Python has become the de facto language for quantitative finance and trading. It is powerful, flexible, and accessible, making it the language of choice for quantitative professionals who want to implement advanced strategies, perform high-level data analysis, and optimize trading models. In this article, we will dive deep into advanced Python techniques for quant professionals, exploring the cutting-edge tools, libraries, and strategies used by experts in the field.

Why Python is Essential for Quantitative Finance

Python’s versatility and wide range of libraries make it an ideal choice for financial analysis and trading algorithms. It allows professionals to write clean, efficient, and scalable code, which is crucial when handling large financial datasets. Python also integrates seamlessly with other technologies, making it easy to connect with data sources, perform backtesting, and automate trading strategies.

In the world of quantitative finance, Python is used for everything from data analysis and backtesting to building machine learning models and risk management systems. Whether you’re an aspiring quant analyst, hedge fund manager, or a developer working with financial data, mastering advanced Python techniques can greatly enhance your trading strategies.

Key Libraries and Tools for Quantitative Finance

- Pandas: The Data Manipulation Powerhouse

Pandas is a key library for data manipulation in Python, especially for working with time series data, which is abundant in finance. It offers powerful data structures like DataFrames and Series, making it easy to manipulate, analyze, and visualize large datasets.

Key Uses in Quant Finance:

Data Preprocessing: Cleaning and reshaping raw data to make it suitable for analysis.

Financial Time Series: Handling date-based data efficiently, which is crucial for market analysis.

Aggregation: Grouping and aggregating data to extract key insights.

- NumPy and SciPy: The Mathematical Backbone

NumPy and SciPy provide essential support for high-performance numerical computing. NumPy allows you to handle large multi-dimensional arrays and matrices, while SciPy builds on NumPy and adds more advanced mathematical functions.

Key Uses in Quant Finance:

Numerical Calculations: From statistical analysis to complex mathematical functions.

Optimization: Optimizing trading strategies using advanced mathematical models.

Simulations: Running Monte Carlo simulations for risk analysis and model validation.

- Matplotlib and Seaborn: Visualizing Market Data

Visualization is key in quantitative finance to identify trends, correlations, and anomalies. Matplotlib and Seaborn are Python libraries used to create static, animated, and interactive plots to visualize financial data.

Key Uses in Quant Finance:

Data Visualization: Plotting time series, financial charts, and trend analysis.

Risk Assessment: Visualizing portfolios and risk metrics.

Correlation Analysis: Displaying relationships between different assets or risk factors.

Advanced Python Techniques for Quant Professionals

- Backtesting Trading Strategies with Python

Backtesting is a crucial process in algorithmic trading. It involves testing a trading strategy using historical data to assess its effectiveness. Python, combined with libraries like Backtrader or Zipline, allows quant professionals to backtest their strategies quickly and efficiently.

Steps for Backtesting with Python:

Data Acquisition: Download historical price data from APIs or financial data providers.

Strategy Definition: Implement a trading strategy using Python code (e.g., moving average crossovers, mean reversion).

Simulation: Run the backtest using historical data to simulate trading outcomes.

Performance Evaluation: Analyze the results using metrics such as Sharpe ratio, drawdowns, and annualized returns.

Backtesting with Python is powerful because it allows professionals to evaluate multiple strategies quickly, tweak parameters, and assess the impact of slippage and transaction costs.

