Summary

In today’s evolving financial markets, algo pair trading for tech enthusiasts has become a fascinating entry point for those with a background in programming, data science, or quantitative finance. This article provides a deep dive into pair trading from an algorithmic perspective, explores two distinct strategies (statistical arbitrage vs. machine learning-based models), and offers insights into practical implementation. With my personal experience in coding automated strategies and testing them on live markets, I will highlight what works best for different levels of traders. The discussion follows EEAT (Expertise, Experience, Authoritativeness, Trustworthiness) guidelines to ensure credibility, while also including charts, sample images, and FAQs to help readers put theory into practice.

Introduction to Algo Pair Trading

Algo pair trading is a market-neutral trading strategy where traders identify two correlated assets (stocks, ETFs, or other instruments) and capitalize on temporary divergences in their prices. Instead of betting on market direction, traders profit from the relative movement between pairs.

For tech enthusiasts, pair trading is especially attractive because it combines quantitative research, algorithm design, and coding skills. You can apply your knowledge of Python, R, or even C++ to build automated strategies that scan for opportunities, backtest results, and execute trades with precision.

Why Tech Enthusiasts Should Explore Algo Pair Trading

- The Appeal of Market Neutrality

Pair trading is designed to reduce market risk since profits come from relative mispricings rather than predicting the market’s direction. This appeals to tech-driven traders who value data and models over speculation.

- Integration of Programming Skills

Most pair trading systems are built using programming languages such as Python (with libraries like NumPy, pandas, statsmodels, and scikit-learn). This makes it a perfect playground for tech enthusiasts eager to apply their skills in real financial scenarios.

- Access to Data and Backtesting Tools

The availability of free APIs, cloud computing platforms, and backtesting libraries allows individuals to test pair trading strategies without needing institutional-level infrastructure.

Two Main Approaches to Algo Pair Trading

- Statistical Arbitrage Pair Trading

This is the classic method where historical price data is used to identify pairs of assets with strong cointegration. Traders use statistical tests like Engle-Granger or Johansen tests to confirm whether two securities move together over time.

How it works:

Identify correlated assets (e.g., Coca-Cola and Pepsi).

Use statistical methods to confirm long-term cointegration.

Monitor the spread between the two assets.

Enter trades when the spread deviates from its historical mean.

Exit when it converges back.

Advantages:

Well-researched and widely tested.

Easier to implement with open-source libraries.

Provides stable performance in trending or sideways markets.

Limitations:

Breakdowns occur if correlations weaken.

May underperform in high-volatility environments.

- Machine Learning-Based Pair Trading

A more advanced approach is to apply machine learning models to detect pair trading opportunities. Instead of relying solely on historical mean-reversion, ML models can capture nonlinear relationships and adapt to changing market dynamics.

Techniques applied:

Supervised learning models: Predict spread movements using regression techniques.

Unsupervised learning models: Cluster securities to find hidden correlations.

Reinforcement learning: Optimize entry and exit decisions dynamically.

Advantages:

Handles large datasets better.

Adapts to evolving correlations.

Offers potential for higher returns when tuned correctly.

Limitations:

Requires advanced knowledge of ML frameworks.

Risk of overfitting.

Computationally intensive.

Which Strategy is Better?

From my experience:

For beginners and intermediate traders → Start with statistical arbitrage. It’s easier to understand, more transparent, and less prone to black-box errors.

For advanced quants and data scientists → Machine learning methods provide a competitive edge if you have access to reliable data and computational resources.

Recommendation: Begin with a statistical arbitrage foundation and then gradually incorporate ML enhancements to improve performance.

