==============================================

Neural networks have become one of the most powerful tools in modern quantitative finance, offering traders and researchers a way to uncover hidden patterns, predict market movements, and automate strategies with precision. This guide explains how to build neural network models for trading, from foundational concepts to advanced implementation, while comparing strategies, exploring tools, and offering practical insights for both retail and institutional market participants.

Understanding Neural Networks in Trading

What Is a Neural Network?

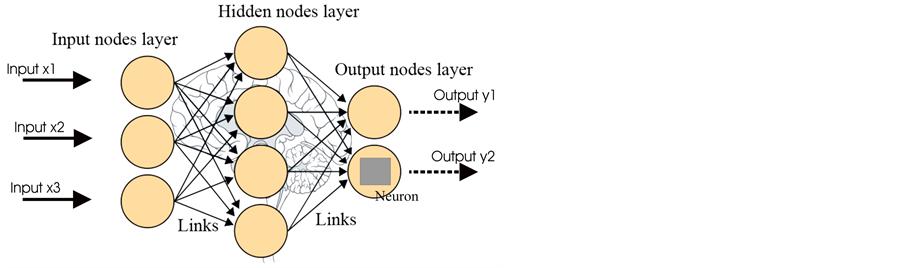

A neural network is a machine learning algorithm inspired by the structure of the human brain. It consists of interconnected layers of artificial neurons that learn from data by adjusting weights during training.

In trading, neural networks are applied to:

- Pattern recognition (e.g., candlestick formations, stock cycles).

- Forecasting (e.g., predicting short-term returns).

- Classification (e.g., buy/sell signals).

- Optimization (e.g., portfolio allocations).

Why Neural Networks Are Used in Quantitative Trading

Unlike traditional statistical models, neural networks can capture non-linear relationships and adapt to evolving market conditions. This makes them especially useful for analyzing complex financial time series data.

A simplified architecture of a feedforward neural network applied in trading analysis.

Steps to Build Neural Network Models for Trading

Step 1: Define Your Objective

Determine whether you want to:

- Predict short-term price movements.

- Forecast volatility.

- Generate signals for algorithmic execution.

Clear objectives shape the data, architecture, and evaluation metrics you use.

Step 2: Collect and Preprocess Market Data

Neural networks require large datasets. Sources include:

- Price data (open, high, low, close, volume).

- Technical indicators (RSI, MACD, moving averages).

- Fundamental data (earnings, balance sheets).

- Alternative data (news sentiment, social media signals).

Preprocessing steps:

- Normalize data for faster training.

- Handle missing values.

- Align multiple data sources into time series format.

Step 3: Choose Neural Network Architecture

Common architectures for trading include:

- Feedforward Networks (FNNs): Good for simple prediction tasks.

