Cup and Handle Market Report: Understanding the Pattern and How to Trade It

The “Cup and Handle” pattern is one of the most recognized chart formations used by traders in technical analysis. This pattern has earned its reputation due to its reliability in predicting bullish breakouts. In this report, we’ll explore the intricacies of the Cup and Handle pattern, how to identify it, its psychological foundation, and how traders can effectively use it to forecast market trends.

What is the Cup and Handle Pattern?

The Cup and Handle pattern is a technical chart formation that resembles the shape of a teacup. It consists of two primary parts:

- The Cup: This part of the pattern looks like a rounded U-shape. It represents a period of consolidation followed by a gradual uptrend, forming the left side of the cup, followed by a retracement (the base of the cup), and then a rally that forms the right side.

- The Handle: The handle is a smaller consolidation pattern that forms after the cup’s right side, typically sloping down slightly or moving sideways. This indicates a brief period of profit-taking or a pause before the price continues its upward trajectory.

The Psychological Behavior Behind the Cup and Handle

Understanding the psychology behind the Cup and Handle pattern is key to trading it effectively. The cup portion symbolizes a period of accumulation, where prices are being absorbed by investors, and the subsequent handle formation represents a slight profit-taking phase before the next rally.

As a result, when the pattern completes, it signifies that there is a strong buying interest in the market, and a breakout above the handle’s resistance level often indicates a high probability of an uptrend.

How to Identify the Cup and Handle Pattern

Identifying the Cup and Handle pattern requires attention to detail. Here’s a step-by-step guide on how to spot it:

- Cup Formation: Look for a price dip followed by a gradual rise, forming a rounded U-shape. The depth of the cup should not be too steep, as this could indicate a sudden correction rather than a true cup.

- Handle Formation: After the cup forms, the price should retrace slightly, moving sideways or downward for a short period. This phase should not be too deep—ideally, the handle should stay above the midpoint of the cup.

- Breakout Point: The key point is the breakout above the handle’s resistance. This is where the pattern confirms itself as a signal for a potential bullish trend. Volume should increase as the price breaks above the resistance level.

