=============================================

The rapid evolution of financial markets has made data-driven decision-making indispensable. Among the most transformative innovations are predictive modeling tools for market analysis, which allow traders, analysts, and portfolio managers to forecast trends, optimize strategies, and mitigate risks with unparalleled accuracy. These tools go beyond traditional charting or macroeconomic analysis, leveraging statistical models, machine learning, and advanced algorithms to uncover patterns invisible to the naked eye.

In this article, we’ll explore the core predictive modeling tools, compare different approaches, examine their pros and cons, and recommend best practices for professionals at various levels.

The Role of Predictive Modeling in Market Analysis

Why Predictive Modeling Matters

Predictive modeling is more than a buzzword—it’s the backbone of modern quantitative trading and portfolio management. Unlike traditional analysis, which often reacts to past movements, predictive models proactively anticipate future market behaviors. This capability helps:

- Reduce uncertainty by quantifying probabilities.

- Enhance trading accuracy through machine learning insights.

- Improve risk-adjusted returns by filtering noise from genuine signals.

As hedge funds and institutional investors increasingly rely on algorithms, predictive modeling has become a core competency. For context, understanding how to use predictive modeling in quantitative trading highlights how these tools bridge theory and real-world execution.

Core Predictive Modeling Tools for Market Analysis

1. Time Series Forecasting Models

Time series forecasting is one of the most widely adopted predictive methods in finance. It uses historical data to identify repeating patterns or long-term trends.

Examples of tools and methods:

- ARIMA (Auto-Regressive Integrated Moving Average): Captures trends, cycles, and seasonality.

- Exponential Smoothing (ETS): Weighs recent data more heavily for short-term forecasting.

- LSTM Neural Networks: Advanced machine learning method for capturing long-range dependencies.

Pros:

- Effective for trend-based forecasting.

- Well-documented and easy to implement.

Cons:

- Struggles with sudden shocks or regime changes.

- Requires extensive data preprocessing.

2. Machine Learning-Based Predictive Tools

Machine learning has redefined market analysis by identifying nonlinear relationships and hidden patterns.

Popular approaches:

- Random Forests & Gradient Boosting: Robust classification and regression tools for market predictions.

- Support Vector Machines (SVMs): Effective for distinguishing between bullish and bearish phases.

- Deep Learning Models (CNNs, RNNs): Handle high-dimensional datasets, such as order book data.

Pros:

- Handles complex, nonlinear data better than traditional statistics.

- Continuously improves as more data is fed.

Cons:

- Risk of overfitting.

- Requires high computational resources.

This approach connects with why predictive modeling is crucial for quantitative strategies, as machine learning is a cornerstone for algorithmic edge.

Comparison of predictive modeling tools

3. Sentiment Analysis and Natural Language Processing (NLP)

Markets are influenced not only by numbers but also by news, tweets, and analyst reports. NLP-powered predictive tools extract actionable insights from textual data.

Examples:

- Lexicon-based sentiment scoring from financial news.

- Transformer models like BERT and GPT adapted for market text.

- Social media scraping for real-time sentiment forecasting.

Pros:

- Provides unique insights into behavioral finance.

- Useful in crypto markets, where fundamentals are less reliable.

Cons:

- Sentiment can be noisy and misleading.

- Requires advanced preprocessing to filter irrelevant data.

4. Predictive Risk Management Tools

Predictive modeling isn’t just about profits—it’s also about controlling risk.

Techniques:

- Value-at-Risk (VaR) with predictive extensions.

- Monte Carlo simulations for scenario testing.

- Bayesian Networks for probabilistic inference.

Pros:

- Enhances portfolio resilience.

- Supports stress testing under multiple scenarios.

Cons:

- Complexity may confuse inexperienced traders.

- Predictions can still fail under black swan events.

Comparing Predictive Modeling Approaches

| Approach | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Time Series Models | Simple, interpretable, effective for trends | Weak with nonlinear data or regime shifts | Stock index forecasting |

| Machine Learning | Handles nonlinearities, adaptable | Risk of overfitting, computationally heavy | High-frequency trading |

| NLP & Sentiment | Captures human-driven market forces | Noisy, difficult to validate | Crypto & social-driven assets |

| Predictive Risk Models | Focused on downside protection | Complexity, not profit-oriented | Portfolio risk management |

Practical Use Cases in Predictive Modeling

Hedge Funds and Institutional Investors

Large funds integrate predictive models to execute multi-factor strategies, combining time series, sentiment, and machine learning.

Retail Traders

Beginner-friendly predictive software provides signals based on simplified algorithms. However, caution is required as many platforms oversell accuracy.

