Introduction

The entry-level quant trader salary in the US is one of the hottest topics among finance graduates, mathematicians, computer scientists, and aspiring traders. Quantitative trading, often shortened to quant trading, is a career path that combines mathematical models, algorithmic execution, and market insights to generate profits. While the profession has always been lucrative, the US market stands out globally as the hub of quantitative finance.

This article explores the salary outlook for entry-level quant traders in the US, compares compensation structures across cities, highlights industry trends, and provides practical strategies for breaking into the field. You will also gain insights into how salaries evolve over time, what factors affect pay, and how to position yourself for success in this competitive industry.

What Is an Entry-Level Quant Trader?

An entry-level quant trader is typically a recent graduate or professional with limited trading experience who is hired by hedge funds, proprietary trading firms, or investment banks.

Key responsibilities often include:

Developing and backtesting trading algorithms.

Monitoring market signals and executing trades.

Performing statistical and risk analysis.

Collaborating with quant researchers and developers.

Despite being “entry-level,” these roles demand advanced technical skills in Python, C++, statistics, econometrics, and machine learning. The US job market is highly competitive, but the rewards—both financial and career growth—can be substantial.

Quantitative trading requires both advanced technical skills and deep market knowledge.

Average Entry-Level Quant Trader Salary in the US

Base Salary

The average entry-level quant trader salary in the US ranges from \(110,000 to \)150,000 annually in 2025. This figure varies depending on firm type, location, and educational background.

Hedge funds & proprietary trading firms: \(120,000–\)150,000 base salary.

Investment banks: \(100,000–\)120,000 base salary.

Fintech/crypto firms: \(90,000–\)130,000 base salary (higher bonuses possible).

Bonus & Profit Sharing

In addition to base pay, quant traders often receive:

Performance bonuses: 30%–100% of base salary.

Profit-sharing schemes: Particularly in proprietary trading shops.

Signing bonuses: \(10,000–\)25,000 for top-tier firms.

👉 This means a top-performing entry-level quant trader can earn total compensation between \(150,000 and \)220,000 in the first year.

Factors Influencing Entry-Level Salaries

- Location

Salaries differ significantly by city:

New York City: \(130,000–\)160,000 base, often with the highest bonuses.

Chicago: \(110,000–\)140,000, with a focus on derivatives and HFT firms.

San Francisco: \(120,000–\)150,000, more tied to fintech and crypto.

(See also: Quant trader salary in New York for a detailed breakdown.)

- Firm Type

Bulge-bracket banks: Structured pay but slightly lower than hedge funds.

Hedge funds: High-performance bonuses.

Prop firms: Lower base but lucrative profit-sharing.

- Educational Background

PhD in quantitative fields: Typically highest entry-level offers.

Master’s in financial engineering, computer science, or applied math: Competitive offers with high growth potential.

Bachelor’s only: Still possible, but candidates must demonstrate exceptional trading or programming ability.

Methods to Maximize Entry-Level Compensation

Strategy 1: Focus on High-Demand Technical Skills

Mastering programming languages (Python, C++, R), machine learning frameworks, and data engineering can make you stand out.

Advantages: Easier to pass technical interviews, higher signing bonuses.

Drawbacks: Requires years of rigorous preparation.

Strategy 2: Target High-Paying Locations & Firms

Applying directly to top firms in New York or Chicago can maximize your salary potential.

Advantages: Higher base and bonus potential.

Drawbacks: Extremely competitive, higher cost of living.

👉 Best Approach: Combine technical expertise with strategic targeting of firms and locations to maximize both salary and long-term career growth.

Entry-level quant trader salaries vary widely depending on location and firm type.

