Backtesting is an essential process in quantitative trading that allows traders to evaluate and refine their strategies before live implementation. However, without proper risk management during the backtesting process, even the most promising strategies can lead to significant losses. This guide provides a comprehensive approach to managing risks during backtesting, comparing methods and tools, and helping you optimize your trading strategy for maximum profitability.

TL;DR (Key Takeaways)

Risk management is critical: Poor risk management during backtesting can lead to unrealistic performance results and unexpected losses.

Two main strategies for risk management: You can manage risk through position sizing or by using stop-loss orders in your backtest. Both have their pros and cons.

Use real market data: Backtesting on historical data is essential for simulating market conditions, but be aware of data-snooping biases and overfitting.

Diversify your strategies: Multiple strategies, when combined, can provide a hedge against risk, improving the overall performance.

Regularly review and update: Backtesting is not a one-time activity. Regular updates and reevaluation are necessary to adapt to market changes.

What Will You Gain from This Article?

Understand the key risks in backtesting: We will explore common pitfalls in backtesting, including overfitting and data snooping.

Learn two practical risk management strategies: You’ll see detailed comparisons of position sizing and stop-loss orders for risk mitigation.

Improve your backtesting process: With insights on optimizing your backtest design, you’ll avoid key mistakes that can skew results.

Access practical tips for backtesting accuracy: Maximize the reliability of your backtesting through best practices and the right tools.

