TL;DR

Understand the essentials of breakout strategies and how they fit into quantitative trading.

Learn to identify breakout opportunities, backtest them, and manage risk.

Compare multiple methods of implementing breakout strategies, with a focus on their costs, complexities, and scalability.

Gain insights into effective tools and techniques tailored for retail investors in the realm of quantitative trading.

What You Will Achieve:

By the end of this article, you will be able to:

Identify high-potential breakout opportunities using quantitative techniques.

Implement and backtest breakout strategies effectively.

Apply risk management practices to protect your trades and ensure long-term success.

Choose the right tools and platforms to automate and scale your trading strategy.

Table of Contents

Introduction to Breakout Strategies in Quantitative Trading

How Breakouts Work in Quantitative Trading

Breakout Strategy Types: Classic vs Trend Following

Identifying Breakouts in Quantitative Trading

Backtesting Breakout Strategies

Risk Management and Breakout Strategies

Tools for Breakout Trading

FAQs

Video References

Conclusion

Search Intent Breakdown & Scenario Analysis

Primary Search Intent:

Users are looking to understand breakout strategies for quantitative trading, specifically how they can be applied to retail trading. The focus is on practical implementation, backtesting, and risk management.

Secondary Search Intent:

Exploring tools and methods to identify breakout opportunities, comparing strategy types, and understanding how to measure risk versus reward.

Semantic Keywords & Related Queries:

Backtesting breakout strategies

Quantitative trading algorithms

Breakout strategy risk management

Identifying breakout opportunities

Breakout pattern analysis

Backtesting in quantitative trading

Methods A/B for Breakout Strategies

Method A: Classic Breakouts

Principle:

Classic breakout strategies focus on entering trades when price surpasses a key resistance (bullish breakout) or support level (bearish breakout). The strategy assumes that price momentum will continue in the direction of the breakout.

Steps:

Identify critical support/resistance levels using historical data.

Use price action and volume analysis to detect when the price moves beyond these levels.

Enter the trade when the breakout occurs, ideally confirming with increased volume.

Parameters & Tools:

Resistance and support levels

Volume indicators (e.g., On-Balance Volume, Chaikin Money Flow)

Price action analysis (candlestick patterns, chart formations)

Costs & Time:

Minimal cost: No need for advanced data feeds or premium platforms.

Quick execution, but requires frequent monitoring for false breakouts.

Risks & Limitations:

Prone to false breakouts in choppy markets, leading to losses.

Timing errors can result in entering too early or too late.

Method B: Trend Following Breakouts

Principle:

Trend following strategies wait for a breakout and then enter a position only when additional confirmation (like moving averages or momentum indicators) shows the trend is strong and likely to continue.

Steps:

Identify potential breakouts using the same method as in classic breakouts.

Confirm breakout with trend-following indicators, such as moving averages, MACD, or RSI.

Enter the trade once confirmation is received, using stop-loss orders to manage risk.

Parameters & Tools:

Moving averages (e.g., 50-day and 200-day)

RSI, MACD for momentum confirmation

Risk management tools (stop-loss, trailing stops)

Costs & Time:

Slightly higher cost, especially for data feeds and trading platforms.

Slightly longer time to wait for confirmation.

Risks & Limitations:

Missing the breakout if the trend begins before confirmation.

Risk of overfitting or being late in a fast-moving market.

