Introduction

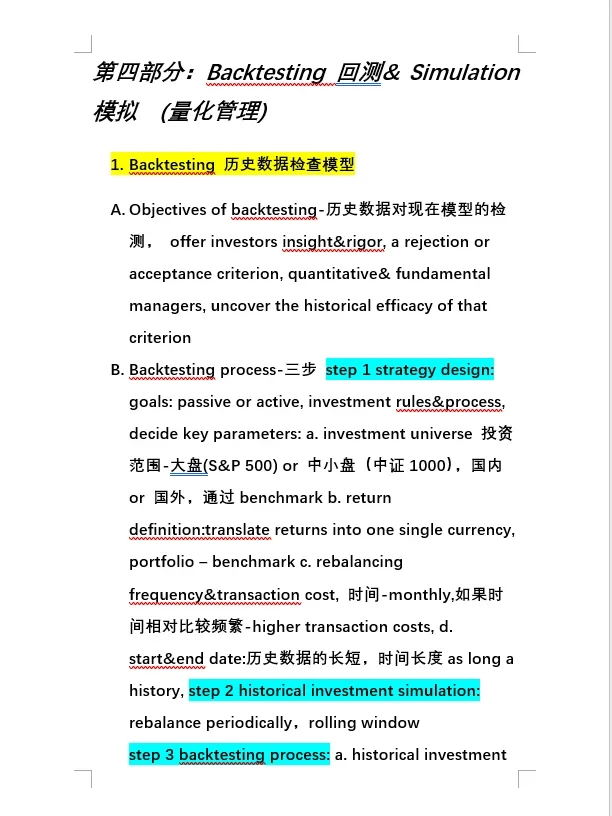

In algorithmic trading, backtesting methods for algorithms developers play a central role in evaluating whether a trading strategy is viable before deploying it in live markets. Backtesting allows developers to simulate performance against historical data, identify weaknesses, and optimize strategy parameters.

This article provides a complete guide to backtesting techniques with real-world applications. We will explore multiple methods, compare their strengths and weaknesses, and highlight industry-standard tools. Developers will also learn how to improve accuracy, avoid common pitfalls, and ensure their strategies meet professional standards.

By the end of this article, you will:

Understand at least two distinct backtesting methods (event-driven vs. walk-forward analysis).

Be able to evaluate pros and cons of each method.

Discover how to perform backtesting in quantitative trading effectively.

