============================================

Trade volume is one of the most essential concepts in financial markets, providing insight into market activity, liquidity, and potential price movements. For beginners, understanding trade volume can significantly improve trading strategies and decision-making. This comprehensive guide explores where beginners can learn about trade volume, explains key concepts, and provides practical strategies for applying trade volume analysis in real-world trading.

Understanding Trade Volume

What is Trade Volume?

Trade volume refers to the total number of shares, contracts, or units of a security that are traded during a specific time period. It reflects the market activity and liquidity, serving as a vital metric for assessing investor interest and potential price trends.

Key points about trade volume:

- High trade volume often signals strong interest or conviction in a market move.

- Low trade volume may indicate uncertainty, lack of participation, or consolidation periods.

- Trade volume is analyzed alongside price movements to confirm trends or anticipate reversals.

Why trade volume is important in quantitative analysis:

Quantitative traders use trade volume as a crucial input for modeling, risk management, and validating trading signals. Changes in volume can indicate the strength or weakness of a price trend and help identify trading opportunities.

Types of Trade Volume

- Equity Volume: Number of shares traded for a specific stock.

- Futures/Options Volume: Contracts traded in derivative markets.

- Forex Volume: Often represented as tick volume due to decentralized trading.

- Crypto Volume: Trades occurring across exchanges, often aggregated to assess market activity.

Each type of volume provides unique insights depending on the asset class and trading objectives.

Illustration showing trade volume differences across stocks, futures, forex, and crypto markets.

Where Beginners Can Learn About Trade Volume

Online Courses and Tutorials

Many platforms provide structured learning for beginners to understand trade volume and its applications:

- Investopedia Academy: Offers beginner-friendly tutorials on market fundamentals, including trade volume interpretation.

- Coursera & Udemy: Feature courses like “Stock Market Fundamentals” and “Introduction to Technical Analysis,” covering volume indicators.

- YouTube Channels: Practical demonstrations on reading volume bars, VWAP, and volume-related technical analysis.

Tip: Look for courses that integrate practical examples and historical trade volume data to reinforce learning.

Books and Guides

- Technical Analysis of the Financial Markets by John J. Murphy – Comprehensive coverage of volume analysis techniques.

- A Beginner’s Guide to Day Trading Online by Toni Turner – Focuses on volume indicators for intraday strategies.

- Market Wizards by Jack D. Schwager – Offers insights from professional traders on interpreting market activity and volume trends.

Trade volume analysis for individual investors:

Books and guides often include exercises and examples that help beginners practice volume interpretation in simulated trading environments.

Interactive Platforms and Simulators

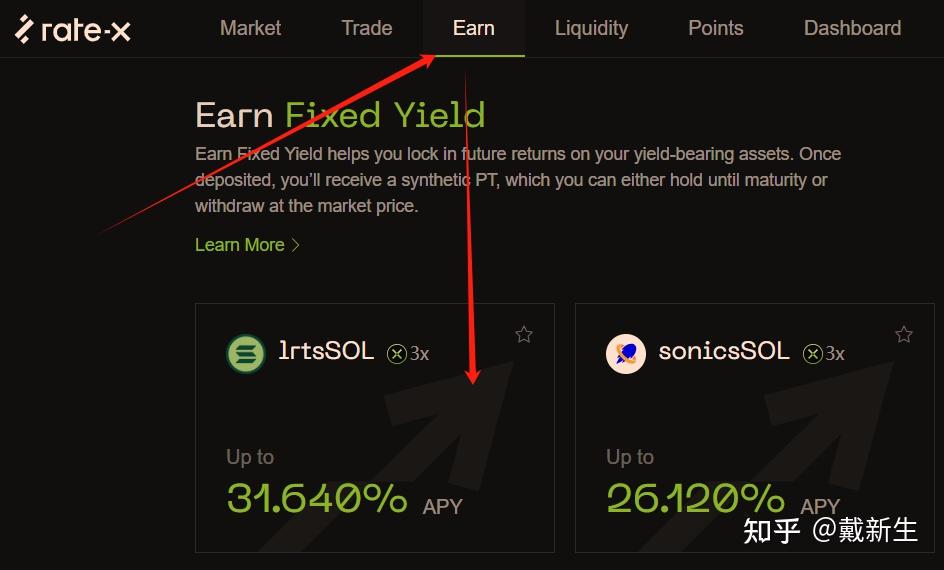

- TradingView: Provides real-time charts with volume indicators, enabling beginners to observe volume trends alongside price action.

