=======================================================================

Summary

Derivatives trading has evolved significantly over the years, moving from basic options and futures contracts to more complex financial instruments used by professionals and institutions. Advanced derivatives trading techniques are now more crucial than ever for managing risk, generating alpha, and hedging against unpredictable market movements. This 3000+ word article will cover the latest trends, techniques, and strategies that professionals use to stay ahead in the derivatives market, offering in-depth analysis and case studies.

Whether you’re an institutional investor, quantitative analyst, or professional trader, this guide will equip you with the knowledge to excel in advanced derivatives trading. Key concepts such as how derivatives work in quantitative trading and derivatives trading for hedge fund managers will be explored in detail, ensuring the content is highly relevant and actionable.

What Are Derivatives and Why Are They Important in Trading?

Understanding Derivatives

A derivative is a financial instrument whose value is derived from the value of an underlying asset, index, or rate. Common types of derivatives include futures contracts, options, swaps, and forwards. These instruments are often used for hedging, speculation, or arbitrage purposes.

- Futures contracts: Agreements to buy or sell an asset at a predetermined price at a future date.

- Options: Provide the right, but not the obligation, to buy or sell an asset at a specified price within a set period.

- Swaps: Agreements to exchange cash flows between two parties, often used for interest rate or currency risk management.

- Forwards: Customized contracts similar to futures but traded over-the-counter (OTC).

In modern markets, derivatives play a significant role by providing leverage, enabling diversification, and offering enhanced risk management capabilities.

| Category | Method/Tool | Description | Pros | Cons |

|---|---|---|---|---|

| Derivatives Types | Futures Contracts | Buy/sell asset at predetermined price in future | Leverage, hedging opportunities | Obligatory execution, market risk |

| Derivatives Types | Options | Right to buy/sell asset at set price | Flexibility, hedging | Premium cost, can expire worthless |

| Derivatives Types | Swaps | Exchange cash flows, manage risk | Manage interest/currency risk | Complexity, counterparty risk |

| Derivatives Types | Forwards | Customized OTC contracts | Tailored hedging | Less liquid, counterparty risk |

| Quantitative Models | Black-Scholes Model | Theoretical pricing of options | Standardized, widely used | Assumes constant volatility |

| Quantitative Models | Monte Carlo Simulation | Scenario-based derivative valuation | Flexible, handles complex instruments | Computationally intensive |

| Quantitative Models | Option Greeks | Measure sensitivity to price, volatility, time | Informed hedging and adjustments | Requires continuous monitoring |

| Advanced Strategies | Volatility Trading | Exploit implied vs historical volatility | Profits from large price swings | Risky if volatility stays low |

| Advanced Strategies | Arbitrage Opportunities | Exploit price differences in markets | Risk-free profit if executed correctly | Needs fast execution, data |

| Advanced Strategies | Credit Derivatives | Use CDS/CDOs to hedge credit risk | Protect against defaults | Complex instruments, counterparty risk |

| Risk Management | Hedging Strategies | Protective puts, covered calls | Minimize potential losses | Limits upside gains |

| Risk Management | Portfolio Diversification | Gain exposure without holding assets | Spread risk across markets | Indirect exposure, may not match asset |

| Risk Management | Value at Risk (VaR) | Estimate potential |

1. Quantitative Models for Derivatives Valuation

Quantitative methods are at the heart of advanced derivatives trading. These models allow traders to evaluate the fair value of derivatives, taking into account factors such as volatility, time decay, and the underlying asset’s behavior.

Black-Scholes Model

The Black-Scholes model is a cornerstone in options pricing. It calculates the theoretical price of options based on inputs like the underlying asset’s price, strike price, time to maturity, risk-free rate, and volatility.

- Limitations: Assumes constant volatility and no dividends.

- Improvement: More advanced models incorporate stochastic volatility (e.g., the Heston model), which accounts for volatility fluctuations.