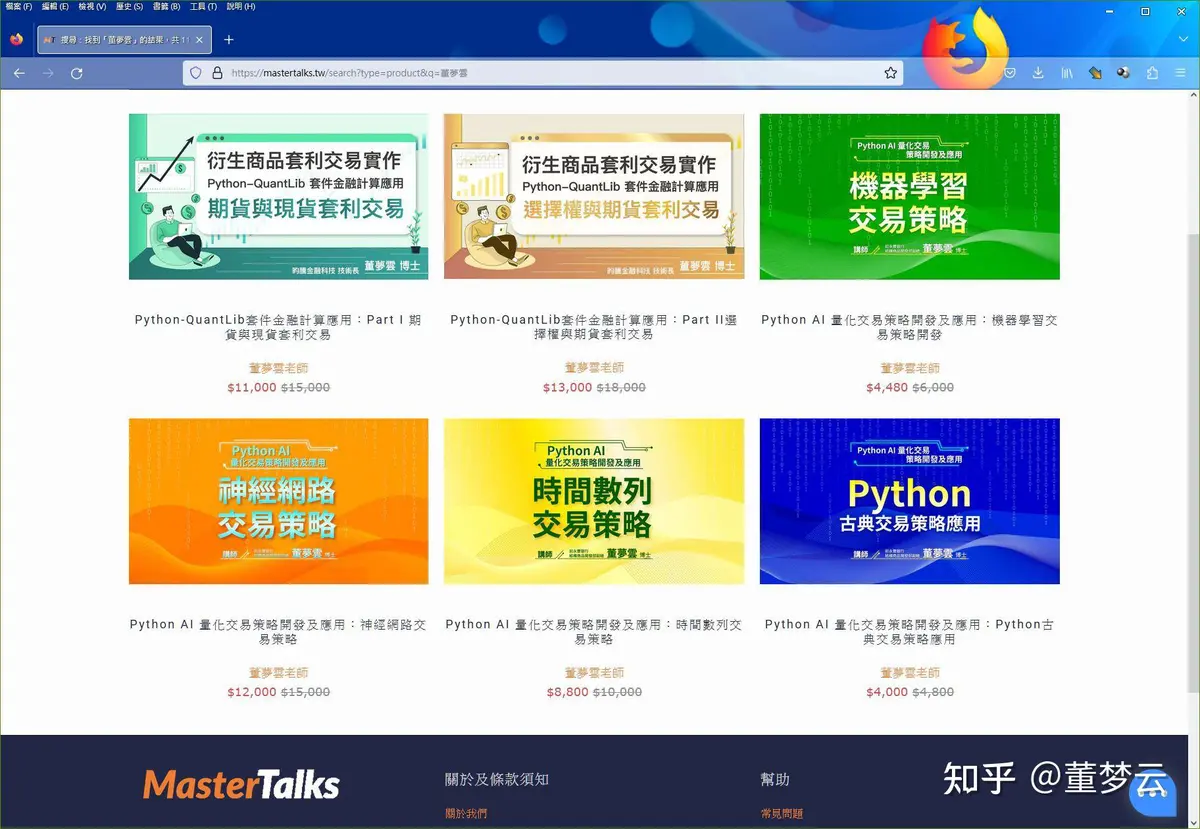

- Automating Crypto Trading with Python

The cryptocurrency market is highly volatile and operates 24⁄7, making manual trading inefficient. Automating crypto trading using Python allows quant professionals to take advantage of price movements in real-time without the need for constant monitoring.

Key Libraries for Crypto Trading Automation:

CCXT: A popular library for interacting with cryptocurrency exchange APIs, enabling easy execution of trades.

TA-Lib: A library for technical analysis that can be used to generate trading signals.

Cryptoquant: A Python library for on-chain data analysis, helping traders base decisions on more than just price and volume.

- Machine Learning for Predictive Trading Models

Machine learning (ML) techniques such as supervised learning, unsupervised learning, and reinforcement learning have revolutionized quantitative finance. Python provides an extensive range of ML libraries, including scikit-learn, TensorFlow, and PyTorch, that allow quants to build and deploy predictive models for trading.

Steps for Building ML Models in Quant Finance:

Data Preprocessing: Clean and prepare historical market data for training.

Feature Engineering: Create relevant features that can predict price movements (e.g., moving averages, volatility).

Model Training: Train models using various algorithms such as regression, decision trees, and neural networks.

Model Evaluation: Validate models using metrics such as accuracy, precision, recall, and F1-score.

