=================================================

Introduction

In recent years, one of the most discussed trends in finance has been the sharp rise in entry level quant trader salaries. While quant roles have always been lucrative, the market has shifted dramatically, pushing starting compensation higher than ever before. From New York to London to Singapore, firms are competing for talent with bigger packages, and this trend shows no sign of slowing.

This article explores why entry level quant trader salaries are rising, the market forces behind this trend, and how graduates and career switchers can benefit from it. Drawing from industry experience, recent hiring data, and real-world examples, we’ll analyze what’s happening across global financial centers and provide actionable insights for aspiring quants.

The Current State of Quant Salaries

Historical Context

Ten years ago, entry level quant trader salaries, while competitive, were not drastically higher than those of investment banking analysts. Today, however, quants often start with packages 30–50% higher, with some hedge funds and proprietary trading firms offering total compensation of \(200,000–\)300,000 for new hires.

Key Drivers of Salary Growth

- Increased competition for talent – Hedge funds, banks, fintechs, and crypto firms are all hiring the same pool of candidates.

- Global talent shortage – Quant roles require advanced math, programming, and market knowledge; such combinations are rare.

- Profitability of quant strategies – High-frequency trading and algorithmic models generate massive revenues, allowing firms to reinvest in talent.

Why Are Entry Level Quant Trader Salaries Rising?

1. Competition Between Firms

In today’s financial markets, top firms compete not just on technology but on human capital. Citadel, Jane Street, Two Sigma, Jump Trading, and Goldman Sachs aggressively recruit top graduates, offering higher salaries and bonuses to secure talent.

This bidding war has led to a salary inflation cycle: once one firm raises offers, others follow to avoid losing candidates.

2. The Rise of Quantitative Strategies

The past decade has seen a shift from discretionary to data-driven trading. Hedge funds and asset managers increasingly rely on:

- Machine learning models

- Algorithmic execution systems

- High-frequency trading platforms

With this reliance, entry-level quants are not seen as “junior support,” but as direct contributors to profitability. This justifies higher pay.

Quant strategies such as HFT and algorithmic execution have increased demand for talent.

3. Cross-Industry Competition

The quant talent pool overlaps with Silicon Valley tech talent. Companies like Google, Amazon, and OpenAI compete for the same PhDs in math, computer science, and physics. To attract candidates away from tech firms that offer flexibility and stock options, trading firms increase salaries and sign-on bonuses.

4. Geopolitical and Regional Factors

Different markets contribute differently to rising salaries. For example:

- New York & Chicago: Home to prop trading firms that set global pay benchmarks.

- London: Brexit created talent shortages, driving up compensation.

- Singapore & Hong Kong: Regional hubs expanding quant capabilities, offering premium salaries to attract international talent.

This explains why quant trader salary vary by region, with Asia catching up to traditional Western hubs.

Comparing Different Strategies and Hiring Practices

Strategy 1: Paying Premium Salaries to Attract Top Graduates

Firms like Jane Street and Citadel often lead with high salaries, believing that top-tier hires bring immediate impact.

- Pros: Attracts the best talent, strengthens firm reputation.

- Cons: Costly, risk of high turnover if recruits leave for compe*****s.

Strategy 2: Investing in Training Programs Instead of Salary Inflation

Other firms offer moderate salaries but comprehensive training and mentorship, betting on long-term loyalty.

- Pros: Builds a strong, loyal workforce; reduces bidding wars.

- Cons: May lose candidates who prioritize immediate compensation.

Recommendation

The most effective approach blends both strategies: competitive salaries plus structured mentorship. This ensures firms attract top candidates while providing growth opportunities that improve retention.

