===================================================

Introduction

The financial markets have always attracted ambitious minds, but in the age of big data and advanced computing, quantitative trading (quant trading) has emerged as one of the most lucrative and competitive career paths. For recent graduates, especially those from mathematics, computer science, engineering, or finance backgrounds, the quant trader salary for recent graduates in the USA represents both opportunity and reward.

This article explores how much new graduates can expect to earn as quant traders, what factors influence these salaries, and how to strategically approach a career in this demanding yet rewarding field.

What Is Quantitative Trading?

Quantitative trading involves using mathematical models, statistical analysis, and computer algorithms to identify trading opportunities. Unlike discretionary traders, quants rely on data-driven strategies to eliminate emotion from decision-making.

For graduates entering the field, this means applying advanced skills in:

- Programming languages (Python, C++, R, Java)

- Statistical modeling

- Machine learning

- Market microstructure analysis

Average Quant Trader Salary for Recent Graduates in the USA

For new entrants into the industry, compensation packages are typically structured as:

- Base Salary – Fixed annual pay.

- Performance Bonus – Variable, based on trading desk performance.

- Signing Bonus & Benefits – Offered by many firms to attract top graduates.

According to 2024 data, the average quant trader salary for recent graduates in the USA falls between \(120,000 to \)160,000 base salary, with total compensation (including bonuses) ranging from \(150,000 to \)220,000.

Salary Breakdown by Firm Type

| Firm Type | Base Salary (Entry Level) | Bonus Range | Total Compensation |

|---|---|---|---|

| Hedge Funds (Top Tier) | \(140,000 – \)160,000 | \(40,000 – \)100,000 | \(180,000 – \)260,000 |

| Proprietary Trading Firms | \(120,000 – \)150,000 | \(30,000 – \)70,000 | \(150,000 – \)220,000 |

| Investment Banks | \(110,000 – \)130,000 | \(20,000 – \)50,000 | \(130,000 – \)180,000 |

| Asset Management Firms | \(100,000 – \)120,000 | \(10,000 – \)30,000 | \(110,000 – \)150,000 |

Factors That Influence Entry-Level Quant Salaries

1. Academic Background

Graduates with advanced degrees (Master’s, PhD) in mathematics, physics, or computer science often command higher starting salaries.

2. Technical Skills

Knowledge of Python, C++, and machine learning libraries significantly boosts earning potential.

3. Location

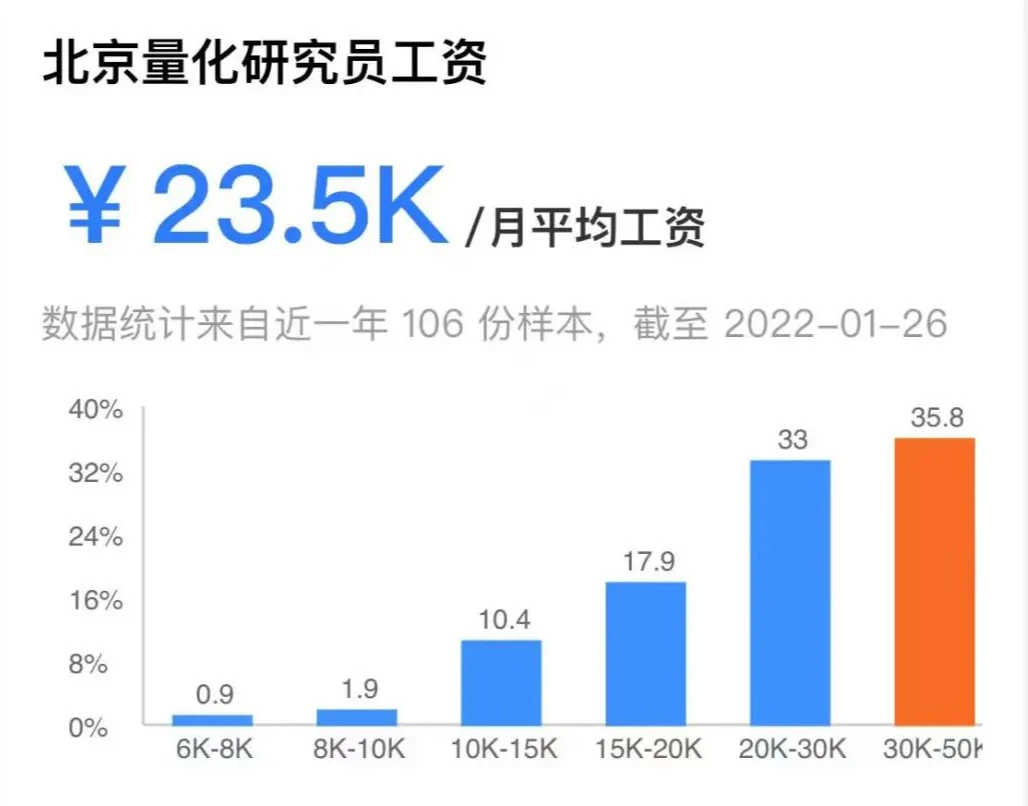

Salaries vary by city:

- New York, NY: $140,000 average base

- Chicago, IL: $130,000 average base

- San Francisco, CA: $135,000 average base

4. Firm Prestige

Elite hedge funds and prop trading firms often pay more than traditional banks.

