================================================================

Mean reversion is one of the most widely used strategies in quantitative trading. By understanding and exploiting the tendency of asset prices to revert to their historical average, traders can design profitable strategies across equities, forex, and crypto markets. However, successful implementation requires robust backtesting tools and precise datasets. This guide provides a step-by-step tutorial on building and using a mean reversion backtesting toolkit, integrating advanced strategies, data management techniques, and practical insights.

Understanding Mean Reversion in Trading

What is Mean Reversion?

Mean reversion is a statistical concept where prices of a financial instrument oscillate around a historical mean or equilibrium. When prices deviate significantly, they tend to revert back over time.

Key aspects include:

- Statistical Analysis: Identifying the mean and standard deviation of price movements.

- Thresholds: Determining entry and exit points when prices are overbought or oversold.

- Timeframe Consideration: Mean reversion can occur over intraday, daily, or weekly intervals depending on the instrument.

How does mean reversion work in quantitative trading?

Quantitative traders implement mean reversion by designing algorithms that automatically identify deviation thresholds, execute trades, and manage risk without emotional bias.

Mean Reversion vs. Momentum Trading

| Feature | Mean Reversion | Momentum Trading |

|---|---|---|

| Direction | Trades against trends | Trades with trends |

| Goal | Capture reversals | Capture trend continuation |

| Risk | Sharp trends can cause losses | Sudden reversals reduce profits |

| Typical Use | Range-bound markets | Trending markets |

Understanding this distinction helps traders decide when mean reversion is appropriate.

Visual comparison of mean reversion and momentum trading behavior.

Step 1: Collecting and Preparing Data

Selecting Reliable Data Sources

- Historical price data (OHLC) from exchanges or APIs like Quandl, Alpha Vantage.

- Volume, volatility, and liquidity indicators.

- External factors for advanced models: macroeconomic data, sentiment indicators.

Where to find mean reversion strategies

Several platforms provide pre-built strategies and historical datasets:

- QuantConnect and Quantopian for equities and crypto.

- Institutional research papers and hedge fund publications for advanced techniques.

Data Cleaning and Normalization

- Handle Missing Data: Fill gaps with interpolation or discard incomplete periods.

- Remove Outliers: Identify spikes caused by errors rather than market conditions.

- Normalize Features: Convert price data into returns or z-scores for statistical analysis.

Steps for preparing datasets for mean reversion backtesting.

Step 2: Building a Backtesting Framework

Core Components of a Toolkit

Signal Generation Module

- Detect deviations from the mean using Bollinger Bands, Z-score, or moving averages.

- Set thresholds for entry and exit signals.

- Detect deviations from the mean using Bollinger Bands, Z-score, or moving averages.

Trade Execution Module

- Simulate order execution with realistic slippage and fees.

- Support different order types (market, limit, stop-loss).

- Simulate order execution with realistic slippage and fees.

Risk Management Module

- Implement position sizing based on volatility and account equity.

- Apply stop-losses, trailing stops, and maximum drawdown limits.

- Implement position sizing based on volatility and account equity.

How to backtest mean reversion models

Backtesting involves applying historical data to your strategy to measure potential performance metrics:

- Win rate

- Sharpe ratio

- Maximum drawdown

- Profit factor

Step 3: Advanced Statistical Methods

Z-Score Normalization

- Converts price deviations into standardized scores.

- Entry example: Z-score > 2 (overbought), Z-score < -2 (oversold).

- Converts price deviations into standardized scores.

Pairs Trading

- Identify correlated assets and trade the spread when divergence occurs.

- Requires cointegration testing for statistical reliability.

- Identify correlated assets and trade the spread when divergence occurs.

Volatility Adjustments

- Adjust thresholds dynamically according to market volatility.

- Reduces false signals during high volatility periods.

- Adjust thresholds dynamically according to market volatility.