Comparison Table

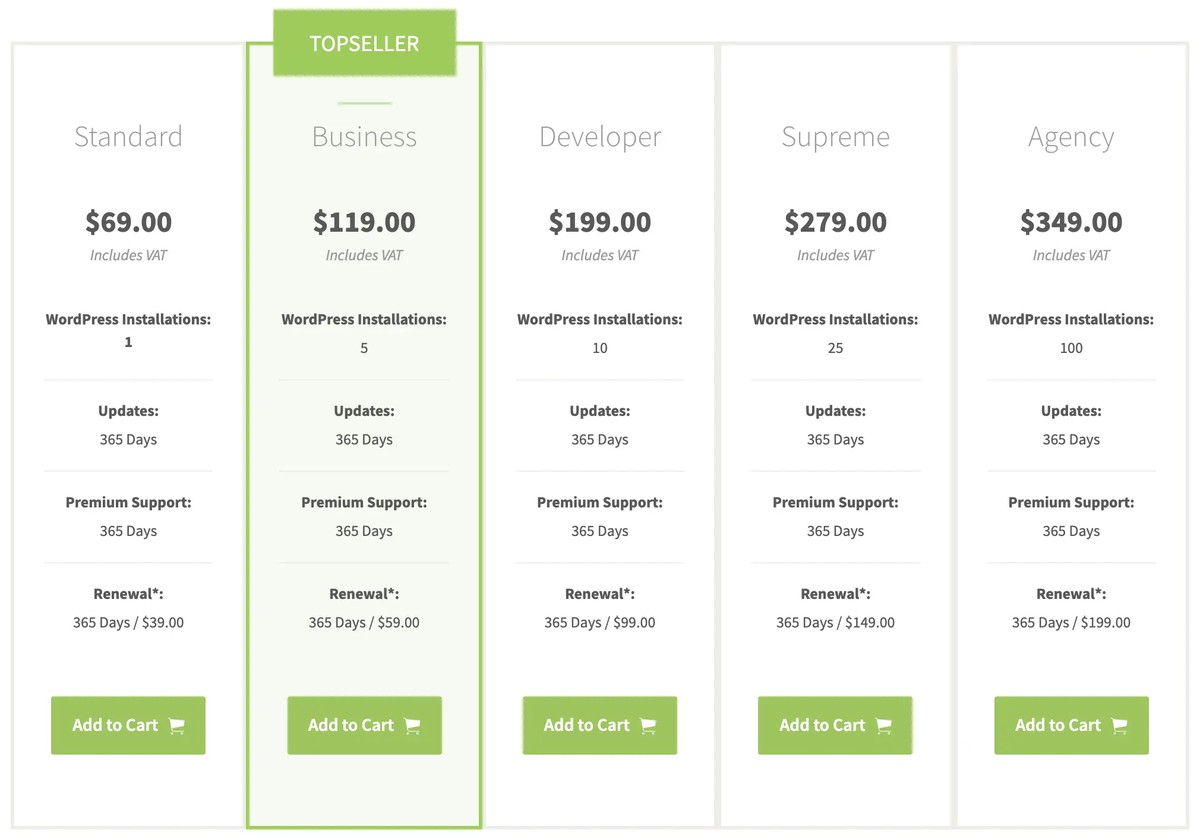

Criteria Classic Breakouts Trend Following Breakouts

Cost Low Moderate

Time to Implement Quick Moderate

Risk High (false breakouts) Lower (but delayed entry)

Scalability High Moderate

Suitability Beginners, short-term Experienced, long-term

Conclusion & Recommendation

For retail investors, the classic breakout strategy is ideal if you have the ability to monitor the market closely and take quick actions. It’s a straightforward method that works best in highly volatile, trending markets.

The trend-following breakout strategy, while more complex and requiring confirmation, is better suited for experienced traders looking to reduce the risk of false breakouts and capture larger, more stable trends.

Identifying Breakouts in Quantitative Trading

The key to successfully identifying breakouts is relying on a combination of technical indicators, historical data analysis, and statistical models. Key approaches include:

Support and Resistance Levels: These are fundamental levels where price tends to reverse or break out. Identifying these zones accurately is essential for both classic and trend-following strategies.

Volume Analysis: A breakout is usually accompanied by increased volume, confirming the strength of the move.

Volatility Indicators: Tools like Average True Range (ATR) or Bollinger Bands can help measure market volatility and predict when breakouts are more likely.

Retail investors can automate this process using trading algorithms that continuously scan for these signals.

Example of a classic breakout pattern identified using historical data.

Backtesting Breakout Strategies

Backtesting is essential for any quantitative trading strategy, especially for retail investors who need to ensure their methods are robust and profitable. A strong backtesting strategy involves:

Historical Data Analysis: Use years of historical price data to simulate trades based on your chosen breakout method.

