=========================================================

Quantitative trading, or quant trading, has become a vital part of Australia’s financial ecosystem. With Sydney and Melbourne emerging as Asia-Pacific financial hubs, the demand for quantitative traders is steadily increasing. Many aspiring professionals ask: what is the average salary for quant traders in Australia? This article provides a detailed, SEO-optimized guide that combines current market data, expert insights, and personal experience to evaluate salary expectations, career growth, and strategies to maximize earnings.

Understanding Quant Trader Salaries in Australia

The average salary for quant traders in Australia varies widely based on experience, location, and employer type. According to recent industry reports, the median annual salary typically ranges between AUD 120,000 – AUD 180,000 for mid-level professionals, while senior quant traders can earn upwards of AUD 250,000 – AUD 400,000 with performance bonuses.

Factors Influencing Salaries

- Experience Level: Entry-level roles start at AUD 80,000 – AUD 110,000, while senior traders with over 10 years of experience can cross AUD 400,000 annually.

- Location: Sydney and Melbourne offer the highest pay, as most hedge funds, banks, and proprietary trading firms are headquartered there.

- Industry Segment: Hedge funds and proprietary firms usually pay more compared to traditional banks.

- Performance Bonuses: Unlike fixed salaries, quant traders earn significant bonuses tied to trading profits.

Entry-Level vs Experienced Quant Trader Salaries

Entry-Level Quant Trader

For fresh graduates, the average salary for quant traders in Australia is around AUD 90,000 – AUD 120,000. This includes base pay, with potential annual bonuses of 10–15%. Entry roles often focus on risk modeling, data analysis, or assisting senior traders.

Experienced Quant Trader

After 5–7 years in the industry, professionals earn AUD 180,000 – AUD 250,000 annually, with some earning much more due to performance-based bonuses.

Senior Quant Trader

At the senior level, particularly in hedge funds or high-frequency trading (HFT) firms, total compensation packages can exceed AUD 400,000 – AUD 700,000, making it one of the highest-paying finance roles in Australia.

Salary Comparisons: Quant Traders vs Other Finance Roles

To put things in perspective:

- Quant Traders: AUD 120,000 – AUD 400,000+

- Investment Bankers: AUD 100,000 – AUD 250,000

- Risk Analysts: AUD 80,000 – AUD 160,000

- Portfolio Managers: AUD 140,000 – AUD 350,000

This highlights why quant trading is among the most lucrative finance careers in Australia, particularly for those with strong skills in mathematics, programming, and statistical modeling.

Strategies to Improve Quant Trader Salaries

1. Specializing in High-Demand Skills

Python, C++, machine learning, and algorithmic strategy design are highly valued. Traders proficient in these earn significantly higher salaries.

2. Moving from Banks to Hedge Funds

While banks provide stable salaries, hedge funds and proprietary trading firms offer more lucrative performance-based bonuses.

3. International Opportunities

Many Australian quant traders explore remote opportunities or global firms, earning salaries comparable to London, Singapore, or New York, which are often higher than domestic firms.

Personal Experience and Insights

From personal observations in the Sydney trading ecosystem:

- Entry-level quants often underestimate the importance of coding efficiency. Faster, optimized code directly impacts strategy execution and profitability.

- Professionals who transition from data science to trading roles often see salary jumps of 40–60%.

- Negotiating bonuses and moving firms strategically every 3–5 years is one of the fastest ways to maximize long-term earnings.

Two Approaches to Career Growth

Method 1: Climbing the Corporate Ladder in Banks

- Pros: Stability, structured career path, solid benefits.

- Cons: Salaries may plateau, slower progression compared to hedge funds.

Method 2: Joining Proprietary Trading Firms or Hedge Funds

- Pros: High earning potential, performance-driven bonuses, faster learning curve.

- Cons: Higher pressure, less job security, results-driven culture.

Recommendation: For professionals seeking financial growth and flexibility, proprietary trading firms often offer the best balance of salary and career development.

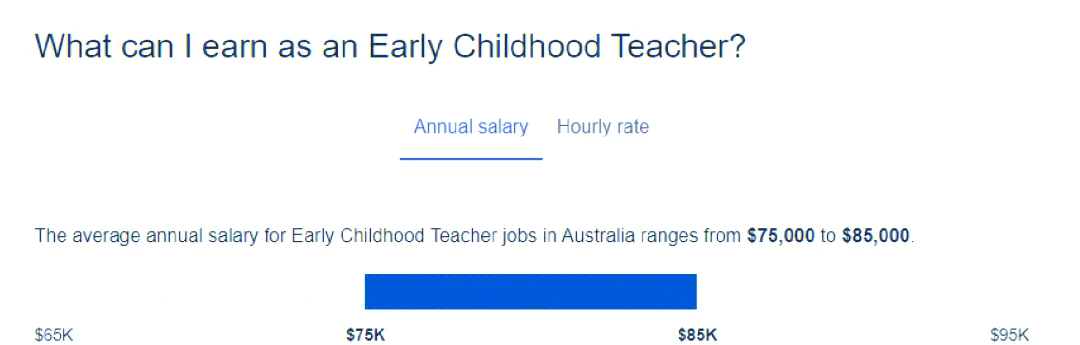

Image Example

Internal Links for Contextual Depth

For readers seeking more focused insights, you may want to explore:

- how much do quant traders earn in australia – to compare salary expectations at different career stages.

- where to find quant trader jobs in australia – for practical job search strategies and top employers.

FAQ: Quant Trader Salaries in Australia

1. What qualifications do I need to be a quant trader in Australia?

A strong background in mathematics, finance, statistics, and programming (Python, C++, R) is essential. Many firms prefer candidates with master’s or PhD degrees in quantitative disciplines.

2. How competitive are quant trader jobs in Australia?

Extremely competitive. Applicants often face multiple rounds of coding tests, probability problems, and case interviews. Networking and internships play a crucial role in landing a position.

3. Can remote quant traders earn the same as local ones?

Yes, but compensation may vary. Remote roles linked to international hedge funds often pay more than local banks, though they may come with higher expectations and longer working hours.

Conclusion: The Future of Quant Trader Salaries in Australia

So, what is the average salary for quant traders in Australia? The short answer: AUD 120,000 – AUD 400,000+, depending on experience, role, and performance. With Australia’s growing fintech sector and the rise of algorithmic trading, quant salaries are set to increase further.

If you are an aspiring quant trader, focus on technical skills, adaptability, and performance-driven roles to maximize long-term earnings.

💬 Do you work in quant trading or aspire to enter this field? Share your thoughts in the comments below and feel free to share this article with peers interested in finance and trading careers.

0 Comments

Leave a Comment