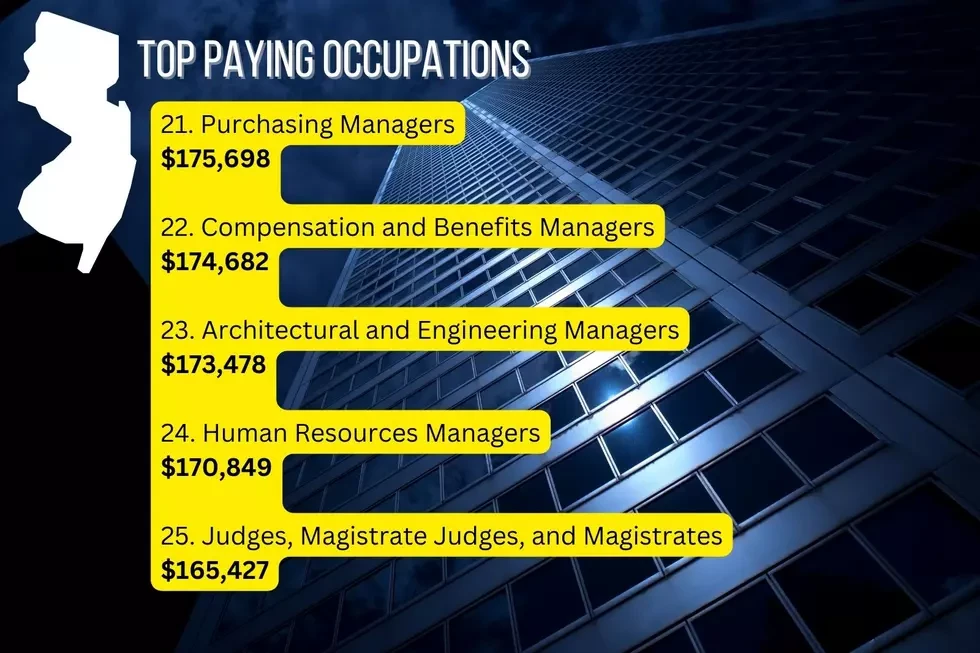

Global Comparison of Entry Level Quant Salaries

Aspiring quants often ask: “How does an entry level quant trader salary compare globally?”

- US (New York, Chicago): \(180,000–\)300,000 (total comp, including bonuses).

- UK (London): £100,000–£160,000.

- Asia (Singapore, Hong Kong): \(120,000–\)200,000.

- Continental Europe (Zurich, Amsterdam): €90,000–€140,000.

These numbers show that where the highest entry level quant trader salaries are typically in US hubs, with Asia catching up quickly.

Global comparison of entry-level quant salaries across major financial centers.

Practical Advice for Aspiring Quants

How to Negotiate a Salary for Entry-Level Quant Trader

- Research benchmarks before interviews using reports and forums.

- Leverage competing offers if possible.

- Highlight rare skills like GPU programming, reinforcement learning, or hybrid finance-tech experience.

How to Improve Entry Level Quant Trader Earnings

- Learn Python, C++, and financial modeling to stand out.

- Publish research or build open-source projects to showcase skills.

- Target firms in locations offering higher pay or tax benefits.

FAQ: Why Are Entry Level Quant Trader Salaries Rising?

1. Are salaries rising everywhere or just in top firms?

Salaries are rising across the board, but the most dramatic increases are at elite hedge funds and prop shops. Traditional banks have also raised pay, though not as aggressively.

2. Will salaries keep rising in the future?

Yes, but growth may stabilize. With AI integration, firms still need top human talent to design and oversee models. The war for talent will continue, though at a slower pace once salary levels plateau.

3. Do higher salaries mean higher competition for jobs?

Absolutely. While salaries are rising, so are the demands. Firms expect recruits to know advanced math, programming, machine learning, and market microstructure before day one.

Conclusion

The rise in entry level quant trader salaries reflects broader trends: growing reliance on quantitative strategies, global competition for scarce talent, and salary wars among top firms. While compensation has reached record highs, expectations for new hires are also greater than ever.

For aspiring quants, the message is clear: focus on building in-demand technical skills, market knowledge, and adaptability. Firms are willing to pay generously, but only for candidates who can contribute quickly and effectively.

📢 Are you considering a career in quant trading? Do you think rising salaries are sustainable, or will the market cool down? Share your thoughts in the comments and pass this article along to friends who are preparing for quant careers!

0 Comments

Leave a Comment