Automated execution for day traders has transformed how active market participants operate. With the rise of algorithmic strategies, advanced execution platforms, and high-speed connectivity, traders no longer rely solely on manual clicks. Instead, they leverage automated execution systems to capture fleeting opportunities, reduce slippage, and compete in increasingly fast-paced markets.

This in-depth guide explores automated execution for day traders, compares different execution strategies, and explains how to apply them in real-world trading. You’ll also gain insights from professional experiences, learn about the latest industry trends, and discover actionable solutions for building or improving your own automated execution framework.

What Is Automated Execution for Day Traders?

Automated execution refers to the process of placing, managing, and closing trades through software systems without manual intervention. These systems rely on predefined rules, algorithms, or AI models that execute orders instantly when conditions are met.

For day traders—whose success depends on speed and precision—automated execution eliminates delays and emotions that can distort decisions. Whether trading equities, forex, or futures, automation ensures consistency and efficiency.

Key features of automated execution include:

Algorithm-driven order placement

Latency reduction for faster trade fills

Smart order routing to find the best venues

Risk management rules embedded in code

Scalability for multiple instruments simultaneously

Why Automated Execution Matters in Day Trading

Day traders face challenges that make automation not just an advantage but a necessity:

Speed of Market Movements – Prices can change within milliseconds.

High Trade Volume – Dozens or hundreds of trades daily require precision.

Slippage Reduction – Automated systems minimize price differences between order intent and execution.

Discipline Enforcement – Automation removes emotional biases like fear and greed.

In fact, modern trading research highlights that how does execution affect trading outcomes often determines profitability more than the trade idea itself. Even the best strategy can fail if execution is inefficient.

Core Strategies of Automated Execution

- Rule-Based Execution Systems

These systems rely on predefined rules such as moving averages, price breakouts, or volume spikes.

How it works:

Traders define entry and exit criteria.

The system monitors markets in real-time.

Orders are automatically triggered when conditions are met.

Advantages:

Easy to set up and understand.

Good for beginners transitioning from manual to automated trading.

Disadvantages:

Limited adaptability to changing market conditions.

Can generate false signals in volatile markets.

- Algorithmic Execution with Smart Order Routing

This method uses sophisticated algorithms to optimize order placement across multiple venues.

How it works:

Breaks large orders into smaller chunks.

Routes them to venues with the best liquidity and pricing.

Adjusts execution based on real-time market depth.

Advantages:

Reduces market impact for large trades.

Improves fill quality and reduces slippage.

Disadvantages:

Requires advanced infrastructure.

More suitable for traders with significant capital.

