==================================

Fear of Missing Out (FOMO) has become one of the most common psychological challenges investors face in both traditional markets and crypto trading. The rise of fast-moving markets, social media hype, and the constant availability of trading platforms has amplified emotional decision-making. FOMO avoidance plans for investors are therefore crucial in maintaining disciplined strategies, minimizing losses, and improving long-term portfolio performance. This comprehensive guide explains actionable strategies, compares different approaches, and provides evidence-based recommendations for avoiding FOMO in investment decisions.

Understanding FOMO in Investing

What Is FOMO in Finance?

In investing, FOMO refers to the emotional reaction investors experience when they fear missing out on potential profits from a rising asset. It often leads to impulsive buying at inflated prices or overexposure to risky trades.

Why FOMO Is Dangerous for Investors

- Buying tops: Entering positions when assets are overvalued.

- Poor risk-reward: Ignoring risk management for the chance of short-term gains.

- Emotional exhaustion: Increased stress, anxiety, and inconsistent decision-making.

- Portfolio imbalance: Overconcentration in trending assets.

According to behavioral finance studies, FOMO is one of the leading causes of underperformance compared to disciplined, systematic investment strategies.

The Psychology Behind FOMO

Why Investors Experience FOMO

- Social influence: News headlines and social media amplify hype cycles.

- Loss aversion: The pain of “missing out” feels stronger than the satisfaction of steady gains.

- Overconfidence: Believing one can time the market better than others.

- Herd mentality: Following crowd behavior without proper analysis.

This explains why traders experience FOMO across asset classes, from stocks to crypto, where volatility amplifies emotional biases.

