=================================================

Quantitative trading thrives on data granularity. Among the most valuable data types for quants is tick data, which captures every single trade, quote, and market event at the microsecond level. But to harness the power of such raw, high-frequency information, one needs robust methods to clean, process, and analyze it effectively. This article will provide a comprehensive, SEO-optimized guide on how to analyze tick data for quantitative trading, covering practical strategies, expert insights, industry best practices, and common pitfalls to avoid.

Understanding Tick Data in Quantitative Trading

Tick data is the most detailed financial dataset available. Unlike minute or daily data, tick data includes every price change, bid/ask quote, and transaction timestamped to the millisecond or microsecond. For quantitative researchers and traders, it opens the door to microstructure modeling, liquidity analysis, high-frequency strategy development, and slippage estimation.

Key Features of Tick Data

- Ultra-granular timestamps (down to nanoseconds in some markets).

- Bid/ask spreads and market depth snapshots.

- Trade volumes linked to each transaction.

- Order book changes that help track supply and demand shifts.

Tick data’s richness enables strategies like market making, statistical arbitrage, and order-flow prediction. However, its complexity requires specialized tools and methods.

Why Tick Data Differs from Minute Data

Many beginners ask why tick data is necessary when minute-level or daily data already exists. The difference lies in the trading signal fidelity. A one-minute candlestick compresses dozens, sometimes hundreds, of ticks, losing critical details like spread widening before news releases or hidden liquidity signals.

For instance:

- Minute data shows only open, high, low, and close.

- Tick data reveals how the price reached that close, including which side (buyer/seller) was more aggressive.

This micro-level information can drastically change how strategies perform in real-world executions.

Methods to Analyze Tick Data for Quantitative Trading

Analyzing tick data requires data engineering, statistical modeling, and domain expertise. Below are two major approaches widely used by professionals.

Method 1: Statistical and Event-Driven Tick Data Analysis

This method focuses on extracting descriptive statistics, patterns, and market reactions to events.

Steps

Data Cleaning

Tick data often contains errors, outliers, and duplicates. Cleaning involves:- Removing zero or negative prices.

- Filtering irregular volumes.

- Synchronizing timestamps.

- Removing zero or negative prices.

Order Flow Analysis

Examining the balance between aggressive buyers and sellers. This can help forecast short-term price pressure.Microstructure Metrics

- Spread analysis: Monitoring bid-ask spread variations.

- Volatility clustering: Identifying periods of heightened trading activity.

- Trade imbalance: Measuring net buying vs. selling volume.

- Spread analysis: Monitoring bid-ask spread variations.

Pros

- Straightforward implementation with Python or R.

- Useful for risk management and liquidity modeling.

Cons

- Limited predictive power in highly efficient markets.

- May miss complex nonlinear relationships.

Method 2: Machine Learning and Algorithmic Tick Data Analysis

With tick data’s scale and complexity, machine learning (ML) techniques have become increasingly popular.

Steps

Feature Engineering

Transform raw ticks into features like rolling volatility, order book depth imbalance, or short-term momentum indicators.

Model Selection

- Supervised learning: Logistic regression, random forests, gradient boosting for price movement prediction.

- Unsupervised learning: Clustering to identify market regimes or anomalies.

- Deep learning: LSTMs and Transformers for sequential data patterns.

- Supervised learning: Logistic regression, random forests, gradient boosting for price movement prediction.

Backtesting

Testing predictions against historical tick data ensures that models generalize well and are not overfitted.

Pros

- Captures complex patterns beyond linear statistics.

- Enables automation of real-time trading strategies.

Cons

- Requires massive computational resources.

- Risk of overfitting if not carefully validated.

Combining Both Approaches

In practice, the best results often come from a hybrid approach:

- Use statistical models to understand market microstructure and reduce noise.

- Apply machine learning models to capture nonlinear dynamics and improve predictive accuracy.

This combination balances interpretability and predictive power, making strategies more robust.

Where to Find Reliable Tick Data Sources

A crucial part of tick data analysis is data acquisition. Free sources exist but often lack depth or quality. Professional quants rely on:

- Exchange-provided feeds (e.g., NASDAQ TotalView, CME tick-level futures data).

- Professional tick data providers for enterprises, offering cleaned and normalized datasets.