- Thinkorswim by TD Ameritrade: Advanced charting tools with volume-based studies and alerts.

- NinjaTrader: Simulation environment for applying trade volume strategies without risking real capital.

Advantages:

- Hands-on experience helps solidify theoretical knowledge.

- Ability to test volume-based strategies in real-time scenarios.

Screenshot showing a trading platform with real-time volume indicators and chart overlays.

Strategies for Using Trade Volume

Strategy 1: Volume-Price Confirmation

Concept: Use trade volume to confirm price trends.

- High volume with upward price movement: Confirms bullish momentum.

- High volume with downward price movement: Confirms bearish trends.

- Low volume during price movement: Indicates potential trend weakness or reversal.

Pros:

- Helps filter false breakouts and identify strong market moves.

Cons:

- Requires continuous monitoring and historical data comparison.

How to calculate trade volume in quantitative trading:

Quant traders often normalize volume against historical averages to generate signals and integrate into automated strategies.

Strategy 2: Volume Oscillators and Indicators

Indicators help interpret trade volume dynamics quantitatively:

- On-Balance Volume (OBV): Tracks cumulative buying and selling pressure.

- Volume Rate of Change (VROC): Measures the percentage change in volume over time.

- Chaikin Money Flow (CMF): Combines price and volume to detect accumulation or distribution.

Pros:

- Provides early signals of potential breakouts or reversals.

- Useful for both short-term and long-term trading.

Cons:

- Indicators may lag in fast-moving markets.

- Should be combined with other technical analysis tools for accuracy.

Where to find reliable trade volume data:

Data can be sourced from broker platforms, financial APIs (e.g., Alpha Vantage, Yahoo Finance), and exchange-provided historical datasets.

Strategy 3: Algorithmic Volume Analysis

Concept: Quantitative traders use volume data to create algorithmic models:

- Detect anomalies in trading patterns.

- Predict price movements using historical volume correlations.

- Integrate with machine learning models for automated execution.

Pros:

- Leverages real-time data for high-frequency trading.

- Reduces emotional bias in decision-making.

Cons:

- Requires programming knowledge and data infrastructure.

- Model performance depends on data quality and validation.

Flowchart showing algorithmic trading incorporating trade volume metrics for signal generation.

Practical Tips for Beginners

- Start with daily volume charts to understand normal trading ranges.

- Compare volume with historical averages to identify abnormal activity.

- Combine volume with price patterns like candlesticks or trend lines.

- Use simulators to practice volume-based strategies without financial risk.

- Document your analysis and refine your interpretation over time.

How to interpret changes in trade volume:

Sudden spikes or drops often indicate market reactions to news, earnings reports, or institutional trades. Observing these changes helps predict short-term price behavior.

FAQ

Q1: Is trade volume only relevant for stocks?

A1: No, trade volume applies to all tradable markets, including futures, forex, and crypto. The key is understanding how volume is represented in each market.

Q2: How can I start learning trade volume effectively?

A2: Begin with online courses and interactive platforms, then supplement learning with books and historical data analysis. Simulated trading helps reinforce concepts without risking capital.

Q3: What are common mistakes beginners make with trade volume?

A3: Mistakes include ignoring historical context, relying solely on volume without price confirmation, and over-trading based on volume spikes alone. Combining multiple indicators improves accuracy.

Conclusion

For beginners, learning about trade volume is crucial for developing effective trading strategies and understanding market dynamics. By leveraging courses, books, simulators, and quantitative analysis, beginners can:

- Interpret market activity accurately.

- Confirm price trends and detect reversals.

- Integrate volume into both manual and algorithmic trading strategies.

Trade volume is not just a metric—it’s a gateway to smarter, data-driven trading decisions.

Visual roadmap for beginners learning trade volume, from theory to practical application.

For aspiring traders, combining practical trade volume exercises with reliable data sources and simulations provides the fastest route to mastering this fundamental market indicator.

If you want, I can create a detailed beginner’s roadmap for mastering trade volume, including recommended courses, platforms, and practice exercises.

Do you want me to create that roadmap?