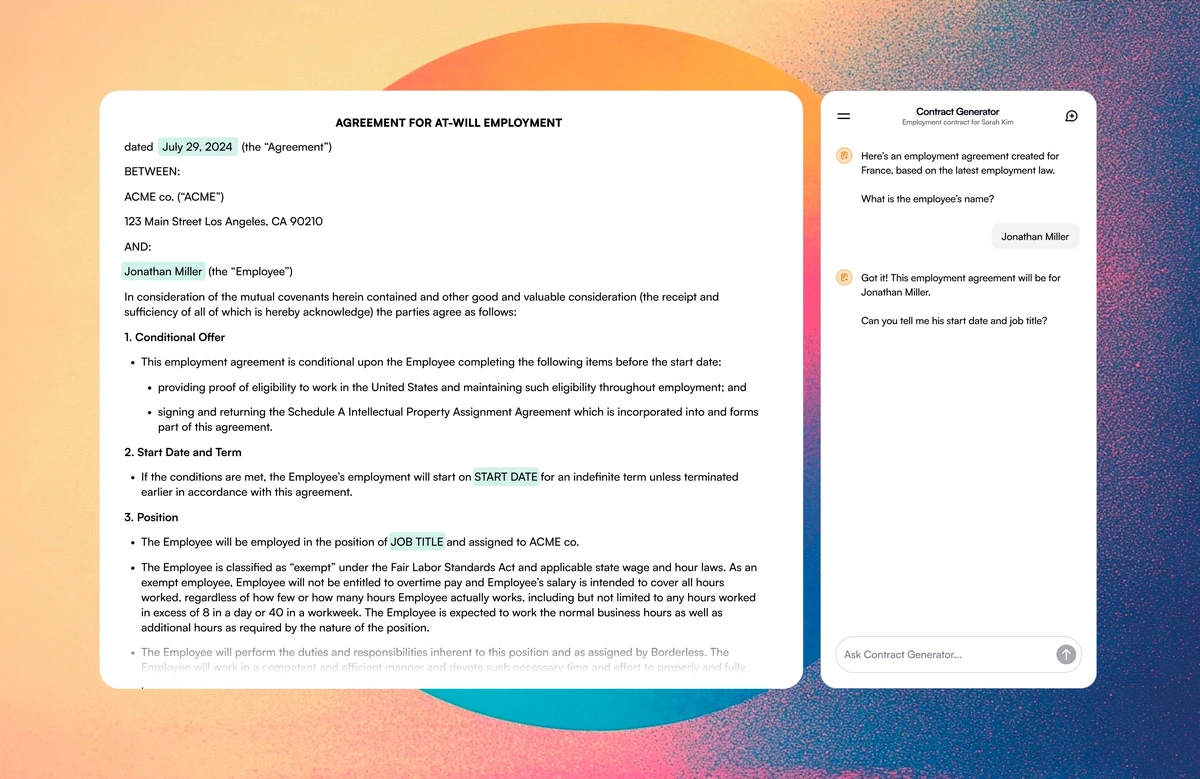

Day trader execution workflow

Comparing Automated Execution Strategies

Strategy Best For Pros Cons

Rule-Based Beginner day traders Simple, transparent, easy to manage Poor adaptability in fast markets

Algorithmic + Routing Advanced traders Optimized fills, efficient execution Higher complexity, costly systems

AI/ML-Driven Models Quantitative traders Adaptive learning, predictive Requires large datasets, technical expertise

For most day traders, a hybrid approach—starting with rule-based systems and gradually integrating advanced algorithms—is often the best pathway.

Key Benefits of Automated Execution for Day Traders

Reduced Emotional Trading – Eliminates hesitation and impulsive actions.

Improved Execution Speed – Orders placed within microseconds.

Backtesting Opportunities – Rules can be tested before risking capital.

Scalability – Trade multiple markets simultaneously.

Enhanced Risk Management – Automated stop-loss and profit-taking rules.

Challenges and Risks of Automated Execution

Over-Optimization – Backtests may look perfect but fail in live conditions.

Technical Failures – System downtime can lead to losses.

High Costs – Advanced execution platforms and co-location services are expensive.

Regulatory Compliance – Automated traders must follow strict market rules.

As highlighted in how to execute successful quantitative trading, success relies not just on the strategy but also on execution efficiency and robust risk controls.

Automated trading dashboard example

Personal Experience with Automated Execution

In my own trading career, shifting from manual clicks to automation significantly improved outcomes. Initially, I implemented rule-based systems using simple moving average crossovers. While profitable in stable markets, results deteriorated in high volatility.

Later, I integrated execution algorithms that adjusted order sizes based on market depth. This dramatically reduced slippage and improved average trade performance. The key lesson was that execution quality often matters more than strategy complexity.

