Introduction: The Importance of Take Profit in Trading

Take profit (TP) strategies are vital components of any successful trading plan. Properly implemented, they allow traders to lock in profits at predefined levels, ensuring disciplined exits and minimizing emotional decision-making. Efficient take profit planning methods are essential for traders who want to maximize returns while managing risk effectively.

In this article, we will explore different methods for setting up take profit levels, comparing traditional strategies with innovative techniques, and offering insights into how these methods can be optimized for different types of markets and assets.

Table of Contents

What is Take Profit in Trading?

Why Take Profit Matters: The Key Benefits

Traditional Take Profit Methods: Fixed Level and Percent-Based Strategies

Fixed-Level Take Profit Strategy

Percent-Based Take Profit Strategy

Advanced Take Profit Techniques: Dynamic Adjustments and Trailing Stops

Dynamic Take Profit Adjustments

Trailing Stop Strategy

Take Profit in Different Markets

Take Profit for Forex Traders

Take Profit for Stock Investors

Take Profit for Cryptocurrency

Take Profit vs. Stop Loss: Key Differences

How to Set the Right Take Profit Level

Risk-Reward Ratio

Market Volatility Considerations

Best Practices for Take Profit in Trading

Conclusion

FAQ: Common Questions on Take Profit Strategies

What is Take Profit in Trading?

Take profit (TP) is an order placed to close a trade once the price reaches a predetermined level of profit. This tool is essential for traders to ensure they do not miss out on potential profits while maintaining discipline in their trading strategies. It helps avoid the temptation of holding onto a trade for too long and allows traders to lock in gains automatically when their target price is hit.

For example, if a trader buys a stock at \(100 and sets a take profit at \)110, the position will close automatically when the price reaches \(110, securing a \)10 profit per share.

Why Take Profit Matters: The Key Benefits

Prevents Emotional Decision Making: By setting a target in advance, traders avoid making impulsive decisions based on short-term market fluctuations.

Locks in Profits: A take profit strategy ensures that profits are secured once the price hits the desired target, rather than risking a potential reversal.

Disciplined Trading: By using take profit, traders can avoid greed-driven behavior that might lead them to overstay a position.

Consistency: Having predefined profit targets in place helps to maintain consistency across multiple trades.

Traditional Take Profit Methods: Fixed Level and Percent-Based Strategies

Fixed-Level Take Profit Strategy

The fixed-level take profit method is one of the simplest and most common strategies in trading. Traders set a fixed price target above (for long trades) or below (for short trades) the entry price. Once the price reaches the predetermined level, the trade is automatically closed.

Pros:

Simplicity: This method is easy to implement and does not require complex calculations or monitoring.

Clear Targets: Traders know exactly when to expect to exit the trade, reducing uncertainty.

Cons:

Lack of Flexibility: Fixed-level take profit strategies do not account for market dynamics such as volatility or trends, which may affect the ideal exit point.

Percent-Based Take Profit Strategy

In the percent-based take profit strategy, traders set a target based on a percentage of the price movement from the entry point. For example, if a trader enters a position at \(100 and sets a 5% take profit, the target price would be \)105.

Pros:

Scalable: This strategy can be adapted to any asset or market condition.

Risk Management: By calculating profit based on percentage moves, traders can maintain consistent risk-reward ratios.

Cons:

Market Sensitivity: The price movement may be too small or too large depending on market conditions, which can lead to missed opportunities or premature exits.

Advanced Take Profit Techniques: Dynamic Adjustments and Trailing Stops

Dynamic Take Profit Adjustments

Dynamic adjustments involve altering the take profit level as market conditions change. This method allows traders to be more flexible in their profit-taking approach.

For example, if the price of an asset is trending strongly, traders may choose to adjust their take profit upwards as the price continues to rise, allowing them to capture more profit while still securing their position if the trend reverses.

Pros:

Maximizes Profit: Traders can capture larger moves in the market by allowing for dynamic adjustments.

Adaptability: This method is flexible and can be used in both trending and range-bound markets.

Cons:

Requires Monitoring: Unlike fixed-level take profit, this method requires continuous monitoring and adjustment, which can be time-consuming.

Trailing Stop Strategy

A trailing stop is a dynamic take profit tool that moves with the price in your favor. For example, if the price of an asset rises by 5%, a trailing stop would move up by 5% as well, locking in profits if the price reverses but allowing the position to remain open if the price continues to rise.

Pros:

Captures Trends: Trailing stops allow traders to benefit from long-term trends without limiting potential profits prematurely.

Automatic Lock-In: It locks in profits as the trade moves in favor of the trader.

Cons:

Risk of Premature Exit: In volatile markets, trailing stops can be triggered too early, closing positions before the full potential of the move is realized.

Take Profit in Different Markets

Take Profit for Forex Traders

In the forex market, take profit strategies are crucial due to the high volatility and rapid price fluctuations. Forex traders typically use dynamic take profit or trailing stops to ride trends while locking in profits at key levels.

For instance, a trader may use a support and resistance approach to set take profit targets, aiming to exit near established market levels.