Monte Carlo Simulation

Monte Carlo methods are used to model the potential outcomes of a derivative position based on a wide range of scenarios. These models generate random price paths for the underlying asset and calculate the payoff distributions for derivatives.

- Pros: Highly flexible, can handle complex instruments and market dynamics.

- Cons: Computationally intensive, requires high-quality data.

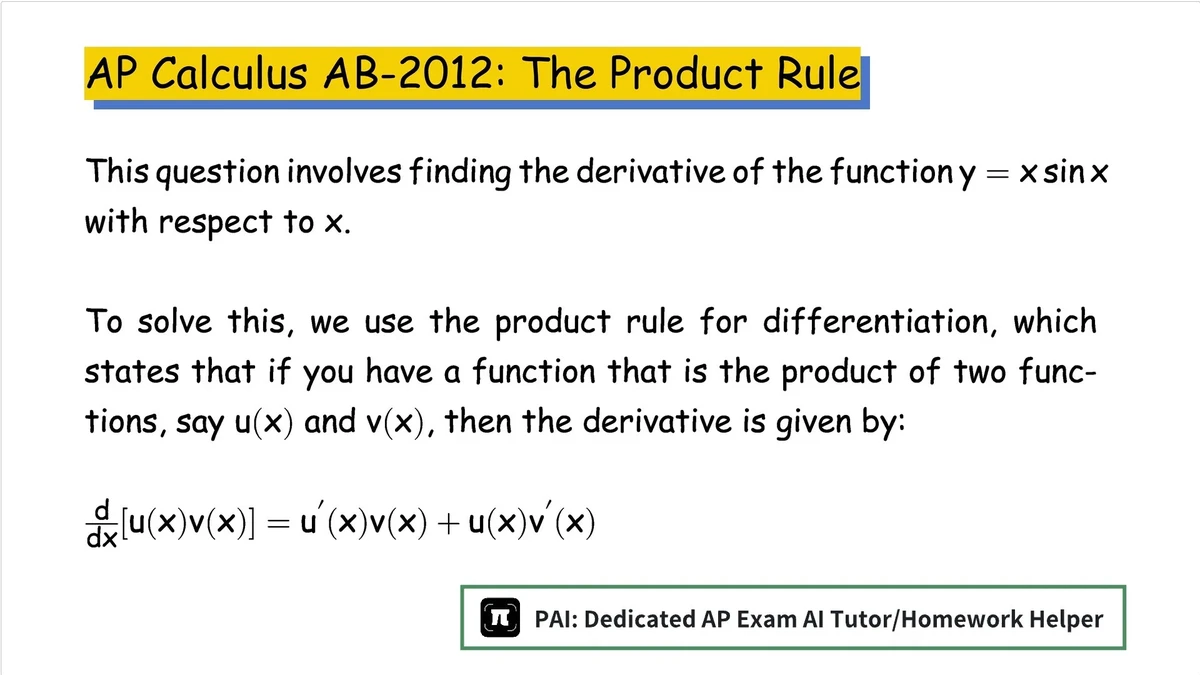

Option Greeks

Traders also rely on the Greeks—Delta, Gamma, Theta, Vega, and Rho—to understand how the value of options changes with respect to various factors like price movements, volatility, and time decay. Advanced traders use these Greeks to hedge, adjust positions, and make more informed decisions.

2. Advanced Derivatives Trading Strategies

Strategy 1: Volatility Trading Using Options

Traders can take advantage of implied volatility (IV) and historical volatility (HV) discrepancies to profit from changes in volatility. The volatility skew is a critical factor, as options on out-of-the-money strikes often have higher premiums due to higher implied volatility.

- Example: A professional trader might enter a straddle or strangle position if they anticipate a significant movement in an asset but are unsure of the direction. These strategies profit from large price swings but can be risky if volatility remains low.

Strategy 2: Arbitrage Opportunities in Futures and Options

Arbitrage trading involves taking advantage of price differences between correlated markets. In derivatives trading, this can include exploiting discrepancies between the spot price and the futures price, or between the price of an option and the underlying stock.

