In the competitive world of quantitative trading, salary expectations can be influenced by various factors such as location, skillset, industry demand, and market conditions. The Australian market presents unique challenges and opportunities for quant traders, with salary structures varying based on the country’s economic conditions, the demand for skilled professionals, and the performance of the finance industry. In this article, we will explore how the Australian market affects quant trader salaries, examining key factors such as job market trends, industry demand, and regional differences in compensation.

TL;DR

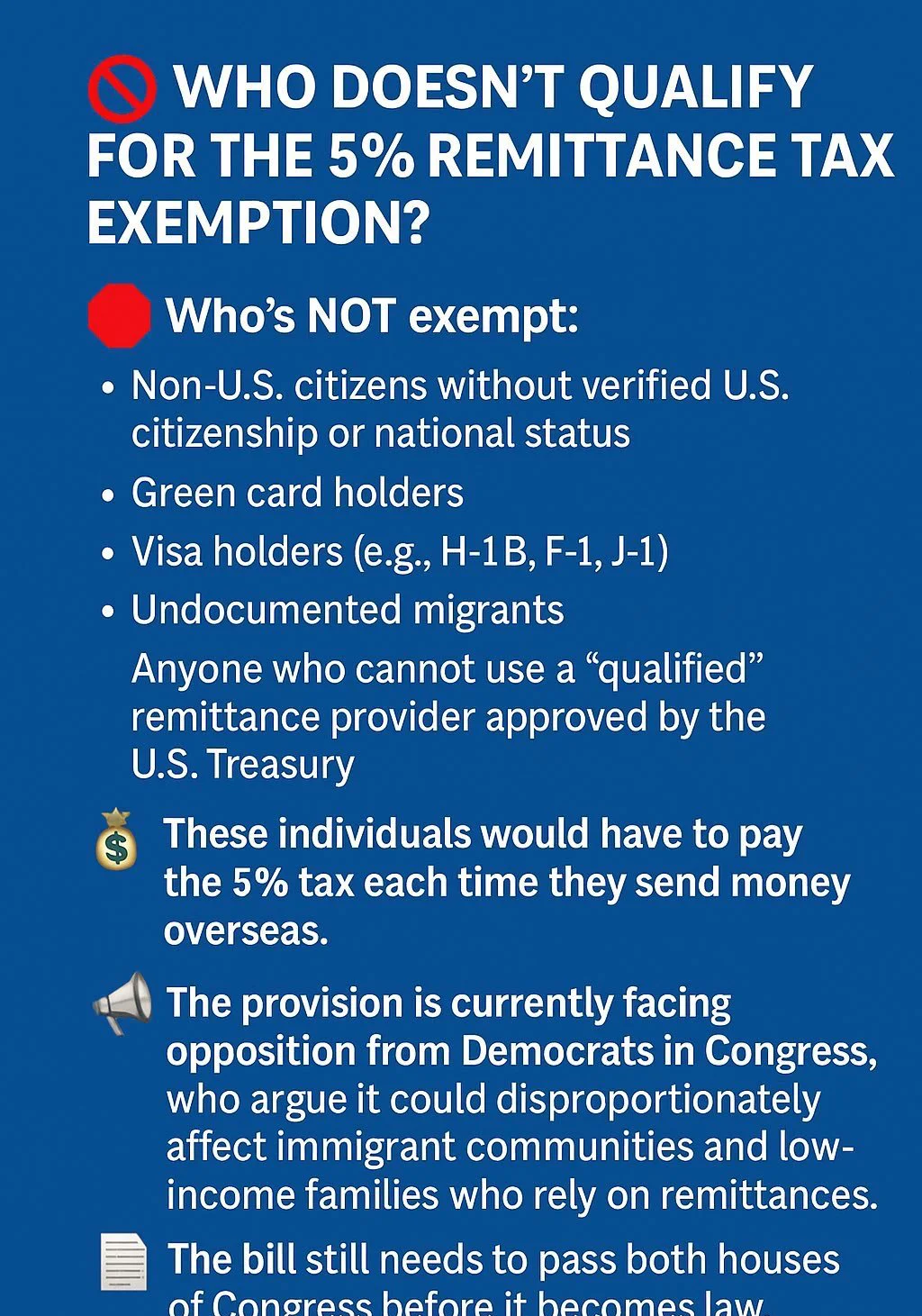

Quant traders in Australia are impacted by the broader economic climate and the state of the finance sector.

The Australian market presents opportunities for quant traders with specialized skills, but also comes with competition.

Salary expectations vary by experience, location, and industry.

Sydney and Melbourne offer higher salaries compared to regional areas.

A well-rounded skillset and continuous professional development can improve earning potential.

Table of Contents

Introduction: Quant Trading in Australia

Factors Affecting Quant Trader Salaries in Australia

Economic Conditions and the Australian Financial Market

Industry Demand and Supply of Quant Traders

How Much Do Quant Traders Earn in Australia?

Entry-Level Quant Trader Salaries

Mid-Career and Senior Quant Trader Salaries

How Location Influences Quant Trader Salaries

Sydney and Melbourne vs Other Australian Cities

Regional Salary Variations

Why Are Quant Trader Salaries High in Australia?

High Demand for Quantitative Skills

Competitive Job Market and Salary Packages

How to Increase Your Salary as a Quant Trader in Australia

Skills and Certifications to Boost Your Earning Potential

Networking and Career Progression Tips

Conclusion: Is a Career in Quant Trading Worth It in Australia?

FAQ

Introduction: Quant Trading in Australia

Quantitative trading in Australia is a growing field, offering opportunities for talented individuals who are well-versed in data analysis, statistical modeling, and algorithmic trading. The Australian financial sector is known for its innovation, and as the demand for automated trading strategies increases, so does the need for skilled quant traders.

