Introduction

The financial markets have evolved rapidly with the integration of artificial intelligence and machine learning. Among these technologies, neural networks have become indispensable for trading system developers aiming to build predictive, adaptive, and high-performing trading systems. By leveraging historical market data, alternative data sources, and algorithmic strategies, neural networks provide a robust framework for enhancing accuracy, risk management, and automation in trading operations.

This guide explores advanced applications of neural networks in trading, highlighting strategies, practical implementation tips, and insights for both retail and institutional developers.

Understanding Neural Networks in Trading

What Are Neural Networks?

Neural networks are computational models inspired by the human brain. They consist of layers of interconnected nodes (neurons) that process input data to detect patterns and make predictions. In trading systems, neural networks can:

- Predict Market Trends: By analyzing historical price movements and volume.

- Detect Patterns: Recognize complex price action patterns, including microstructural signals.

- Optimize Strategy Execution: Enhance algorithmic trading performance through adaptive learning.

Why Neural Networks Are Critical for Trading System Developers

Neural networks allow developers to model non-linear relationships, which traditional statistical models often fail to capture. They are particularly valuable in environments with high volatility, complex correlations, and rapid market changes.

Key benefits include:

- Adaptive Learning: Continuous model retraining with new market data.

- Pattern Recognition: Detect subtle market anomalies before conventional signals.

- Quantitative Trading Enhancements: Improve predictive accuracy, risk-adjusted returns, and strategy optimization.

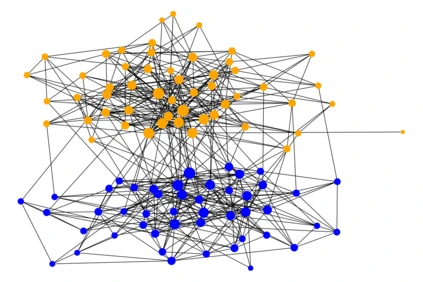

Visualization of neural network architecture applied to financial market analysis.

Neural Network Approaches for Trading System Development

Approach 1: Supervised Learning Models

Description

Supervised learning involves training neural networks on labeled datasets to predict future asset prices or classify market conditions.

Implementation Steps

- Data Collection: Gather historical price data, order books, and market indicators.

- Feature Engineering: Include technical indicators, macroeconomic data, and sentiment analysis.

- Model Training: Use architectures like LSTM (Long Short-Term Memory) or CNN (Convolutional Neural Networks) for sequence and pattern recognition.

- Validation & Backtesting: Ensure predictive performance is robust against unseen market conditions.

Advantages

- High predictive accuracy in identifying trends and reversals.

- Can incorporate multiple data sources for comprehensive analysis.

Considerations

- Requires large, high-quality datasets.

- Prone to overfitting if the model is overly complex or training data is limited.

Approach 2: Reinforcement Learning-Based Models

Description

Reinforcement learning (RL) enables neural networks to make sequential trading decisions by maximizing cumulative rewards in simulated market environments.

Implementation Steps

- Environment Simulation: Create realistic trading environments with transaction costs and slippage.

- Agent Design: Develop neural network agents that learn optimal trading actions (buy, sell, hold).

- Reward Function: Define rewards based on profit, risk-adjusted returns, or Sharpe ratios.

- Policy Optimization: Train agents using algorithms like Deep Q-Networks (DQN) or Proximal Policy Optimization (PPO).

Advantages

- Capable of developing adaptive strategies in dynamic markets.

- Incorporates risk management directly into decision-making.

Considerations

- Computationally intensive and requires extensive simulation data.

- Strategy performance may vary in live markets due to unmodeled market events.

Diagram of reinforcement learning applied to adaptive trading strategy development.

Tools and Frameworks for Developers

Popular Neural Network Platforms

- TensorFlow & Keras: Flexible frameworks for designing deep learning models.

- PyTorch: Efficient for dynamic computational graphs and rapid prototyping.

- Trading-Specific Libraries: Libraries such as Backtrader or Zipline integrate neural network outputs into trading execution systems.

Best Practices for Implementation

- Regular Model Retraining: Update models with the latest market data to maintain predictive accuracy.

- Cross-Validation: Use walk-forward testing to ensure robustness across different market regimes.

- Feature Selection: Combine price, volume, macroeconomic, and alternative data for multi-dimensional insights.

Comparative Analysis: Supervised vs. Reinforcement Learning

| Approach | Strengths | Weaknesses | Suitable For |

|---|---|---|---|

| Supervised Learning | Accurate trend prediction, interpretable | Requires labeled data, risk of overfitting | Short-term forecasting, pattern recognition |

| Reinforcement Learning | Adaptive, risk-aware decision making | Computationally heavy, simulation-dependent | Dynamic strategy development, portfolio optimization |

Understanding how neural networks improve quantitative trading helps developers choose the right approach based on strategy requirements and data availability.

Real-World Applications

- Algorithmic Hedge Funds: Use LSTM networks to predict intraday price movements and optimize execution.

- Retail Trading Platforms: Integrate neural network models to provide predictive signals to users.

- Forex and Commodity Trading: CNNs analyze candlestick patterns and microstructural signals to enhance trade timing.

Examples of neural network applications across equities, forex, and commodity markets.

Risk Management in Neural Network Trading

Techniques

- Stop-Loss Integration: Neural network signals combined with traditional risk controls.

- Position Sizing Algorithms: Adjust trade sizes based on confidence levels predicted by models.

- Ensemble Models: Combine outputs from multiple networks to reduce model-specific risks.

Evaluation Metrics

- Sharpe Ratio and Sortino Ratio: Measure risk-adjusted returns.

- Maximum Drawdown: Evaluate downside risk exposure.

- Prediction Accuracy vs. Profitability: Balance signal precision with practical execution outcomes.

FAQ

1. Can beginners use neural networks for trading systems?

Yes. Beginners can start with supervised learning models using historical price data and simple architectures. Starting with neural networks for beginner quantitative traders courses can provide structured learning pathways.

2. How do neural networks predict market trends?

By analyzing historical patterns and correlations, neural networks detect complex non-linear relationships that traditional statistical models often miss. LSTM networks, for instance, are adept at time-series prediction for trend forecasting.

3. Are reinforcement learning models suitable for live trading?

RL models excel in simulations, but live deployment requires careful adjustment for slippage, transaction costs, and real-world uncertainties. Combining RL with supervised models often improves real-market robustness.

Conclusion

For trading system developers, neural networks offer a powerful toolkit to:

- Enhance predictive accuracy and market signal detection.

- Build adaptive and automated trading strategies.

- Integrate risk management into model-based trading decisions.

By leveraging neural network approaches to financial forecasting and combining supervised and reinforcement learning techniques, developers can create robust, high-performing trading systems capable of navigating complex and volatile markets.

Summary of neural network strategies, applications, and best practices for trading system developers.

This guide equips developers with practical insights, advanced strategies, and actionable steps to integrate neural networks into modern trading system development.