Industry Trends Affecting Entry-Level Quant Salaries in the US

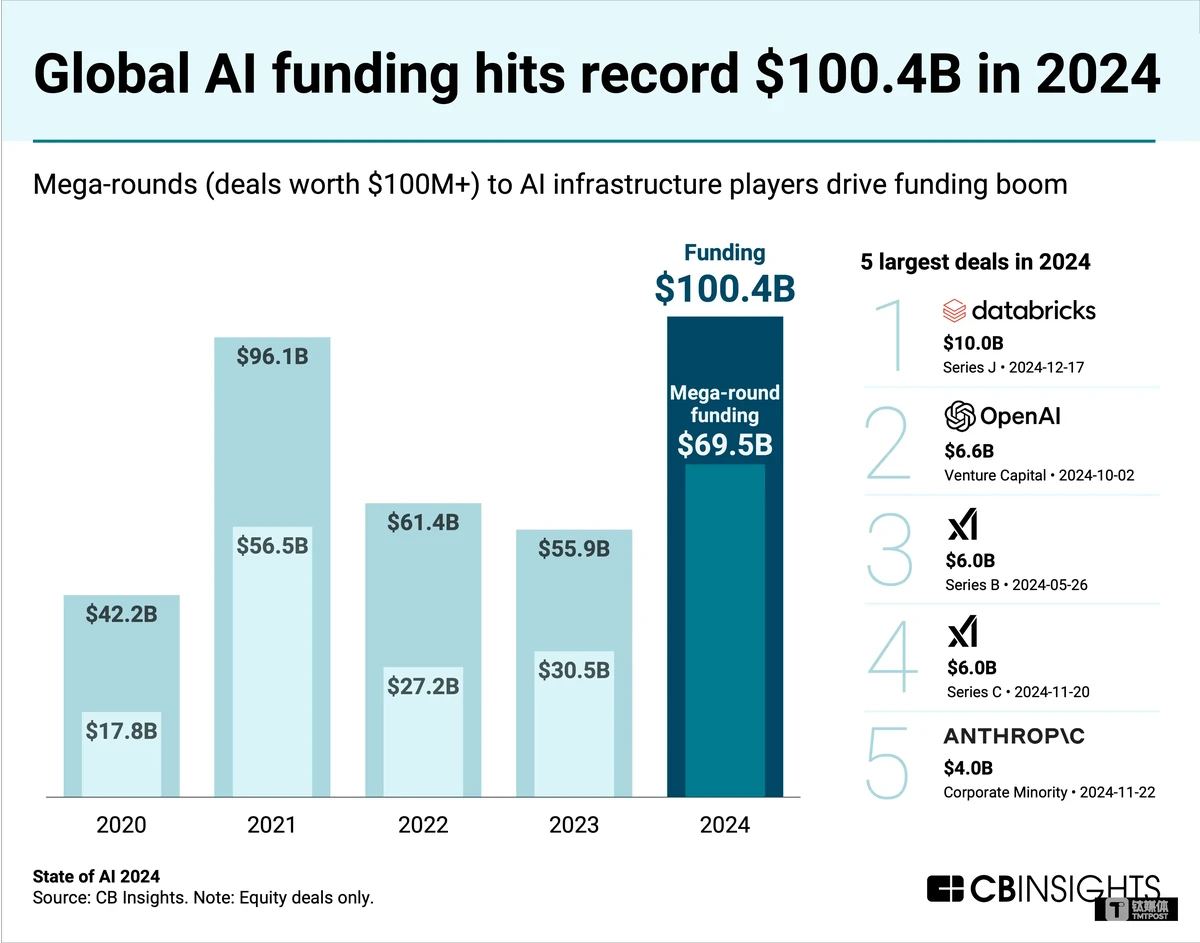

AI and Machine Learning Integration – Firms now prioritize candidates with ML expertise.

Crypto and Digital Assets – Crypto firms attract quants with competitive offers, especially for algorithmic trading.

Remote Work Flexibility – Expanding opportunities for quants outside traditional hubs.

Talent Competition – Rising salaries due to competition among hedge funds, prop shops, and fintech firms.

For deeper insights, you can explore Quant trading job market trends US, which highlights how demand is shaping compensation.

Personal Experience and Insights

From my experience working with both institutional clients and new hires, salary negotiation is just as important as technical ability. Many candidates underestimate their worth, especially in competitive cities like New York. Firms expect negotiation, and those who demonstrate confidence often secure 5%–15% higher offers.

Additionally, the career trajectory for a US quant trader is steep. Many entry-level traders see their total compensation double within 3–5 years if they consistently generate returns.

FAQs: Entry-Level Quant Trader Salary in the US

On average, entry-level quant traders make \(110,000–\)150,000 base salary, with bonuses pushing total compensation to \(150,000–\)220,000 in the first year. Experienced quant traders can earn \(300,000–\)1M+ annually depending on performance.

The top cities are New York, Chicago, and San Francisco. New York offers the highest salaries and career opportunities, while Chicago specializes in derivatives and proprietary trading. San Francisco provides more fintech and crypto-related opportunities.

- Why is a quant trader’s salary high in the US?

Quant trading combines rare skills (math, coding, financial markets) with high revenue potential for firms. Successful quants can directly influence profits, which is why firms are willing to pay high salaries to attract top talent.

Conclusion

The entry-level quant trader salary in the US is among the highest for fresh graduates in any industry, reflecting both the technical demands and the profit potential of the role. With average total compensation ranging between \(150,000 and \)220,000, the profession attracts some of the brightest minds in finance, computer science, and mathematics.

Key insights:

Salaries vary by city, firm type, and education.

Technical skills and negotiation can significantly boost compensation.

Industry trends like AI, crypto, and fintech are reshaping the job market.

💡 Are you considering a career as a quant trader in the US? Share your thoughts in the comments, and don’t forget to share this article with peers preparing for interviews and salary negotiations!

| Aspect | Description | Salary Range | Key Factors | Strategies to Maximize | Industry Trends | Career Insights |

|---|---|---|---|---|---|---|

| Role Definition | Entry-level quant trader in US firms | N/A | Limited experience, strong technical skills, coding, statistics | N/A | N/A | High growth potential with technical and market knowledge |

| Base Salary | Annual base pay | \(110,000–\)150,000 | Firm type, location, education | Target top firms, high-demand skills | N/A | Base varies by hedge fund, investment bank, fintech |

| Bonus & Profit Sharing | Additional compensation | 30%–100% of base; signing \(10k–\)25k | Performance, firm type | Negotiate confidently | AI/ML, crypto integration | Total first-year pay \(150k–\)220k |

| Location Influence | City-based salary differences | NYC \(130k–\)160k; Chicago \(110k–\)140k; SF \(120k–\)150k | Cost of living, local demand | Apply to high-paying hubs | Remote work flexibility | NYC highest, Chicago derivatives focus, SF fintech/crypto |

| Firm Type | Impact on compensation | Hedge funds: \(120k–\)150k; Prop firms: lower base, high profit-sharing; Banks: \(100k–\)120k | Revenue potential, bonus structure | Choose firms with lucrative packages | Talent competition | Hedge funds and prop shops offer top total compensation |

| Education | Effect on entry-level offers | PhD highest; Master’s competitive; Bachelor’s possible | Quantitative background, technical expertise | Highlight skills and projects | AI/ML demand | Advanced degrees provide higher starting salaries |

| Skills Strategy | Technical skill focus | N/A | Python, C++, R, ML frameworks | Master programming for interviews and bonuses | AI & ML integration | Strong skills increase signing bonus and total compensation |

| Career Growth | Long-term trajectory | Total comp can double in 3–5 years | Consistent returns, performance | Combine technical + strategic targeting | Fintech and crypto opportunities | Early negotiation and results accelerate career path |

0 Comments

Leave a Comment