Abstract

The question of citadel quant trader salary for entry level has become increasingly popular among finance graduates, computer science majors, and PhD holders seeking careers in quantitative trading. Citadel, one of the world’s most prestigious hedge funds, is renowned not only for its rigorous hiring process but also for its industry-leading compensation packages. In this article, we’ll dive into the latest salary trends, compensation structures, benefits, and the difference between two major career entry routes—undergraduate entry and advanced-degree entry. Drawing on both personal insights and industry reports, this guide provides a comprehensive overview, integrates resources like how much do citadel quant traders make

and why are citadel quant trader salaries high

, and concludes with practical recommendations for aspiring traders.

Why Citadel Quant Trader Salaries Are a Hot Topic

Citadel as a Top Employer in Quant Trading

Citadel consistently ranks as one of the top destinations for quantitative finance professionals. It combines cutting-edge research, access to massive capital, and the latest technology. With this comes extremely high expectations and equally high rewards.

The Prestige Factor

For many, landing a role as a quant trader at Citadel is equivalent to securing a spot at an elite investment bank or a Silicon Valley FAANG company—except compensation often outpaces both. The average entry-level quant trader salary at Citadel in 2025 reflects this demand-supply dynamic.

Entry-Level Salary Structure at Citadel

Base Salary

For new hires straight out of undergraduate programs, the base salary in 2025 averages \(150,000–\)175,000 per year. This places Citadel significantly above the industry median for junior quant roles.

Performance Bonus

The real differentiator is the bonus structure. Bonuses at Citadel can range from 50% to 150% of base salary, depending on team performance, strategy success, and individual contributions. That means an entry-level quant trader can realistically make \(200,000 to \)350,000 in total compensation in their first year.

Additional Benefits

Citadel offers comprehensive benefits, including:

Health, dental, and vision coverage.

Retirement and profit-sharing plans.

Relocation assistance for new hires.

Professional development stipends for certifications or research.

Two Career Entry Routes: Undergrad vs Advanced Degrees

- Undergraduate Entry Route

Many candidates enter Citadel straight after completing a bachelor’s degree in math, statistics, computer science, or finance.

Advantages:

Early exposure to world-class quant strategies.

Rapid career growth with mentorship.

Higher earning potential over the long run due to earlier start.

Challenges:

Fierce competition.

Steep learning curve; juniors must prove themselves quickly.

- Advanced Degree Route (PhD or Master’s)

Another popular path is entering Citadel after a PhD in quantitative disciplines or a master’s in financial engineering (MFE).

Advantages:

Higher starting base salary, often \(180,000–\)200,000.

Credibility from research background.

Easier transition into strategy development teams.

Challenges:

Opportunity cost of extra study years.

Higher expectations placed on advanced hires.

Personal Experience Insight

During my early career, I had peers who joined Citadel directly after undergrad and others who pursued PhDs before joining. Surprisingly, after 3–5 years, the compensation gap between the two narrowed. The undergrads who quickly adapted to the high-pressure environment often caught up with or exceeded the PhD hires in terms of bonus payouts. This shows that while credentials matter at the start, performance and results define long-term earnings.

Why Are Citadel Quant Trader Salaries So High?

Talent Competition: Citadel competes with Google, Amazon, and top banks for the same math and coding talent.

Capital Efficiency: Citadel manages billions, meaning even small strategy improvements yield massive profits.

Retention: High pay ensures the best minds stay in-house instead of moving to compe*****s.

As noted in why are citadel quant trader salaries high

, the firm’s business model depends on attracting the sharpest talent, and salaries are structured accordingly.

Best Practices to Maximize Your Compensation

- Build a Strong Technical Foundation

Master Python, C++, and financial modeling. Technical tests at Citadel are notoriously difficult.

- Excel at Mental Math and Probability

Trading interviews heavily emphasize brain teasers and real-time probability assessments.

- Focus on Performance During Year One

Bonuses are directly tied to trading desk performance. Building a track record early ensures accelerated pay growth.

