Australia is home to a burgeoning financial market, with a strong demand for quantitative traders who use mathematical models, algorithms, and data analysis to make informed decisions in financial markets. If you’re considering a career in quantitative trading in Australia, it’s crucial to understand the salary expectations, factors that influence pay, and how to position yourself to earn at the top of the pay scale.

In this comprehensive guide, we’ll break down everything you need to know about quant trader salaries in Australia, including the key factors influencing these salaries, regional differences, and insights into how to improve your earning potential in this competitive field.

Introduction to Quantitative Trading in Australia

Quantitative trading (also known as quant trading) involves the use of mathematical models, complex algorithms, and data analysis to execute high-frequency trades in financial markets. This role is highly specialized and requires individuals with strong backgrounds in mathematics, finance, and programming.

Quantitative traders in Australia often work in various sectors, including investment banks, hedge funds, proprietary trading firms, and fintech startups. The demand for quants has increased significantly in recent years, leading to attractive salaries for professionals in the field.

Key Factors Influencing Quant Trader Salaries in Australia

- Educational Background

Your educational qualifications play a major role in determining your starting salary as a quant trader. In Australia, a strong academic background, particularly in fields such as mathematics, physics, engineering, computer science, and finance, is highly valued.

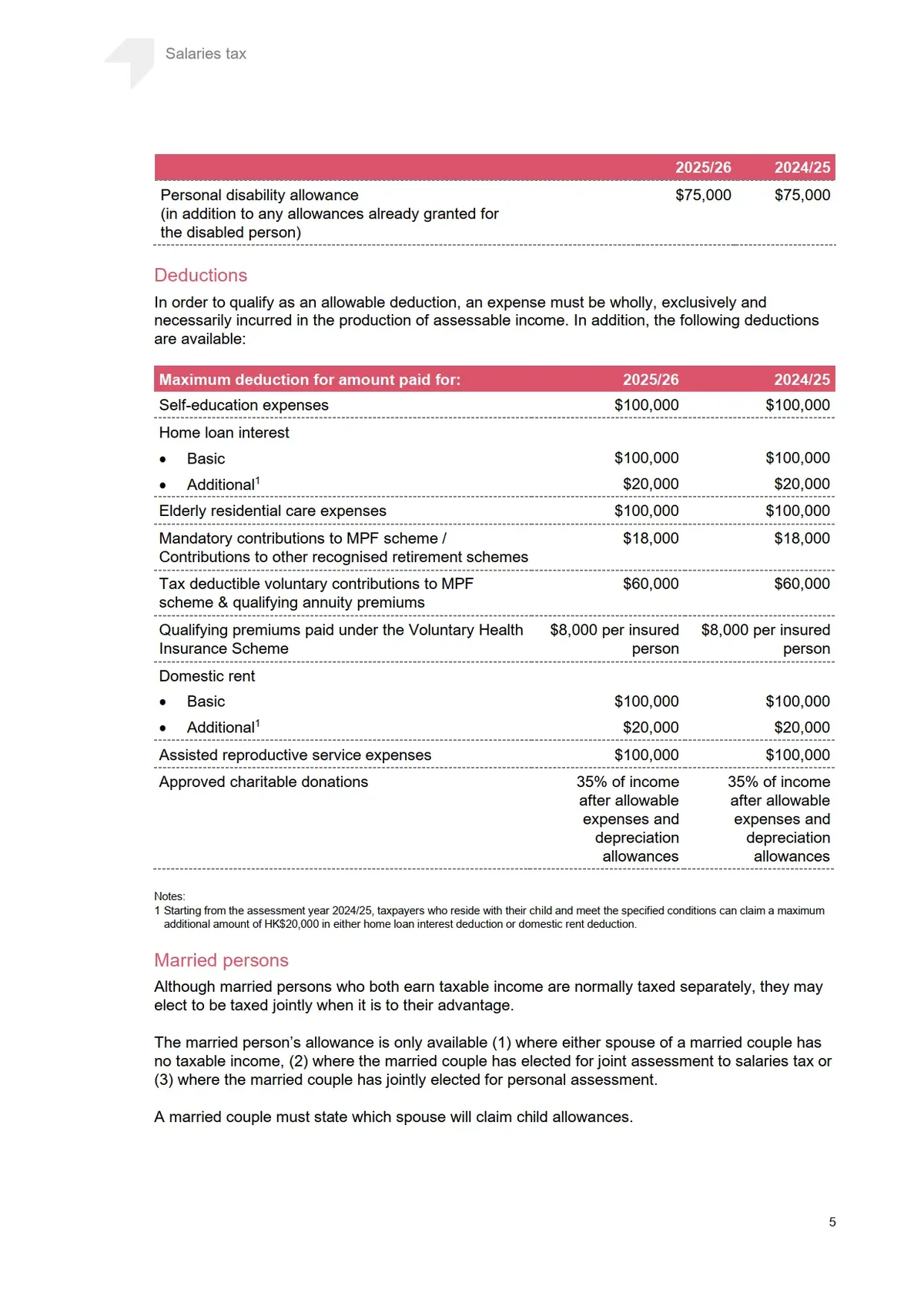

Bachelor’s Degree: Entry-level quants with a bachelor’s degree typically earn between AUD \(70,000 to \)90,000 annually.

Master’s or PhD: Those with a master’s or PhD in quantitative finance or related fields can expect salaries to range from AUD \(90,000 to \)130,000, or higher, depending on the industry and location.

- Industry and Sector

Quantitative traders in Australia work across different industries, and salaries can vary based on the sector.

Investment Banks and Hedge Funds: These are the most lucrative sectors for quants. Entry-level salaries range from AUD \(90,000 to \)130,000, with the potential for performance-based bonuses. Experienced quants can make well over AUD $200,000 per year.

