==================================================================================================================

Momentum, a core concept in finance and economics, has gained increasing attention among academic researchers due to its strong predictive power in market behavior. Momentum-based strategies, primarily rooted in quantitative finance, suggest that assets that have performed well in the past will continue to perform well in the short term, and vice versa for underperforming assets. Understanding momentum concepts is crucial for researchers aiming to develop strategies for market forecasting, risk management, and portfolio optimization. This article delves into the essence of momentum, its application in academic research, and offers insights into how academic researchers can incorporate momentum analysis into their work.

What Is Momentum in Financial Markets?

Momentum refers to the tendency of assets to persist in the direction of their recent price trends. For example, stocks that have risen in value over the past few months tend to continue rising, while those that have fallen often continue their decline. In financial markets, momentum is a well-documented phenomenon and has been used to explain various aspects of asset price movements.

Momentum in Trading: A Key Factor in Quantitative Finance

In quantitative finance, momentum trading strategies exploit this trend-following behavior. By using sophisticated algorithms and data-driven models, quantitative traders aim to identify and capitalize on price momentum to maximize profits. Momentum is commonly measured using price-based indicators, such as moving averages or relative strength indexes (RSI), which help researchers identify periods when assets are likely to continue their upward or downward trajectories.

Why Is Momentum Important for Academic Researchers?

For academic researchers, momentum is more than just a trading strategy—it’s an important concept for understanding market behavior, investor psychology, and market efficiency. The academic exploration of momentum provides valuable insights into market anomalies, and it has been the subject of extensive research in areas like asset pricing models, behavioral finance, and portfolio theory.

Momentum vs. Other Market Factors: How Does Momentum Differ?

Momentum is often compared with other market factors like value and size, which are also critical in determining asset performance. While value investing focuses on buying undervalued stocks with strong fundamentals, and size investing capitalizes on the “small stock effect,” momentum strategies focus solely on price trends rather than fundamentals.

In academic research, momentum can be contrasted with other factors to determine its robustness across different time horizons, market conditions, and asset classes. Understanding the relationship between momentum and other factors is a key area of study for academic researchers.

Theoretical Foundation of Momentum in Academic Research

Understanding the theoretical foundation of momentum is essential for academic researchers looking to apply it in financial models or trading systems. The two primary explanations for momentum in the financial markets are behavioral finance and market efficiency theory.

1. Behavioral Finance Explanation

Behavioral finance suggests that momentum exists due to psychological biases and herd behavior. Investors tend to overreact to recent news and trends, either buying into a rising asset or selling off a falling asset due to anchoring bias or herding behavior. This leads to the continuation of price trends, thus creating momentum.

- Anchoring bias: Investors tend to rely too heavily on recent price movements when making investment decisions.

- Herd behavior: Investors tend to follow the actions of other traders, leading to exaggerated price trends.

2. Market Efficiency Theory

From the perspective of market efficiency, momentum could be a result of slower price adjustments. Although markets are efficient in the long term, some investors may react slowly to information, allowing momentum to persist in the short run. The delayed adjustment of prices could explain why momentum strategies work even in highly efficient markets.

