=======================================================

In today’s sophisticated financial markets, where fundamental analysis fits in quantitative trading has become a crucial question for traders, portfolio managers, and algorithmic strategists. Combining traditional financial insights with data-driven models offers a hybrid approach that enhances risk-adjusted returns while leveraging the speed and precision of quantitative trading.

Understanding Fundamental Analysis in the Context of Quant Trading

What is Fundamental Analysis?

Fundamental analysis evaluates the intrinsic value of assets by examining economic indicators, company financials, market conditions, and macroeconomic factors. It focuses on:

- Earnings and revenue trends

- Debt-to-equity ratios

- Cash flow and liquidity metrics

- Industry and economic outlook

In essence, fundamental analysis seeks to determine whether an asset is overvalued, undervalued, or fairly priced.

Why It Matters in Quantitative Trading

Quantitative trading relies on mathematical models, algorithms, and historical data to drive decision-making. Integrating fundamental analysis helps quant models:

- Identify mispriced assets overlooked by purely technical signals.

- Improve long-term portfolio performance.

- Reduce reliance on short-term noise and volatility.

How fundamental analysis impacts quantitative models is a critical consideration, as it introduces qualitative insights into data-driven strategies, creating a more holistic trading approach.

Diagram illustrating the integration of fundamental metrics into quantitative models.

Methods to Integrate Fundamental Analysis in Quantitative Strategies

1. Factor-Based Quant Models

How It Works

Factor-based models assign numerical weights to fundamental metrics like P/E ratio, EBITDA growth, or debt ratios. These factors are incorporated into quant algorithms to screen and rank stocks.

Example factors:

- Value Factors: P/B, P/E ratios

- Quality Factors: ROE, profit margins

- Growth Factors: Revenue and earnings growth

- Value Factors: P/B, P/E ratios

Pros

- Provides objective quantification of fundamental signals.

- Enhances predictive power for long-term trends.

- Easy to backtest with historical data.

Cons

- Requires constant data updates.

- Overfitting risk if too many factors are included.

- May lag in fast-moving markets.

Tip: Traders can explore where to find fundamental analysis data for quant strategies to ensure high-quality inputs for factor models.

2. Hybrid Algorithmic Models

How It Works

Hybrid models combine fundamental data with technical and market indicators:

- Step 1: Quant algorithm identifies potential trades based on historical patterns.

- Step 2: Fundamental filters screen assets for long-term viability.

- Step 3: Final ranking integrates risk-adjusted metrics and macroeconomic trends.

Pros

- Balances short-term technical signals with long-term fundamental outlook.

- Reduces false positives in high-frequency trading scenarios.

- Supports diversified portfolio strategies.

Cons

- Complexity increases development time.

- Requires significant computational resources.

- Model validation can be more challenging.

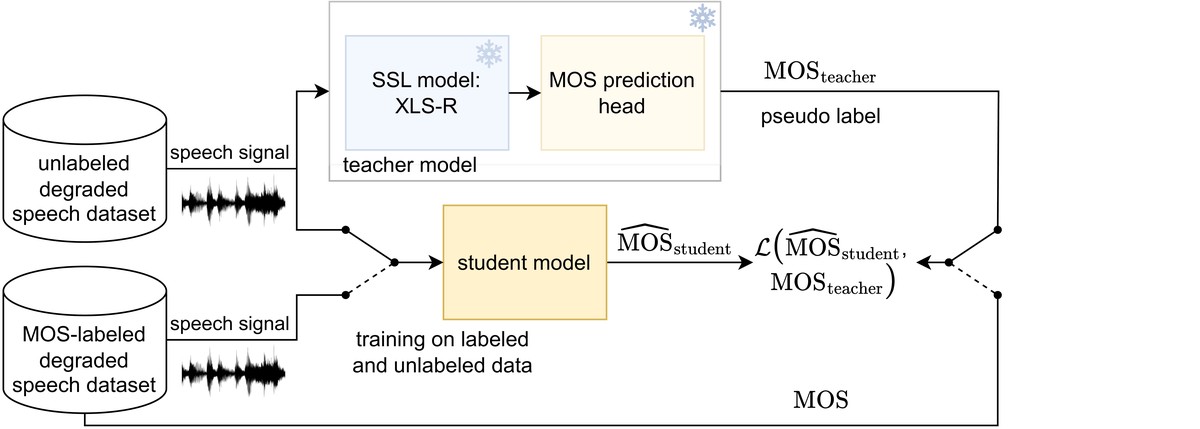

Flowchart showing hybrid model combining fundamental and quantitative signals.

Comparing Factor-Based vs. Hybrid Approaches

| Strategy | Advantages | Challenges |

|---|---|---|

| Factor-Based Quant Models | Simple, data-driven, easy to backtest | May lag in volatile markets, overfitting risk |

| Hybrid Algorithmic Models | Comprehensive, balances short-term & long-term | Complex setup, computationally intensive |

Recommendation: For most traders, starting with factor-based models and gradually integrating hybrid approaches provides a balance of simplicity, accuracy, and long-term insight.

Tools and Resources for Quantitative Fundamental Analysis

- Data Sources: Bloomberg, FactSet, Yahoo Finance API

- Software Platforms: Python libraries (Pandas, QuantLib), R packages for financial analysis

- Courses & Tutorials: Fundamental analysis courses for aspiring quant traders, step-by-step fundamental analysis approach in quantitative trading

Using these resources ensures that quantitative strategies are backed by high-quality fundamental insights.

FAQ – Integrating Fundamental Analysis in Quant Trading

1. Can fundamental analysis improve high-frequency trading?

While HFT typically focuses on millisecond price movements, incorporating fundamental insights can refine asset selection and risk management over longer holding periods.

2. How do I avoid overfitting when combining fundamental data with quant models?

Use cross-validation, limit the number of factors, and ensure data is robust and consistent across timeframes. Hybrid models should be tested under multiple market conditions.

3. Where should retail quantitative traders start?

Begin with factor-based models using a few key metrics like P/E, ROE, and revenue growth. Gradually integrate technical signals and more advanced fundamental indicators.

4. Does fundamental analysis slow down algorithmic trading?

Not necessarily. With proper data pipelines and pre-computed factors, integration can occur without significant execution delays.

Conclusion

Understanding where fundamental analysis fits in quantitative trading allows traders to combine the best of both worlds: the rigor and speed of algorithms with the strategic insight of fundamental valuation. Whether using factor-based models or hybrid approaches, integrating fundamentals enhances portfolio resilience, reduces risk, and improves long-term returns. By leveraging high-quality data, effective tools, and validated strategies, quant traders can achieve a sustainable edge in competitive markets.

Visual overview of combining quantitative models with fundamental analysis.

Engage with this article by sharing your experiences with combining fundamental and quantitative approaches, commenting on the methods that worked best, or discussing innovative ways to enhance quant strategies with fundamental insights.