===================================================

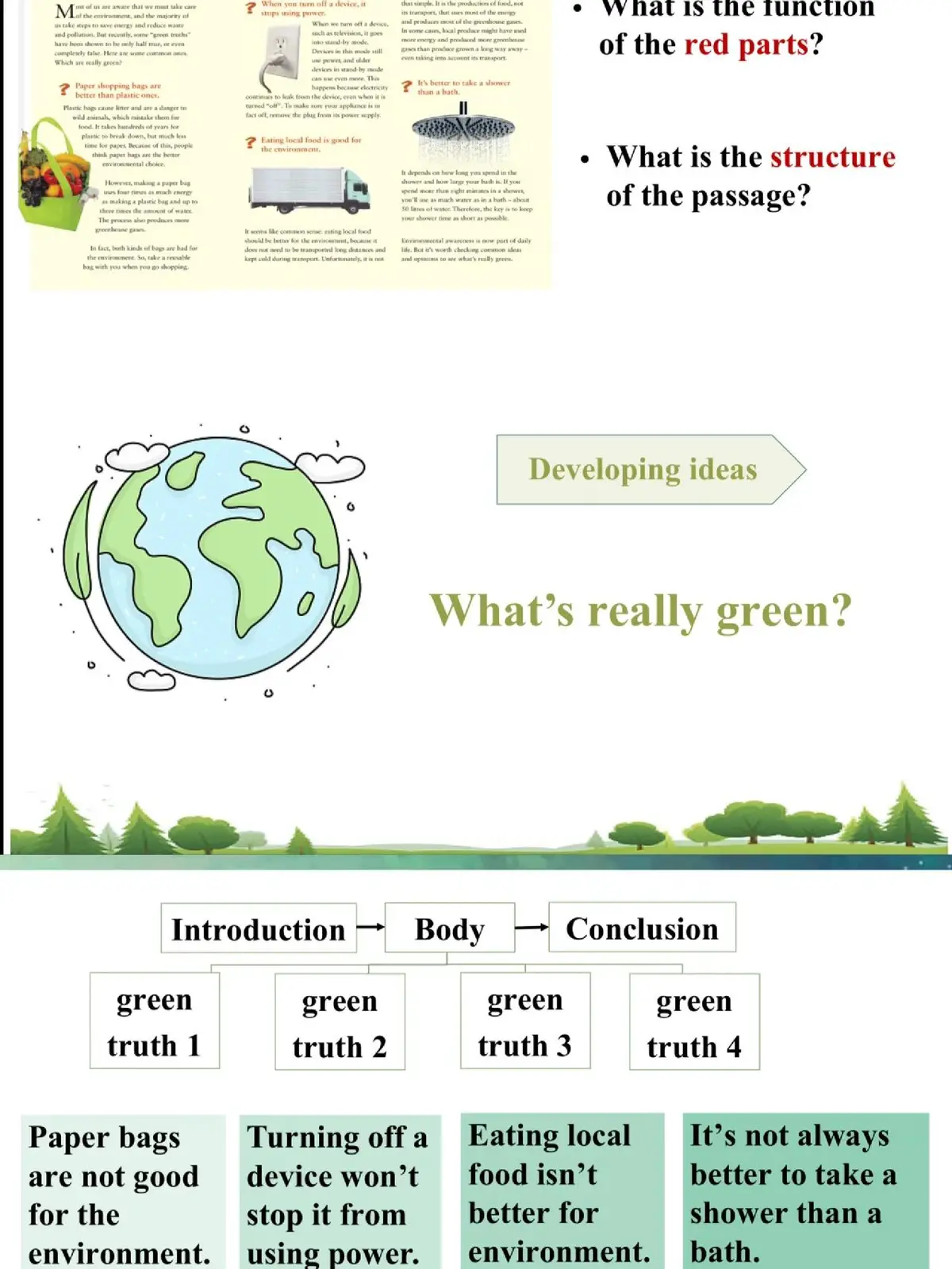

Introduction

Quantitative trading, or “quant trading,” has become one of the most competitive and sought-after careers in finance, particularly in global financial hubs like London. With hedge funds, investment banks, and proprietary trading firms constantly seeking top mathematical and programming talent, candidates often wonder: What is the hiring process for quant traders in UK?

This article provides a comprehensive breakdown of the recruitment journey—from the initial application to final offer—while highlighting the challenges, strategies, and best practices that candidates can use to stand out. We will also integrate real-world insights from industry professionals, compare hiring practices across firms, and explore how aspiring quants can position themselves for success.

The Importance of Quant Trader Hiring in the UK

The UK, particularly London, remains one of the largest centers for algorithmic and high-frequency trading in Europe. Institutions demand candidates with deep knowledge in mathematics, statistics, machine learning, and financial markets. Understanding the hiring process is crucial for anyone preparing to enter this competitive space, as the recruitment journey reflects both technical ability and cultural fit.

Stages of the Quant Trader Hiring Process in the UK

1. Application and CV Screening

The first step is submitting an application through a firm’s career portal, recruiter, or referral network. At this stage, employers filter for:

- Educational background: Top-tier universities in mathematics, physics, computer science, or finance.

- Programming expertise: Python, C++, R, or Java.

- Quantitative experience: Research, internships, or prior trading roles.

