Calculating a quant trader’s salary isn’t as straightforward as reading a single number from a compensation report. Unlike standard job roles, quant trading salaries vary dramatically based on factors like firm type (hedge fund, prop shop, investment bank), location, role seniority, and performance bonuses. This guide will walk you through the main methods to calculate quant trader salaries, analyze how different strategies compare, and highlight industry benchmarks you can rely on.

By the end of this article, you will:

Understand two core methods of calculating quant trader salary: market benchmarking and performance-based modeling.

Learn how to compare salary ranges across firms, locations, and career stages.

Access reliable sources for real-world compensation data.

Gain insights into salary negotiation and career progression strategies.

See common pitfalls and how to avoid underestimating total compensation.

TL;DR

Quant trader salaries range widely: \(100k–\)200k base for juniors, rising to \(400k–\)1M+ total comp for senior hedge fund traders.

Method A: Benchmarking salary surveys and industry reports → best for averages and wide comparisons.

Method B: Performance-linked compensation models → best for accurate total earnings in trading-heavy firms.

Salaries vary by region, firm type, and asset class traded.

Negotiation skills and firm selection can increase compensation by 20–40%.

What You Will Achieve After Reading

Calculate a quant trader’s salary using two reliable methods.

Compare expected salaries by location, seniority, and firm type.

Identify which method fits your situation (students, professionals, or career switchers).

Learn how to use real salary data sources for fact-checking.

Get a clear roadmap for salary growth and negotiation.

Table of Contents

Search Intent and Context

Method A: Benchmarking with Market Data

Method B: Performance-Based Compensation Modeling

Method Comparison Table

Case Studies and Data

Checklist and Common Pitfalls

FAQ

Video Reference

References

Search Intent and Context

The main search intent behind “How to calculate quant trader salary” is informational + comparison. Readers want:

Reliable formulas or methods to estimate compensation.

Real-world salary ranges from quant firms.

Insights into career stage differences.

Negotiation and growth advice.

Related semantic clusters include:

Compensation benchmarks: quant trader salary by firm, location, seniority.

Performance-based bonuses: P&L share, profit split, alpha generation rewards.

Comparisons: Quant trader salary for hedge funds vs investment banks.

Career path: Quant trader salary for beginners, interns, and experienced professionals.

Negotiation and trends: Quant trader salary survey results, salary growth statistics.

Method A: Benchmarking with Market Data

The first method to calculate a quant trader’s salary is by using external benchmarks and industry surveys.

How It Works

Collect salary data from reliable sources:

Glassdoor, Levels.fyi, Payscale.

Hedge fund and investment bank reports.

Industry surveys and recruitment firms.

Segment data by:

Role type (trader, researcher, quant developer).

Career stage (junior, mid-level, senior).

Location (US, UK, Hong Kong, Singapore).

Calculate the median and interquartile ranges for base and bonus.

Strengths

Provides transparent ranges across industries.

Useful for career planning and comparing offers.

Easy to replicate with public data.

Weaknesses

Lagging data: surveys may reflect last year’s market.

Doesn’t account for performance-linked bonuses, which often double or triple pay.

Data can be skewed by outliers.

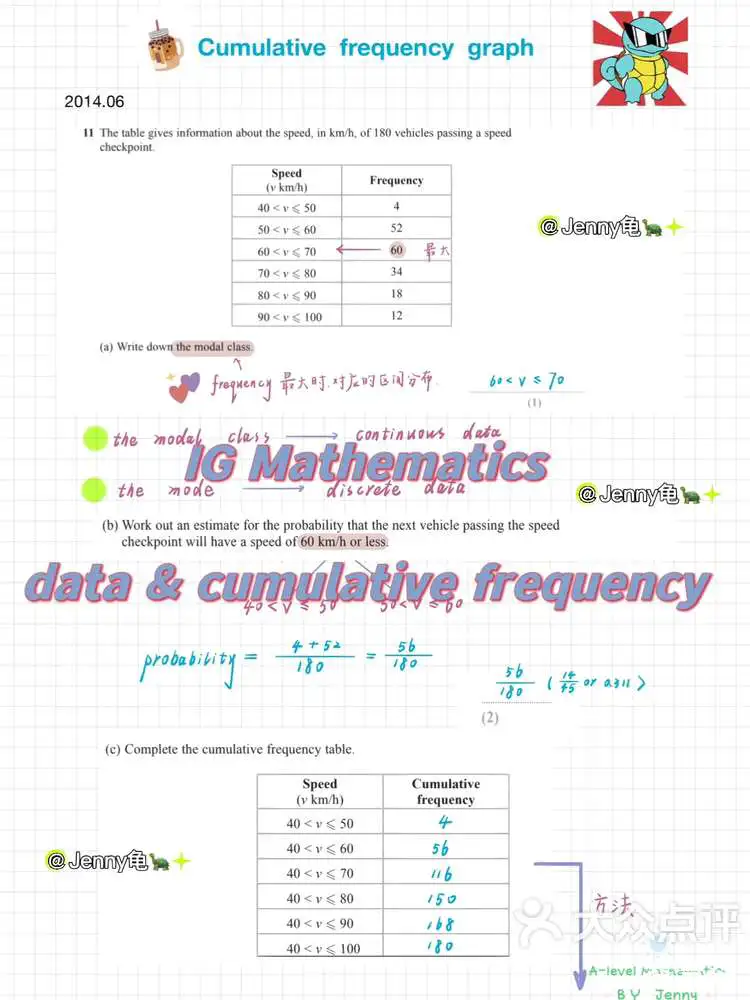

Salary benchmarking data across regions

Method B: Performance-Based Compensation Modeling

The second method focuses on modeling compensation based on trading performance, which is especially relevant in hedge funds and proprietary trading firms.

How It Works

Estimate P&L attribution:

Example: Trader contributes $20M profit in a year.

Apply profit-sharing rules:

Prop shops may pay 10–20% of profits directly to the trader.

Hedge funds may give smaller cuts but higher base.

Add base salary and guaranteed bonuses.

Example Formula

mathematica

Copy code

Total Salary = Base Salary + (P&L * Profit Share %) + Performance Bonus

For instance:

Base: $150,000

P&L Contribution: $10,000,000

Profit Share: 12% → $1,200,000

Total Compensation = $1,350,000

Strengths

Reflects true earning potential in performance-heavy firms.

Allows traders to project upside earnings.

Weaknesses

Requires access to internal P&L data.

Risk of overestimating if performance drops.

Harder to b

0 Comments

Leave a Comment