=======================================================

Quantitative trading, with its reliance on complex algorithms and statistical models, has revolutionized how traders and investors approach the markets. However, despite its technical nature, there is still a place for fundamental analysis—the study of economic and financial factors that can influence the value of assets. This article explores how to incorporate fundamental analysis into quantitative trading, offering strategies, tips, and real-world applications to help you build more robust models.

What is Fundamental Analysis in Quantitative Trading?

Fundamental analysis involves analyzing macroeconomic indicators, financial reports, earnings, and other data points to evaluate the intrinsic value of a security. In the context of quantitative trading, fundamental data can be integrated into trading models to enhance predictive accuracy and improve decision-making.

While traditional quantitative trading focuses on price action, market volume, and other time-series data, incorporating fundamental analysis can provide a deeper understanding of the market forces that drive asset prices.

This approach is not without its challenges, as combining these two methodologies requires careful consideration and precise data integration. Let’s explore how to effectively use fundamental analysis within quantitative strategies.

Why Fundamental Analysis is Important in Quantitative Trading

The fusion of fundamental analysis with quantitative trading introduces several advantages:

- Enhanced Predictive Power: While quantitative methods focus on statistical relationships and historical data, fundamental analysis adds a layer of macroeconomic and corporate health indicators that can help predict longer-term price movements.

- Improved Risk Management: By understanding the intrinsic value of assets through fundamental data, quant traders can better assess risks, such as those related to market overvaluation or undervaluation.

- Increased Strategy Diversification: Integrating fundamental analysis allows traders to diversify their strategies by incorporating not only technical but also fundamental factors in asset selection and market timing.

Where to Find Fundamental Analysis Data for Quant Strategies

To incorporate fundamental analysis, you need access to reliable data. There are several sources for gathering fundamental data:

- Financial Statements: Data from company reports such as income statements, balance sheets, and cash flow statements.

- Macroeconomic Indicators: Data on inflation, unemployment, GDP growth, interest rates, etc., from government or central bank sources.

- Analyst Reports: Insights from financial analysts, including stock ratings, earnings estimates, and price targets.

- Third-Party Data Providers: Subscription-based services like Bloomberg, Reuters, and Morningstar offer high-quality fundamental data.

By selecting the right data sources, you can ensure that your models are built on accurate and comprehensive information, which is critical for effective quantitative analysis.

Two Strategies for Incorporating Fundamental Analysis into Quantitative Models

Integrating fundamental analysis into quantitative trading can be approached in several ways. Below are two key strategies that blend both methodologies effectively.

Strategy 1: Factor Models with Fundamental Data

One common approach is the use of factor models, where fundamental data serves as one of the factors influencing asset returns. In a typical multi-factor model, quantitative traders use various factors, such as price momentum, earnings growth, or debt-to-equity ratios, to predict future stock prices.

Example: Using Price-to-Earnings (P/E) Ratio in a Multi-Factor Model

The Price-to-Earnings (P/E) ratio is one of the most commonly used fundamental indicators. It measures the price of a stock relative to its earnings and can provide insight into whether a stock is overvalued or undervalued.

- Data Integration: In this strategy, you could combine the P/E ratio with other technical indicators (e.g., moving averages, RSI) to generate trading signals. A stock with a low P/E ratio compared to its historical average and positive momentum might present a buying opportunity.

- Advantages: This strategy takes into account both fundamental valuation and market sentiment, offering a comprehensive view.

- Disadvantages: The challenge lies in the selection and weighting of factors. Poorly chosen factors or incorrect weights can lead to suboptimal performance.

Strategy 2: Quantitative Screening Based on Fundamental Criteria

Another method is quantitative screening based on fundamental criteria. This approach uses predefined thresholds for fundamental metrics (e.g., return on equity, debt levels, earnings growth) to filter potential investment opportunities.

Example: Screening Stocks Based on Return on Equity (ROE) and Debt-to-Equity Ratio

You might design a quantitative model to screen stocks with a high return on equity (ROE) and a low debt-to-equity ratio (D/E), which typically indicate a company’s financial health and ability to generate profits without excessive borrowing.

- Data Integration: Set specific thresholds for each fundamental metric (e.g., ROE > 15%, D/E < 0.5). The model filters out companies that don’t meet these criteria and ranks the remaining stocks based on other quantitative metrics like momentum or volatility.

- Advantages: This approach allows you to select stocks that meet both fundamental and technical criteria, reducing risk.

- Disadvantages: Over-relying on a narrow set of criteria could limit diversification, and unexpected market events could impact stock performance, even for fundamentally strong companies.

Comparing the Strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Factor Models with Fundamental Data | Comprehensive view, integrates valuation with momentum | Can be complex to optimize and requires careful factor selection |

| Quantitative Screening Based on Fundamentals | Simple to implement, screens for financially healthy companies | May miss high-growth opportunities or market anomalies |

How to Improve Quant Strategies with Fundamental Analysis

Integrating fundamental analysis into quantitative strategies isn’t a one-time task. Here are several ways to continually improve and optimize your models:

1. Regularly Update Data Sources

Ensure that your data is up to date, as macroeconomic conditions, corporate earnings, and other fundamental factors can change rapidly. By regularly refreshing the data, you can avoid stale models and adapt to new market realities.

2. Combine with Machine Learning

Machine learning can be a powerful tool in improving fundamental analysis models. By using algorithms to identify complex relationships between fundamental indicators and asset prices, you can uncover new patterns and refine your predictions.

