=====================================================================================

A career as a quantitative trader, commonly known as a quant trader, is one of the most sought-after positions in the financial sector today. It combines the rigor of mathematics, programming, and finance to develop data-driven trading strategies that can yield significant profits. If you’ve ever wondered why you should pursue a career as a quant trader, this article will provide insights into the reasons behind its growing popularity, the skills required, and the high rewards associated with the role. Let’s explore how to step into this exciting field, evaluate the key benefits, and weigh the challenges that come with the territory.

What Does a Quant Trader Do?

The Role of a Quantitative Trader

A quantitative trader uses advanced mathematical models, algorithms, and statistical analysis to make trading decisions. Unlike traditional traders who rely on intuition or fundamental analysis, quants focus on using complex data and automated systems to identify profitable trading opportunities. The essence of quantitative trading lies in leveraging computational power to model and predict price movements in financial markets.

Key Responsibilities

- Algorithm Development: Design, test, and refine algorithms that can automatically execute trades.

- Data Analysis: Analyze large volumes of historical and real-time market data to identify patterns and correlations.

- Risk Management: Develop strategies to minimize risk while optimizing trading strategies.

- Optimization: Continuously improve trading models to adapt to changing market conditions.

Why Pursue a Career as a Quant Trader?

1. High Earning Potential

Quant traders are among the highest-paid professionals in the financial world. With specialized knowledge in areas like financial modeling, data analysis, and machine learning, quant traders can command lucrative salaries and performance-based bonuses. According to industry reports, quant traders in Dubai and other financial hubs around the world earn impressive compensation packages, with some positions offering base salaries upwards of $150,000 annually, in addition to performance incentives.

The earning potential increases with experience and specialization. As a senior quant trader, you can expect even higher compensation, especially if you work in hedge funds or proprietary trading firms, where profits are directly linked to performance.

2. Job Security and Demand

The demand for quant traders has surged in recent years, especially in global financial centers like Dubai, London, New York, and Hong Kong. With the rise of algorithmic trading and machine learning models, financial institutions are constantly on the lookout for skilled professionals who can create innovative trading strategies. In fact, quant trader jobs are in demand not just in banks, but also in hedge funds, asset management firms, and fintech startups.

Moreover, the increasing reliance on data-driven decision-making across the financial industry ensures that quant traders will remain indispensable in the years to come. This high demand for quant traders provides job security and long-term career growth opportunities.

3. Intellectual Challenge and Innovation

One of the main attractions of becoming a quant trader is the intellectual challenge. Unlike traditional finance roles, quant trading requires constant problem-solving and innovation. You’ll need to stay ahead of the curve by incorporating new techniques and technologies, such as artificial intelligence (AI), machine learning, and big data analytics into your strategies.

The constantly evolving landscape of global financial markets means that there are always new problems to solve, whether it’s finding inefficiencies in the market or developing strategies to hedge against risk. If you have a passion for numbers, analysis, and programming, the challenges in quant trading can be incredibly rewarding intellectually.

4. Dynamic and Fast-Paced Environment

Quant traders work in a high-pressure, fast-paced environment where every decision can have significant financial implications. The thrill of executing successful trades and seeing the immediate impact of your work is one of the most exciting aspects of this career. The dynamic nature of the markets ensures that no two days are alike, keeping the work engaging and intellectually stimulating.

5. Opportunities for Career Growth and Specialization

In a quant trading career, there are numerous opportunities to specialize. You can choose to focus on a particular asset class (stocks, bonds, derivatives, commodities), develop expertise in a specific algorithmic technique, or even transition into areas like risk management or portfolio optimization. As you gain more experience, you can move into leadership roles, such as managing a team of quants or developing firm-wide trading strategies.

Furthermore, quant trader roles for finance enthusiasts can evolve into opportunities in financial advising, where quants can offer their expertise to institutional clients or individual investors.

