Backtesting is an essential step in the development of quantitative trading strategies, particularly for hedge funds. The ability to test strategies using historical data allows firms to understand how their models would have performed in the past and optimize them before deploying real capital. In this article, we will explore backtesting strategies for hedge funds, focusing on best practices, advanced techniques, and practical advice for improving accuracy and performance.

TL;DR

Backtesting is crucial for evaluating trading strategies using historical data.

We compare two main backtesting strategies: Monte Carlo Simulation and Walk-Forward Analysis.

The guide provides tools and tips to optimize backtesting, reduce overfitting, and improve model robustness.

Key aspects of backtesting such as data quality, risk management, and simulation are discussed.

What You’ll Gain from This Guide

A clear understanding of backtesting and its role in hedge fund strategy development.

A deep dive into two powerful backtesting techniques used by hedge funds: Monte Carlo Simulation and Walk-Forward Analysis.

Insights into the challenges and common mistakes in backtesting and how to avoid them.

Tools and platforms for running backtests and optimizing trading strategies.

Answers to frequently asked questions, providing practical advice for hedge fund managers and quantitative analysts.

Table of Contents

What is Backtesting in Hedge Funds?

Key Backtesting Strategies for Hedge Funds

2.1 Monte Carlo Simulation

2.2 Walk-Forward Analysis

Backtesting Tools and Platforms

Common Challenges in Backtesting and How to Overcome Them

Optimizing Backtesting Accuracy

Case Study: Hedge Fund Strategy Backtesting Example

FAQ

Conclusion

- What is Backtesting in Hedge Funds?

Backtesting is the process of applying a trading strategy or model to historical market data to assess its viability. By simulating how the strategy would have performed in past market conditions, hedge funds can evaluate whether the model has predictive power and adjust it to better handle different market scenarios.

In hedge funds, where the stakes are high and risk management is critical, backtesting provides a structured, data-driven approach to strategy development. Without backtesting, there’s no reliable way to know if a trading model will be effective in live markets.

Backtesting helps hedge funds:

Evaluate strategy performance: Understand how a strategy would have performed in different market conditions.

Reduce risk: Identify potential flaws in the strategy before committing significant capital.

Optimize strategies: Fine-tune models based on past performance to improve future returns.

- Key Backtesting Strategies for Hedge Funds

2.1 Monte Carlo Simulation

Monte Carlo simulation is a powerful technique that uses random sampling to model the potential outcomes of a trading strategy. By running thousands (or even millions) of simulations, this method generates a wide range of possible outcomes, allowing hedge funds to assess the likelihood of different levels of performance.

Key Features of Monte Carlo Simulation:

Randomized testing: The strategy is run under various randomized conditions to simulate different market scenarios.

Risk and return analysis: It helps identify the probability of a strategy meeting specific risk-return targets.

Stress testing: Monte Carlo is particularly useful for evaluating strategies under extreme market conditions, such as market crashes or high volatility periods.

Pros and Cons of Monte Carlo Simulation

Pros Cons

Provides a wide range of possible outcomes Computationally expensive (requires significant resources)

Helps in stress-testing strategies Can be sensitive to input assumptions (e.g., volatility and correlation)

Suitable for complex strategies with many variables Requires accurate historical data for reliable results

2.2 Walk-Forward Analysis

Walk-forward analysis is a method that breaks down historical data into segments (or “walks”) and tests a strategy on each segment sequentially. This process involves training a model on one segment, testing it on the next, and then moving forward to the next segment. The strategy is repeatedly optimized on the historical data and then validated on unseen data.

Key Features of Walk-Forward Analysis:

Out-of-sample testing: Unlike traditional backtesting, which uses the same data for both training and validation, walk-forward analysis tests the strategy on new data after each optimization phase.

Realistic performance evaluation: This technique simulates how the strategy would perform in a live environment by continuously adapting to new data.

Improved robustness: Walk-forward analysis helps prevent overfitting, ensuring that the strategy generalizes well across different market conditions.

Pros and Cons of Walk-Forward Analysis

Pros Cons

Prevents overfitting and reduces bias Time-consuming, especially for large datasets

Provides more realistic performance estimates May not account for rare market events (due to limited training data)

Good for validating multi-step models Requires consistent rebalancing and strategy updates

- Backtesting Tools and Platforms

There are several platforms available that hedge funds can use to conduct backtesting. These tools range from open-source libraries to full-fledged commercial software.

Popular Backtesting Platforms:

QuantConnect: A cloud-based platform that offers backtesting, research, and strategy development tools for hedge funds.

Backtrader: An open-source Python library that allows for easy backtesting of various strategies.

MetaTrader 5: A popular platform among retail and institutional traders for running backtests on forex and other financial instruments.

Key Features to Look for in Backtesting Tools:

Data integration: Ability to integrate with historical and real-time market data feeds.

Risk management capabilities: Built-in tools for assessing risk, such as maximum drawdown and value at risk (VaR).

Multi-asset support: Ability to backtest strategies across different asset classes (stocks, options, futures, etc.).

Simulation capabilities: Simulate different market conditions, including high volatility and crashes.

- Common Challenges in Backtesting and How to Overcome Them

4.1 Overfitting

Overfitting occurs when a model is too closely aligned with historical data, making it less likely to perform well in live markets. It’s one of the most common issues in backtesting, especially when strategies are too complex or data is improperly used.

Solution:

Use out-of-sample data for testing.

Implement regularization techniques to prevent overfitting.

4.2 Data Quality

Poor-quality data can distort backtest results. This issue arises due to incomplete, inaccurate, or noisy data that doesn’t represent real market conditions.

