Automated trading systems using machine learning have become one of the most disruptive innovations in modern finance. These systems leverage powerful algorithms and predictive models to make decisions in real time, minimizing human bias while exploiting opportunities at lightning speed. In this comprehensive article, we will dive deep into the foundations, methods, strategies, challenges, and future of automated trading with machine learning. Drawing on personal experience, industry case studies, and the latest research, this guide provides everything traders, quants, and financial engineers need to know.

Understanding Automated Trading Systems

Automated trading systems (ATS) are computer programs that automatically generate, execute, and manage trading orders based on predefined rules or models. Traditionally, these systems relied on static technical indicators or rule-based strategies. However, with the rise of machine learning (ML), ATS have evolved into adaptive, intelligent frameworks that can learn from vast amounts of financial data and improve performance over time.

Key Benefits of Automated Trading with Machine Learning

Speed and Efficiency – Execute trades in milliseconds, far faster than manual decision-making.

Adaptability – Algorithms can adjust to changing market dynamics through retraining.

Reduced Human Bias – Emotional trading is eliminated, ensuring decisions rely on data.

Scalability – Machine learning allows monitoring of hundreds of assets simultaneously.

Predictive Accuracy – Sophisticated models like neural networks can capture nonlinear market behavior.

Core Machine Learning Approaches in Automated Trading

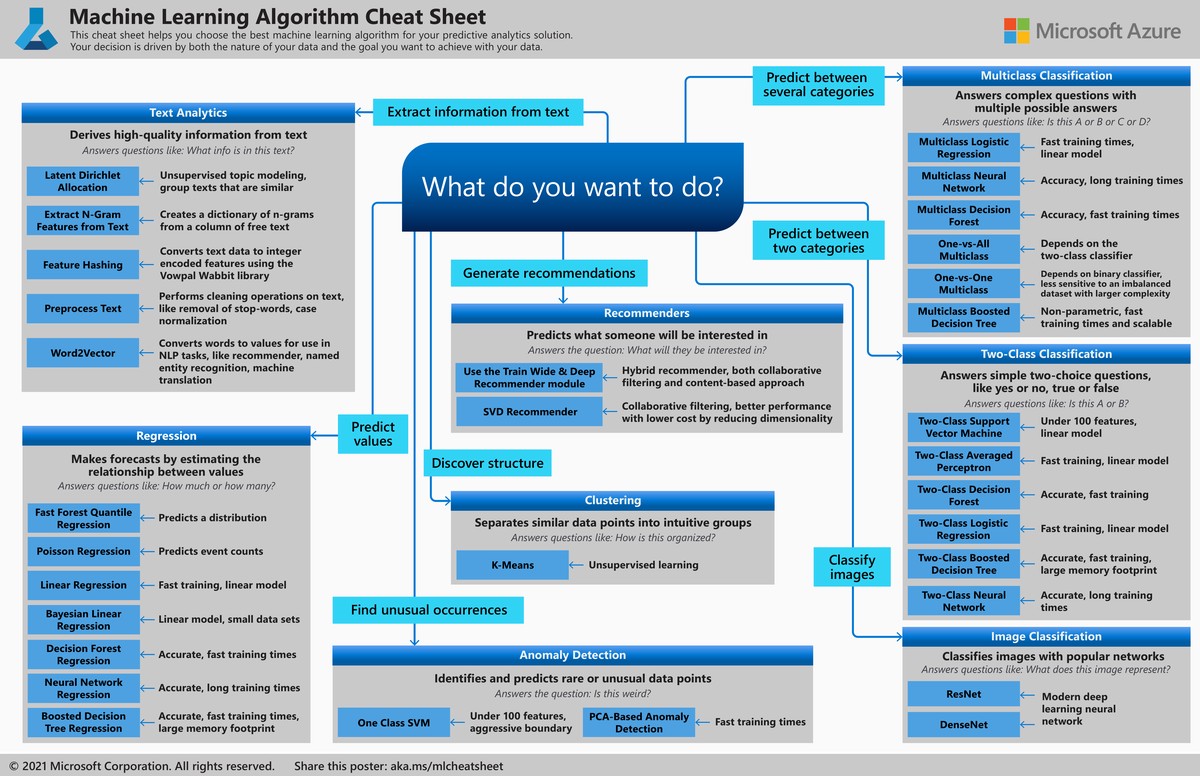

Machine learning introduces a wide range of techniques that can be integrated into trading systems. Here, we will explore two dominant methods—supervised learning and reinforcement learning—and assess their pros and cons.