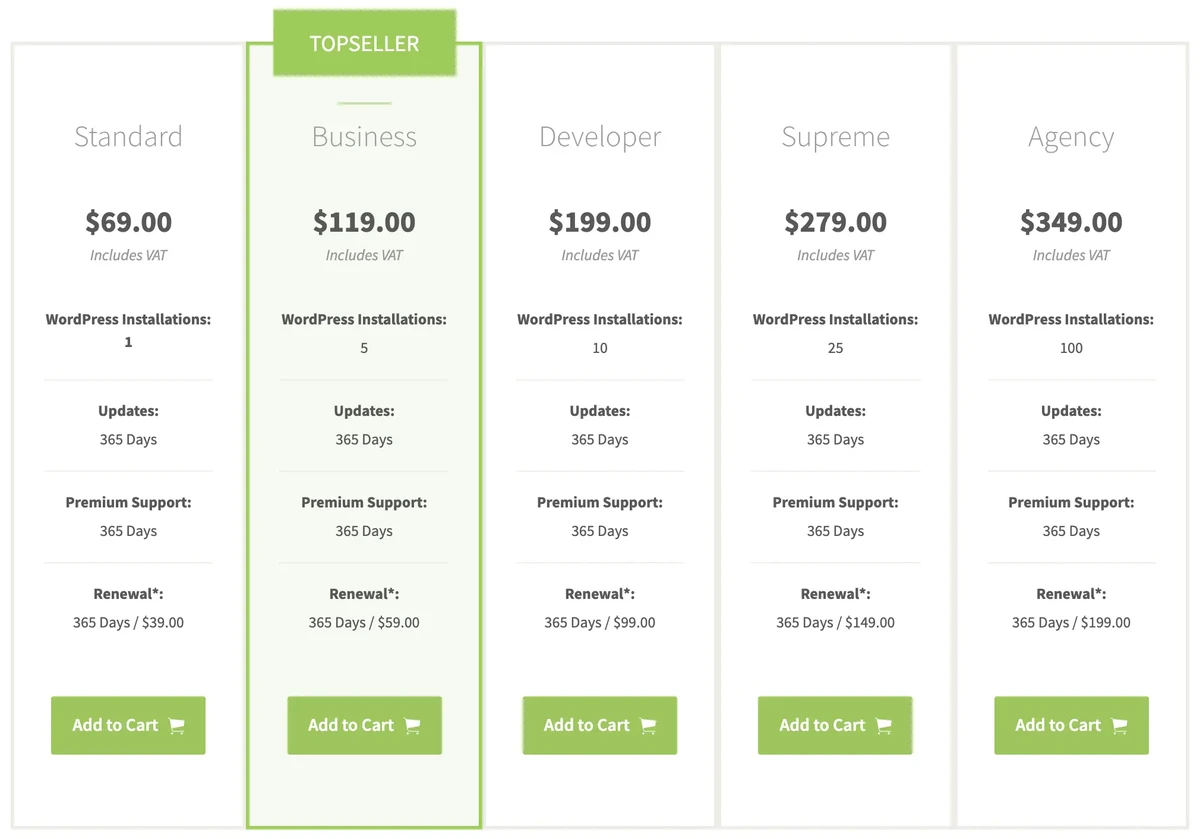

Learn where to find backtesting software and tools for implementation.

Gain practical insights to avoid errors that cause misleading results.

Table of Contents

Why Backtesting Matters in Algorithm Development

Core Principles of Backtesting

Method A: Event-Driven Backtesting

Method B: Walk-Forward Analysis

Comparison of Methods

Data Quality and Its Impact

Common Backtesting Pitfalls

Case Study: Backtesting a Trend-Following Strategy

Checklist for Successful Backtesting

FAQ

Conclusion and Call to Action

Why Backtesting Matters in Algorithm Development

Backtesting provides a controlled environment to test strategies using past market data. Developers can estimate potential performance metrics such as:

Annualized returns

Sharpe ratio (risk-adjusted returns)

Maximum drawdown

Win-loss ratios

Without backtesting, developers risk deploying unproven strategies, potentially leading to significant financial losses. This explains why backtesting is important in finance and why it’s considered a mandatory step in professional algorithm design.

Core Principles of Backtesting

Historical Data

Accurate, high-resolution historical data (tick-level or minute-level) is critical. Gaps or errors can distort outcomes.

Strategy Logic

Rules must be clearly defined and free from hindsight bias. Example: “Buy when the 50-day moving average crosses above the 200-day moving average.”

Performance Metrics

Backtesting is not only about profit but also risk exposure, consistency, and robustness.

Method A: Event-Driven Backtesting

Definition

Event-driven backtesting simulates trades based on realistic order execution triggered by market events, such as price movements, signals, or news releases.

Advantages

Closely mimics live trading environments.

Allows testing of latency, slippage, and transaction costs.

Suitable for high-frequency trading strategies.

Disadvantages

Computationally expensive.

Requires detailed tick-level data.

More complex to implement.

Method B: Walk-Forward Analysis

Definition

Walk-forward analysis divides historical data into training (in-sample) and testing (out-of-sample) periods. The strategy is optimized on training data and validated on unseen testing data.

Advantages

Reduces overfitting by exposing the strategy to new data.

Reflects real-world adaptation where models are recalibrated periodically.

Useful for medium- and long-term strategies.

Disadvantages

More time-consuming than simple backtests.

Performance depends on the chosen data-split method.

Requires robust optimization algorithms.

Comparison of Methods

Criteria Event-Driven Backtesting Walk-Forward Analysis

Best For High-frequency strategies Medium/long-term models

Data Needs Tick/minute data Daily/hourly data

Realism Very high Moderate

Overfitting Risk Moderate Low

Complexity High Medium

Recommendation:

Use event-driven backtesting for latency-sensitive strategies.

Use walk-forward analysis for predictive or machine learning-based models.

In practice, many professional developers combine both.

Data Quality and Its Impact

The quality of historical data often determines the reliability of backtests. For example, using daily OHLCV data may overlook intraday volatility, leading to unrealistic risk metrics.

Best practices:

Source from reputable data providers (e.g., Bloomberg, Quandl).

Adjust for corporate actions (splits, dividends).

Clean data to remove outliers.

