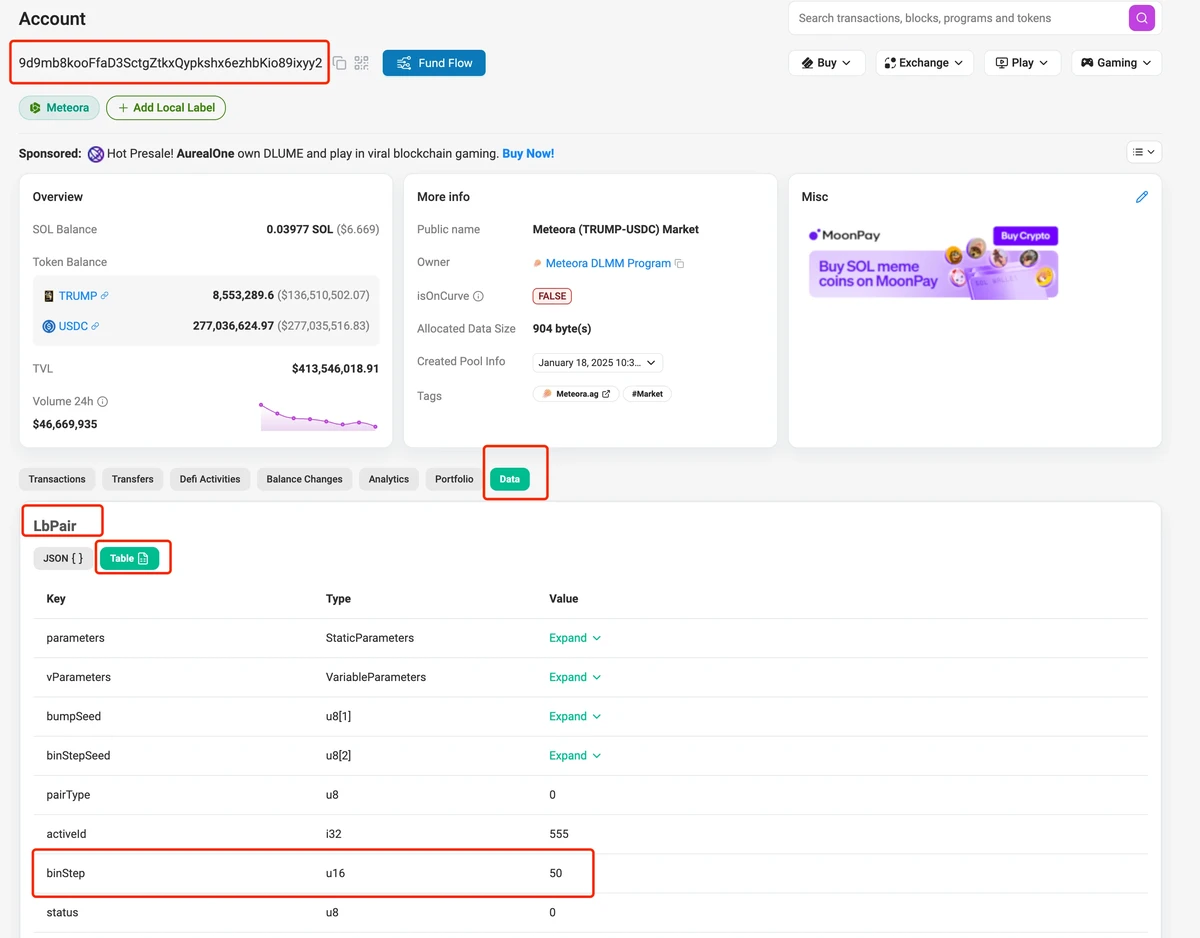

| Step | Description | Tools / Methods | Key Considerations | Example |

|---|---|---|---|---|

| 1 | Define strategy rules | Algorithm logic, trading plan | Clear entry, exit, and risk criteria | Moving average crossover |

| 2 | Collect historical data | Market data feeds, CSV, APIs | Ensure data quality and completeness | 5 years BTC price data |

| 3 | Clean and preprocess data | Remove errors, adjust for splits | Normalize, handle missing values | Correct missing candlesticks |

| 4 | Implement backtesting engine | Python, Backtrader, QuantLib | Accurate simulation of trades | Use VWAP for order execution |

| 5 | Run strategy simulation | Apply rules to historical data | Include slippage, fees, and spreads | Test MA crossover on BTC/USD |

| 6 | Analyze performance metrics | Sharpe ratio, drawdown, ROI | Evaluate profitability and risk | Max drawdown 12%, ROI 25% |

| 7 | Optimize parameters | Grid search, walk-forward testing | Avoid overfitting | Adjust MA periods for best ROI |

| 8 | Validate with out-of-sample data | Separate dataset from training | Confirm strategy robustness | Test optimized MA on new 6 months data |

| 9 | Document results | Performance summary, charts | Transparency and reproducibility | PDF report with equity curve |

| 10 | Prepare for live deployment | Paper trading or demo account | Monitor for real-world issues | Execute trades with small capital |

“languages”: “en”

}

0 Comments

Leave a Comment