Supervised Learning for Trading

Supervised learning uses labeled historical data to predict future outcomes, such as stock prices or volatility.

Common Models: Linear regression, support vector machines, random forests, gradient boosting, and deep neural networks.

Applications: Predicting price direction, identifying entry/exit signals, and classifying profitable vs. non-profitable trades.

Strengths:

Works well with large amounts of historical data.

Transparent evaluation with metrics such as accuracy or precision.

Weaknesses:

Requires high-quality labeled data.

Models may overfit to past conditions and fail in volatile markets.

Reinforcement Learning for Trading

Reinforcement learning (RL) treats trading as a sequential decision-making problem. The algorithm learns an optimal trading policy by interacting with the market environment.

Common Models: Deep Q-Networks (DQN), policy gradient methods, and actor-critic frameworks.

Applications: Portfolio optimization, dynamic position sizing, and long-term risk management.

Strengths:

Learns directly from actions and outcomes, without needing labeled data.

Adapts to complex environments with evolving patterns.

Weaknesses:

Computationally intensive.

Requires careful tuning of reward functions to avoid unintended behavior.

Comparison: Which is Better?

Supervised learning is practical for traders starting out with automated systems, offering predictability and ease of deployment. Reinforcement learning, however, excels in dynamic, real-world trading environments where adaptability is crucial. In practice, hybrid systems combining both approaches are emerging as the most powerful solutions.

Real-World Applications and Case Studies

Predictive Price Modeling

Using supervised learning, models can predict short-term price changes with reasonable accuracy. For example, gradient boosting algorithms applied to tick-level data have shown strong predictive performance for forex markets.

Risk Management with Reinforcement Learning

Reinforcement learning has been applied to optimize risk-adjusted returns by dynamically rebalancing portfolios. Large hedge funds experiment with RL-based systems that manage capital allocation across asset classes in response to volatility.

Machine learning workflow for automated trading systems

Industry Trends in Automated Trading

The financial industry is experiencing a rapid transformation due to AI and ML technologies. Key trends include:

Deep Reinforcement Learning in Hedge Funds: Increasing adoption for long-term strategy optimization.

Explainable AI (XAI): Regulatory demands are pushing for transparency in machine learning-driven trading.

Integration with Alternative Data: Social media sentiment, satellite imagery, and ESG data are becoming critical inputs.

Cloud and Edge Computing: Faster model deployment and real-time trading decisions.

For those interested in going deeper, check our guide on How does machine learning improve quantitative trading, which explores how these systems directly impact performance and efficiency.

Practical Strategies for Building Automated Trading Systems

Strategy 1: Technical Indicator Enhancement with ML

Traders often start by enhancing classical technical indicators (e.g., moving averages, RSI) with supervised machine learning. ML models can filter false signals, improving win rates significantly.

Strategy 2: Portfolio Optimization with Reinforcement Learning

Instead of predicting exact prices, RL agents focus on allocation decisions that maximize long-term portfolio growth. This method is more resilient to noise and market shocks.

Strategy 3: Hybrid Modeling

Combining supervised models for signal generation with reinforcement learning for trade execution is emerging as the industry standard. This hybrid structure leverages the strengths of both worlds.

Supervised vs. reinforcement learning strategies in trading systems

Challenges and Limitations

Overfitting Risk – Models that perform well in backtesting may fail in live trading.

Data Quality Issues – Biased, incomplete, or low-frequency data reduces effectiveness.

High Infrastructure Costs – Advanced models require strong computing power and low-latency connections.

Regulatory Concerns – AI-based trading must comply with transparency and auditability standards.