Momentum Concepts in Quantitative Models

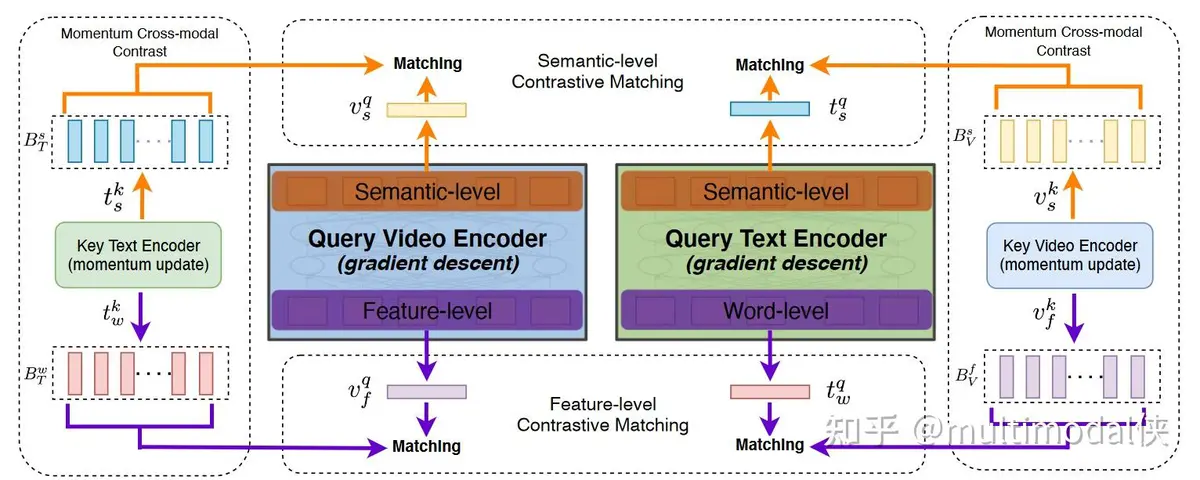

For academic researchers, momentum is often integrated into quantitative models that analyze and forecast asset prices. Researchers often explore how momentum interacts with other quantitative factors like volatility, liquidity, and market sentiment. By incorporating momentum into their models, they can enhance predictive accuracy and risk-adjusted returns.

- Factor models: Momentum is often treated as a factor in multi-factor models that explain asset returns. Researchers use momentum alongside other factors (e.g., size, value, and volatility) to create comprehensive models.

- Machine learning and AI: With the rise of machine learning in financial research, many researchers now use supervised learning algorithms to predict future momentum based on historical data. Machine learning models can uncover hidden patterns in momentum and forecast its behavior with high precision.

Strategies for Implementing Momentum in Research

For academic researchers, applying momentum analysis involves several methodologies, tools, and data sources. Below are two strategies that researchers can implement to analyze momentum and improve their research outcomes:

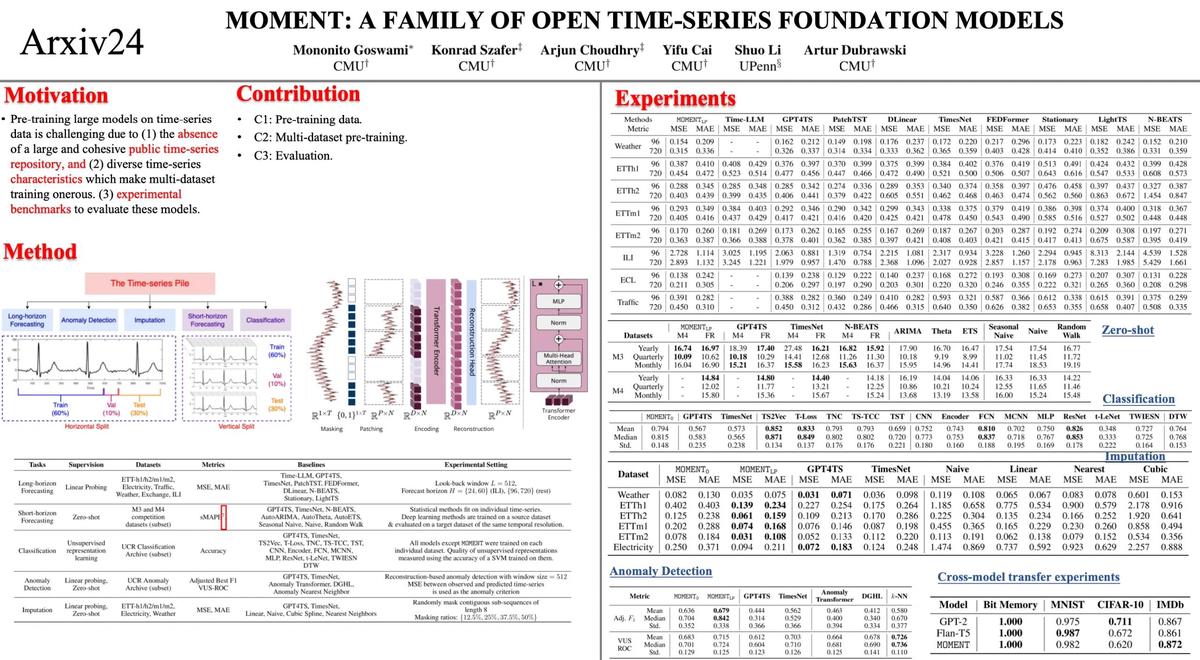

1. Time-Series Momentum Analysis

Time-series analysis involves examining the historical price trends of an asset over time. Researchers can measure momentum by calculating the rate of change in asset prices over a specific period, typically using indicators such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). These indicators help identify periods of overbought or oversold conditions, which are indicative of momentum.

