=================================================

Order flow analysis has become one of the most critical tools for traders and quants seeking to gain a deeper understanding of market dynamics. By interpreting buy and sell orders, trade volumes, and liquidity imbalances, traders can identify hidden signals that traditional price charts often miss. In this article, we will provide a comprehensive guide on how to analyze order flow in quantitative trading, explain multiple strategies, highlight their strengths and weaknesses, and recommend best practices.

Understanding Order Flow in Quantitative Trading

What Is Order Flow?

Order flow refers to the real-time stream of buy and sell orders placed in the market. Unlike lagging indicators, it provides traders with direct insight into supply and demand, showing how aggressive buyers and sellers move prices. For quants, order flow is more than just market depth—it’s raw data for building predictive models and algorithms.

Why Is Order Flow Crucial?

- Market Transparency: It reveals the intentions of participants before price movements are fully reflected.

- Liquidity Analysis: Helps traders identify where major liquidity pools are located, often serving as support and resistance zones.

- Algorithmic Advantage: Quantitative models using order flow data can capture microstructure patterns that traditional chart-based strategies ignore.

This is why many professionals argue that understanding why order flow is important in trading strategies is a cornerstone of successful algorithmic and discretionary trading alike.

Key Components of Order Flow Analysis

1. Limit Order Book (LOB)

The LOB shows active buy and sell orders at different price levels. By analyzing bid-ask spreads, depth of market (DOM), and liquidity concentration, traders can predict potential price movements.

2. Time and Sales Data (Tape Reading)

This includes real-time executed trades with price, size, and time stamps. High-frequency strategies rely heavily on these tick-by-tick data streams.

3. Volume Imbalance

By comparing buy and sell pressure, traders can anticipate whether an order imbalance will trigger a breakout, continuation, or reversal.

4. Order Flow Indicators

Specialized tools—like Footprint charts, Cumulative Delta, and Volume Profile—visualize hidden buying/selling pressure. Traders who want to go deeper often explore how to use order flow indicators effectively to refine their entries and exits.