Crypto Markets

Predictive modeling for cryptocurrency investors often relies more on NLP sentiment tools due to the limited availability of fundamental data.

Predictive modeling workflow for traders

Emerging Trends in Predictive Modeling Tools

- AI-Driven Market Forecasting: Deep reinforcement learning is being applied to create self-learning trading agents.

- Explainable AI (XAI): Provides transparency to machine learning predictions, increasing trust.

- Integration with Cloud Computing: Scalable solutions now make heavy models accessible to smaller firms.

- Hybrid Approaches: Combining statistical and ML models to capture both short- and long-term patterns.

These trends highlight the ongoing evolution of predictive analytics, ensuring models are not only accurate but also explainable and scalable.

Best Practices for Using Predictive Modeling Tools

- Diversify models: Avoid relying on a single tool; use ensemble approaches.

- Backtest extensively: Validate models under different market regimes.

- Stay updated: Markets evolve, and models require retraining.

- Balance complexity with usability: A simpler, well-calibrated model often outperforms an overengineered one.

FAQ: Predictive Modeling Tools for Market Analysis

1. How can predictive models improve trading accuracy?

Predictive models filter out noise and highlight statistically significant signals. By combining data science with financial theory, they identify higher-probability setups, leading to more disciplined trading.

2. What are the best predictive modeling tools for beginners?

Beginners should start with time series forecasting tools (like ARIMA in Python) and explore platforms offering simplified predictive analytics dashboards. Over time, transitioning to machine learning libraries (TensorFlow, scikit-learn) is advisable.

3. How do predictive models compare to traditional analysis?

Traditional analysis often relies on fundamental or technical indicators in isolation. Predictive models integrate vast datasets and apply statistical learning, producing probabilistic forecasts that adapt to changing conditions. This explains how predictive modeling compares to traditional analysis—the former is dynamic and data-driven, while the latter is more static.

Conclusion

Predictive modeling tools are no longer optional—they’re essential for anyone seeking an edge in modern markets. From time series analysis to machine learning and sentiment-driven models, these tools provide deeper insights, sharper accuracy, and enhanced risk management.

For professionals, blending multiple predictive approaches ensures adaptability across diverse conditions. For beginners, starting small and gradually scaling into advanced methods is key. Ultimately, the power of predictive modeling lies not just in forecasting but in transforming uncertainty into structured, data-driven decision-making.

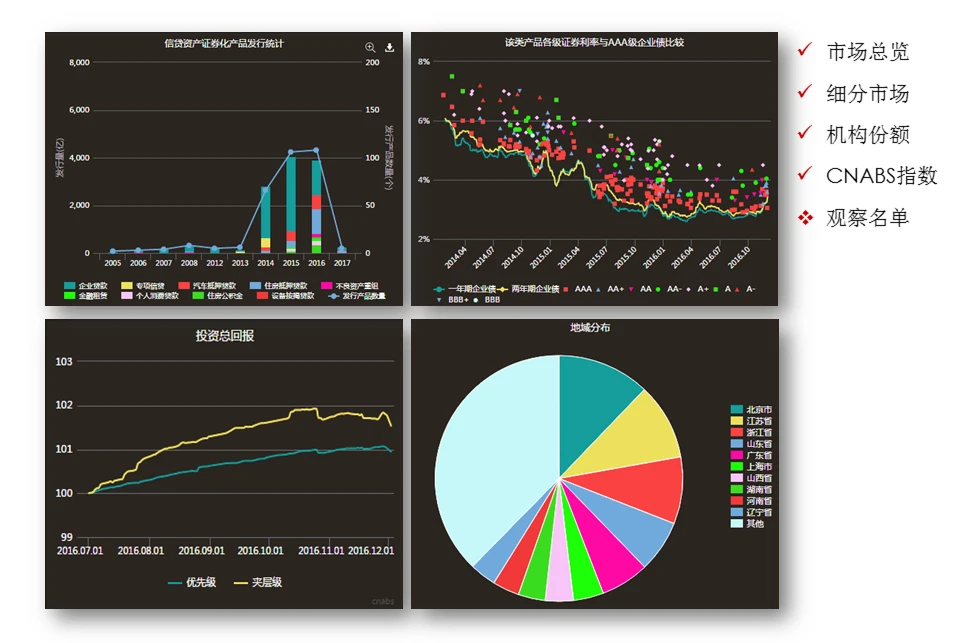

Data-driven trading insights with predictive modeling

💡 What predictive modeling tools do you rely on most in your market analysis? Share your experiences in the comments below—and don’t forget to share this article with colleagues and trading communities to spark deeper discussions on the future of predictive analytics.