Advantages:

- Simplicity: Time-series momentum analysis is straightforward to implement and understand.

- Popularity: Many traditional academic models and frameworks rely on time-series analysis.

- Simplicity: Time-series momentum analysis is straightforward to implement and understand.

Disadvantages:

- Short-term focus: Time-series models can be limited in capturing long-term momentum trends.

- Data sensitivity: Momentum models can be highly sensitive to the choice of time window and data frequency.

- Short-term focus: Time-series models can be limited in capturing long-term momentum trends.

2. Cross-Sectional Momentum

Cross-sectional momentum compares the performance of multiple assets at the same point in time. Researchers use this approach to identify which assets are outperforming others and are likely to continue doing so. This strategy involves ranking assets based on their relative returns over a given period and selecting those with the strongest positive momentum.

Advantages:

- Broader scope: Cross-sectional momentum allows for comparisons across different assets, improving the robustness of findings.

- Useful in portfolio construction: This approach is widely used in factor investing, where assets with strong momentum are overweighted in a portfolio.

- Broader scope: Cross-sectional momentum allows for comparisons across different assets, improving the robustness of findings.

Disadvantages:

- Requires large datasets: Cross-sectional analysis typically requires substantial datasets, especially when applied across multiple asset classes.

- Complexity: The methodology can be complex and may require advanced statistical tools for implementation.

- Requires large datasets: Cross-sectional analysis typically requires substantial datasets, especially when applied across multiple asset classes.

Momentum Research Tools for Academic Analysts

There are several tools that academic researchers can leverage to analyze momentum in financial markets. Some of these tools include:

1. Statistical Software (e.g., R, Python)

Both R and Python are widely used in academic research for momentum analysis. Researchers can use these programming languages to implement momentum-based trading strategies, backtest models, and conduct statistical analysis.

Advantages:

- Flexibility: Both languages provide extensive libraries for statistical analysis and machine learning.

- Community support: R and Python are supported by vibrant research communities, making it easy to find resources and collaborate.

- Flexibility: Both languages provide extensive libraries for statistical analysis and machine learning.

Disadvantages:

- Steep learning curve: For newcomers, mastering statistical packages and coding can be challenging.

- Steep learning curve: For newcomers, mastering statistical packages and coding can be challenging.

2. Momentum Indicators and Analytics Platforms

There are numerous commercial and open-source platforms for momentum analysis, including MetaTrader, TradingView, and QuantConnect. These platforms offer pre-built momentum indicators and backtesting features that allow researchers to implement strategies quickly.

Advantages:

- Ready-made tools: These platforms offer built-in technical indicators for momentum analysis.

- User-friendly: Many platforms offer intuitive interfaces, reducing the need for programming.

- Ready-made tools: These platforms offer built-in technical indicators for momentum analysis.

Disadvantages:

- Limited customization: Researchers may be restricted by the tools offered on the platform.

- Subscription costs: Advanced features may require paid subscriptions.

- Limited customization: Researchers may be restricted by the tools offered on the platform.

Frequently Asked Questions (FAQ)

1. What are the best momentum indicators for academic research?

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are two of the most popular momentum indicators in academic research. Both are simple to use, well-documented, and widely accepted in the academic community for measuring momentum.

2. How do I incorporate momentum analysis into my research?

You can incorporate momentum analysis into your research by applying time-series models to historical price data, using cross-sectional analysis to compare asset performance, or utilizing machine learning techniques to predict future momentum. Several tools and software platforms, such as R, Python, and MetaTrader, can help in this process.

3. How does momentum impact quantitative trading?

Momentum is a core factor in quantitative trading, as it helps traders identify trends and make informed predictions about future price movements. By understanding and quantifying momentum, researchers can develop trading algorithms that capitalize on trend-following behaviors, improving risk-adjusted returns.

Conclusion

Momentum is a powerful concept in both academic research and quantitative trading. For researchers, understanding the dynamics of momentum can lead to more accurate models for asset pricing, risk management, and portfolio optimization. By leveraging time-series and cross-sectional momentum analysis, as well as utilizing advanced tools and techniques, academic researchers can further enrich their work and contribute to the broader field of financial analysis.