============================================

Introduction: Why Quant Trading Courses Matter

Quantitative trading, often referred to as “quant trading,” is one of the most competitive and rewarding career paths in modern finance. With financial markets becoming increasingly data-driven, professionals are expected to master complex mathematical models, algorithmic strategies, and programming skills. For individuals seeking to grow in this field, quant trading courses for career advancement provide the essential knowledge, tools, and hands-on skills needed to remain competitive.

This article explores the importance of quant trading education, compares different learning strategies, highlights real-world applications, and provides a comprehensive guide for professionals aiming to elevate their careers. By the end, you’ll understand which courses are best suited for your professional development and how to strategically position yourself in this evolving industry.

The Growing Importance of Quant Trading Education

Industry Trends Driving Demand

The finance industry is experiencing rapid digitalization. Hedge funds, investment banks, and proprietary trading firms rely heavily on algorithmic trading and data science. According to recent reports, over 70% of U.S. stock market trades are executed by algorithms, highlighting the dominance of quantitative methods.

Professionals entering this space cannot rely solely on traditional finance knowledge; instead, they need advanced technical skills. As a result, courses that teach programming (Python, C++), machine learning, stochastic calculus, and portfolio optimization have become essential stepping stones.

Career Advancement Through Continuous Learning

Quantitative finance is highly competitive. Employers expect professionals to stay updated with the latest trading models and regulatory changes. Enrolling in quant trading courses helps candidates:

- Strengthen their technical expertise in statistical modeling and financial engineering.

- Gain hands-on experience through simulated trading platforms.

- Build networks with industry professionals and recruiters.

- Increase their chances of landing high-paying roles, such as quantitative researcher, algorithmic trader, or risk analyst.

Key Skills Taught in Quant Trading Courses

1. Programming for Quantitative Finance

Programming is the backbone of quant trading. Courses often emphasize languages like Python, R, MATLAB, and C++, which are critical for backtesting strategies and building trading algorithms.

Example Course Modules:

- Data manipulation with Python’s Pandas and NumPy.

- High-frequency trading system development in C++.

- API integration for real-time trading execution.

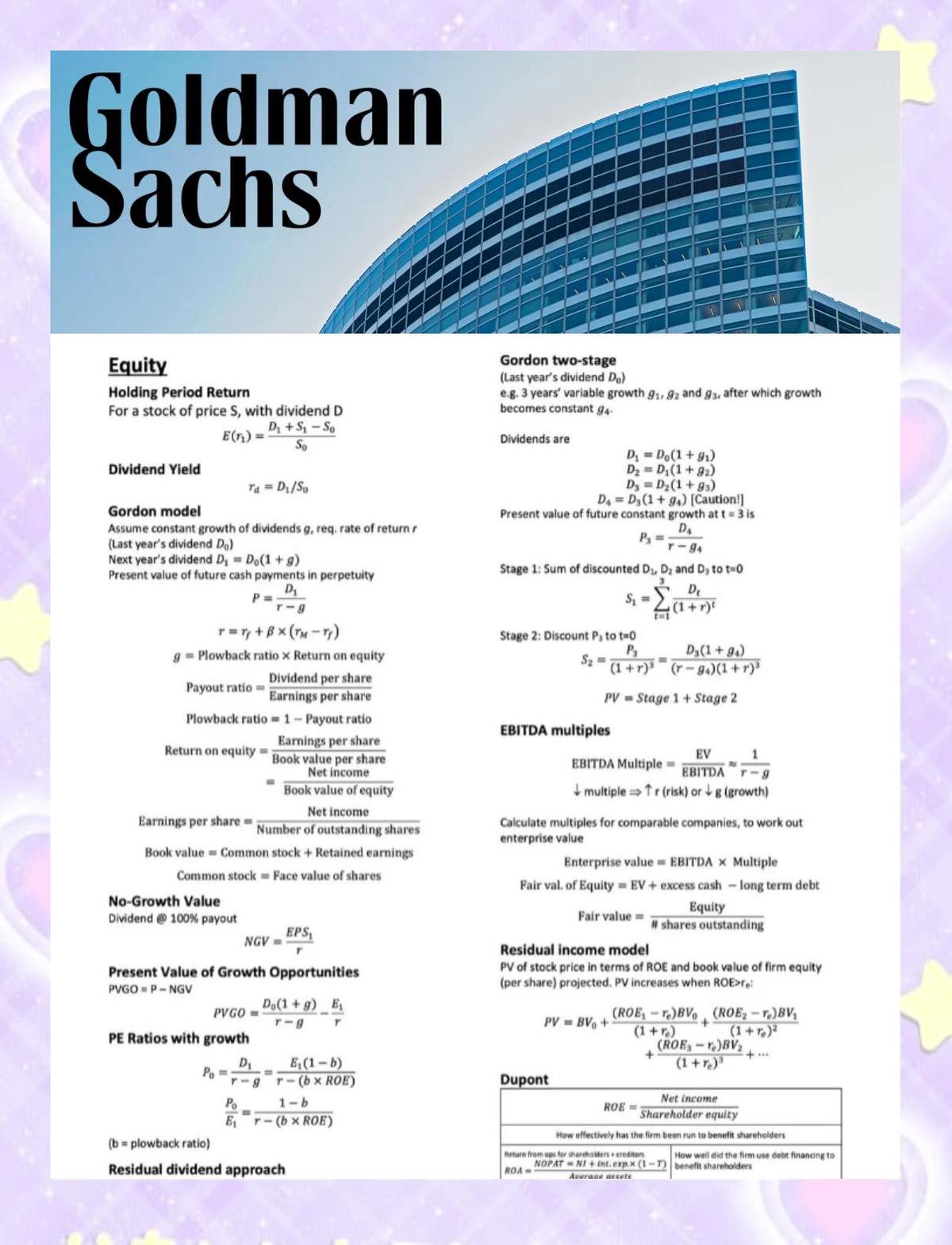

2. Mathematical Foundations

A deep understanding of probability, linear algebra, and stochastic calculus is essential. Advanced courses integrate Ito’s lemma, Monte Carlo simulations, and Black-Scholes models, enabling traders to price complex derivatives and optimize portfolios.