Applicants should tailor their CVs to highlight relevant technical skills, publications, and projects. Reading guides like Quant trader resume tips for UK market can provide practical formatting and content strategies.

2. Online Assessments

Most firms require online assessments designed to measure raw quantitative ability and problem-solving speed. Typical components include:

- Math puzzles (probability, statistics, mental arithmetic).

- Programming challenges (Python coding, algorithm optimization).

- Logical reasoning (pattern recognition, data interpretation).

These assessments act as filters to quickly identify candidates with strong numerical intuition.

3. Technical Interviews

Candidates who pass assessments are invited to multiple rounds of technical interviews. These often cover:

- Stochastic calculus and probability theory.

- Statistical modeling and time series analysis.

- Optimization and algorithm design.

- Market microstructure and trading strategy design.

Some firms also require candidates to perform live coding exercises or solve case studies related to how to become a quant trader in UK?, reflecting both technical knowledge and practical trading insight.

4. Behavioral and Cultural Fit Interviews

Beyond technical ability, firms evaluate candidates for adaptability, teamwork, and risk management awareness. Questions may probe:

- Motivation for entering quant trading.

- Examples of working under pressure.

- Ability to collaborate with traders, developers, and risk managers.

In a market as competitive as London, where firms receive thousands of applications, cultural fit often becomes the deciding factor between two equally skilled candidates.

5. Final Round: Trading Simulations and Presentations

Some firms include trading simulations, where candidates must make decisions based on live or historical data. Others may require candidates to present a small research project, demonstrating analytical depth and communication skills.

6. Offer and Negotiation

If successful, candidates receive an offer, often including base salary, performance bonus, and benefits. Negotiation can be delicate, but resources like how to negotiate quant trader salary in UK? provide strategies for balancing competitiveness with professionalism.

Quant trader hiring pipeline in the UK

Two Key Strategies to Navigate the Hiring Process

Strategy 1: Academic Excellence and Research Track Record

Strengths:

- Builds credibility in mathematics, data science, and AI.

- Demonstrates ability to handle complex theories.

- Builds credibility in mathematics, data science, and AI.

Weaknesses:

- Can be overly academic if not linked to practical trading experience.

- Can be overly academic if not linked to practical trading experience.

Best Fit: Candidates targeting research-driven hedge funds or banks.

Strategy 2: Practical Trading and Coding Experience

Strengths:

- Shows applied skills in building and testing strategies.

- More attractive to proprietary trading firms and HFT shops.

- Shows applied skills in building and testing strategies.

Weaknesses:

- May lack theoretical rigor if not balanced with academic background.

- May lack theoretical rigor if not balanced with academic background.

Best Fit: Candidates aiming for fast-paced prop firms or algorithmic trading startups.

Recommendation

The best approach is a hybrid: combining strong theoretical grounding with hands-on coding and trading practice. Candidates who can bridge academic research and real-time trading environments are most likely to succeed.

How Competitive is the Market for Quant Traders in UK?

The UK quant trading market is extremely competitive, with thousands of applicants for a limited number of roles each year. According to industry data, top-tier firms often hire less than 2% of applicants. London, in particular, attracts global talent, making it essential for candidates to prepare rigorously.

Reading resources on where to find quant trading jobs in UK? helps candidates identify the right firms and application channels, ensuring they target opportunities that align with their skills.

Common Mistakes Candidates Make

- Overfocusing on theory without coding skills.

- Generic CVs that fail to highlight relevant achievements.

- Underestimating mental math and problem-solving speed tests.

- Poor interview preparation for behavioral questions.

- Lack of networking—many hires are made through referrals.

Key skills firms look for in UK quant traders

Personal Insights

From conversations with industry professionals, one recurring theme is the importance of balance. Some candidates excel at coding but fail behavioral rounds. Others are academically brilliant but cannot explain their work in simple terms. Success requires technical depth, communication skills, and resilience.

One hiring manager noted that the strongest candidates “can think mathematically under pressure, code efficiently, and communicate clearly across teams.”

FAQ: Hiring Process for Quant Traders in UK

1. How long does the hiring process take?

The process typically lasts 6–12 weeks, depending on the firm. Larger banks may have multi-stage assessments, while prop firms often move faster.

2. Do I need a PhD to become a quant trader in the UK?

Not necessarily. While PhDs are common, many firms also hire candidates with master’s or bachelor’s degrees in math, physics, computer science, or finance—especially if they demonstrate strong coding and trading skills.

3. What skills are most important?

Core skills include statistics, probability, stochastic calculus, machine learning, and programming (Python, C++, R). Equally important are problem-solving speed, risk management awareness, and the ability to explain technical work in plain language.

Conclusion

The question “What is the hiring process for quant traders in UK?” reveals a multi-step journey combining technical tests, coding challenges, interviews, and cultural assessments. Success requires not just academic brilliance, but also applied trading experience and soft skills.

Key takeaways:

- The process is rigorous and highly competitive.

- Academic excellence and coding ability are both essential.

- A hybrid skill set—bridging theory and practice—offers the best chance of success.

📢 If you found this guide helpful, share it with peers preparing for quant roles, comment with your own hiring experiences, and join the conversation to help others succeed in the UK quant trading job market.

Would you like me to also create a quant trader hiring checklist PDF (covering CV prep, coding practice, interview tips, and negotiation strategies) that readers could download and use for job applications?

0 Comments

Leave a Comment