Quantitative trading roles in the UK are among the most competitive and rewarding in the financial sector. If you’re already working as a quant trader or preparing to enter the industry, one of the most pressing questions is: how do you negotiate a higher salary without damaging your career prospects?

In this article, you will learn:

Proven strategies to negotiate quant trader salaries in the UK.

How to prepare using market data and benchmarks.

Two contrasting approaches to salary negotiation with pros and cons.

Real-world trends affecting compensation packages in London and other UK cities.

Expert-level FAQs addressing common pain points.

Why Salary Negotiation Matters for Quant Traders in the UK

Quant traders in London, Edinburgh, and other financial hubs often command six-figure salaries. However, base pay, bonuses, and equity packages vary widely depending on your skills, the firm’s structure, and economic conditions.

According to recruiters, a skilled negotiator can improve their compensation by 15–30% without switching firms. In an industry where base salaries often exceed £80,000 for early-career professionals, this uplift is significant.

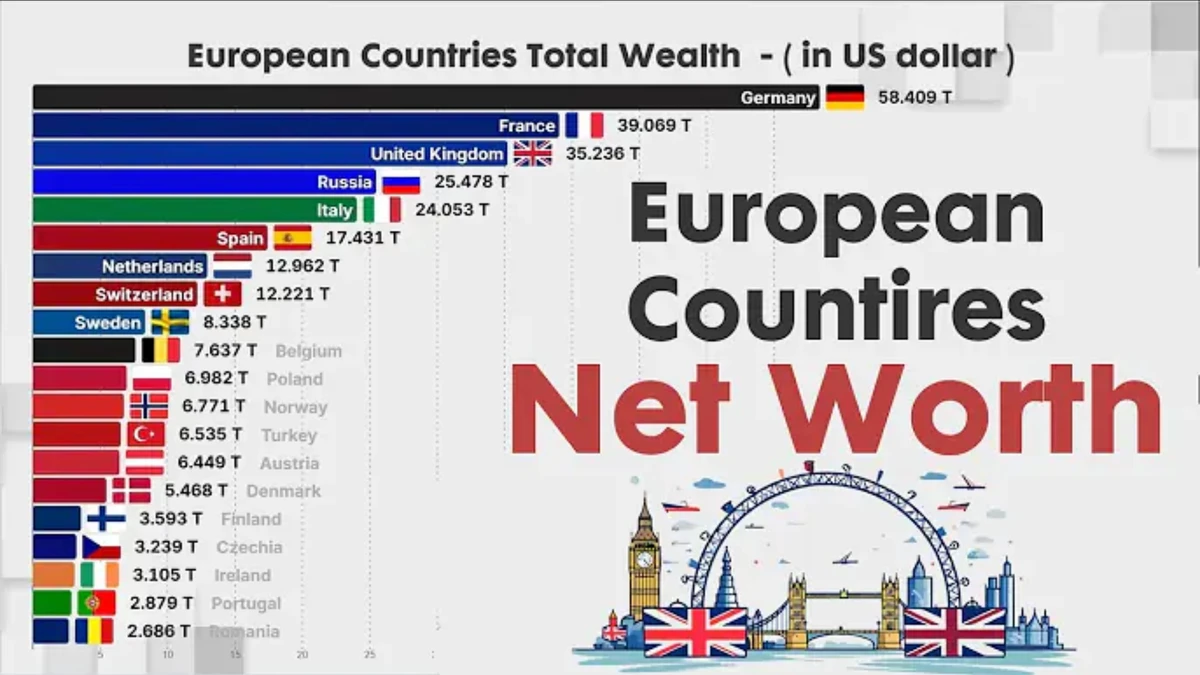

Understanding the UK Quant Trader Salary Landscape

Before negotiating, you must know where you stand compared to the market. Several factors influence quant trader salaries in the UK:

Location: London dominates with the highest offers, but cities like Edinburgh, Manchester, and Oxford are catching up.

Experience: Senior quant researchers and traders can command multiples of entry-level salaries.

Specialisation: Expertise in machine learning, high-frequency trading (HFT), or risk modelling raises market value.

Economic conditions: Inflation, regulatory changes, and market volatility directly affect bonus pools.

For more detailed benchmarking, see related research on Why quant trader salaries vary in UK?

and Which UK cities offer best quant trader salaries?

. These insights can anchor your negotiation strategy.

Strategy A: Data-Driven Benchmarking

How It Works

Gather salary data from Glassdoor, eFinancialCareers, and UK recruiter reports.

Compare against industry-specific benchmarks and academic studies.

Build a personalised salary range (base + bonus + equity) that aligns with your profile.

