Introduction

In modern trading, having timely and accurate trade signals can make the difference between profitable trades and missed opportunities. With the rise of online platforms offering trade signals, traders now have access to actionable insights in real time, whether they operate in forex, stocks, cryptocurrencies, or commodities.

This comprehensive guide explores the best ways to leverage online trade signals, comparing strategies, analyzing platforms, and providing practical advice for traders of all experience levels. Additionally, we will cover how to interpret trading signals and where to find reliable trade signals to ensure your strategies are backed by quality data.

Understanding Trade Signals

What Are Trade Signals?

Trade signals are alerts generated through analysis of market data, technical indicators, or algorithmic models, suggesting when to buy or sell an asset. They are typically delivered via:

- Email or mobile notifications

- Trading platforms dashboards

- API connections for automated systems

Trade signals can be derived from technical analysis, fundamental analysis, or AI-driven predictive models.

Why Are Trade Signals Important

- Speed: Signals can alert traders to opportunities faster than manual monitoring.

- Accuracy: Properly verified signals reduce emotional decision-making.

- Strategy Support: Signals help implement complex strategies such as swing trading, scalping, or algorithmic execution.

Illustration showing how trade signals flow from data analysis to trader execution.

Types of Online Trade Signal Platforms

Platform 1: Subscription-Based Signal Services

Features

- Real-time alerts for multiple asset classes

- Algorithmic or human-generated recommendations

- Historical performance reports and statistics

Advantages

- Consistent access to curated signals

- Usually includes risk management tips and tutorials

- Customer support and community insights

Disadvantages

- Subscription fees can be high

- Quality varies between providers; due diligence is necessary

Platform 2: Free or Freemium Platforms

Features

- Basic signals for selected assets

- Limited features compared to premium services

- Often supported by ads or affiliate links

Advantages

- Accessible for beginners with limited budgets

- Provides an opportunity to test signal quality before subscribing

Disadvantages

- Limited data and alerts

- Less reliability and fewer customization options

Comparison of features between subscription-based and free trade signal platforms.

Methods to Use Trade Signals Effectively

Strategy 1: Manual Interpretation and Execution

- Analyze received signals using charts and indicators.

- Confirm signal with technical or fundamental analysis before executing trades.

- Best suited for traders who want control over decision-making.

Pros:

- Allows critical evaluation of each signal.

- Reduces dependency on platform algorithms alone.

Cons:

- Requires time and expertise.

- Can be slower than automated solutions.

Strategy 2: Automated Signal Integration

- Signals are fed directly into trading software or APIs.

- Allows algorithmic execution according to predefined rules.

- Suitable for day traders, scalpers, and algorithmic trading enthusiasts.

Pros:

- Rapid execution with minimal latency.

- Can handle high-frequency opportunities efficiently.

Cons:

- Requires programming skills and setup of trading bots.

- Risk of over-reliance on signal accuracy.

Diagram showing manual versus automated signal execution approaches.

Evaluating Online Trade Signal Providers

How to Choose a Signal Provider

- Track Record: Check historical performance and verification methods.

- Transparency: Look for detailed explanations of signal generation.

- Support and Community: Providers with active communities offer insights and peer verification.

- Trial Periods: Test the signals before committing financially.

Common Pitfalls to Avoid

- Following unverified free signals blindly.

- Ignoring market context and relying solely on signals.

- Falling for unrealistic profitability claims or scams.

Advanced Signal Utilization Techniques

Combining Signals with Personal Analysis

- Use signals as a foundation, then apply your technical analysis.

- Integrate signals with portfolio risk management strategies.

- Customize alerts based on preferred timeframes and asset classes.

Signal-Based Algorithmic Trading

- Connect trade signals directly to automated trading bots.

- Implement rules for stop-loss, take-profit, and position sizing.

- Optimize performance through backtesting and scenario analysis.

Chart showing the integration of trade signals with automated trading strategies and optimization feedback loops.

Recommended Learning Resources

- Signal Analysis Courses: Structured learning to interpret and apply trade signals effectively.

- Community Forums and Groups: Peer discussions and real-time insights.

- Platform Tutorials: Step-by-step guides for setting up alerts and dashboards.

Tip: Consistently review how to interpret trading signals to refine decision-making and maximize the benefit of signal-based strategies.

FAQ

1. Where can I find reliable trade signals?

Reliable trade signals can be found through verified subscription services, reputable trading platforms, and educational communities. Look for providers with transparent performance records and third-party verification.

2. How do I verify the accuracy of trading signals?

Check historical performance against market data, compare results across multiple providers, and test signals in demo or paper trading environments before deploying real capital.

