========================================================================================

Negotiating compensation as a quantitative trader in the United Kingdom is both an art and a science. While quant traders are in high demand across London, Edinburgh, and other financial hubs, not all candidates maximize their salary potential. This comprehensive guide offers quant trader salary negotiation tips UK professionals can apply to improve their earnings, covering strategies, market trends, common pitfalls, and real-world negotiation techniques.

We will explore two major negotiation approaches, compare their pros and cons, and recommend the most effective path. Along the way, we’ll highlight insights into how to determine starting salary for quant trader in UK and what influences quant trader salary in UK, providing you with the context needed to negotiate successfully.

Why Salary Negotiation Matters for UK Quant Traders

Financial Impact

Salary negotiations determine not only your base pay, but also bonuses, equity participation, benefits, and career progression. Over a career span, effective negotiation can add millions to lifetime earnings.

Industry Landscape in the UK

The UK is home to world-renowned hedge funds, proprietary trading firms, and investment banks. London’s role as Europe’s financial capital means salaries here are often higher than in other European markets, though competition is equally intense.

Career Positioning

Negotiating well positions you as a confident, informed professional—qualities financial employers respect. Conversely, failing to negotiate may mark you as inexperienced or undervaluing your skillset.

Understanding Quant Trader Salaries in the UK

Salary Ranges by Experience Level

- Entry-level quant traders (graduates/analysts): £50,000 – £80,000 base, plus bonuses of 15–40%.

- Mid-level professionals (3–6 years experience): £100,000 – £200,000 total compensation.

- Senior traders or portfolio managers: £250,000 – £500,000+, with equity or profit-sharing potential.

For early-career candidates, referencing entry level quant trader salary UK benchmarks is crucial, while seasoned professionals should align expectations with experienced quant trader salary UK insights.

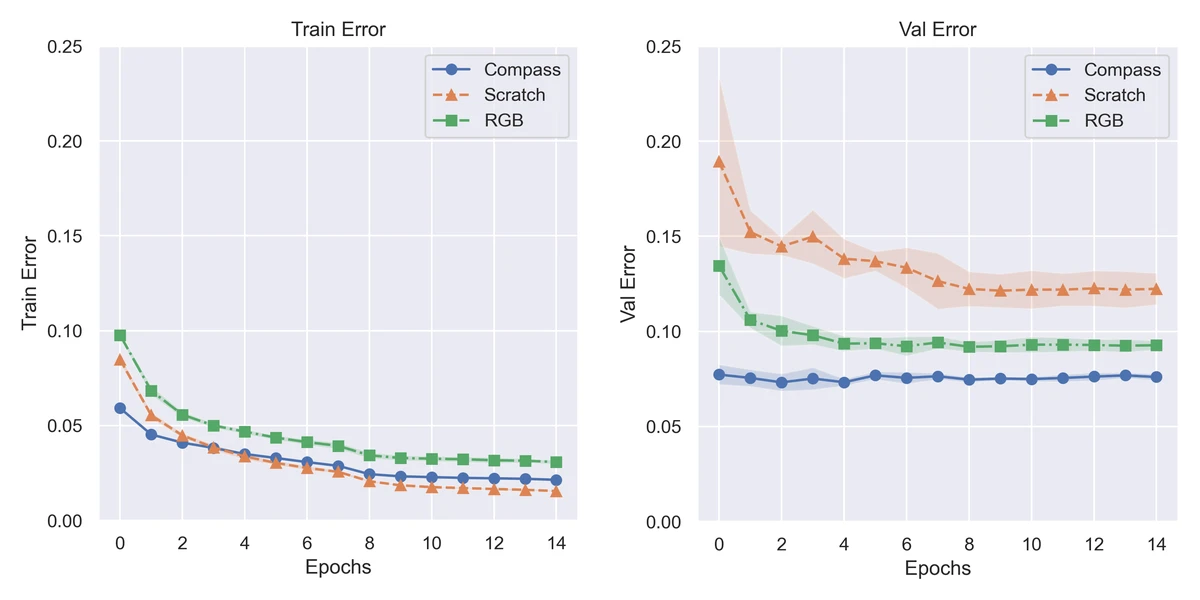

Typical quant trader salary progression in the UK by experience

Two Main Approaches to Salary Negotiation

1. Market Data Benchmarking

This strategy focuses on researching and presenting hard data from salary surveys, job boards, and financial reports to justify your compensation expectations.