Ethical Risks – Overreliance on AI can destabilize markets during crises.

How to Get Started with Automated Trading Using Machine Learning

For beginners, the best approach is to start small:

Use supervised models on liquid instruments.

Experiment with open-source libraries like TensorFlow or PyTorch.

Deploy models in simulated environments before going live.

Advanced quants and hedge fund professionals can explore Machine learning strategies for hedge fund managers, which covers institutional-level deployments.

Frequently Asked Questions (FAQ)

- Can machine learning completely replace human traders?

Not entirely. While machine learning provides speed, efficiency, and adaptability, human oversight is still essential for strategic decision-making, ethical considerations, and risk control. The best systems are human-AI hybrids.

- What kind of data is best for automated trading systems using machine learning?

High-frequency market data, order book depth, news sentiment, and alternative data sources (such as satellite imagery and economic reports) are highly valuable. However, the choice of data depends on the strategy—short-term trading favors high-frequency data, while long-term portfolio optimization benefits from macroeconomic and sentiment data.

- How do I avoid overfitting when training trading models?

Key techniques include cross-validation, regularization, dropout (for neural networks), and stress-testing models across multiple market regimes. Always validate on out-of-sample data before deployment.

Example of trading signals generated by machine learning models

Conclusion: The Future of Automated Trading Systems with Machine Learning

Automated trading systems using machine learning are transforming financial markets, offering traders and institutions unparalleled speed, predictive power, and adaptability. From supervised learning strategies to reinforcement learning frameworks, these systems provide a spectrum of solutions tailored to different market conditions.

Yet success depends on more than algorithms: quality data, risk management, and human oversight remain crucial. The future points to hybrid systems combining human intuition with AI-driven precision.

If you found this article insightful, share it with fellow traders and professionals. Leave your thoughts in the comments below—what machine learning technique do you believe will dominate trading in the next decade?

| Section | Key Points |

|---|---|

| Introduction | ML-driven automated trading systems execute fast, unbiased trades |

| Definition of ATS | Programs that generate, execute, and manage trades automatically |

| Benefits | Speed, adaptability, reduced human bias, scalability, predictive accuracy |

| Supervised Learning | Uses historical labeled data to predict prices and signals |

| Supervised Learning Models | Linear regression, SVM, random forests, gradient boosting, neural nets |

| Supervised Learning Strengths | Works well with large historical data; transparent metrics |

| Supervised Learning Weaknesses | Requires high-quality data; may overfit to past conditions |

| Reinforcement Learning | Learns trading policies through interaction with market environment |

| Reinforcement Learning Models | DQN, policy gradient, actor-critic frameworks |

| Reinforcement Learning Applications | Portfolio optimization, position sizing, long-term risk management |

| RL Strengths | Learns from actions, adapts to evolving patterns, no labeled data needed |

| RL Weaknesses | Computationally intensive; careful reward tuning required |

| Supervised vs RL | Supervised: predictable, easier; RL: adaptive, better in dynamic markets |

| Hybrid Approach | Combines supervised for signals and RL for execution |

| Real-World Applications | Predictive price modeling, RL for dynamic risk-adjusted portfolios |

| Industry Trends | Deep RL adoption, Explainable AI, alternative data, cloud/edge computing |

| Practical Strategy 1 | Enhance technical indicators with ML to filter false signals |

| Practical Strategy 2 | RL for portfolio allocation, resilient to noise and shocks |

| Practical Strategy 3 | Hybrid modeling for signal generation and trade execution |

| Challenges | Overfitting, data quality issues, high infrastructure costs, regulatory/ethical risks |

| Getting Started | Start small, use supervised models, simulate before live deployment |

| FAQ: Human Replacement | ML cannot fully replace humans; hybrid systems are best |

| FAQ: Data Types | High-frequency, order book, sentiment, alternative data depending on strategy |

| FAQ: Avoid Overfitting | Cross-validation, regularization, dropout, stress-testing, out-of-sample validation |

| Conclusion | ML systems offer speed and adaptability; success needs data quality and human oversight |

0 Comments

Leave a Comment