Take Profit for Stock Investors

Stock investors often employ a percent-based take profit strategy, especially for long-term investments. For example, an investor might set a target of a 20% return on a stock before selling, ensuring they don’t hold onto a position too long while still maximizing their gains.

Take Profit for Cryptocurrency

Cryptocurrency markets are known for their extreme volatility, which makes take profit strategies even more crucial. Trailing stops and dynamic take profit adjustments work well in crypto markets, as they allow traders to follow price movements while locking in profits during sudden price swings.

Take Profit vs. Stop Loss: Key Differences

While both take profit and stop loss are essential risk management tools, they serve opposite functions:

Take Profit: A take profit order locks in profits when a price target is reached.

Stop Loss: A stop loss order limits losses by closing a trade if the price moves against the trader by a certain amount.

The key difference is that take profit aims to secure profits, while stop loss is designed to prevent excessive losses.

How to Set the Right Take Profit Level

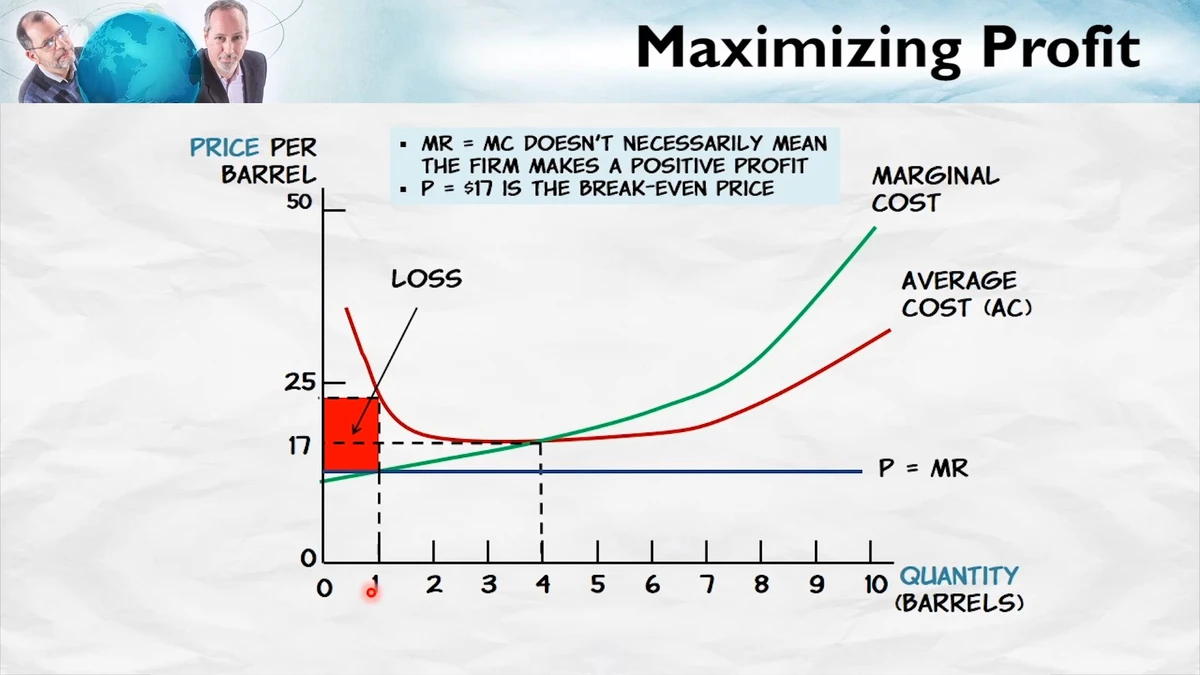

Risk-Reward Ratio

One of the most important factors in setting a take profit level is the risk-reward ratio. A common ratio is 1:2, meaning for every dollar risked, the trader targets two dollars in profit. This approach ensures that even if the trader experiences losses, the profits from successful trades will outweigh the losses.

Market Volatility Considerations

When setting take profit levels, it’s crucial to consider market volatility. In highly volatile markets, traders may want to set wider take profit targets to avoid premature exits, whereas in more stable markets, tighter targets might be more appropriate.

Best Practices for Take Profit in Trading

Set Realistic Targets: Use technical analysis, support and resistance levels, and risk-reward ratios to set realistic take profit levels.

Avoid Greed: While it’s tempting to let a trade run, it’s important to secure profits at reasonable levels to avoid giving back gains.

Combine with Stop Loss: Always use take profit in conjunction with stop loss to ensure you are managing both profit and risk effectively.

Conclusion

Efficient take profit planning methods are essential for traders aiming to maximize their profits while managing risk. Whether you use traditional strategies like fixed-level or percent-based take profit or more advanced techniques like trailing stops or dynamic adjustments, having a clear exit plan is crucial for long-term success.

By understanding and applying the right take profit strategies for your specific trading style and market, you can ensure that your profits are locked in and your risk is effectively controlled.

FAQ: Common Questions on Take Profit Strategies

- What is the best take profit strategy for beginners?

For beginners, a fixed-level or percent-based take profit strategy is recommended. It’s simple to implement and ensures you can lock in