==============================================================

Quantitative trading is one of the most dynamic and rewarding fields within the finance industry. For those entering this profession, salary expectations can vary widely depending on a range of factors such as location, educational background, and the specific industry sector. In the UK, the salary for entry-level quant traders can offer a lucrative start to a career in finance, but understanding the specifics of these salaries is essential for anyone looking to break into the field.

In this article, we will explore what the average salary is for an entry-level quant trader in the UK, discuss the factors that influence these salaries, and provide insights into the best strategies for improving salary prospects in the field.

Understanding the Role of an Entry-Level Quant Trader

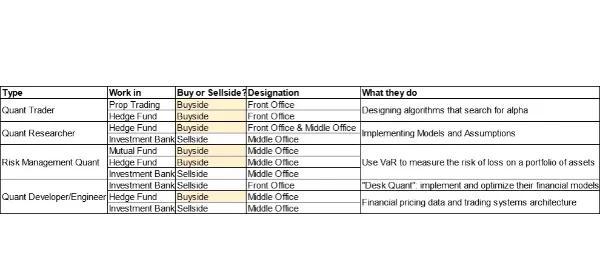

Before diving into salary expectations, it is important to understand the role of a quant trader. Quantitative traders, or “quants,” use mathematical models, algorithms, and programming languages to make data-driven decisions in the financial markets. They work with financial instruments such as stocks, futures, and options to execute trades that optimize profit while managing risk. Entry-level quant traders are typically recent graduates or those transitioning from other fields, such as mathematics, computer science, or economics.

The role demands a deep understanding of statistics, mathematics, and programming, especially in languages like Python, C++, or R. Entry-level quant traders may focus on areas such as algorithmic trading, data analysis, or developing pricing models, often working in teams within investment banks, hedge funds, or proprietary trading firms.

Average Salary Overview for Entry-Level Quant Traders in the UK

The average entry-level salary for a quant trader in the UK varies based on factors like location, the type of firm, and the educational background of the individual. Based on recent data, the typical salary range for an entry-level quant trader in the UK falls between £40,000 to £60,000 per year.

However, these numbers can fluctuate, especially when considering bonuses and additional compensation, which are common in trading roles. Bonuses can range from 20% to 100% of the base salary, depending on the performance of the firm and the individual trader. At large financial institutions or hedge funds, these bonuses can significantly raise total compensation.

What Influences the Entry-Level Quant Trader Salary in the UK?

While the average salary for an entry-level quant trader in the UK provides a general benchmark, several key factors influence how much a quant trader can expect to earn. Understanding these factors is crucial for those aiming to negotiate or boost their salary.

1. Educational Background

One of the most significant determinants of salary in quantitative trading is the level of education. Quant traders typically come from strong academic backgrounds in fields such as mathematics, computer science, engineering, or finance. Having a degree from a top-tier university, or holding a master’s or PhD in a quantitative field, can result in higher salary offers.

- Bachelor’s Degree: An entry-level quant trader with a bachelor’s degree typically earns between £40,000 and £50,000 per year.

- Master’s Degree: A master’s in a quantitative field can push starting salaries into the £50,000 to £60,000 range.

- PhD: Entry-level quant traders with a PhD may see salaries starting at £60,000 or higher, with significant bonuses and long-term earning potential.

2. Location

The location of the job plays a crucial role in salary expectations. London, as the financial hub of the UK, offers the highest salaries for quant traders due to the concentration of major financial institutions, hedge funds, and proprietary trading firms. In London, starting salaries for entry-level quant traders are generally at the higher end of the spectrum, typically between £50,000 and £70,000.

Outside of London, salaries can be somewhat lower, with regional firms offering starting salaries between £40,000 and £50,000. However, this is balanced by lower living costs in areas outside of the capital.

3. Type of Employer

The type of financial institution also significantly impacts the salary. Investment banks, hedge funds, and proprietary trading firms are known for offering more lucrative salaries and bonuses compared to other firms.

- Investment Banks: Large institutions like Goldman Sachs or JPMorgan offer competitive starting salaries in the range of £50,000 to £70,000, with bonuses that can significantly increase total compensation.

- Hedge Funds & Proprietary Trading Firms: These firms often provide higher base salaries and more substantial bonuses. A quant trader at a hedge fund may start with a base salary of £60,000, with the potential for substantial performance-based bonuses.

4. Industry Sector

Different sectors of the financial industry also offer varying levels of compensation for entry-level quant traders. For example, hedge funds tend to provide higher compensation than investment banks due to the nature of the work and the higher risk involved in trading.

- Hedge Funds: As mentioned, hedge funds tend to offer higher compensation packages to attract top talent in the highly competitive trading space.

- Proprietary Trading Firms: These firms focus on leveraging their own capital to trade financial markets. They often offer higher performance-based compensation, with base salaries that start higher and performance bonuses that can vary widely.

How to Improve Your Entry-Level Quant Trader Salary

For those looking to maximize their salary as an entry-level quant trader in the UK, there are several strategies to consider:

1. Pursue Advanced Degrees and Certifications

Obtaining a master’s or PhD in a quantitative discipline can dramatically improve salary prospects. In addition to formal education, certifications such as the CFA (Chartered Financial Analyst) or FRM (Financial Risk Manager) can add credibility and demonstrate expertise.

2. Specialize in High-Demand Programming Languages

Quant traders with strong programming skills, particularly in languages like Python, C++, and R, are in high demand. Specializing in algorithmic trading, machine learning, or data analysis can make you more attractive to employers and help justify a higher salary.

3. Gain Experience through Internships or Graduate Programs

Participating in internships or graduate programs at top financial institutions can help you build experience and connections. Firms often prefer candidates with some hands-on experience, and internships can lead to full-time job offers with competitive salaries.

4. Look for Opportunities at High-Compensation Firms

Focusing your job search on high-paying firms, such as hedge funds or proprietary trading firms, can lead to a higher salary. These firms often offer base salaries above the average, along with significant performance bonuses.

5. Develop Strong Negotiation Skills

Being able to negotiate effectively is an essential skill for maximizing your salary. Research salary benchmarks, be confident in your abilities, and don’t hesitate to negotiate for a higher salary, especially if you have additional skills or experience that align with the firm’s needs.

FAQ: Entry-Level Quant Trader Salary in the UK

1. What is the typical salary for an entry-level quant trader in the UK?

The average salary for an entry-level quant trader in the UK is between £40,000 and £60,000 annually. This can vary depending on factors such as location, education, and the type of financial institution.

2. Do quant traders receive bonuses?

Yes, many quant traders, especially in investment banks, hedge funds, and proprietary trading firms, receive performance-based bonuses. These bonuses can range from 20% to 100% of their base salary, depending on the performance of both the firm and the individual.

3. Which cities offer the highest quant trader salaries in the UK?

London offers the highest salaries for entry-level quant traders due to the concentration of financial institutions and hedge funds. However, salaries may be slightly lower in other regions of the UK, though this is offset by lower living costs.

Conclusion

The entry-level quant trader salary in the UK offers a strong starting point for those entering the field of quantitative trading. While the average salary falls between £40,000 and £60,000, there are several factors that can influence earnings, including education, location, and the type of firm. By investing in education, gaining relevant experience, and targeting high-compensation employers, aspiring quant traders can increase their earning potential in this lucrative field.

This article provides a comprehensive overview of entry-level quant trader salaries in the UK. Let me know if you’d like further adjustments or specific data points!

0 Comments

Leave a Comment