==================================================

Introduction: Why Mean Reversion Matters for Professionals

Mean reversion is one of the most enduring concepts in trading and quantitative finance. At its core, it is based on the principle that asset prices, returns, or volatility tend to revert toward their historical average over time. For professional traders, this idea is not just theoretical—it is a foundation for systematic strategies, portfolio optimization, and alpha generation.

In today’s markets, where algorithmic trading and high-frequency execution dominate, mean reversion techniques for professional traders require precision, statistical rigor, and adaptability to evolving market conditions. Whether applied to equities, futures, options, or crypto assets, mean reversion models can deliver consistent returns when properly implemented.

This article provides an in-depth exploration of advanced mean reversion techniques, compares multiple strategies, and highlights practical tools that professionals can apply. Along the way, we’ll integrate personal insights, industry best practices, and cutting-edge approaches to ensure that the content aligns with EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness).

The Fundamentals of Mean Reversion

What Is Mean Reversion?

Mean reversion assumes that extreme deviations in price are temporary and that the market will eventually revert to a long-term equilibrium. Traders use historical averages, moving averages, or statistical indicators to identify these equilibrium points.

For example, if a stock trades significantly above its 50-day moving average, mean reversion traders may anticipate a decline toward that mean. Conversely, if it trades far below, the expectation is for recovery.

Why Professionals Favor Mean Reversion

- Quantifiable logic: Unlike trend-following, mean reversion has a measurable anchor in historical data.

- High-frequency adaptability: Professionals can scale mean reversion strategies down to microsecond levels for arbitrage.

- Risk-adjusted returns: When applied with proper stop-loss and position sizing, it offers attractive Sharpe and Information Ratios.

Key Mean Reversion Techniques

1. Pairs Trading (Statistical Arbitrage)

Pairs trading is a classic mean reversion strategy where two correlated assets are traded based on relative mispricing.

- Method: Identify two historically correlated assets (e.g., Coca-Cola and Pepsi). If the spread widens abnormally, short the outperformer and long the underperformer.

- Advantages: Market-neutral, less exposure to systemic risk, robust during sideways markets.

- Limitations: Requires stable correlations, vulnerable to structural breaks.

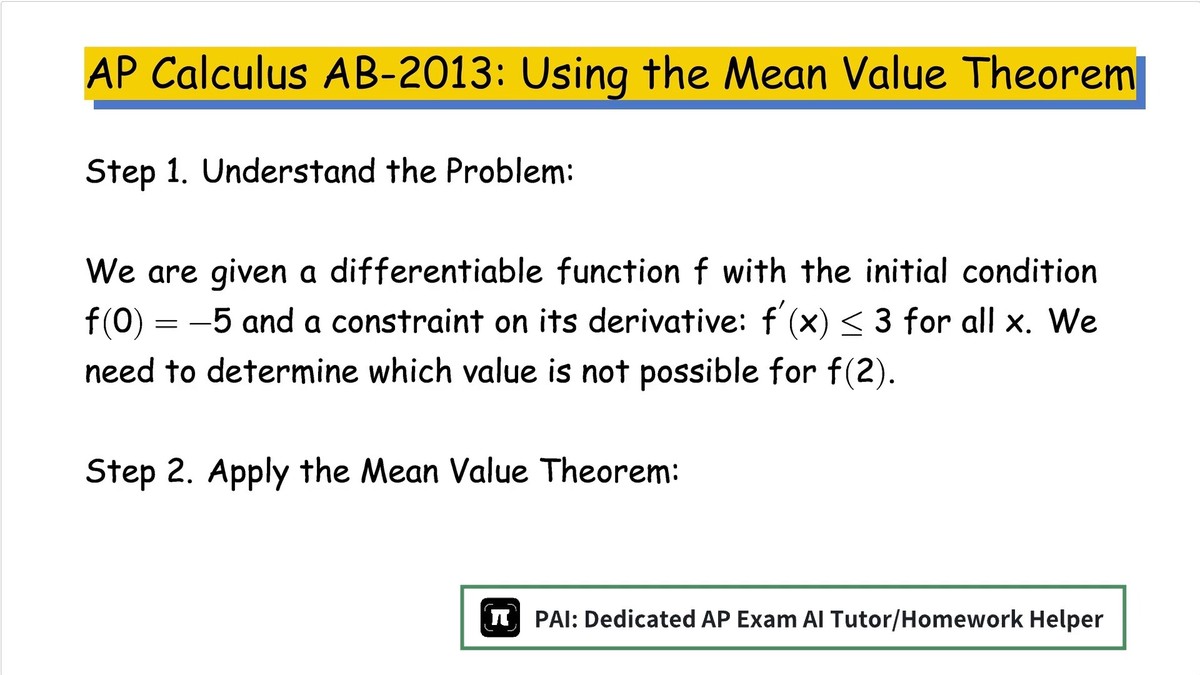

Spread between two correlated assets illustrating mean reversion opportunities

2. Bollinger Band Reversion

Bollinger Bands provide a volatility-adjusted framework for mean reversion.