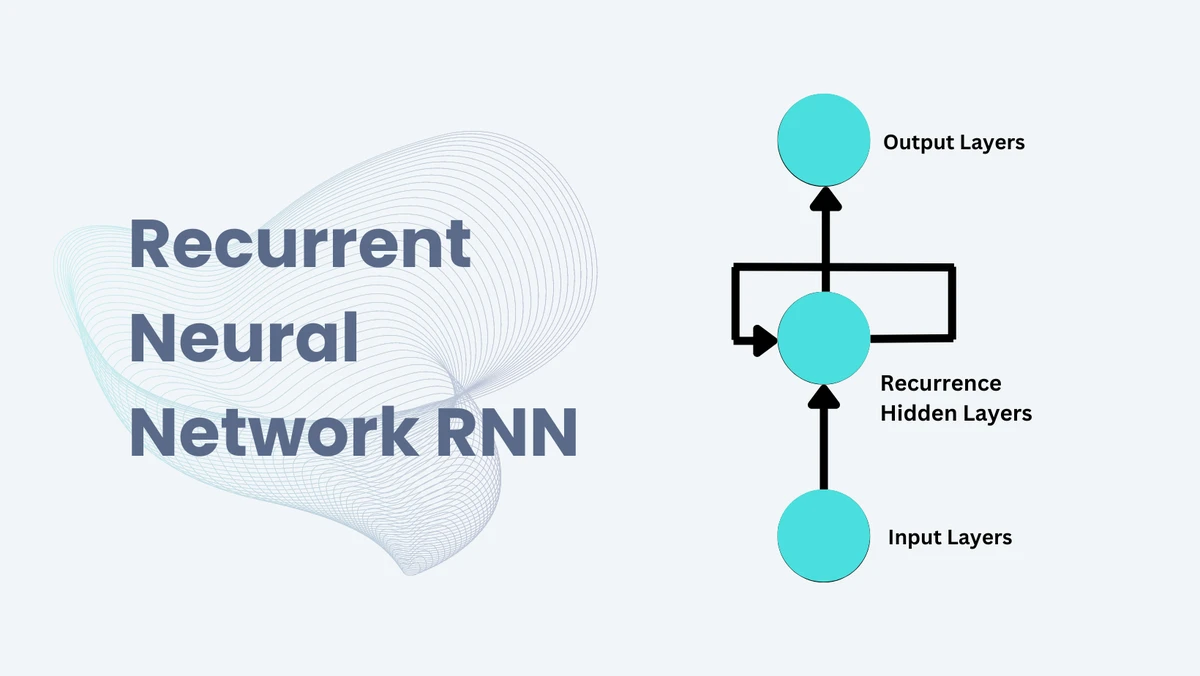

- Recurrent Neural Networks (RNNs): Handle sequential data such as stock time series.

- Long Short-Term Memory (LSTM): Capture long-term dependencies, especially useful for trend forecasting.

- Convolutional Neural Networks (CNNs): Effective in recognizing visual patterns from candlestick charts.

Step 4: Train the Model

Training involves:

- Splitting data into training, validation, and testing sets.

- Using backpropagation to adjust weights.

- Selecting an optimizer (Adam, RMSprop, SGD).

- Tuning hyperparameters (learning rate, number of layers, dropout).

Step 5: Evaluate Performance

Use metrics such as:

- Accuracy of predictions.

- Sharpe ratio on backtested trades.

- Maximum drawdown.

- Profit factor.

Step 6: Deploy and Monitor

Once validated, deploy the model into a live or paper-trading environment. Continuous monitoring is essential because financial markets evolve, and models may lose effectiveness over time.

Two Approaches to Building Neural Networks for Trading

Approach 1: Supervised Learning with Price Data

- Method: Train models using historical OHLCV data and technical indicators to predict price direction.

- Advantages: Simple to implement, abundant data.

- Limitations: Susceptible to overfitting, performance declines in changing market regimes.

Approach 2: Hybrid Models with Alternative Data

- Method: Combine price data with sentiment analysis (news, Twitter, Reddit) and fundamental indicators.

- Advantages: Broader view of market dynamics, more robust in volatile conditions.

- Limitations: Requires complex data engineering and higher computational power.

LSTM neural networks are widely used for forecasting price time series in algorithmic trading.

Comparing the Two Approaches

| Feature | Price Data Supervised Models | Hybrid Models with Alternative Data |

|---|---|---|

| Complexity | Moderate | High |

| Data Requirements | Historical market data | Market + sentiment + fundamentals |

| Robustness to Regime Shifts | Low | High |

| Suitable for Retail Traders | Yes | Advanced users only |

Recommendation: Start with supervised learning models to build a foundation, then gradually move into hybrid models for more advanced strategies.

Neural Network Applications in Trading

Neural networks are increasingly shaping modern trading systems. For example:

- How neural networks improve quantitative trading by detecting subtle non-linear correlations.

- How to implement neural networks in trading systems through APIs that connect models with broker platforms for automated execution.

Institutions are also using neural networks to estimate volatility, perform risk management, and optimize portfolio allocation.

Common Challenges When Building Neural Networks for Trading

- Overfitting: Models that perform well on historical data but fail in live markets.

- Data Quality Issues: Incomplete or biased datasets lead to inaccurate forecasts.

- Computational Cost: Training deep networks can require GPUs and large-scale infrastructure.

- Changing Market Regimes: Financial markets are dynamic; models may degrade over time.

Mitigation strategies include cross-validation, dropout regularization, and model retraining.

FAQs

1. Do neural networks guarantee profitable trading?

No. Neural networks are powerful tools but not magic bullets. They can uncover hidden patterns and enhance decision-making but must be combined with proper risk management and diversification.

2. Which neural network architecture is best for trading?

It depends on your objective:

- Use LSTM for sequential data forecasting.

- Use CNN if working with visual data like candlestick images.

- Use hybrid models if combining sentiment and fundamentals with market data.

3. Where can I learn to build neural networks for trading?

Several platforms offer training:

- Online courses (Coursera, Udemy, QuantInsti).

- Open-source frameworks (TensorFlow, PyTorch).

- Research papers and tutorials specific to financial applications.

Conclusion

Learning how to build neural network models for trading is one of the most valuable skills for modern traders. From price prediction to sentiment analysis and algorithmic execution, neural networks provide a competitive edge when designed and applied correctly.

For beginners, start with simple supervised models using historical data. As you gain confidence, explore hybrid architectures with alternative datasets to capture broader market dynamics.

👉 Have you tried building your own trading neural network? Share your experiences in the comments below, and if you found this guide useful, don’t forget to share it with fellow traders and quants!

Neural networks are becoming essential tools for traders seeking to gain an edge in financial markets.