Essential Skills Required to Be a Quantitative Trader

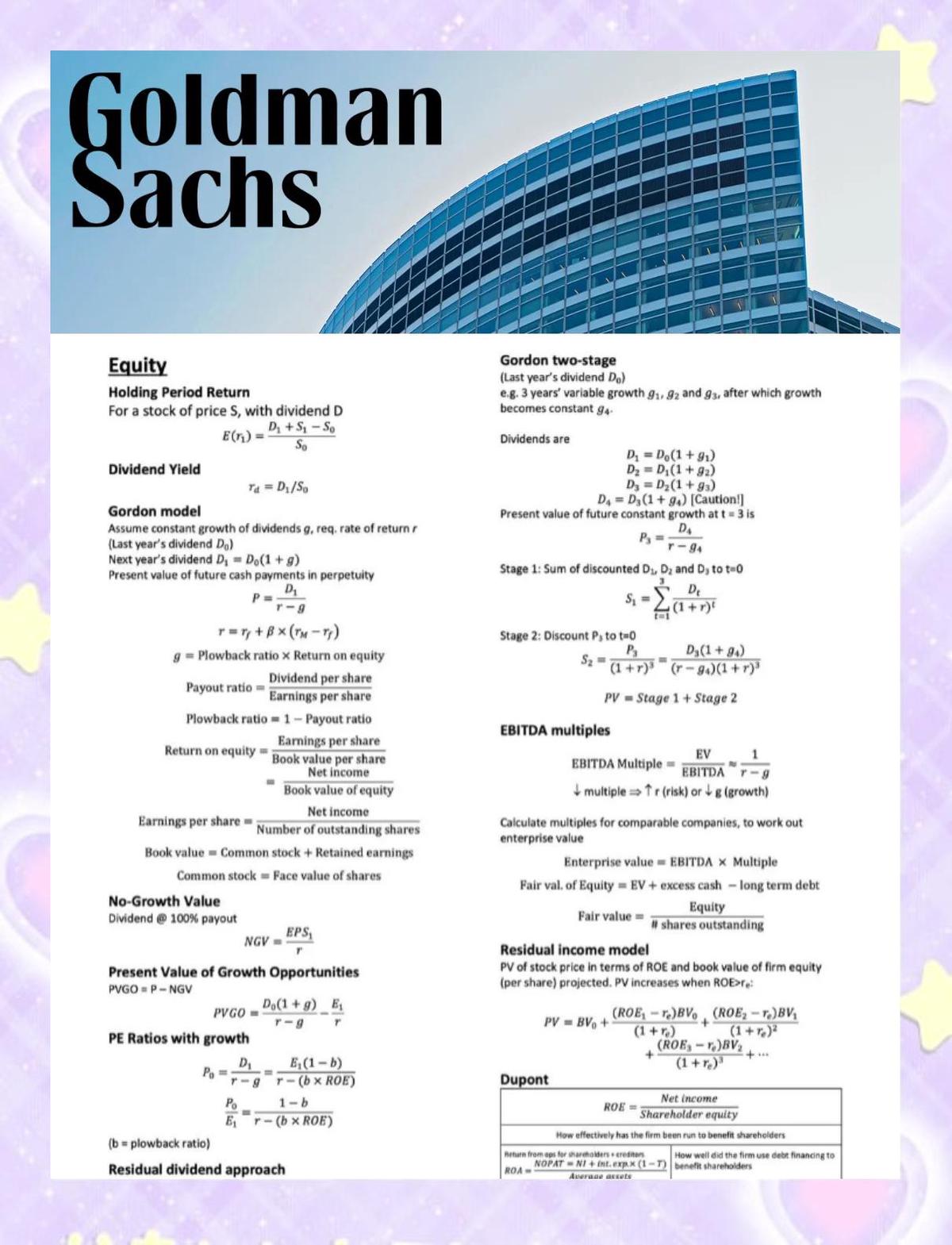

1. Mathematics and Statistical Analysis

Quantitative trading revolves around mathematics, especially in areas such as calculus, linear algebra, and statistics. Understanding concepts like stochastic processes, time series analysis, and probability theory is crucial for developing accurate trading models. You must be comfortable working with complex mathematical formulas and algorithms.

2. Programming Skills

Proficiency in programming languages like Python, C++, R, and Matlab is essential for building trading algorithms and automating processes. Many quantitative traders use Python for its flexibility and strong support for data analysis libraries such as Pandas, NumPy, and SciPy.

3. Financial Market Knowledge

While quants use mathematical models, an understanding of financial markets and instruments is crucial. You should be familiar with trading strategies, asset classes, and financial instruments like options, futures, and swaps. This knowledge helps you create models that align with market realities and investor behavior.

4. Problem-Solving and Analytical Thinking

As a quant trader, you’ll need strong problem-solving and analytical thinking skills. Whether it’s optimizing a trading strategy or finding correlations in large datasets, your ability to analyze and identify patterns in data will determine your success in this field.

Strategies to Enter a Career as a Quantitative Trader

1. Educational Background and Qualifications

To become a quant trader, having a strong educational foundation in mathematics, finance, or computer science is crucial. A master’s degree or PhD in quantitative disciplines can greatly enhance your prospects, though many quants come from varied educational backgrounds. Some of the best quant trading courses cover topics like algorithmic trading, statistical modeling, and financial engineering.

2. Internships and Networking

Gaining hands-on experience through internships is one of the best ways to break into the quant trading world. Internships allow you to work on real-world trading problems and interact with professionals in the field. Networking is equally important. Building relationships with industry leaders and peers can open up valuable job opportunities and provide insights into the latest trends in quant trading.

3. Certifications and Continuous Learning

While formal education is important, continuous learning and certification can help set you apart from other candidates. Pursuing certifications in financial modeling, quantitative analysis, or machine learning can demonstrate your commitment to improving your skills and staying ahead of industry trends.

FAQ: Common Questions About Pursuing a Career as a Quant Trader

1. What qualifications do I need to become a quant trader?

Typically, quant traders have advanced degrees in mathematics, computer science, engineering, or finance. A strong foundation in statistical modeling and programming is essential. Having additional certifications or taking quant trading courses can also enhance your qualifications.

2. What is the typical career path for a quant trader?

The career path usually starts with an entry-level role as a quantitative analyst or junior trader. With experience, you can progress to senior roles such as lead quant trader or portfolio manager. Some quants may move into leadership positions, managing teams of traders or quants, or transition into specialized areas like risk management or algorithmic strategy development.

3. How much does a quant trader earn?

Salaries for quant traders can vary widely based on experience, location, and the firm you work for. Entry-level quant traders typically earn between \(100,000 to \)150,000 annually, while senior quant traders can earn upwards of $500,000, including bonuses and performance incentives. In Dubai, quant traders are especially well-compensated due to the city’s growing financial sector.

Conclusion

Pursuing a career as a quantitative trader offers a combination of high earning potential, intellectual stimulation, and career growth. With the right qualifications, skills, and determination, you can carve out a rewarding career in this exciting field. Whether you are attracted by the potential to earn a high salary, the challenge of solving complex problems, or the opportunity to specialize in innovative trading techniques, becoming a quant trader is an excellent career choice for those with a passion for math, finance, and programming.

0 Comments

Leave a Comment