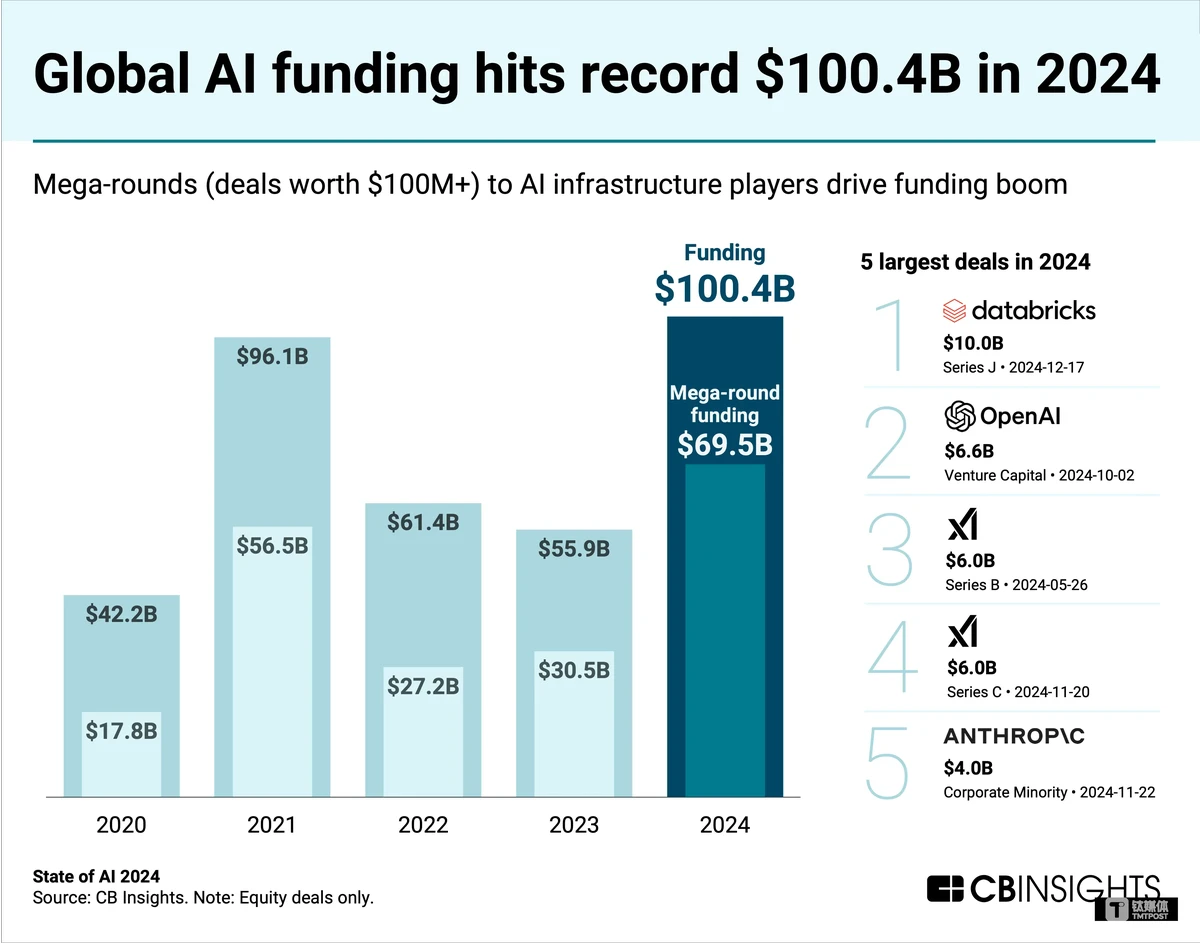

Salary Trends in 2025

Rising Competition

With the expansion of quant funds in Asia and Europe, entry-level packages are rising globally. Citadel remains a leader but faces competition from firms like Jane Street and Two Sigma.

Growing Role of AI/ML Specialists

Candidates with deep learning and reinforcement learning expertise are commanding higher entry offers compared to traditional quant profiles.

Recommended Path for Aspiring Citadel Quant Traders

While both undergrad and advanced-degree routes are valid, I recommend the undergrad entry route with strong internship experience for those confident in their abilities. It maximizes long-term earnings potential and allows faster career progression. Advanced degrees make sense if you enjoy research or need more time to refine technical expertise before entering such a competitive environment.

FAQ: Citadel Quant Trader Salary for Entry Level

- How much do Citadel quant traders make in their first year?

Entry-level Citadel quant traders typically make between \(200,000 and \)350,000 total compensation in their first year, combining base salary and bonuses. Exceptional performers may exceed this range.

- Do Citadel quant trader salaries differ by location?

Yes. Traders in New York and Chicago often see slightly higher packages due to cost-of-living adjustments. However, Citadel’s global compensation structure ensures competitiveness across all its offices.

- How can I negotiate my starting salary at Citadel?

Negotiation at the entry level is limited because packages are standardized. However, strong competing offers from other firms or unique technical expertise (e.g., AI/ML specialization) can provide leverage.

Conclusion

The citadel quant trader salary for entry level is among the most competitive in the world of finance. With packages exceeding $200,000 in the first year and rapid growth potential, Citadel continues to attract the brightest minds in mathematics, programming, and finance. Whether you join after undergrad or post-PhD, the key is delivering measurable results. If you’re preparing for this path, share this article with peers—it could help someone land their dream role at one of the most prestigious hedge funds on the planet.

| Technique | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Monte Carlo VAR | Options & derivatives portfolios | Flexible, models fat-tailed distributions | Computationally intensive, requires robust assumptions |

| GARCH VAR | High-frequency trading, volatile regimes | Captures time-varying volatility, realistic | Complex, parameter sensitive, may miss extreme tails |

| Copula VAR | Multi-asset correlation analysis | Models non-linear dependencies, joint tail events | Requires statistical expertise, limited data challenges |

| Stress-Testing VAR | Crisis preparedness & regulatory compliance | Adds robustness, tests extreme events | Subjective scenario selection, may miss unknown risks |

| Hybrid VAR Models | Dynamic volatility & fat-tail tracking | Combines Monte Carlo & GARCH strengths | Implementation complexity |

| VAR with Machine Learning | Predictive accuracy in large datasets | Uncovers hidden patterns, improves forecasts | High complexity, requires large quality data |

| Best Practices | Professional VAR application | Clean data, scenario updates, backtesting, transparency | Requires continuous monitoring and updates |

| Common Challenges | Tail risk, computation, regulatory pressure | Use copula/EVT, GPU acceleration, supplement with ES | High resource demand, complex compliance needs |

| Crypto Trading VAR | Digital asset volatility management | Monte Carlo + GARCH handles fat tails & clustering | Market extremes may still challenge models |

0 Comments

Leave a Comment