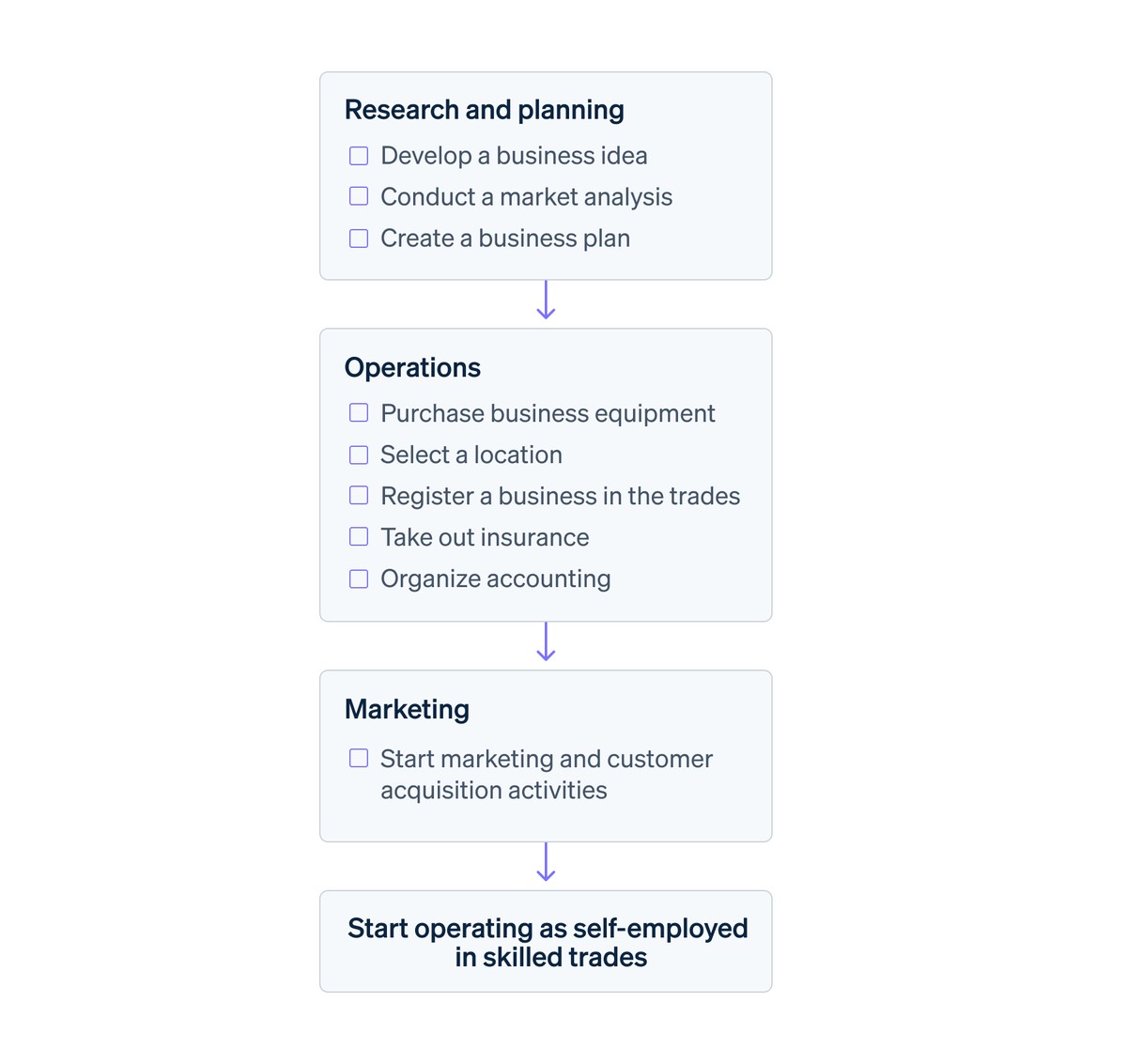

Core Elements of FOMO Avoidance Plans

1. Predefined Investment Framework

One of the strongest defenses against FOMO is having a written investment plan that sets rules for entry, exit, and position sizing.

- Asset allocation models (e.g., 60⁄40 stock-bond split).

- Risk parameters (e.g., maximum 2% portfolio risk per trade).

- Time horizon definitions (short-term vs. long-term).

Pros: Reduces impulsive decisions.

Cons: May feel restrictive during unexpected opportunities.

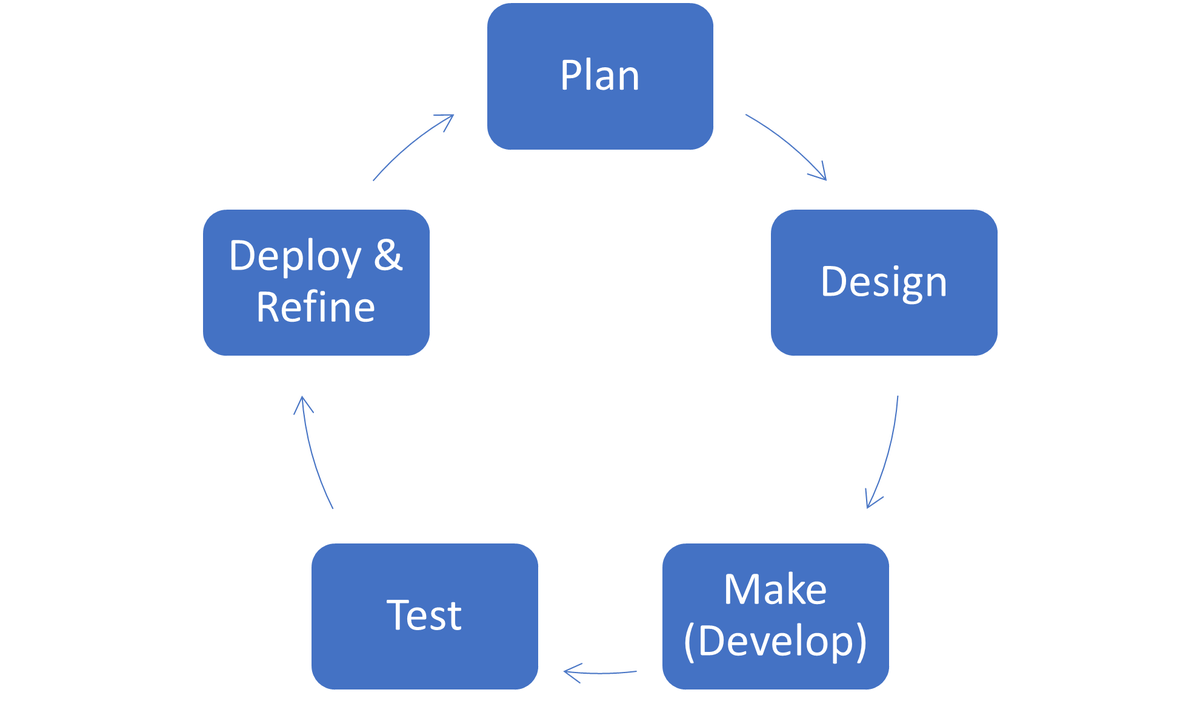

2. Automated or Algorithmic Trading

Automation removes emotions by executing trades strictly based on pre-set rules. Algorithms can monitor trends, volatility, and risk levels more objectively than humans.