The salaries of quant traders in Australia are shaped by several factors, including economic conditions, industry demand, location, and skillset. Understanding how these variables impact compensation can help professionals in the field assess their potential earnings and plan their career trajectories.

Factors Affecting Quant Trader Salaries in Australia

Economic Conditions and the Australian Financial Market

Australia’s economic environment plays a significant role in shaping the compensation of professionals in the financial sector, including quant traders. The Australian financial market, driven by institutional investors, hedge funds, and financial firms, is influenced by both local and global economic trends.

Global market conditions: Australia’s financial sector is tied to global markets, and the performance of major global economies can directly impact the Australian market. This, in turn, affects demand for quantitative trading strategies and, consequently, the salaries of those who develop and implement them.

Local economic performance: Australia’s economy, including interest rates, inflation, and GDP growth, can affect the availability of jobs in the finance sector, thus influencing salary trends for quant traders.

A thriving economy generally leads to an increase in financial activity, which boosts the demand for quant traders. Conversely, during economic downturns or periods of uncertainty, salary growth may stagnate, and the job market may become more competitive.

Industry Demand and Supply of Quant Traders

The demand for quantitative traders in Australia is heavily influenced by the growth of the finance and tech sectors. Australia’s financial institutions, hedge funds, and investment banks require skilled professionals who can analyze large datasets and build trading algorithms to maximize returns. The supply of qualified quant traders, however, is limited, which contributes to higher salaries.

Increased demand for automation: As financial institutions continue to adopt automation and artificial intelligence for trading decisions, the need for quant traders to build and refine these systems has grown.

Specialized skill sets: Those with expertise in machine learning, data science, and financial modeling are particularly in demand, as these skills enable traders to analyze complex datasets and create high-performance algorithms.

This supply-demand imbalance often leads to higher salaries for those with the right expertise, as employers compete to secure top talent.

How Much Do Quant Traders Earn in Australia?

Quantitative trading salaries in Australia can vary significantly based on experience, location, and the specific industry in which the trader works. Let’s break down salary expectations based on career stages.

Entry-Level Quant Trader Salaries

For entry-level professionals entering the quant trading field in Australia, the salary range typically falls between AUD 70,000 and AUD 100,000 per year. These professionals are usually fresh graduates with a strong academic background in finance, mathematics, engineering, or computer science.

However, the salary range can fluctuate depending on the organization and location. For example, those working in larger cities such as Sydney or Melbourne might expect higher starting salaries due to the higher cost of living and the concentration of financial firms.

Mid-Career and Senior Quant Trader Salaries

As quant traders gain experience, their earning potential increases significantly. Mid-career professionals with several years of experience can earn anywhere from AUD 120,000 to AUD 180,000 annually. Senior professionals, particularly those in leadership positions or with specialized skills, can earn upwards of AUD 200,000 per year.

Senior quant traders who lead trading desks or manage teams of analysts and developers often have salaries in the AUD 250,000 to AUD 300,000 range, or even higher if bonuses and profit-sharing arrangements are included.

How Location Influences Quant Trader Salaries

Sydney and Melbourne vs Other Australian Cities

Location plays a significant role in the salary of quant traders in Australia. Major financial hubs like Sydney and Melbourne tend to offer the highest salaries, given the concentration of financial institutions, hedge funds, and trading firms.

Sydney: As Australia’s financial capital, Sydney offers the highest salaries for quant traders, with entry-level salaries often starting at AUD 90,000 to AUD 100,000, and senior traders earning significantly more.

Melbourne: Melbourne, while slightly smaller than Sydney, also offers competitive salaries, with figures similar to those in Sydney.

Regional Salary Variations

In contrast, cities outside of Sydney and Melbourne, such as Brisbane or Perth, may offer slightly lower salaries, though they are still competitive by Australian standards. The cost of living in these areas is also lower, which may offset the salary differences.

Why Are Quant Trader Salaries High in Australia?

High Demand for Quantitative Skills

Australia’s financial sector is increasingly reliant on quantitative skills for managing risk, optimizing portfolios, and making data-driven investment decisions. The growing need for automation and machine learning in financial modeling means that highly skilled quant traders are in high demand, pushing salaries upward.

Competitive Job Market and Salary Packages

Quantitative trading is a competitive field, and firms are often willing to offer higher salaries, bonuses, and benefits to attract and retain top talent. This is especially true for firms in cities like Sydney, where the financial sector is robust and offers high-paying opportunities.

How to Increase Your Salary as a Quant Trader in Australia

Skills and Certifications to Boost Your Earning Potential

Advanced degrees: Earning a master’s or Ph.D. in a quantitative field like finance, computer science, or mathematics can significantly boost your earning potential.

Specialized certifications: Pursuing certifications like CFA, FRM, or CQF can enhance your credibility and increase your value to employers.

Networking and Career Progression Tips

Building a professional network, gaining experience in high-demand sectors, and continuously improving your skills can help you command a higher salary. Additionally, seeking roles in leadership or management can open the door to higher compensation packages.

Conclusion: Is a Career in Quant Trading Worth It in Australia?

Quantitative trading is a highly rewarding career, both intellectually and financially, especially in Australia. The demand for skilled quant traders continues to grow, particularly in cities like Sydney and Melbourne. While the competition for top positions is fierce, those with the right skillset, education, and experience can enjoy lucrative salaries and career progression opportunities.

If you’re considering a career in quantitative trading in Australia, it’s essential to continuously refine your skills and understand the factors

0 Comments

Leave a Comment