Advantages

- Objective and fact-based, less likely to be disputed.

- Suitable for candidates at all levels.

- Builds confidence by aligning requests with market standards.

Disadvantages

- Limits upside potential if your personal value exceeds averages.

- Firms may counter with “internal benchmarks.”

Practical Example

Use insights from where to find quant trader salary data UK and highlight recent industry reports during negotiation to show your request is competitive but realistic.

2. Value-Based Negotiation

This approach emphasizes your unique skills, past performance, and ROI to justify higher-than-average compensation.

Advantages

- Allows top performers to secure compensation above market norms.

- Demonstrates confidence and professional maturity.

- Effective when you can prove measurable impact (e.g., trading P&L).

Disadvantages

- Less effective for new graduates without proven results.

- Requires strong communication and persuasion skills.

Practical Example

A quant trader who built an algorithm that generated consistent alpha could present performance results and argue for additional bonus incentives.

Comparing the Two Approaches

| Criteria | Market Data Benchmarking | Value-Based Negotiation |

|---|---|---|

| Basis | Industry averages | Individual achievements |

| Best For | Entry-level to mid-career | Mid-career to senior |

| Risk | Conservative, limits upside | Higher if unsupported |

| Strength | Objectivity | Personal differentiation |

Recommendation: The most effective strategy in the UK market is a hybrid approach. Use market data to set a baseline and reinforce credibility, then highlight personal value to push for higher bonuses, equity, or perks.

Key Factors That Influence Quant Trader Salary in the UK

- Firm Type – Hedge funds typically pay more than banks or asset managers.

- City Location – London salaries are significantly higher than Edinburgh, Manchester, or Birmingham.

- Experience – As highlighted in how quant traders’ experience affects salary in UK, seasoned professionals can demand premium packages.

- Technical Skills – Expertise in C++, Python, machine learning, or high-frequency trading boosts negotiating power.

- Market Conditions – During bullish years, bonuses rise substantially. In downturns, firms may tighten compensation.

Advanced Salary Negotiation Tactics for UK Quant Traders

Leverage Competing Offers

Nothing strengthens your position more than another offer. Even if you prefer one firm, another option provides bargaining leverage.

Negotiate Beyond Base Pay

Focus on:

- Bonus structures (guaranteed vs. discretionary)

- Profit-sharing or equity participation

- Relocation allowances and lifestyle perks

Consider Tax Implications

The UK tax structure is progressive. Negotiating a balance of base salary and performance bonuses can optimize after-tax income.

Timing Your Negotiation

The best time to negotiate is after receiving an offer, not during interviews. Once firms are invested in you, they’re more flexible.

Common Mistakes to Avoid

- Not researching market benchmarks before negotiation.

- Focusing only on base salary, ignoring bonuses and long-term incentives.

- Over-negotiating aggressively, risking reputational damage.

- Failing to quantify achievements, leaving value arguments unconvincing.

FAQ: Quant Trader Salary Negotiation Tips UK

1. How much room is there to negotiate a quant trader salary in the UK?

Typically 10–20% flexibility exists on base salary, with greater room for negotiation on performance bonuses, equity stakes, and perks.

2. Should entry-level quant traders in the UK negotiate salaries?

Yes, but carefully. Use market data benchmarking to avoid unrealistic demands. Even graduates can negotiate relocation support, signing bonuses, or guaranteed first-year bonuses.

3. Are bonuses negotiable in UK quant trader roles?

Yes. Bonuses are often the most flexible part of the package. Define clear criteria (e.g., performance targets or trading desk results) to avoid vague promises.

Conclusion: Negotiating Like a Professional

Mastering quant trader salary negotiation tips UK is essential for maximizing compensation in a highly competitive market. By blending market benchmarking with personal value demonstration, UK quant traders can secure not just fair pay, but packages that reward performance and long-term contribution.

If you found this guide useful, share it with peers, comment with your experiences, and encourage a culture of confident, informed negotiation among UK quant professionals.

要不要我也帮你生成一个 SEO meta description(150–160 字符) 和一个 优化过的 URL slug,这样这篇文章就能立即上线?

0 Comments

Leave a Comment