- Stop-loss and take-profit automation.

- Rule-based strategies such as momentum or mean reversion.

- Portfolio rebalancing bots.

This approach directly aligns with how to handle FOMO in quantitative trading, as algorithms enforce discipline and minimize emotional bias.

Pros: Emotion-free execution, consistent performance.

Cons: Requires technical setup and backtesting knowledge.

3. Mindset and Behavioral Adjustments

Investors must actively develop psychological resilience to avoid emotional traps.

- Delayed decision rule: Waiting 24 hours before executing a trade.

- Mindfulness practices: Meditation or journaling to recognize emotional triggers.

- Education: Studying market cycles and historical patterns of bubbles.

Pros: Long-term improvement in self-control.

Cons: Takes time and discipline to internalize.

4. Diversification and Dollar-Cost Averaging (DCA)

By investing systematically and across multiple assets, investors reduce the urgency to “chase winners.”

- DCA strategy: Investing a fixed amount periodically, regardless of price.

- Diversification: Spreading across asset classes, industries, and geographies.

Dollar-Cost Averaging Chart for FOMO Reduction

Pros: Smooths out volatility, removes pressure of timing the market.

Cons: Can underperform lump-sum investing during long bull runs.

Comparing Different FOMO Avoidance Strategies

| Strategy | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Predefined Investment Framework | Consistent, rule-based decisions | May miss short-term opportunities | Long-term investors |

| Automated Trading | Removes emotion, systematic execution | Requires technical expertise | Quantitative & disciplined traders |

| Behavioral Adjustments | Strengthens long-term discipline | Requires practice and patience | All investors |

| DCA & Diversification | Reduces timing risk, spreads exposure | Lower returns in straight bull markets | Conservative & retail investors |

Case Studies: FOMO in Action

Crypto Bull Market 2021

Many retail investors bought Bitcoin near all-time highs due to hype, only to see large drawdowns. Investors using DCA significantly reduced average entry prices compared to those who chased rallies.

Meme Stocks & Social Media Hype

During the 2021 meme stock surge, investors influenced by online communities bought at unsustainable valuations. Institutional investors with FOMO risk management strategies avoided exposure and focused on long-term fundamentals.

FOMO-driven retail vs. disciplined investor performance comparison

Best Practices for FOMO Avoidance

- Write and review your investment policy statement (IPS).

- Limit exposure to hype-driven platforms that encourage emotional trading.

- Use position sizing and stop-loss orders to control downside risk.

- Conduct post-trade reviews to identify FOMO-driven decisions.

- Balance rational analysis with behavioral awareness.

FAQ: FOMO Avoidance for Investors

1. How to avoid FOMO in stock trading?

Use predefined entry and exit rules, diversify portfolios, and apply DCA. Avoid trading based on news or social media trends without independent verification.

2. How does FOMO lead to trading mistakes?

It leads to entering at market tops, over-leveraging, and ignoring risk controls. The emotional urgency to “not miss out” overrides rational analysis, causing poor timing.

3. Why avoiding FOMO improves trading performance?

Avoiding FOMO ensures decisions are based on analysis, not emotions. Over time, this improves consistency, reduces drawdowns, and builds long-term wealth stability.

Conclusion: Building Sustainable FOMO Avoidance Plans

FOMO avoidance plans for investors are not about avoiding opportunities—they are about making decisions from a position of clarity, discipline, and strategy. Whether through automated systems, diversification, or behavioral training, the goal is the same: reduce emotional interference in financial decision-making.

For long-term success, investors should combine structural methods (frameworks, automation) with psychological resilience (mindset training). This hybrid plan ensures balance, consistency, and confidence in volatile markets.

👉 What’s your go-to strategy for avoiding FOMO—automation, DCA, or behavioral discipline? Share your thoughts below and pass this guide along to fellow investors who may benefit from practical solutions to one of the biggest psychological challenges in finance.