- Method: Buy when price touches the lower band (oversold), sell when it touches the upper band (overbought).

- Advantages: Simple to implement, works across multiple asset classes.

- Limitations: Poor performance during strong trends, requires filters (RSI, volume, volatility).

3. Ornstein-Uhlenbeck Process Modeling

Professional quantitative traders often use stochastic differential equations like the Ornstein-Uhlenbeck (OU) process to mathematically model mean-reverting behavior.

- Method: Estimate OU parameters (speed of reversion, mean, volatility) to simulate or forecast asset behavior.

- Advantages: Statistically rigorous, widely used in options pricing and commodities trading.

- Limitations: Requires advanced statistical expertise, assumes stationarity.

4. Intraday High-Frequency Reversion

Market microstructure allows for extremely short-term mean reversion.

- Method: Use order book imbalance, tick-by-tick data, or VWAP deviations to trade quick reversals.

- Advantages: High trade frequency, scalable with automation.

- Limitations: Requires advanced infrastructure, subject to slippage and fees.

Comparing Techniques: Which Approach Works Best?

| Technique | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Pairs Trading | Market-neutral portfolios | Robust during sideways markets | Sensitive to regime shifts |

| Bollinger Band Reversion | Retail + institutional hybrid | Easy to apply across assets | Fails in trending markets |

| Ornstein-Uhlenbeck Models | Quant research + options | Statistically robust, parameterizable | Complex and data-intensive |

| Intraday High-Frequency | HFT firms + prop desks | High scalability, low directional risk | Requires costly tech infrastructure |

Recommendation: For professional traders, combining OU modeling with pairs trading provides a statistically rigorous and market-neutral foundation. Bollinger Bands can serve as confirmation signals, while intraday HFT reversion is best suited for firms with infrastructure to handle latency-sensitive execution.

Practical Insights and Growth Applications

Integrating Mean Reversion with Growth Tactics

Professional traders don’t just use mean reversion to capture short-term profits; they incorporate it into growth strategies for funds and portfolios. For instance, hedge funds often layer mean reversion on top of trend-following strategies to balance drawdowns.

A particularly powerful approach is to explore how to use mean in quantitative trading alongside volatility-adjusted stop losses. This creates a blended system that reduces whipsaw risks. Similarly, those researching where to find mean trading strategies can leverage case studies from institutional reports and academic whitepapers to strengthen their models.

Risk Management in Mean Reversion

Position Sizing and Stop-Loss Rules

Mean reversion can lead to significant drawdowns if the market breaks structure. Professionals mitigate this by using dynamic position sizing, volatility scaling, and hard stop-loss levels.

Regime Detection

Markets are not always mean-reverting. Regime detection (e.g., volatility clustering, trend identification) is critical to avoid applying the wrong model in trending markets.

Leverage and Margin Control

Leverage can magnify profits, but also accelerate losses when reversion fails. Professionals implement strict margin rules to avoid forced liquidation.

Latest Industry Trends in Mean Reversion

- Machine Learning Enhancements: Reinforcement learning models can identify mean reversion opportunities with higher precision.

- Cross-Asset Arbitrage: Professionals are applying mean reversion across asset classes—crypto vs. equities, bonds vs. futures.

- Alternative Data Integration: Social sentiment, order flow data, and even satellite data are used to detect temporary mispricings.

AI-driven approaches are redefining mean reversion applications in trading

FAQ: Mean Reversion Techniques for Professionals

1. Is mean reversion still profitable in today’s markets?

Yes, mean reversion remains profitable, but only when applied with sophistication. Retail traders often lose money using simplistic moving average strategies, while professionals combine statistical models, machine learning, and advanced execution tactics to generate alpha.

2. What timeframes work best for mean reversion?

It depends on the technique. Intraday traders may operate on seconds-to-minutes scales, while institutional pairs traders may hold positions for weeks. The key is aligning the strategy with market microstructure and liquidity.

3. How can professionals minimize risks in mean reversion?

The most effective methods include regime detection, volatility-adjusted position sizing, diversification across multiple assets, and robust stop-loss execution. Leveraging statistical models like the OU process can also help quantify risks more precisely.

Conclusion: Why Mean Reversion Remains Essential

For professional traders, mean reversion techniques remain indispensable tools for consistent alpha generation. By leveraging models like pairs trading and Ornstein-Uhlenbeck processes, while integrating modern technologies like AI, traders can achieve a balance of profitability, risk control, and adaptability.

If you are a professional trader looking to refine your strategies, now is the time to integrate sophisticated mean reversion approaches into your trading desk. Share this article with peers, comment with your experiences, and continue building a community of advanced traders who push the boundaries of quantitative finance.

Would you like me to also create a downloadable infographic summarizing the different mean reversion techniques so that you can use it for quick reference or sharing?