3. Machine Learning in Trading

AI-driven models are becoming increasingly common in quant strategies. Courses now incorporate:

- Supervised learning for market prediction.

- Reinforcement learning for trade execution.

- Natural language processing (NLP) for sentiment analysis.

Comparing Two Learning Paths: University Programs vs. Online Courses

1. University-Based Quant Trading Programs

Top universities like MIT, Princeton, and NYU offer master’s programs in Financial Engineering and Quantitative Finance. These are structured, rigorous, and provide access to world-class faculty.

Advantages:

- Deep academic foundation.

- Access to career placement centers.

- Strong alumni network.

Disadvantages:

- High tuition costs (often above $60,000).

- Time commitment of 1–2 years.

2. Online Quant Trading Courses

Platforms like Coursera, Udemy, QuantInsti, and EdX offer specialized courses tailored to working professionals.

Advantages:

- Affordable (ranging from \(200 to \)2,000).

- Flexible, self-paced learning.

- Focused on real-world projects and applications.

Disadvantages:

- Less networking compared to universities.

- Requires self-discipline and motivation.

Recommendation

For professionals already in finance or data science, online courses are the fastest way to advance careers. For students or career changers seeking long-term development, university programs offer structured depth and prestige.

Real-World Career Applications of Quant Trading Courses

Building Competitive Strategies

Courses help professionals design strategies that adapt to real-world conditions, such as:

- Statistical arbitrage for short-term profit opportunities.

- Volatility modeling to manage risk during uncertain markets.

Expanding Career Opportunities

For career-oriented learners, quant trading courses directly translate into new job opportunities. For example, many graduates transition into roles such as:

- Quantitative researcher.

- Risk model developer.

- Portfolio strategist.

This also connects with broader career questions such as “How to become a quant trader in the USA”, where courses provide a structured path toward necessary certifications and skills.

Visualizing the Learning Path

Quant trading courses provide a roadmap from beginner to advanced strategies, covering programming, mathematics, and AI applications.

How Quant Trading Courses Enhance Career Advancement

Higher Earning Potential

Completing quant courses often leads to roles with significantly higher salaries. For instance, algorithmic traders and quantitative researchers in the USA typically earn six-figure salaries, with bonuses tied to performance. This aligns with industry discussions such as “Why is quant trading salary high in the USA”, where specialized skills command premium compensation.

Competitive Differentiation

In a crowded job market, certifications and practical experience from structured courses act as strong differentiators for recruiters. Employers value candidates who demonstrate both academic understanding and practical implementation skills.

Recommended Quant Trading Courses for Career Advancement

Beginner Level

- Introduction to Python for Finance (Coursera)

- Algorithmic Trading for Beginners (Udemy)

Intermediate Level

- Executive Program in Algorithmic Trading (QuantInsti)

- Machine Learning for Trading (Google/Georgia Tech, Coursera)

Advanced Level

- MFE Programs (NYU, Columbia, Princeton)

- Financial Engineering with C++ (Baruch College)

Case Study: From Analyst to Quant Trader

Consider the example of a financial analyst with a background in economics. By enrolling in online quant trading courses, they mastered Python, machine learning, and derivatives pricing. Within two years, they transitioned to a quant research role at a U.S. hedge fund, doubling their salary and expanding career growth opportunities.

Frequently Asked Questions (FAQ)

1. Do I need a math background to succeed in quant trading courses?

Yes, but the level depends on your goals. Introductory courses often simplify math concepts, while advanced programs require strong knowledge of linear algebra, calculus, and probability theory. If you’re from a non-math background, you can start with beginner courses and progressively build your foundation.

2. Which is better for career advancement: online quant trading courses or full-time degrees?

It depends on your situation. Online courses are best for professionals already in finance or tech who want to upskill quickly. University programs are more suitable for career changers or recent graduates who want in-depth exposure and academic credibility.

3. How do employers view quant trading course certifications?

Employers value certifications if they demonstrate practical skills. Completing well-regarded programs (such as QuantInsti’s EPAT) or recognized university certificates adds credibility to your resume. However, hands-on projects and backtested strategies often matter more than the certificate itself.

Conclusion: Elevate Your Career with Quant Trading Courses

Quantitative trading is no longer limited to elite PhDs; with accessible and structured quant trading courses for career advancement, anyone with determination can build the skills required for success. Whether you choose a university program or an online platform, the key lies in consistent practice, networking, and adapting to industry trends.

As financial markets continue evolving, professionals who invest in continuous learning will gain a competitive advantage. Now is the time to take the leap, enroll in the right course, and move one step closer to your quant career goals.

Quant trading courses act as a ladder for career growth, bridging the gap between theory and high-paying professional opportunities.

👉 If you found this article useful, share it with peers or colleagues interested in finance. Leave a comment below about your learning journey in quant trading—we’d love to hear your thoughts and experiences!

0 Comments

Leave a Comment