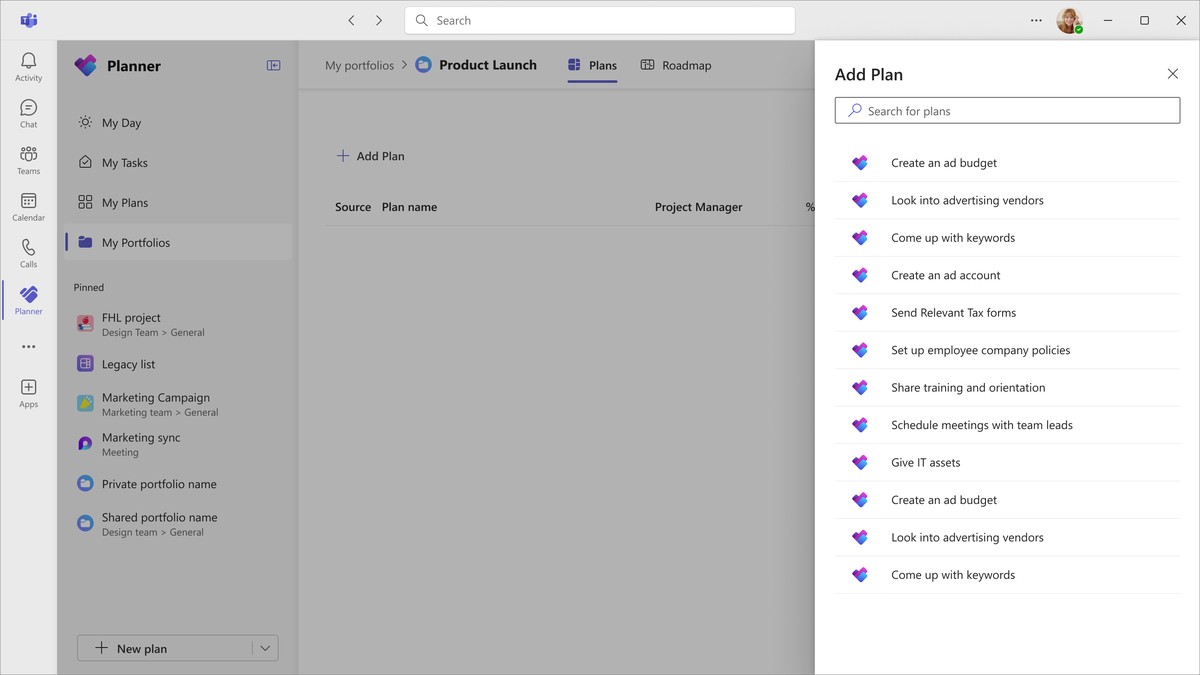

Image 1: Example of a Cup and Handle Pattern with breakout point marked.

How Cup and Handle Indicates Trends

The Cup and Handle pattern is primarily used to signal bullish trends. When the breakout occurs, it typically indicates the beginning of a new uptrend. Traders use this formation as a way to predict market direction, taking advantage of the price movement after the breakout.

The pattern is particularly effective in longer-term trends, often seen in daily or weekly charts. Its reliability increases when combined with other indicators like volume analysis and moving averages.

Why the Cup and Handle Pattern Works

The Cup and Handle pattern works because of its psychological foundations. The pattern forms as market participants accumulate shares (or assets) during the cup phase, and a pullback during the handle phase allows the market to rest before the next round of buying pressure forces the price higher. This market behavior shows that there is growing bullish sentiment that will likely continue after the breakout.

Trading Strategies Using the Cup and Handle Pattern

There are multiple strategies that traders can implement when trading the Cup and Handle pattern. Here are two primary approaches:

1. Breakout Strategy

One of the most common strategies is to trade the breakout once the price moves above the resistance level of the handle. Traders should wait for the price to close above the handle’s resistance with a significant increase in volume. This confirms that the pattern has completed and the uptrend is likely to continue.

Advantages:

- Offers high reward potential with proper risk management.

- Suitable for long-term investors who can afford to wait for a breakout.

Disadvantages:

- False breakouts can occur, leading to losses.

- Requires patience and a keen eye on volume patterns.

2. Buy on the Pullback Strategy

In this strategy, traders wait for the price to break out but instead of entering immediately, they wait for the price to pull back to retest the breakout level (which now acts as support). Once the price shows signs of holding above the breakout level, traders enter the market.

Advantages:

- Reduces the risk of entering at the top of the breakout.

- Provides a more favorable risk/reward ratio.

Disadvantages:

- Timing the pullback can be tricky.

- May miss some of the initial breakout movement.

FAQ: Common Questions About the Cup and Handle Pattern

1. How do I know when the Cup and Handle pattern is complete?

The Cup and Handle pattern is complete when the price breaks above the resistance level formed by the top of the handle. This breakout should be accompanied by an increase in volume, confirming the pattern’s validity.

2. Can the Cup and Handle pattern fail?

Yes, the Cup and Handle pattern can fail. A failure occurs if the price does not break above the handle’s resistance or if it breaks out but then quickly reverses back below the breakout point. It is important to use stop-loss orders and other risk management tools to minimize losses in case of a failure.

3. What is the ideal time frame for trading the Cup and Handle pattern?

While the Cup and Handle pattern can appear on various time frames, it is most effective on longer time frames like daily or weekly charts. This allows enough time for the pattern to develop properly and for the breakout to have a significant impact.

Conclusion

The Cup and Handle pattern is a powerful tool for traders looking to capitalize on bullish market movements. By understanding the psychology behind the pattern and utilizing effective strategies, traders can increase their chances of success. However, like any technical tool, it’s essential to combine the Cup and Handle pattern with other indicators and risk management strategies to minimize the impact of false signals.

For further learning, you can explore more advanced strategies on how to identify the Cup and Handle pattern and how to combine it with other chart formations for better results.