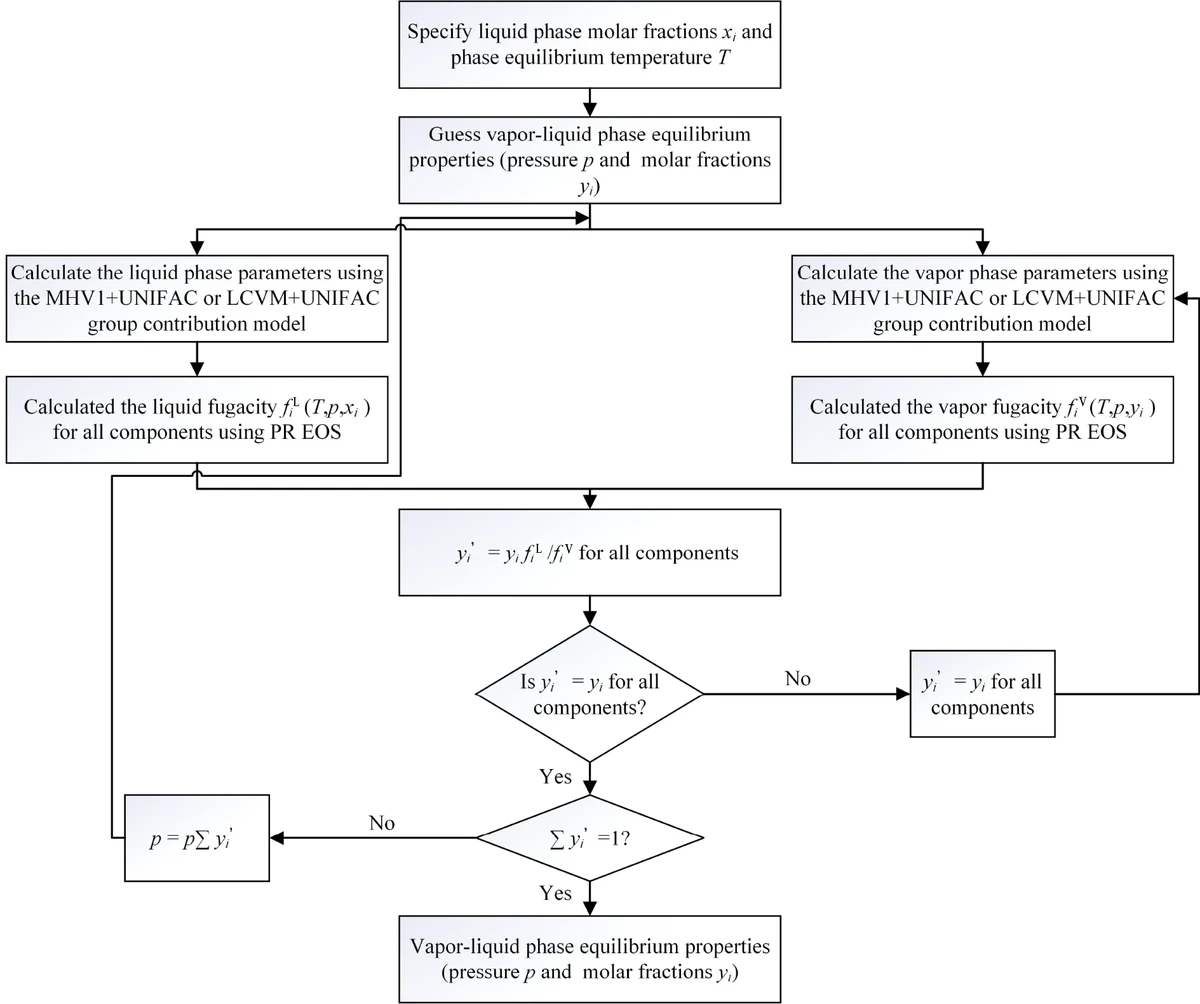

Methods to Analyze Order Flow in Quantitative Trading

Method 1: Volume Delta Analysis

Definition: This method measures the difference between aggressive buyers (market orders lifting the ask) and aggressive sellers (market orders hitting the bid).

How It Works:

- A positive delta suggests stronger buying activity.

- A negative delta suggests stronger selling activity.

Pros:

- Simple yet powerful for trend confirmation.

- Helps identify “fake” moves caused by thin liquidity.

Cons:

- May provide false signals in low-volume conditions.

- Requires high-quality tick data.

Method 2: Order Book Dynamics

Definition: An advanced approach that evaluates liquidity distribution and how it changes over time.

How It Works:

- Track limit order placement, cancellations, and modifications.

- Measure liquidity shifts that indicate institutional order activity.

Pros:

- Offers predictive insight before trades are executed.

- Useful for high-frequency and market-making strategies.

Cons:

- Data-intensive, requiring advanced infrastructure.

- Can be overwhelming for beginners.

Comparison and Recommendation

- Volume Delta Analysis is ideal for swing traders and beginners building their first models, as it provides intuitive buy/sell pressure signals.

- Order Book Dynamics suits professional quants and algorithmic traders who require precise insights into microstructure.

Recommendation: Beginners should start with delta-based models, then gradually integrate order book analytics as they gain confidence and access to better infrastructure.

Practical Tools for Order Flow Analysis

Popular Platforms

- Bookmap: Known for visual heatmaps of liquidity.

- Sierra Chart: Advanced order flow indicators.

- NinjaTrader: Widely used for futures order flow trading.

Data Sources

When learning where can I find order flow data for trading, it’s essential to choose reputable providers like CME (for futures), Binance (for crypto), or Refinitiv (for equities and forex).

Case Study: Applying Order Flow in Quantitative Trading

Scenario: Crypto Futures Arbitrage

A quantitative trading desk monitors Bitcoin perpetual futures order flow. By analyzing delta shifts and sudden liquidity withdrawals from the order book, they detect large players absorbing sell pressure before a breakout.

Result: Entering long before the surge yielded a 1.8% return within 30 minutes, outperforming a simple moving average strategy.

Key Takeaway: Order flow reveals real-time supply and demand shifts that static indicators miss.

Step-by-Step Approach to Order Flow Trading

- Collect High-Quality Data (tick-by-tick order book and trades).

- Visualize Liquidity using footprint charts or heatmaps.

- Identify Imbalances between aggressive buyers and sellers.

- Backtest Models with order flow indicators.

- Integrate Risk Management to handle slippage and false signals.

Images for Better Understanding

Order book heatmap showing liquidity concentration

Footprint chart with cumulative delta

Common Mistakes in Order Flow Analysis

- Overfitting Data: Building models too specific to historical patterns.

- Ignoring Liquidity Voids: Thin order books can exaggerate signals.

- Neglecting Macro Events: Order flow can shift dramatically during major news events.

FAQ: How to Analyze Order Flow in Quantitative Trading

1. What is the most reliable order flow indicator?

Cumulative Delta is one of the most trusted indicators because it aggregates buyer and seller aggression. However, professional traders often combine it with Volume Profile to confirm institutional interest.

2. Can beginners use order flow trading effectively?

Yes, but they should start simple. Focus on basic footprint charts and delta analysis before moving to complex order book dynamics. Beginners can also explore order flow analysis for beginner traders to avoid information overload.

3. How does order flow impact market trends?

Order flow shows real-time demand and supply imbalances. Large buy orders at key price levels can create support, while sudden sell-side absorption often triggers trend reversals. This is why understanding how does order flow impact market trends is essential for building robust quantitative models.

Conclusion

Analyzing order flow in quantitative trading offers traders a powerful edge by uncovering hidden market dynamics. From volume delta analysis to order book dynamics, traders can leverage different methods depending on their experience level and infrastructure. By combining tools like footprint charts, liquidity heatmaps, and algorithmic strategies, traders can anticipate price moves more accurately than traditional indicators allow.

If you found this guide useful, share it with fellow traders, comment your experiences, and let’s build a stronger trading community together!

Would you like me to extend this article with more visual case studies (e.g., futures vs crypto order flow) so that it feels even more practical and research-driven?

0 Comments

Leave a Comment