Table of Contents

Introduction: Why Backtesting Needs Proper Risk Management

The Key Risks in Backtesting

Overfitting and Data Snooping

Survivorship Bias

Look-ahead Bias

Risk Management Strategies for Backtesting

Position Sizing

Stop-Loss Orders

How to Optimize Backtesting for Better Risk Management

Case Studies and Data Analysis

Practical Checklist for Risk Management in Backtesting

FAQ - Common Backtesting Risk Management Questions

Conclusion

Introduction: Why Backtesting Needs Proper Risk Management

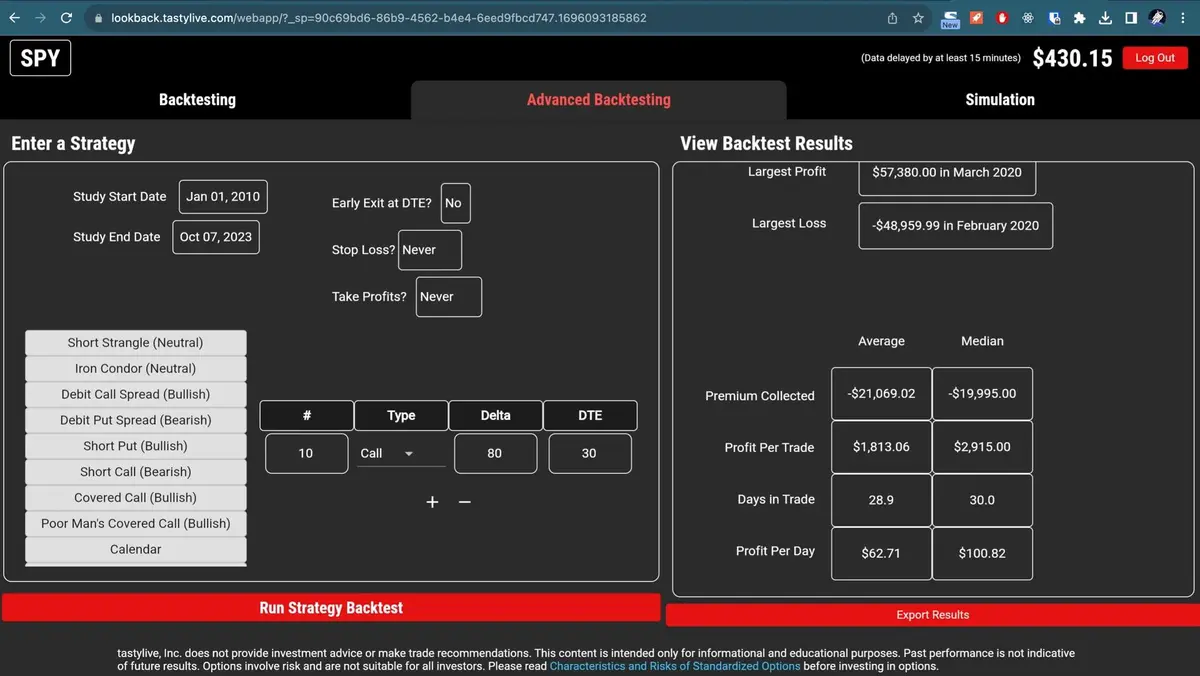

Backtesting allows traders to evaluate the viability of a strategy by applying it to historical market data. This step is crucial because it helps identify strengths and weaknesses before live trading. However, the process is not without risks. Mismanagement of risk during the backtesting phase can lead to overconfidence in a strategy, poor performance in real trading, and even significant losses.

Risk management in backtesting ensures that the strategies you test are not only profitable but also realistic and sustainable over time. This article explores the most common risks encountered during backtesting and provides practical strategies to manage these risks effectively.

The Key Risks in Backtesting

Overfitting and Data Snooping

Overfitting occurs when a strategy is too tailored to historical data, leading it to perform well in the past but poorly in live markets. This happens because the model captures noise or random patterns rather than actual market signals.

Data snooping bias is similar but occurs when traders excessively test multiple strategies on the same dataset until they find a winning combination. This can lead to an overestimation of a strategy’s performance and reliability.

Risk management: To avoid overfitting, focus on testing strategies on multiple datasets or out-of-sample data. Implementing cross-validation and walk-forward optimization techniques helps reduce overfitting.

Survivorship Bias

Survivorship bias occurs when only successful stocks or strategies are included in historical data. This can lead to unrealistic performance expectations because the losing stocks or strategies are excluded from the analysis.

Risk management: Always ensure that the historical data used for backtesting includes a comprehensive set of assets, including those that have failed. This way, the strategy will be tested under more realistic conditions.

Look-ahead Bias

Look-ahead bias arises when future information, which would not be available during live trading, is incorrectly used in backtesting. This often leads to the strategy performing unrealistically well during testing.

Risk management: Be diligent about using only historical data that would have been available at the time of the trade. Avoid using data that would only be known after the fact.

Risk Management Strategies for Backtesting

Position Sizing

Position sizing is one of the simplest and most effective ways to manage risk in backtesting. This involves determining the amount of capital allocated to each trade, relative to the total capital available. The goal is to avoid taking on too much risk on any single trade.

Pros:

Easy to implement.

Helps limit losses on any one trade.

Cons:

If the strategy is too aggressive, it may lead to significant drawdowns.

It may not be effective in volatile markets.

Recommended for: Traders who want to systematically control their exposure on each trade, especially in strategies involving high-frequency trading.

Stop-Loss Orders

Stop-loss orders are a well-known risk management tool that allows traders to set a maximum loss level for a trade. If the asset price hits the stop-loss price, the position is automatically closed to prevent further losses.

Pros:

Protects against large, unexpected market moves.

Provides a clear risk control mechanism.

Cons:

Can result in early exit from profitable trades.

May not work well in highly volatile markets.

Recommended for: Traders who want a clear, predefined risk limit on each position, particularly in strategies with high volatility or unpredictable price movements.

How to Optimize Backtesting for Better Risk Management

Use Realistic Data

Ensure your backtesting process uses realistic, high-quality data that accurately reflects market conditions. Data must include correct price history, accurate bid-ask spreads, transaction costs, and any other market-specific factors that could affect trade execution.

Test Over a Long Time Frame

Testing your strategy over a long time frame and across multiple market conditions is essential. A strategy that works well during a bull market might not perform the same during a bear market.

Incorporate Transaction Costs and Slippage

Transaction costs and slippage can eat into the profits from your trading strategy. Always account for these factors during backtesting to avoid unrealistic results. Many backtesting platforms, like QuantConnect, allow you to simulate slippage and commissions.