- Example: A cash-and-carry arbitrage strategy involves buying an asset in the spot market and simultaneously selling a futures contract, locking in a risk-free profit if the futures price is overpriced.

Strategy 3: Credit Derivatives for Risk Management

Credit default swaps (CDS) and collateralized debt obligations (CDOs) are used for managing credit risk. By trading these instruments, investors can hedge against the risk of default by a bond issuer or other debt obligations.

- Example: Hedge funds use CDS contracts to protect against the risk of corporate bond defaults, or to speculate on the creditworthiness of companies.

3. Advanced Risk Management Techniques in Derivatives

Managing risk in derivatives trading is complex, especially when leveraging these instruments for speculation. Advanced traders use various techniques to limit potential losses and protect their portfolios.

Hedging Strategies

One of the most common uses of derivatives is hedging. A professional trader may hedge against adverse price movements using options or futures contracts. Protective puts and covered calls are common strategies to minimize risk in long positions.

- Example: A hedge fund manager holding a large stock position might buy put options to protect against a decline in stock prices.

Portfolio Diversification with Derivatives

Traders and investors can use derivatives to diversify their portfolios without directly buying the underlying assets. For example, investors can use futures contracts to gain exposure to commodities like oil, gold, or agricultural products, without holding physical assets.

Value at Risk (VaR) Analysis

Value at Risk (VaR) is a common risk management technique used to estimate the potential loss in value of a portfolio or position over a given period for a specific confidence interval. This approach allows professionals to manage the downside risk and adjust positions accordingly.

Key Tools for Advanced Derivatives Trading

To stay competitive, traders must have access to sophisticated tools and platforms that allow them to implement advanced derivatives trading strategies effectively.

1. Derivatives Trading Software Solutions

Platforms like MetaTrader 5, ThinkOrSwim, and Interactive Brokers offer powerful tools for derivatives trading, including real-time data, backtesting capabilities, and advanced order types.

2. Quantitative Trading Systems

For those using algorithmic or quantitative approaches, systems like QuantConnect, TradeStation, and Amibroker offer a wide array of options for strategy development, backtesting, and live execution.

3. Data Providers and APIs

Having reliable data is crucial. Providers like Bloomberg, Reuters, and Quandl offer access to comprehensive market data and financial reports, while API platforms like Alpaca and Interactive Brokers allow algorithmic traders to directly interface with trading systems.

FAQs

1. How can I start trading derivatives as a professional?

To start trading derivatives professionally, you must first gain a solid understanding of financial markets, especially options, futures, and swaps. You should also familiarize yourself with quantitative analysis and algorithmic trading. Start with a well-established trading platform and consider using backtesting tools to refine your strategies.

2. What are the most effective risk management techniques for derivatives?

Effective risk management in derivatives includes using hedging strategies like protective puts or covered calls, implementing diversification across different asset classes, and regularly analyzing your portfolio using Value at Risk (VaR) metrics. Additionally, you should never risk more than a small percentage of your capital on any one position.

3. What’s the role of quantitative analysis in derivatives trading?

Quantitative analysis plays a pivotal role in derivatives trading by using mathematical models to predict market movements and evaluate the risk/reward of specific trades. This analysis helps traders create more sophisticated trading strategies, including statistical arbitrage, options pricing, and volatility forecasting.

Conclusion

Advanced derivatives trading techniques are an essential part of the modern trading landscape. Whether you’re a professional trader, hedge fund manager, or quantitative analyst, incorporating sophisticated models, advanced strategies, and cutting-edge tools will help you navigate the complex and ever-changing world of derivatives. By mastering these techniques and continuously adapting to market trends, you can enhance your trading edge and manage risk more effectively.

If you found this article useful, don’t hesitate to share it with your peers or on social media to spread the knowledge. Happy trading!

0 Comments

Leave a Comment