Proprietary Trading Firms: These firms also offer competitive salaries, often between AUD \(80,000 and \)120,000 for entry-level roles. Bonuses are also significant, especially for traders who perform well.

Fintech and Startups: While the fintech sector offers good opportunities, the salaries may be slightly lower compared to traditional financial institutions, typically ranging from AUD \(70,000 to \)100,000.

- Location

Australia’s geographical location and its financial hubs have a major impact on the salaries of quant traders. The major financial centers such as Sydney, Melbourne, and Brisbane are home to most of the industry’s key players.

Sydney: As the financial capital of Australia, Sydney offers the highest salaries for quant traders. Entry-level salaries can range from AUD \(90,000 to \)130,000, with senior traders earning significantly more.

Melbourne: Melbourne is another important financial hub, with salaries typically ranging from AUD \(80,000 to \)120,000 at the entry level.

Brisbane: While not as competitive as Sydney or Melbourne, Brisbane still offers reasonable salaries, typically ranging from AUD \(70,000 to \)100,000 for entry-level quant roles.

- Experience Level

As with most professions, the more experience you have, the higher your salary potential.

Entry-Level Quant Traders: At the beginning of your career, you can expect to earn between AUD \(70,000 and \)100,000, depending on your industry and location.

Mid-Career Quant Traders: With a few years of experience, salaries increase significantly. Mid-career quants typically earn between AUD \(120,000 and \)180,000.

Senior Quant Traders: Experienced quant traders, especially those with expertise in algorithmic trading or risk management, can earn upwards of AUD $200,000 annually, with significant bonuses based on their trading performance.

Salary Comparison: Quant Trader Salaries in Australia vs. Other Countries

Quant Salaries in Australia vs. the United States

While Australia offers competitive salaries, quant traders in major U.S. financial centers like New York and Chicago often earn higher base salaries. In the U.S., entry-level quant traders can expect to earn between USD \(100,000 to \)150,000 annually, with bonuses significantly increasing total compensation.

However, Australia offers a higher quality of life, lower taxes, and fewer living expenses compared to the U.S., making it an attractive destination for quant professionals.