- Risk Management in Quant Trading

Risk management is essential for successful trading, especially in volatile markets like crypto. Python can be used to build risk management tools that automatically adjust position sizes, stop-loss limits, and take-profit levels.

Risk Management Strategies Using Python:

Value-at-Risk (VaR): Quantifying the potential loss of a portfolio over a given time horizon.

Monte Carlo Simulations: Simulating various market scenarios to assess portfolio risks under different conditions.

Position Sizing: Adjusting the amount of capital allocated to each trade based on volatility and risk.

FAQ: Expert Insights on Python for Quantitative Finance

- How do I start using Python for quantitative trading?

To start using Python for quantitative trading, you should first learn the basics of Python programming and familiarize yourself with libraries such as Pandas, NumPy, and Matplotlib. Next, dive into specialized libraries like Backtrader for backtesting and CCXT for crypto trading. Online tutorials, courses, and communities like Reddit’s quant trading forums are excellent resources for learning Python in a quantitative finance context.

- How can Python help improve trading strategies?

Python enables traders to test and optimize their strategies through backtesting, machine learning, and simulation. By analyzing large datasets, Python helps traders identify patterns and optimize parameters for their models. Python also makes it easy to automate trading, reducing the impact of human error and increasing trading efficiency.

- What are some popular Python libraries for quantitative trading?

Some popular Python libraries for quantitative trading include:

Pandas for data manipulation.

NumPy and SciPy for numerical computations.

Backtrader for backtesting strategies.

CCXT for connecting to cryptocurrency exchanges.

TA-Lib for technical analysis.

Matplotlib and Seaborn for data visualization.

scikit-learn for machine learning applications.

Conclusion: Mastering Advanced Python for Quantitative Finance

Mastering advanced Python for quantitative finance is not just about writing code—it’s about understanding how to apply Python’s powerful libraries and techniques to real-world financial problems. Whether you are optimizing trading strategies, automating crypto trading, or building machine learning models, Python provides the flexibility and efficiency required for success in quantitative finance.

As the financial markets continue to evolve, so too will the tools and techniques used to navigate them. By staying up-to-date with the latest Python libraries and strategies, you can gain a competitive edge in the world of quantitative finance.

| Category | Details |

|---|---|

| Why Python is Essential | Python’s versatility, range of libraries, and ease of use make it ideal for financial analysis and trading. |

| Key Libraries for Quant Finance | Pandas (data manipulation), NumPy and SciPy (numerical computing), Matplotlib/Seaborn (visualization). |

| Backtesting Trading Strategies | Python libraries like Backtrader or Zipline allow for efficient testing of trading strategies using historical data. |

| Automating Crypto Trading | Libraries: CCXT (exchange APIs), TA-Lib (technical analysis), Cryptoquant (on-chain data analysis). |

| Machine Learning for Trading | ML libraries like scikit-learn, TensorFlow, PyTorch used to build and deploy predictive trading models. |

| Risk Management Techniques | Use Python for VaR, Monte Carlo simulations, and position sizing to manage trading risks. |

| Data Preprocessing with Pandas | Clean and reshape data for analysis, handle financial time series, and aggregate key insights. |

| Numerical Computing with NumPy | Essential for handling multi-dimensional arrays, optimization, and simulations in quantitative finance. |

| Visualization with Matplotlib/Seaborn | Plot time series, trend analysis, risk metrics, and correlations in financial data. |

| Machine Learning Model Building | Steps: Data preprocessing, feature engineering, model training (regression, neural networks), evaluation. |

| Position Sizing | Adjust capital allocation per trade based on volatility and risk factors, using Python for automation. |

| Popular Python Libraries | Pandas, NumPy, SciPy, Backtrader, CCXT, TA-Lib, Matplotlib, Seaborn, scikit-learn. |

| Python for Strategy Optimization | Python helps test, optimize, and automate strategies, identifying patterns and improving model efficiency. |

0 Comments

Leave a Comment