- Affordable tick data options for startups, which are ideal for small teams and independent traders.

Choosing a reliable provider ensures accurate and consistent backtests, which directly affect strategy profitability.

Step-by-Step Guide to Tick Data Analysis

To bring theory into practice, here’s a streamlined workflow for quants:

- Collect Data – Obtain raw tick data from a trusted source.

- Clean Data – Deduplicate, validate timestamps, normalize quotes.

- Store Efficiently – Use columnar databases (e.g., Parquet, HDF5) for speed.

- Analyze – Apply statistical or ML techniques depending on strategy goals.

- Visualize – Plot order flow, spreads, or predictive signals for clarity.

- Backtest – Ensure results are statistically significant.

- Deploy – Integrate into trading systems with proper risk controls.

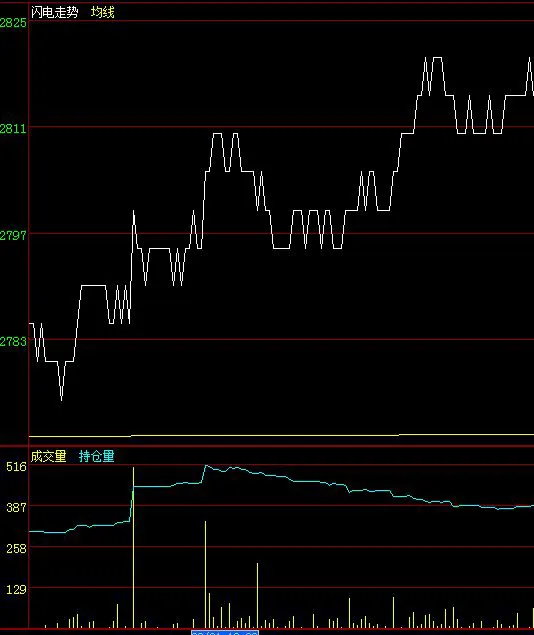

Visualization of Tick Data Trends

Data visualization is critical for pattern recognition. For example:

Bid-ask spread analysis over time provides insights into liquidity and trading costs.

Challenges in Tick Data Analysis

- Data Size: A single day of tick data for liquid assets can exceed several GBs.

- Latency: Real-time processing requires optimized code and low-latency infrastructure.

- Costs: Enterprise tick feeds can be expensive.

- Overfitting Risks: Especially when using ML on noisy tick data.

Best Practices for Analyzing Tick Data

- Always start small with one instrument before scaling.

- Use resampling techniques to aggregate ticks into volume bars or time windows when needed.

- Ensure robust out-of-sample testing to avoid data snooping.

- Combine domain expertise with quantitative methods for better decision-making.

FAQs on Tick Data Analysis

1. How much historical tick data do I need for backtesting?

It depends on your strategy. High-frequency trading models may require months of tick-level data, while event-driven strategies can be validated with shorter datasets. Generally, the more data, the better, as it reduces overfitting.

2. What platforms support tick data integration?

Platforms like QuantConnect, AlgoTrader, and MetaTrader 5 offer direct tick data integration. For advanced users, Python libraries such as pandas, Dask, and Vaex are widely used.

3. How can I clean and process tick data efficiently?

Efficient cleaning involves:

- Converting raw data into columnar storage formats.

- Removing duplicates and correcting out-of-order timestamps.

- Normalizing prices and volumes across exchanges.

Following a comprehensive tick data processing tutorial helps ensure accuracy.

Conclusion: The Future of Tick Data Analysis

Learning how to analyze tick data for quantitative trading is essential for quants seeking a competitive edge. Whether you use statistical microstructure models or machine learning algorithms, success depends on data quality, computational efficiency, and rigorous backtesting.

Tick data will continue to shape the future of algorithmic trading as markets become faster and more competitive. By combining solid statistical foundations with modern AI techniques, traders can unlock deeper insights and stronger predictive signals.

💡 If you found this guide useful, share it with your peers, leave a comment with your tick data experiences, and join the discussion. Your insights can inspire other quants in their journey!

Would you like me to also create ready-to-use Python code snippets (e.g., tick data cleaning, order flow imbalance calculation, visualization) so your readers can directly implement the methods from this article?

0 Comments

Leave a Comment