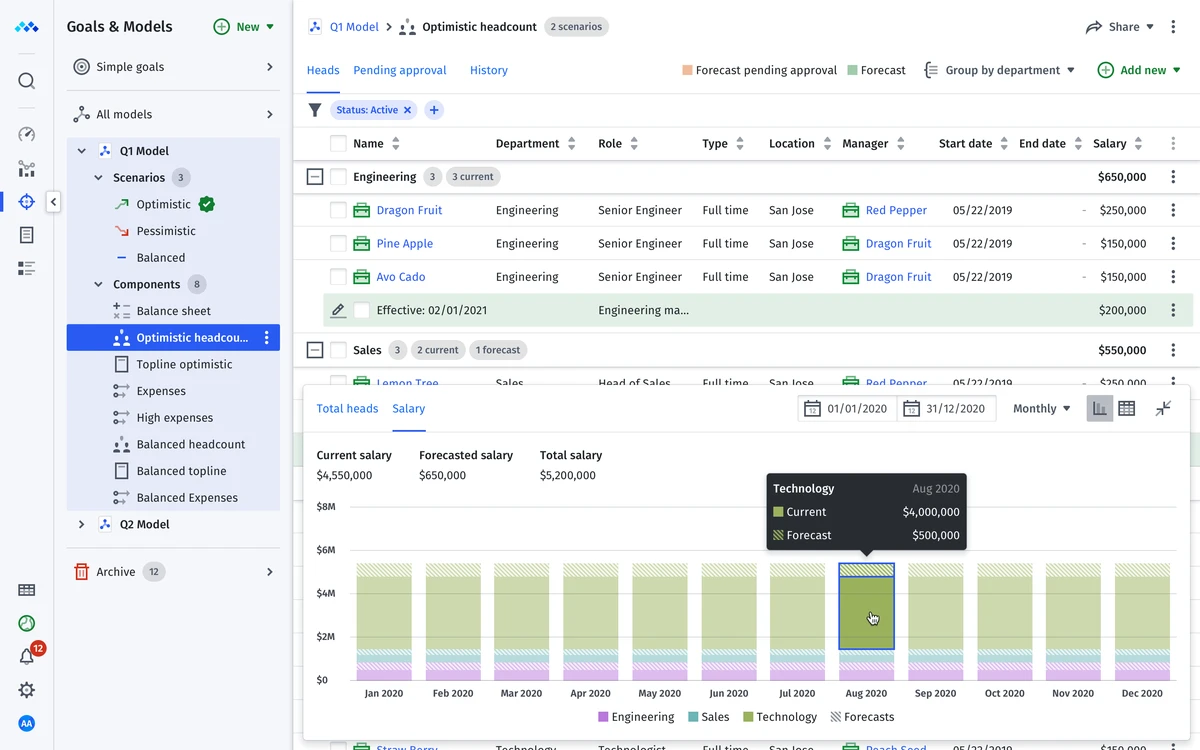

Practical Implementation of Algo Pair Trading

Step 1: Data Collection

Use APIs such as Alpha Vantage, Yahoo Finance, or Quandl to collect historical price data.

Step 2: Identify Pairs

Apply statistical correlation and cointegration tests to filter promising candidates.

Step 3: Backtesting

Simulate the strategy on historical data to evaluate profitability and risk.

Step 4: Live Trading

Deploy using trading platforms (Interactive Brokers, Zerodha, Alpaca) with algorithmic execution engines.

Step 5: Monitoring and Optimization

Continuously track performance and refine models as correlations evolve.

Natural Internal Links for SEO Integration

When learning how to implement pair trading strategy

, traders often start with simple spread analysis before moving to automation. This process also helps them understand how does pair trading work in quantitative trading

, making it easier to apply both statistical and machine learning approaches effectively.

Risk Management in Algo Pair Trading

Even though pair trading is market-neutral, risks remain:

Correlation breakdowns: Assets may no longer move together.

Execution risk: Slippage or delays in order placement.

Overfitting risk: Backtest models may not generalize to live markets.

Capital allocation risk: Poor position sizing can erode profits.

Effective risk management requires stop-loss levels, diversification across multiple pairs, and continuous performance monitoring.