Solution:

Source data from reliable providers such as Bloomberg or Refinitiv.

Clean and preprocess the data before using it for backtesting.

4.3 Survivorship Bias

Survivorship bias occurs when a backtest only includes assets or instruments that are still active today, ignoring those that failed or were delisted. This can lead to an overly optimistic view of a strategy’s performance.

Solution:

Include both active and delisted assets in your backtesting dataset.

- Optimizing Backtesting Accuracy

5.1 Improving Data Inputs

Ensure that your data is clean, consistent, and free from errors. The more accurate your input data, the more reliable your backtest results will be.

5.2 Reducing Overfitting

To reduce overfitting, avoid excessively complex models. Use techniques like cross-validation and regularization to ensure your models generalize well to new data.

5.3 High-Performance Computing

For computationally expensive simulations like Monte Carlo, hedge funds can benefit from high-performance computing (HPC) resources or cloud-based services that scale with demand.

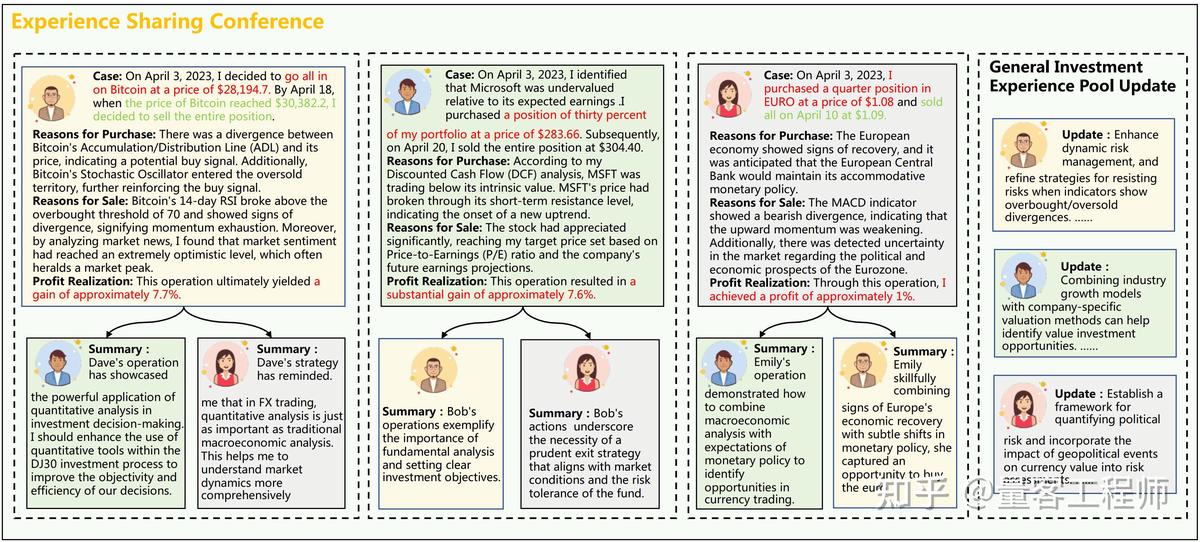

- Case Study: Hedge Fund Strategy Backtesting Example

Example: Trend Following Strategy

A hedge fund wanted to test a simple trend-following strategy using historical data from the S&P 500. They applied Monte Carlo simulations to model various market scenarios, then used walk-forward analysis to optimize the strategy on different time periods.

Results:

Monte Carlo Simulation: The strategy showed a 60% probability of achieving positive returns in most simulated environments.

Walk-Forward Analysis: The strategy performed consistently well across multiple time periods, proving its robustness.

- FAQ

- What is the best backtesting method for hedge funds?

The best method depends on the strategy. Monte Carlo simulation is great for stress testing under varied conditions, while walk-forward analysis is better for ensuring that a strategy will generalize well to unseen data.

- How can hedge funds avoid overfitting in backtesting?

Hedge funds can avoid overfitting by using simpler models, cross-validation, and testing on out-of-sample data. Walk-forward analysis also helps reduce the risk of overfitting.

- What are the most common mistakes in backtesting?

The most common mistakes include using poor-quality data, failing to account for transaction costs, and overfitting the model to historical data. These can all distort the results and lead to unrealistic expectations.

- Conclusion

Backtesting is a vital process for hedge funds to evaluate and optimize trading strategies. By leveraging advanced backtesting strategies such as Monte Carlo Simulation and Walk-Forward Analysis, hedge funds can build more robust models that are likely to perform well in live markets. While there are challenges such as overfitting and data quality issues, using the right tools and techniques can significantly improve the accuracy of your backtest results.

| Aspect | Description |

|---|---|

| What is Backtesting? | Evaluating a strategy using historical data to assess its viability and optimize performance. |

| Monte Carlo Simulation | Uses random sampling to simulate different market conditions and assess risk-return probabilities. |

| Walk-Forward Analysis | Tests strategy sequentially on segments of data, optimizing and validating on new data. |

| Backtesting Tools | Platforms like QuantConnect, Backtrader, and MetaTrader 5 for testing strategies. |

| Common Challenges | Overfitting, data quality, and survivorship bias. |

| Overfitting Solution | Use out-of-sample data, regularization, and simpler models to prevent overfitting. |

| Data Quality Solution | Source reliable data, clean, and preprocess it before testing. |

| Survivorship Bias Solution | Include both active and delisted assets to avoid biased results. |

| Optimizing Accuracy | Ensure clean data, reduce model complexity, and use high-performance computing for simulations. |

| Case Study Example | Trend-following strategy showed robust results using Monte Carlo and Walk-Forward analysis. |

0 Comments

Leave a Comment