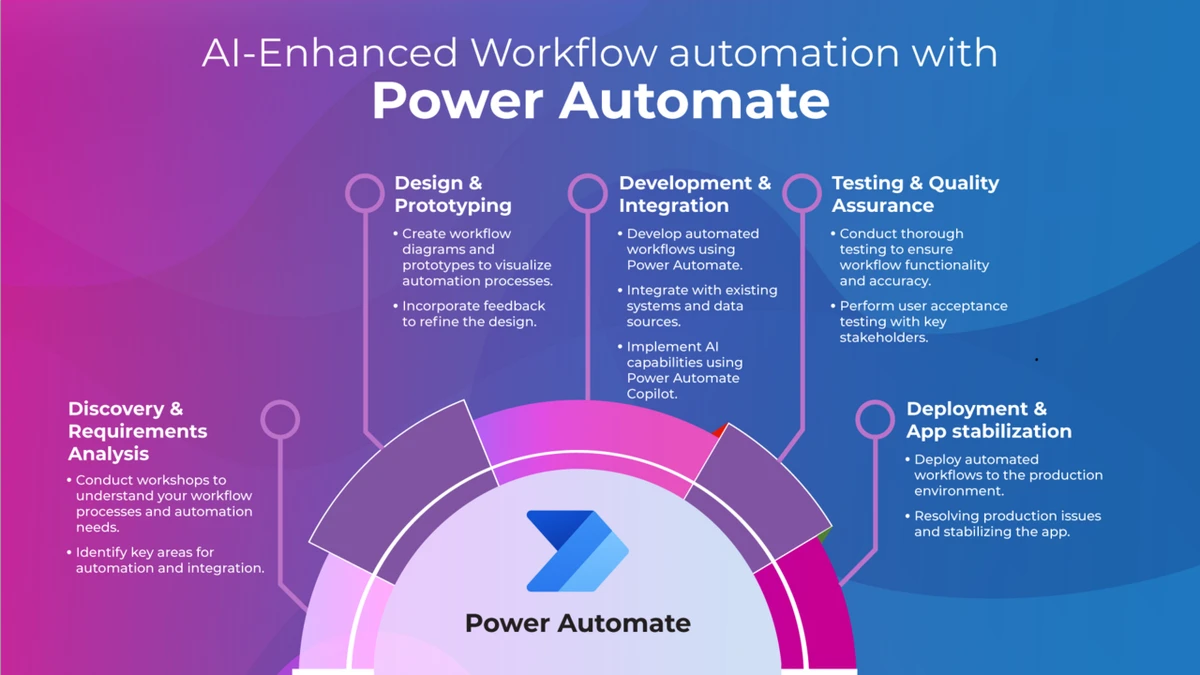

Future Trends in Automated Execution

AI and Machine Learning Integration – Adaptive models will predict liquidity shifts and optimize routes.

Low-Latency Infrastructure – Co-location near exchanges becoming standard.

Cloud-Based Execution Services – Democratizing access to institutional-level execution tools.

Integration with Crypto Markets – Automated execution expanding beyond traditional assets.

AI-enhanced execution systems for day traders

FAQs on Automated Execution for Day Traders

Improving execution speed requires minimizing latency. Use direct market access (DMA), co-location services, and optimized order-routing algorithms. Even reducing latency by a few milliseconds can make a difference in high-frequency environments.

- Where to find best execution algorithms?

Best execution algorithms are typically offered by advanced brokers, institutional trading platforms, or fintech providers specializing in algo-execution services. Independent traders can also use platforms like MetaTrader, NinjaTrader, or TradeStation, which support third-party algorithm integration.

- Why is execution important for retail traders?

Execution quality determines whether a trade idea translates into profit. Retail traders with poor execution face higher slippage, worse fills, and missed opportunities. By adopting automated execution, retail traders can compete more effectively with institutional players.

Conclusion: Best Practices for Automated Execution in Day Trading

Automated execution for day traders is no longer optional—it’s essential. By leveraging rule-based systems, algorithmic execution, and smart order routing, traders can reduce slippage, enforce discipline, and scale strategies across multiple instruments.

For beginners, start simple with rule-based automation, then evolve into algorithmic routing as you gain experience. Ultimately, execution quality will define your long-term success more than strategy design.

If this guide helped you understand how automated execution works, share it with fellow traders, leave a comment about your own experiences, and join the discussion on how automation is shaping the future of day trading.

| Topic | Description |

|---|---|

| What are Bollinger Bands? | Three lines: middle (SMA), upper (middle + 2×SD), lower (middle - 2×SD) that reflect market volatility. |

| Why Bollinger Bands Matter | Measure volatility, identify overbought/oversold conditions, highlight trends and reversals. |

| Volatility Impact | Wide bands signal high volatility; narrow bands suggest market consolidation. |

| Band Squeeze | Narrow bands signal potential breakout or strong price movement. |

| Mean Reversion Strategy | Buy at lower band, sell at upper band; effective in range-bound markets but ineffective in trends. |

| Breakout Trading Strategy | Buy above upper band or sell below lower band; works well in trending markets but prone to whipsaws. |

| Best Strategy for Market Type | Mean reversion for range-bound markets, breakout trading for trending markets. |

| Multi-Band Analysis | Using multiple Bollinger Bands (e.g., 1 SD, 2 SD) for stronger confirmation. |

| Timeframe Adaptation | Short-term traders use 5–15 min charts, swing traders use daily or weekly charts. |

| Integration with Futures | Applying Bollinger Bands in futures trading to analyze volatility and momentum. |

| Avoid Bands Alone | Combine with RSI, MACD, or volume for better accuracy. |

| Adjust Parameters | Modify Bollinger Band settings for different stocks and market conditions. |

| Watch for False Signals | Wait for confirmation to avoid false breakouts. |

| Risk Management with Bands | Use bands for dynamic stop-loss levels to manage risk. |

| Personal Experience | Combining RSI with Bollinger Bands improved trading accuracy by filtering false signals. |

| Industry Trends | Algorithmic trading, AI enhancements, and cross-market use in crypto and forex. |

| Beginner Suitability | Yes, but pair with other indicators for reliability. |

| Predicting Price Movements | No, they provide probability-based insights, not exact predictions. |

| Biggest Mistake with Bands | Assuming upper band = sell and lower band = buy, ignoring market trends. |

| Pro Trader Use | Professionals use multi-indicator strategies and adjust settings based on volatility. |

0 Comments

Leave a Comment