs. hedging with derivatives

Portfolio diversification for risk-averse trading

FAQ: Risk-Averse Quantitative Trading

1. How does risk-aversion impact trading decisions?

Risk-aversion leads traders to prioritize capital protection over aggressive profit-seeking. It influences decisions such as smaller position sizes, lower leverage, and choosing less volatile assets. Traders who adopt this mindset often experience fewer emotional stress points and steadier returns.

2. Where to find risk-averse trading strategies?

Risk-averse strategies can be found through financial literature, quantitative research papers, and specialized platforms. Many hedge funds publish white papers, and online platforms provide accessible models. Retail traders can also join communities dedicated to step-by-step risk-averse quantitative methods.

3. How to minimize losses with risk-averse techniques?

Losses are minimized by combining diversification, hedging, and strict stop-losses. Quantitative risk models help identify when risk levels exceed acceptable thresholds. Automated trading systems enforce discipline, preventing emotional overreactions.

4. What are the benefits of risk-averse trading?

Key benefits include smoother equity curves, lower volatility, and psychological comfort for traders. By reducing drawdowns, risk-averse methods also preserve compounding potential, ensuring long-term wealth growth.

Conclusion: Mastering Risk-Averse Quantitative Trading

Practicing risk-averse quantitative trading is about striking the right balance between safety and opportunity. By applying systematic models, low-volatility investing, and derivative hedges, traders can secure consistent performance in uncertain markets.

For beginners, starting with diversification and simple low-volatility strategies is recommended. Advanced traders can integrate options-based hedging and AI-driven risk models for optimal results.

If you found this guide insightful, share it with your network, leave a comment about your own experience, and start a conversation on how risk-aversion has shaped your trading journey. Together, we can refine strategies for safer and more profitable markets.

Would you like me to also create a downloadable “Risk-Averse Trading Toolkit” checklist (covering risk models, metrics, and tools) that traders can use as a practical reference?