Graduate Salary Expectations vs Career Growth

While the quant trader salary for recent graduates in the USA is highly competitive, it is only the beginning. Within 5–7 years, successful quants can earn \(400,000 to \)1M+ annually, particularly if they develop proprietary strategies or manage trading desks.

Quant trader salary progression over career stages

Strategies to Maximize Earnings as a Graduate

Strategy 1: Joining a Hedge Fund Early

Pros:

- High pay potential from day one

- Exposure to innovative trading models

- Strong performance-based bonuses

Cons:

- Intense competition and high-pressure environment

- Shorter job security if performance is weak

Strategy 2: Starting at a Major Investment Bank

Pros:

- Structured training programs

- Broader exposure to financial products

- Strong career mobility

Cons:

- Lower bonuses compared to hedge funds

- More bureaucracy and slower decision-making

Recommended Path

For graduates seeking long-term growth and high earnings, starting at a hedge fund or proprietary trading firm provides the fastest trajectory. However, those who value structured development may prefer banks before transitioning into hedge funds later.

Why Is Quant Trader Salary So High in the USA?

The demand for skilled quants far exceeds supply. The salary premium is justified by:

- The ability to generate millions in trading profits from well-designed models.

- Scarcity of talent combining finance, math, and coding skills.

- The need for 24⁄7 innovation in competitive markets.

This answers the question of why quant trading is popular in the USA—the financial ecosystem rewards performance heavily, making it a magnet for top graduates.

Internships and Early Career Opportunities

Internships are a critical gateway. For those wondering how to find quant trading internships in the USA, opportunities are available through:

- Major banks (Goldman Sachs, JPMorgan)

- Proprietary firms (Jane Street, Citadel, Jump Trading)

- Hedge funds (Two Sigma, DE Shaw, Point72)

Internship performance often translates directly into full-time offers with competitive salaries.

Skills That Boost Salary Potential

- Strong quantitative skills: Probability, statistics, linear algebra.

- Coding efficiency: Writing low-latency code for execution.

- Machine learning expertise: Predictive modeling and deep learning applications.

- Financial knowledge: Derivatives, options pricing, and risk management.

Future Salary Trends for Quant Traders

- AI & Machine Learning – Firms are increasingly paying premiums for AI talent.

- Global Expansion – Salaries in the USA remain the benchmark, but firms are expanding to Singapore, London, and Hong Kong, creating opportunities for mobility.

- Hybrid Roles – Data scientists crossing into finance are pushing salary ceilings higher.

FAQ: Quant Trader Salary for Recent Graduates in the USA

1. What is the typical entry-level quant trader salary in the USA?

Most recent graduates earn between \(120,000 and \)160,000 base, with bonuses pushing total compensation to \(150,000–\)220,000 annually.

2. Do you need a PhD to earn a high quant trader salary?

Not necessarily. While PhDs can earn higher starting salaries, many successful quants come from bachelor’s or master’s backgrounds in computer science, mathematics, or engineering, provided they have strong coding and statistical skills.

3. Which cities offer the highest quant trader salaries in the USA?

New York and Chicago remain the top hubs, with San Francisco close behind. These cities host major trading firms, banks, and hedge funds.

Conclusion

The quant trader salary for recent graduates in the USA makes this one of the most attractive entry-level roles in finance. With base pay averaging \(120,000–\)160,000 and bonuses often pushing total earnings beyond $200,000, the financial rewards are substantial.

For graduates with the right mix of mathematics, coding, and problem-solving skills, quant trading offers both financial security and intellectual excitement. Whether you aim to join a hedge fund or start at a bank, your trajectory depends on skill, persistence, and adaptability.

💡 If this guide helped you understand quant trader salaries and career paths, share it with classmates, colleagues, or friends exploring the world of finance. And don’t forget to drop your thoughts below—would you choose a hedge fund, a prop firm, or a bank to start your quant trading journey?

Would you like me to create a state-by-state salary comparison chart for quant traders in the USA to visually highlight geographic differences for graduates?

0 Comments

Leave a Comment