Strengths

Objective: Relies on verifiable market data.

Professional: Less confrontational, framed as alignment with market norms.

Scalable: Works for both early-career and senior roles.

Weaknesses

Data lag: Published figures may be outdated in fast-moving markets.

Limited granularity: Public datasets often lack role-specific detail (e.g., systematic vs. discretionary quant).

Strategy B: Value-Centric Negotiation

How It Works

Instead of focusing on market averages, quantify your direct contribution:

Alpha generation from trading strategies.

Risk-adjusted return metrics (Sharpe ratio improvements).

Cost savings from improved models or infrastructure.

Use concrete achievements to justify higher pay.

Strengths

Persuasive: Shows tangible value to the firm.

Differentiated: Less about market averages, more about your unique edge.

Flexible: Can include “non-salary” asks such as flexible bonuses, remote work, or research budgets.

Weaknesses

Requires strong documentation and communication skills.

More subjective; depends on how managers perceive your value.

Comparison of Strategies

Factor Data-Driven Benchmarking Value-Centric Negotiation

Evidence Base Market salary reports Individual performance data

Complexity Low–Medium High (requires metrics)

Risk Low Medium–High (if poorly framed)

Effectiveness Medium High (if achievements are strong)

Best For Early-career or cautious negotiators Experienced quants with measurable impact

Recommendation: Combine both approaches. Use benchmarking to set a minimum acceptable range, then highlight your personal contribution to push above that baseline.

Real-World Trends in UK Quant Trader Compensation

Brexit impact: Certain trading desks shifted to Paris or Frankfurt, but London remains the primary quant hub.

Tech-driven salaries: Skills in Python, C++, TensorFlow, and advanced ML libraries directly increase earning potential.

Hybrid packages: Equity and performance-linked bonuses are more common than fixed pay increases.

Remote roles: While rare in trading-heavy desks, research quant roles now offer partial remote flexibility, influencing salary trade-offs.

Practical Checklist Before Negotiation

✅ Research latest quant salary benchmarks in the UK.

✅ Define your “walk-away” minimum and ideal target.

✅ Document at least 3 achievements with quantifiable metrics.

✅ Prepare for alternative compensation (bonuses, equity, perks).

✅ Rehearse conversations to avoid emotional arguments.

Common Pitfalls to Avoid

❌ Relying only on Glassdoor averages without deeper context.

❌ Asking for unrealistic jumps (e.g., +50% in one year).

❌ Ignoring bonus structures, which can be more lucrative than base pay.

❌ Failing to consider timing—bonus season vs. mid-year reviews.

Frequently Asked Questions (FAQ)

- How much leverage do junior quant traders have when negotiating salary in the UK?

Junior traders have less leverage than senior counterparts, but preparation helps. By presenting benchmarks and highlighting technical skills (Python, stochastic calculus, or machine learning projects), juniors can realistically push for 5–10% improvements. Many firms also offer sign-on bonuses or accelerated promotion tracks.

- Should I focus more on base salary or bonus structure?

In the UK, bonuses can exceed base pay in profitable years. Negotiating a balanced package is key: ensure your base covers living costs in expensive cities like London, while pushing for performance-linked bonuses if you’re confident in your trading strategies.

- What role do recruiters play in negotiating quant salaries?

Specialised finance recruiters are powerful allies. They hold updated salary data and can negotiate on your behalf, reducing confrontation. However, recruiters also take commission, so ensure their incentives align with yours.

Visual Insight

Salary negotiation framework for quant traders in the UK

Encouraging Discussion

Salary negotiation is both an art and a science. Some professionals prefer playing safe with benchmarks, while others take bold value-based stances.

👉 What about you? Would you rather negotiate based on market averages or your personal trading performance? Share your experience in the comments and pass this guide to peers who are preparing for reviews or offers.

References

eFinancialCareers · Quant trader salaries in London 2024 · https://www.efinancialcareers.co.uk/

· Published 2024 · Accessed 2025-09-17.

Glassdoor · Quantitative Trader Salaries UK · https://www.glassdoor.co.uk/

· Updated 2025 · Accessed 2025-09-17.

Hays UK · 2025 Salary & Recruiting Trends · https://www.hays.co.uk/

· Published 2025 · Accessed 2025-09-17.

JSON-LD Structured Data

json

Copy code

{

“@context”: “https://schema.org”,

“@type”: “Article”,

“headline”: “How to Negotiate Higher Salary as a Quant Trader in UK?”,

“author”: {

"@type": "Person",

"name": "Finance Con

0 Comments

Leave a Comment