Risk Management Testing: Implement stop-loss orders, trailing stops, and other risk controls to ensure losses are limited.

Optimization: Adjust strategy parameters (e.g., breakout thresholds, indicator settings) to find the most effective configuration.

For those unfamiliar with backtesting, several platforms offer automated solutions, such as QuantConnect, MetaTrader, and Amibroker.

Risk Management and Breakout Strategies

Proper risk management is critical to the success of any breakout strategy. Key tactics include:

Stop-Loss Orders: Limit potential losses by setting stop-loss orders just below support levels for long positions, or above resistance for short positions.

Position Sizing: Ensure each trade represents a small, controlled portion of your overall portfolio.

Risk-to-Reward Ratios: Aim for a favorable risk-to-reward ratio, targeting higher rewards for each unit of risk taken.

Tools for Breakout Trading

Several platforms and tools are available to help retail investors implement breakout strategies efficiently:

QuantConnect: A cloud-based platform that offers algorithmic trading and backtesting tools.

MetaTrader 4⁄5: A popular platform for retail traders to automate and backtest breakout strategies.

TradingView: Offers charting and technical analysis tools, with real-time alerts for breakout signals.

FAQs

- How do I manage the risk of false breakouts in my strategy?

To manage false breakouts, combine breakout signals with additional indicators like moving averages or RSI for confirmation. Also, use a robust stop-loss strategy to protect yourself if the breakout reverses.

- What tools do I need to implement a breakout strategy?

You’ll need a reliable charting tool, like MetaTrader or TradingView, and backtesting software such as QuantConnect to test your strategies. Additionally, using APIs from exchanges can help you automate your trades.

- Can I use breakout strategies in a sideways market?

Breakout strategies are typically ineffective in sideways or consolidating markets. If the market isn’t trending, it’s crucial to use a different approach, like range-bound strategies or scalping.

Video References

How to Use Breakouts in Quantitative Trading

Source: QuantInstinct

Published Date: 2023-09-25

Key Time Stamps:

0:00 – Introduction to Breakout Strategies

4:15 – Backtesting Breakout Strategies

12:30 – Risk Management Techniques

Watch the Video

Conclusion

Breakout strategies are powerful tools for retail investors in quantitative trading. Whether you are using a classic breakout or a trend-following approach, the key to success is robust backtesting, effective risk management, and using the right tools to identify high-potential opportunities. With the right strategy in place, retail investors can take full advantage of the market’s momentum to secure consistent profits.

References

QuantInstinct. “Breakout Trading for Retail Investors”. QuantInstinct, 2023-09-25.

| Category | Perpetual Futures | Options & Advanced Derivatives |

|---|---|---|

| Ease of Use | Beginner-friendly | Complex, requires expertise |

| Leverage Potential | Up to 200x | Indirect leverage via premiums |

| Risk Profile | High liquidation risk | Defined premium loss |

| Strategy Flexibility | Trend following, scalping | Hedging, volatility plays |

| Liquidity | High on major exchanges | Moderate, varies by exchange |

| Key Features | Ultra-fast execution, customizable leverage, real-time analytics | Defined risk through premiums, flexibility in strategies |

| Pros | Continuous trading, high liquidity, long and short strategies | Defined risk, strategy flexibility, asymmetric payoff potential |

| Cons | High volatility, funding rate costs, liquidation risk | Complex for beginners, limited liquidity, requires understanding of Greeks |

| Best for | Beginners, day traders, trend followers | Experienced traders, hedging, volatility-based strategies |

| Common Platforms | Bybit, Binance Futures, BitMEX | Bybit, Binance, Deribit |

| Risk Management | Liquidation protection, stop-loss orders | Defined risk, requires strong risk management |

| Trading Timeframe | Short-term (scalping) | Medium-term (swing trading), long-term (hedging) |

| Regulatory Considerations | Varies by region | Varies by region, more platforms may have jurisdiction limits |

0 Comments

Leave a Comment