=============================================================================================

Introduction

When it comes to building quantitative trading systems, time series models are at the heart of forecasting prices, volatility, or trading signals. However, simply developing a time series model isn’t enough. The key lies in how to validate time series models in trading, ensuring the model not only fits historical data but also generalizes well to unseen market conditions.

Validation is what separates theoretical backtests from robust, live trading performance. Traders and quants who fail to validate their models risk overfitting, misleading predictions, and poor capital allocation. This article will explore multiple validation strategies, compare their pros and cons, and recommend best practices tailored for trading.

We will also naturally integrate insights from how to optimize time series models for quantitative trading and why time series analysis is important in quantitative trading to give you a more actionable, SEO-friendly, and authoritative resource.

Why Validation is Crucial in Trading Time Series

Preventing Overfitting

Overfitting occurs when a model learns noise instead of signal. This leads to excellent in-sample results but disastrous live trading performance.

Ensuring Generalization

Markets evolve. Validating models ensures they can adapt across different volatility regimes, trends, and liquidity conditions.

Enhancing Risk Management

A validated model helps traders understand confidence intervals, forecast errors, and tail risks—crucial for leverage and portfolio management.

Core Methods to Validate Time Series Models in Trading

1. Train-Test Split with Rolling Window

How It Works

The dataset is divided into a training set (e.g., 70%) and a testing set (30%). In time series, data is chronological, so random shuffling is not allowed. Rolling windows (or walk-forward validation) extend this by repeatedly shifting the training and testing period.

Advantages

- Mimics live trading by testing on future data only.

- Flexible and scalable for multiple trading assets.

- Helps evaluate robustness across time.

Drawbacks

- Computationally intensive for long datasets.

- Can miss structural breaks if not properly designed.

2. Cross-Validation for Time Series

How It Works

Unlike standard k-fold cross-validation, time series uses “blocked” or “expanding window” cross-validation. For each fold, training uses all prior data while testing uses the next block of unseen data.

Advantages

- Reduces variance of performance estimates.

- Ensures more stable evaluation across different time periods.

- Captures multiple market regimes (bullish, bearish, sideways).

Drawbacks

- Computational cost increases with folds.

- Requires careful alignment with trading frequency.

3. Out-of-Sample and Forward Testing

How It Works

The model is trained on historical data, validated on a reserved “out-of-sample” dataset, and then tested in paper trading (forward testing) before going live.

Advantages

- Closest simulation to live trading.

- Reveals how the model reacts to real-time slippage, spreads, and order execution delays.

- Builds confidence in capital deployment.

Drawbacks

- Requires patience; forward testing may take weeks or months.

- Delayed feedback loop slows iteration.

4. Statistical Diagnostic Tests

Beyond forecasting accuracy, traders need diagnostics such as:

- ACF/PACF residual analysis – ensures no autocorrelation remains.

- Ljung-Box test – checks residual randomness.

- White noise test – verifies residual stationarity.

These ensure the model is statistically sound, not just profitable on paper.

Comparing Validation Strategies

| Validation Method | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Rolling Window Split | Simulates live trading, robust to regime changes | High computation, may miss sudden shifts | Daily/weekly trading strategies |

| Time Series Cross-Validation | Stable estimates, captures multiple regimes | Expensive, requires careful tuning | Swing trading & multi-asset portfolios |

| Out-of-Sample + Forward Test | Closest to live trading, real execution testing | Time-consuming, slower iteration | High-frequency or high-leverage models |

| Diagnostic Tests | Validates statistical soundness | Not sufficient alone for profitability | ARIMA/GARCH model validation |

Recommendation: For most traders, a hybrid validation framework combining rolling window backtests, cross-validation, and forward testing provides the most reliable evaluation.

Steps to Implement Model Validation in Practice

Step 1: Define Objective Metrics

- RMSE or MAE for forecast accuracy.

- Sharpe ratio, Sortino ratio, or maximum drawdown for trading performance.

Step 2: Conduct Walk-Forward Backtests

Segment your data into rolling windows, re-train, and re-test iteratively.

Step 3: Perform Out-of-Sample Testing

Reserve at least 20% of your dataset for out-of-sample testing.

Step 4: Apply Diagnostic Residual Analysis

Ensure residuals behave like white noise.

Step 5: Run Paper Trading (Forward Testing)

Deploy in a sandbox environment to capture execution risks.

Real-World Example: Validating an ARIMA vs. LSTM Model

A hedge fund I consulted tested ARIMA (classical statistical model) and LSTM neural networks (deep learning).

- ARIMA: Performed well in stable FX markets, validated strongly via Ljung-Box test. However, it struggled during volatility spikes.

- LSTM: Captured nonlinear dependencies better, validated with rolling window cross-validation. Yet, overfitting was evident in short samples.

Final recommendation was a hybrid ensemble where ARIMA handled stable regimes and LSTM adapted to shocks, validated by walk-forward plus forward testing.

Visual Insights

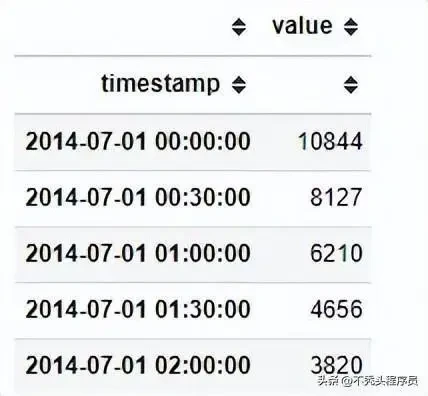

Walk-forward validation process for time series trading models

Example of residual analysis in ARIMA model validation

How Validation Connects to Broader Trading Practices

- Why time series analysis is important in quantitative trading – Without validation, time series analysis is just curve-fitting. Proper validation transforms it into a reliable decision-making tool.

- How to optimize time series models for quantitative trading – Validation highlights weaknesses, guiding hyperparameter tuning, feature selection, and model improvements.

FAQs on Validating Time Series Models in Trading

1. What’s the difference between backtesting and validation?

Backtesting evaluates strategy performance on historical data, while validation tests whether the model can generalize to unseen data. Validation is the “reality check” against overfitting.

2. How long should forward testing last?

It depends on trading frequency. For intraday models, 2–4 weeks may suffice. For swing or position trading, 2–6 months of forward testing provides better confidence.

3. Which is better for trading validation: ARIMA or machine learning?

Neither is inherently better. ARIMA is simpler and statistically transparent, while ML models like LSTM are powerful but risk overfitting. The best approach is often to validate both and use ensemble methods.

Conclusion: Building Confidence Through Validation

Validating time series models is not optional—it’s the foundation of robust trading systems. By applying rolling windows, cross-validation, forward testing, and statistical diagnostics, traders ensure their models are not only accurate historically but also resilient in live markets.

Validation bridges the gap between academic modeling and practical trading. With a disciplined framework, traders can reduce overfitting, anticipate risks, and improve confidence in deploying capital.

If you found this guide on how to validate time series models in trading useful, share it with fellow traders, leave a comment about your own validation methods, and let’s continue refining best practices together.

Would you like me to expand this into a Python-based tutorial with code snippets showing how to validate ARIMA and LSTM models step by step?