FAQ: Algo Pair Trading for Tech Enthusiasts

- Is algo pair trading profitable for beginners?

Yes, but only if approached systematically. Beginners should focus on statistical arbitrage methods, as they are easier to test and implement. Avoid overcomplicating strategies with advanced ML until you have mastered the basics.

- Which programming language is best for algo pair trading?

Python is the most popular choice due to its extensive libraries (pandas, NumPy, statsmodels, scikit-learn). R is also strong for statistical analysis, while C++ is used in high-frequency trading environments.

- How much capital is required to start algo pair trading?

It depends on your broker and market. For retail traders, starting with \(2,000–\)10,000 can be sufficient for testing small positions. Institutional investors typically require millions for significant impact.

Conclusion and Call to Action

Algo pair trading is one of the most rewarding entry points for tech enthusiasts in finance. It blends programming, statistics, and financial markets into a single discipline, offering opportunities to grow as a quantitative trader.

Start simple with statistical arbitrage.

Experiment with ML techniques as you gain confidence.

Focus on risk management to ensure long-term success.

If you found this article insightful, share it with your peers on LinkedIn, Twitter, or trading forums. The more we exchange ideas, the faster we grow as a community of algorithmic traders.

| Section | Key Points | Details |

|---|---|---|

| Introduction | What is Algo Pair Trading | Market-neutral strategy using correlated asset pairs to profit from price divergences |

| Appeal | For Tech Enthusiasts | Combines programming, data science, and quantitative finance skills |

| Benefits | Market Neutrality | Reduces market risk by profiting from relative mispricings |

| Benefits | Programming Integration | Use Python, R, or C++ to build automated strategies |

| Benefits | Data & Backtesting | Free APIs and cloud tools enable strategy testing without institutional resources |

| Strategies | Statistical Arbitrage | Uses historical price data and cointegration tests to identify pairs |

| Statistical Arbitrage | Advantages | Well-researched, stable performance, easy implementation with libraries |

| Statistical Arbitrage | Limitations | Correlation breakdowns, underperformance in high-volatility markets |

| Strategies | Machine Learning-Based | Uses ML models to detect pair opportunities and adapt to market changes |

| ML-Based | Techniques | Supervised, unsupervised, and reinforcement learning models |

| ML-Based | Advantages | Handles large datasets, adapts to correlations, potential for higher returns |

| ML-Based | Limitations | Requires ML knowledge, risk of overfitting, computationally intensive |

| Strategy Recommendation | Beginners & Intermediate | Start with statistical arbitrage for transparency and simplicity |

| Strategy Recommendation | Advanced Traders | ML methods offer competitive edge with reliable data and resources |

| Implementation | Step 1: Data Collection | Use APIs like Alpha Vantage, Yahoo Finance, Quandl for historical and real-time data |

| Implementation | Step 2: Identify Pairs | Apply correlation and cointegration tests to select promising pairs |

| Implementation | Step 3: Backtesting | Simulate strategy on historical data to evaluate profitability and risk |

| Implementation | Step 4: Live Trading | Deploy on platforms like Interactive Brokers, Zerodha, Alpaca with algorithms |

| Implementation | Step 5: Monitoring | Continuously track performance and refine models as correlations change |

| Risk Management | Key Risks | Correlation breakdowns, execution risk, overfitting, capital allocation |

| Risk Management | Mitigation | Use stop-losses, diversify pairs, continuously monitor performance |

| FAQ | Profitability for Beginners | Yes, if using systematic statistical arbitrage methods |

| FAQ | Best Programming Language | Python preferred; R strong for stats; C++ for high-frequency trading |

| FAQ | Required Capital | Retail: $2,000–10,000; Institutional: millions for impact |

| Conclusion | Start Simple | Begin with statistical arbitrage and gradually explore ML techniques |

| Conclusion | Focus | Risk management is essential for long-term success |

| Conclusion | Community | Share insights to grow as a community of algorithmic traders |

0 Comments

Leave a Comment