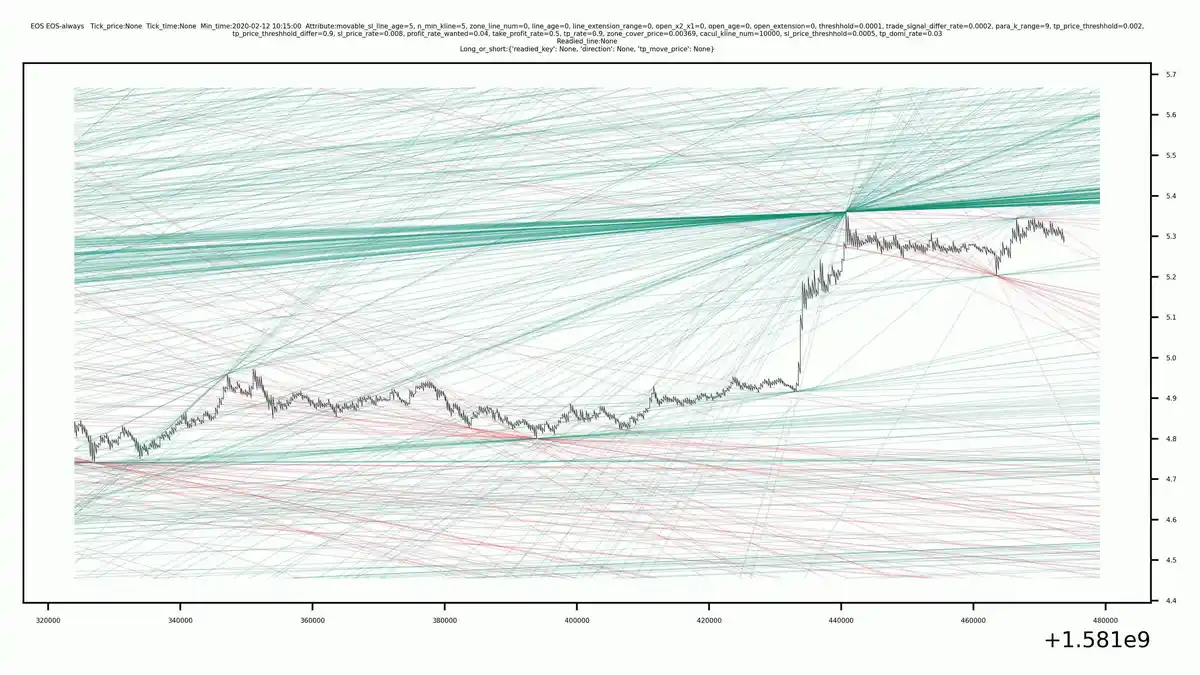

Illustration of a Z-score-based mean reversion entry and exit signal.

Step 4: Strategy Implementation

Configuring the Toolkit

- Integrate datasets and statistical modules.

- Set parameters for lookback periods, thresholds, and trading frequency.

- Ensure modularity to test multiple strategies concurrently.

Simulation and Optimization

- Run multiple backtests with different parameters to identify optimal settings.

- Evaluate performance metrics and risk-reward profiles.

- Optimize for transaction costs, slippage, and leverage where applicable.

Comparison of Strategies:

| Strategy | Advantage | Disadvantage | Best Use |

|---|---|---|---|

| Z-score mean reversion | Simple, statistically robust | Sensitive to sudden trend shifts | Range-bound equities |

| Pairs trading | Exploits correlations, hedged risk | Requires cointegration testing | ETF or correlated stock pairs |

| Bollinger Bands | Visual, intuitive | Can lag in fast markets | Intraday trading |

Step 5: Live Testing and Execution

- Connect toolkit to a paper trading account.

- Monitor real-time deviations and execution performance.

- Adjust parameters based on live feedback without risking capital.

Benefits:

- Detects discrepancies between historical and live market behavior.

- Helps refine execution algorithms and risk controls.

Step 6: Continuous Improvement

Incorporating Machine Learning

- Train predictive models using historical deviations and market conditions.

- Implement reinforcement learning to adapt thresholds dynamically.

Monitoring and Updating

- Recalculate statistical parameters regularly.

- Incorporate new data to maintain predictive accuracy.

- Periodically review risk parameters in changing market conditions.

Continuous improvement cycle for mean reversion strategies.

FAQ: Mean Reversion Backtesting Toolkit

1. Why use mean reversion in forex trading?

Forex pairs often revert to a historical mean due to macroeconomic equilibrium. Mean reversion strategies exploit these tendencies to generate consistent returns in range-bound markets.

2. How to implement mean reversion in trading algorithms?

Start with a statistical measure (Z-score, Bollinger Bands), set entry/exit rules, integrate risk management, and backtest using historical data. Refine through parameter optimization and live paper trading.

3. Why does mean reversion fail sometimes?

Mean reversion can fail during strong trending markets, unexpected news events, or when correlations break down. Using adaptive thresholds and volatility adjustments reduces this risk.

Conclusion

A mean reversion backtesting toolkit is essential for any quantitative trader aiming to implement statistically sound strategies. By following this guide, traders can:

- Construct reliable datasets.

- Test multiple mean reversion strategies.

- Optimize parameters and manage risk effectively.

Combining statistical methods, historical and real-time data, and systematic backtesting ensures higher confidence in executing profitable mean reversion trades.

Share Your Experience: Share this guide with your trading community or comment below with insights from your own mean reversion backtesting!

Integrated toolkit showcasing data input, signal generation, backtesting, and optimization for mean reversion strategies.