Clean and accurate data ensures reliable backtesting results

Common Backtesting Pitfalls

Lookahead Bias

Occurs when strategies use information not available at the time of trading.

Survivorship Bias

Excluding delisted stocks inflates performance results.

Overfitting

Excessive parameter tuning leads to unrealistic backtest success.

Ignoring Slippage and Fees

Unrealistic assumptions about costs make strategies seem profitable when they aren’t.

Developers can improve outcomes by learning how to backtest a trading strategy with strict controls against these biases.

Case Study: Backtesting a Trend-Following Strategy

Strategy: Buy when the 50-day moving average crosses above the 200-day moving average; sell when it crosses below.

Data: S&P 500 daily prices from 2000–2023.

Results:

Annualized Return: 7.2%

Maximum Drawdown: -25%

Sharpe Ratio: 1.1

Outperformed buy-and-hold during bear markets.

This example demonstrates how developers can test classic strategies before applying more complex quant models.

Performance comparison of moving average strategy vs. buy-and-hold

Checklist for Successful Backtesting

Use high-quality, cleaned historical data.

Define clear entry and exit rules.

Incorporate transaction fees and slippage.

Test across multiple market regimes.

Perform out-of-sample validation.

Analyze robustness with sensitivity testing.

For newcomers, resources like where to start backtesting for beginners offer step-by-step tutorials and beginner-friendly tools.

FAQ

- What is the best backtesting method for beginners?

For beginners, walk-forward analysis is easier to understand and implement. It provides a good balance between realism and simplicity while teaching the importance of out-of-sample validation. Beginners can start with platforms like TradingView or Python-based libraries such as Backtrader.

- Why do some backtests fail in live trading?

Backtests may fail due to overfitting, poor data quality, or ignoring slippage/fees. In live trading, unexpected conditions (liquidity gaps, flash crashes) expose weaknesses not captured in historical simulations. This explains why backtesting fails for many retail traders.

- How can I improve backtesting accuracy?

Improving accuracy requires:

Using tick-level or high-frequency data for short-term strategies.

Applying robust optimization to avoid overfitting.

Incorporating realistic assumptions about order execution, including latency and fees.

Advanced traders can also explore backtesting automation tools to increase efficiency.

Conclusion and Call to Action

Backtesting is a cornerstone of algorithmic strategy development. By mastering both event-driven simulation and walk-forward analysis, developers can create robust, profitable strategies.

The key is to balance realism with computational efficiency, avoid common pitfalls, and continuously refine methodologies.

👉 What do you think is more reliable for crypto markets: event-driven backtesting with tick data, or walk-forward analysis with daily data? Share your insights in the comments and join the discussion!

| Category | Details |

|---|---|

| Importance of Backtesting | Evaluates strategy viability, simulates performance, and optimizes parameters before live trading. |

| Core Principles | Accurate data, clear strategy rules, and risk-adjusted performance metrics like Sharpe ratio and drawdown. |

| Event-Driven Backtesting | Simulates trades based on market events, mimicking live trading with slippage, latency, and costs. |

| Walk-Forward Analysis | Divides data into training and testing periods, validates strategy on unseen data, reducing overfitting. |

| Comparison of Methods | Event-Driven: High realism, needs tick data, complex. Walk-Forward: Moderate realism, uses daily data, easier for longer-term models. |

| Data Quality Impact | High-quality, cleaned data is critical. Poor data leads to inaccurate results, and gaps can distort backtest outcomes. |

| Common Pitfalls | Lookahead bias, survivorship bias, overfitting, ignoring slippage/fees, and unrealistic assumptions. |

| Case Study | Trend-following strategy (50-day MA vs. 200-day MA), annual return of 7.2%, max drawdown -25%, outperforming buy-and-hold in bear markets. |

| Checklist for Success | Use high-quality data, define clear rules, include slippage/fees, test across regimes, validate out-of-sample, and test robustness. |

| Best Method for Beginners | Walk-forward analysis is simpler, providing a good balance of realism and ease, suitable for learning and starting with platforms like TradingView. |

| Why Backtests Fail | Failures due to overfitting, poor data quality, ignoring slippage/fees, and unforeseen market conditions in live trading. |

| Improving Accuracy | Use tick-level data, apply robust optimization, and account for real-world execution like latency and fees. |

0 Comments

Leave a Comment