3. Backtest and Refine

Before deploying any strategy, backtest it rigorously using historical data. This helps you understand how your models would have performed in different market conditions, allowing you to make necessary adjustments.

FAQ: Common Questions About Using Fundamental Analysis in Quantitative Trading

1. Can fundamental analysis be used in high-frequency trading?

While high-frequency trading (HFT) relies on microsecond price movements and technical factors, fundamental analysis can still play a role in identifying long-term trends. However, it is typically less prominent in HFT, where speed is paramount.

2. What is the best fundamental indicator for quant trading?

There is no “best” indicator, as it depends on the strategy and asset being traded. Common choices include P/E ratio, ROE, debt-to-equity ratio, and earnings growth. A combination of indicators often yields the best results.

3. How can I automate the integration of fundamental analysis into my quant model?

Automation can be achieved by integrating API services from data providers like Bloomberg or Alpha Vantage into your quant trading software. This allows you to pull real-time fundamental data directly into your models.

Conclusion

Incorporating fundamental analysis into quantitative trading is not just about adding a layer of traditional financial analysis—it’s about creating a more comprehensive, data-driven approach that combines the best of both worlds. By employing strategies such as multi-factor models or quantitative screening, and continually refining your models, you can enhance the accuracy of your predictions and manage risk more effectively.

If you’re looking to dive deeper into fundamental analysis for quantitative trading, start by exploring resources like financial statements, macroeconomic data, and expert insights. Remember, the key is to blend technical and fundamental data in a way that optimizes your model’s performance.

If you found this article helpful, feel free to share it with your peers or leave a comment with your thoughts and questions. Let’s continue the conversation on how to improve quantitative trading strategies!

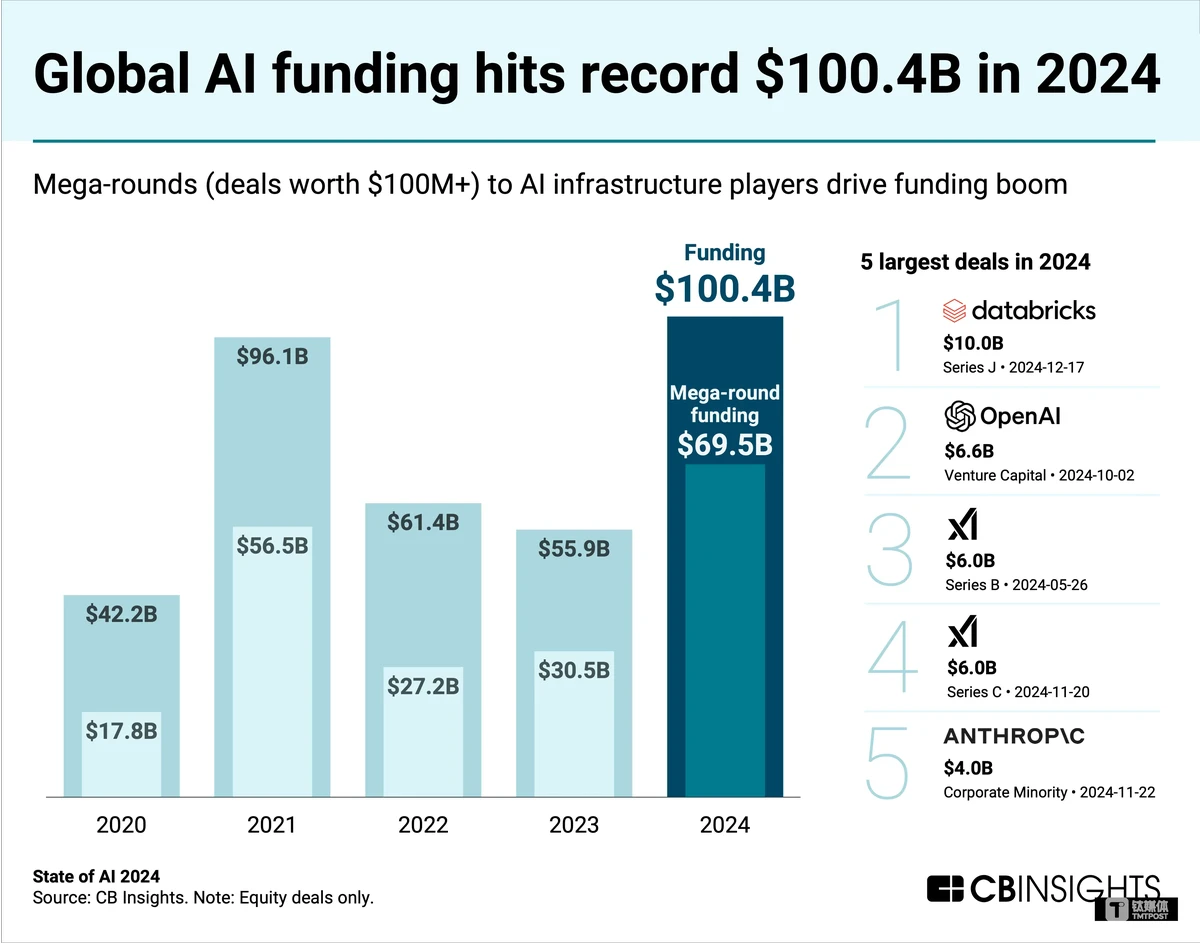

Chart showing how multiple factors, including fundamental analysis, are used to predict stock returns