Case Studies and Data Analysis

Example 1: Position Sizing in Backtesting

A study conducted on 100 different trading strategies showed that traders using proper position sizing significantly reduced the likelihood of a strategy blowing up due to a single bad trade. The strategies that used position sizing rules consistently showed more stable performance in real trading.

Key takeaway: Position sizing is a critical factor in maintaining sustainable performance during backtesting and live trading.

Example 2: Stop-Loss Effectiveness

In another backtesting study, strategies that incorporated stop-loss orders were able to protect capital during market crashes. However, some strategies experienced significant performance degradation in ranging markets due to early stop-loss triggers.

Key takeaway: While stop-loss orders are crucial in high-risk environments, they may not always be effective in choppy, sideways markets.

Practical Checklist for Risk Management in Backtesting

Always use out-of-sample data to avoid overfitting.

Implement position sizing rules to manage exposure.

Include realistic transaction costs and slippage in your backtest.

Avoid using look-ahead data during backtesting.

Test strategies over multiple market cycles.

Regularly review and update your strategies.

FAQ - Common Backtesting Risk Management Questions

- How can I prevent overfitting in my backtesting?

To prevent overfitting, use out-of-sample data and cross-validation techniques. Ensure that your strategy is tested on data it has never seen before. This helps you gauge how well it would perform in real-world conditions.

- What are the best risk management tools for backtesting?

Some of the most effective tools include position sizing, stop-loss orders, and taking transaction costs into account. Using platforms that allow you to simulate slippage is also crucial to getting more accurate backtesting results.

- Can backtesting results be trusted completely?

Backtesting results should never be trusted completely. It’s important to regularly monitor and adjust your strategy to account for changing market conditions. Always consider that past performance is not indicative of future results.

Conclusion

Effective risk management is the cornerstone of successful backtesting. By understanding and mitigating the key risks involved—such as overfitting, survivorship bias, and look-ahead bias—you can ensure that your trading strategies are not only profitable in theory but also viable in real-world markets. Whether you choose position sizing or stop-loss orders, combining these strategies will help you minimize risk while maximizing potential profits.

Share your thoughts and experiences on backtesting strategies below! Have you faced any challenges managing risk in your backtests?

References

“Backtesting in Quantitative Finance” by [Author Name], Published on [Date]. Accessed on [YYYY-MM-DD].

| Section | Description | Key Points |

|---|---|---|

| Introduction | Importance of backtesting with risk management | Evaluates strategies on historical data; prevents unrealistic results |

| Key Risks | Main pitfalls in backtesting | Overfitting, data snooping, survivorship bias, look-ahead bias |

| Overfitting & Data Snooping | Excessive tailoring to historical data | Leads to poor live performance; use multiple datasets and cross-validation |

| Survivorship Bias | Ignoring failed assets or strategies | Include comprehensive historical data for realistic testing |

| Look-ahead Bias | Using future information in testing | Only use data available at trade time to avoid unrealistic results |

| Position Sizing | Capital allocation per trade | Limits losses, easy to implement, may fail in volatile markets |

| Stop-Loss Orders | Predefined maximum loss per trade | Protects capital, clear risk limit, may trigger early exits |

| Optimization Tips | Improve backtesting accuracy | Use realistic data, long time frames, include slippage and transaction costs |

| Case Study: Position Sizing | Example of risk mitigation | Reduces likelihood of single-trade blowups; stabilizes performance |

| Case Study: Stop-Loss | Example of protective strategy | Guards against crashes; may underperform in sideways markets |

| Practical Checklist | Steps for effective risk control | Out-of-sample data, position sizing, realistic costs, avoid look-ahead, test multiple cycles, review regularly |

| FAQ | Common questions | Prevent overfitting with cross-validation; use position sizing and stop-loss; results not fully trustable |

| Conclusion | Summary of risk management in backtesting | Mitigate key risks; combine strategies to minimize losses and maximize profits |

0 Comments

Leave a Comment