Quant Salaries in Australia vs. the UK

In the UK, especially in London, entry-level quant salaries range from £50,000 to £80,000, with senior roles reaching up to £150,000 or more. Although the UK offers slightly lower salaries than Australia, the cost of living in London can be higher, reducing the overall financial advantage.

How to Improve Your Salary as a Quant Trader in Australia

- Gain Advanced Qualifications

Pursuing a master’s or PhD in quantitative finance, mathematics, or a related field can significantly increase your salary prospects. The more specialized your education, the more valuable you become to firms willing to pay top-dollar for your expertise.

- Enhance Technical Skills

Technical proficiency is key for any quant trader. Familiarize yourself with programming languages such as Python, R, C++, and MATLAB. Having a strong background in machine learning and data science is highly desirable and can help you land a higher-paying role.

- Target High-Paying Firms

Focus on securing positions at investment banks, hedge funds, or proprietary trading firms, as these offer the highest earning potential. Many of these firms offer performance-based bonuses, which can significantly boost your annual salary.

- Stay Updated with Market Trends

The finance and tech industries are evolving rapidly. Staying updated with the latest trends in algorithmic trading, AI, and big data analytics will give you a competitive edge and make you more valuable to potential employers.

FAQ: Common Questions About Quant Trader Salaries in Australia

- How much do quant traders earn in Australia?

The average salary for an entry-level quant trader in Australia ranges from AUD \(70,000 to \)100,000. With more experience, salaries can rise to AUD \(150,000 to \)200,000, and senior quant traders can earn over AUD $250,000, including bonuses.

- What is the best city in Australia for quant traders?

Sydney is the top city for quant traders, offering the highest salaries and the largest number of job opportunities. Melbourne is also a good option, with competitive salaries and a strong financial industry presence.

- How do I become a quant trader in Australia?

To become a quant trader in Australia, you typically need a strong educational background in mathematics, computer science, or finance. Additionally, gaining experience through internships or entry-level roles, as well as developing skills in programming and algorithmic trading, will improve your chances of landing a quant role.

Conclusion: Navigating Your Career as a Quant Trader in Australia

The role of a quantitative trader offers lucrative salary potential, especially as you progress in your career. While entry-level salaries in Australia are competitive, those with advanced qualifications, technical skills, and relevant experience can command higher salaries.

| Aspect | Key Points |

|---|---|

| Definition | Derivative contracts to speculate on Bitcoin price without expiry |

| How It Works | Hold positions indefinitely; pay/receive funding fees; leverage available |

| Appeal | High leverage, liquidity, easy access without owning Bitcoin |

| Volatility Risk | Sharp price fluctuations can cause large gains or losses |

| Leverage Risk | Amplifies profits and losses; high leverage can liquidate entire positions |

| Funding Rate Risk | Varies with market; mismanagement adds costs |

| Leverage Management | Use leverage responsibly; never risk more than willing to lose |

| Optimal Leverage Ratios | Beginners: 2x-3x; Experienced: higher with close monitoring |

| Stop-Loss Orders | Automatically closes position at set price to limit losses |

| Effective Stop-Loss Setting | Avoid placing too close or too far from market price |

| Funding Rate Monitoring | Track funding rates and adjust positions accordingly |

| Hedging Funding Rate Risks | Balance long and short positions to offset costs |

| Diversification of Positions | Spread trades across assets or markets to reduce risk |

| Portfolio Rebalancing | Regularly adjust portfolio to maintain balanced exposure |

| Common Pitfalls: Overleveraging | Excessive leverage leads to rapid liquidation and losses |

| Common Pitfalls: Ignoring R/R | Focusing on short-term gains without assessing risk-to-reward |

| Ideal Leverage | Beginners: 2x-3x; Experienced traders may use higher cautiously |

| Protecting Against Funding Rates | Use combination of long/short positions or hedging instruments |

| Calculating Potential Loss | Multiply position size by leverage; higher leverage reduces price movement needed for liquidation |

0 Comments

Leave a Comment