3. Why use algorithmic signals for trading?

Algorithmic signals can process large datasets in real time, identify patterns humans might miss, and allow for rapid execution of trades. This enhances efficiency and reduces emotional bias.

Conclusion

Online platforms offering trade signals have transformed modern trading by providing faster, data-driven insights. By understanding the types of platforms, strategies for manual or automated execution, and evaluation methods, traders can maximize profitability while mitigating risks.

Whether a beginner or professional, leveraging signals in combination with personal analysis and risk management ensures informed and strategic trading decisions. Engage with the content, experiment with platforms, and share your experiences to grow within the trading community.

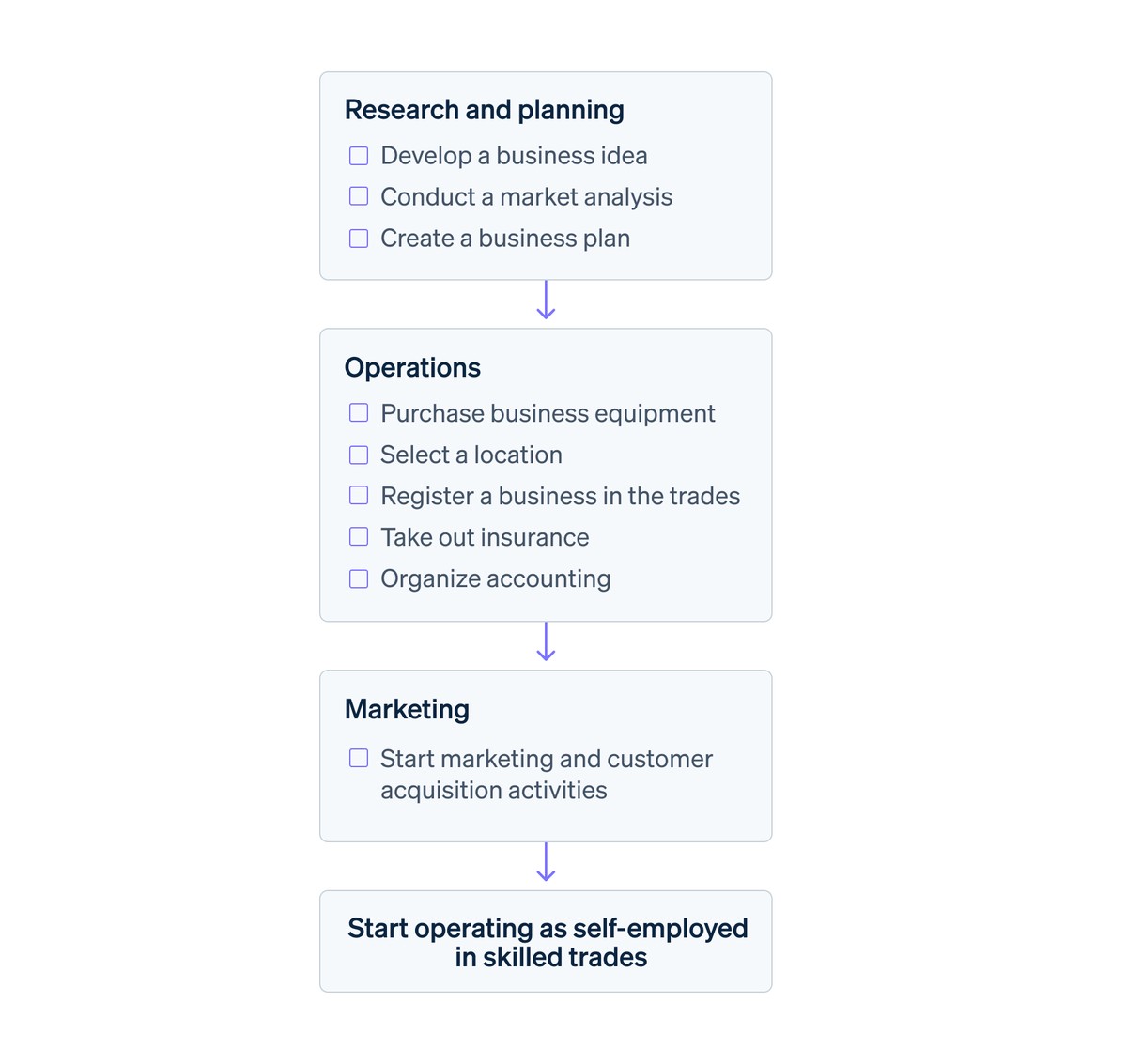

Comprehensive roadmap for utilizing trade signals from selection to execution and optimization.