Quantitative trading has rapidly evolved over the last decade, driven by advances in computing power, access to financial data, and the democratization of trading platforms. For both institutional and retail investors, choosing the best quantitative strategy tools can make the difference between consistent profits and underperforming results.

In this article, we’ll explore the top quantitative strategy tools in 2025, compare their strengths and weaknesses, and provide a structured guide for selecting the right solution for your trading needs. We’ll also discuss practical use cases, industry trends, and answer common questions to help you make informed decisions.

Why Quantitative Strategy Tools Matter

Quantitative strategies rely on mathematical models, statistical analysis, and algorithmic execution. The tools you choose affect every stage of the workflow:

Data Collection & Cleaning – Reliable market data is the backbone of any quant strategy.

Backtesting & Simulation – Accurately testing strategies on historical data prevents costly live trading mistakes.

Execution & Automation – Algorithms must operate in real time, with minimal latency and maximum risk control.

Risk Management & Reporting – Tools must integrate risk frameworks and produce actionable insights.

With markets becoming more competitive, even small inefficiencies in tools can create significant performance gaps.

Key Features of the Best Quantitative Strategy Tools

When evaluating tools, professionals should look for these critical capabilities:

- Data Integration and Quality

Access to reliable tick-level and fundamental data is non-negotiable. The best platforms offer APIs, multiple data vendors, and real-time feeds.

- Backtesting Engine

A robust backtesting system should simulate slippage, transaction costs, market impact, and liquidity constraints.

- Programming Flexibility

Tools that support Python, R, or C++ provide flexibility for custom models and seamless integration with AI/ML libraries.

- Cloud and On-Premise Options

In 2025, many firms prefer cloud-native solutions for scalability, but some hedge funds still require on-premise deployment for security.

- Risk and Portfolio Management

The tool should support VaR (Value at Risk), drawdown analysis, stress testing, and factor exposure tracking.

Top 2 Quantitative Strategy Tools Compared

To help you navigate the landscape, let’s compare two of the most widely used tools: QuantConnect and MATLAB with Financial Toolbox.

QuantConnect

QuantConnect is an open-source algorithmic trading platform built on Lean, a powerful backtesting engine.

Pros:

Access to equities, futures, options, forex, and crypto data.

Free backtesting and cloud deployment.

Active community and integration with broker APIs.

Supports Python and C#.

Cons:

Requires programming knowledge.

Limited support for proprietary high-frequency trading.

Free tier has limited computational resources.

MATLAB with Financial Toolbox

MATLAB remains a favorite for institutional quant teams due to its mathematical robustness.

Pros:

Powerful libraries for time-series modeling and optimization.

Excellent visualization capabilities.

Industry-grade reliability and support.

Cons:

Expensive licenses.

Less community-driven than open-source alternatives.

Slower adoption for real-time execution compared to Python-based solutions.

Comparison Table

Feature QuantConnect MATLAB Financial Toolbox

Programming Language Python, C# MATLAB

Asset Coverage Equities, futures, options, FX, crypto Equities, bonds, options, derivatives

Cost Free (paid cloud compute) High license fees

Ideal Users Retail traders, startups Institutional quant teams

Backtesting Speed High with Lean engine Moderate

Risk Management Tools Moderate Advanced

Verdict: For retail and semi-professional traders, QuantConnect is the most accessible tool. For institutional-level modeling, MATLAB still dominates.

QuantConnect vs MATLAB – Comparing the best quantitative strategy tools in 2025

Other Notable Tools in 2025

Besides the two leaders, traders can explore additional platforms:

Backtrader – A Python-based framework for customizable backtesting.

MetaTrader 5 – Popular in forex, now expanding into multi-asset trading.

Python Quant Libraries (Pandas, NumPy, Scikit-learn, PyTorch) – For traders building custom research pipelines.

Bloomberg Terminal & API – Still unmatched for institutional data coverage.

Each of these tools serves different levels of expertise and trading styles, from retail beginners to hedge fund managers.

Practical Use Case: Breakout Strategy Testing

To illustrate how tools impact strategy outcomes, consider a breakout trading strategy:

Step 1: Data Collection – Use QuantConnect’s data API to pull 5 years of minute-level SPY data.

Step 2: Model Setup – Define entry/exit rules based on price breaking above/below moving averages.

Step 3: Backtest – Run the strategy in QuantConnect to assess Sharpe ratio, max drawdown, and PnL.

Step 4: Risk Controls – In MATLAB, apply stress tests to evaluate how the strategy performs during 2008 or 2020 crash scenarios.

This combination shows how tools can complement each other: QuantConnect for speed and flexibility, MATLAB for deep risk analytics.

Breakout strategy backtest results illustrated in a quantitative strategy tool

Integration with Learning and Development

Traders new to the field often wonder how to develop a quantitative trading strategy. Modern platforms like QuantConnect now provide research notebooks, pre-built templates, and educational resources, reducing the barrier to entry.

Similarly, professionals seeking structured education can explore where to find quantitative strategy courses, many of which are directly integrated with these tools, combining theory with practical implementation.

Latest Trends in Quantitative Tools (2025)

AI Integration – Machine learning models are increasingly embedded in platforms, enabling automated feature selection and adaptive trading rules.

Crypto Quant Tools – Platforms now provide DeFi and on-chain data APIs, reflecting the growth of digital assets.

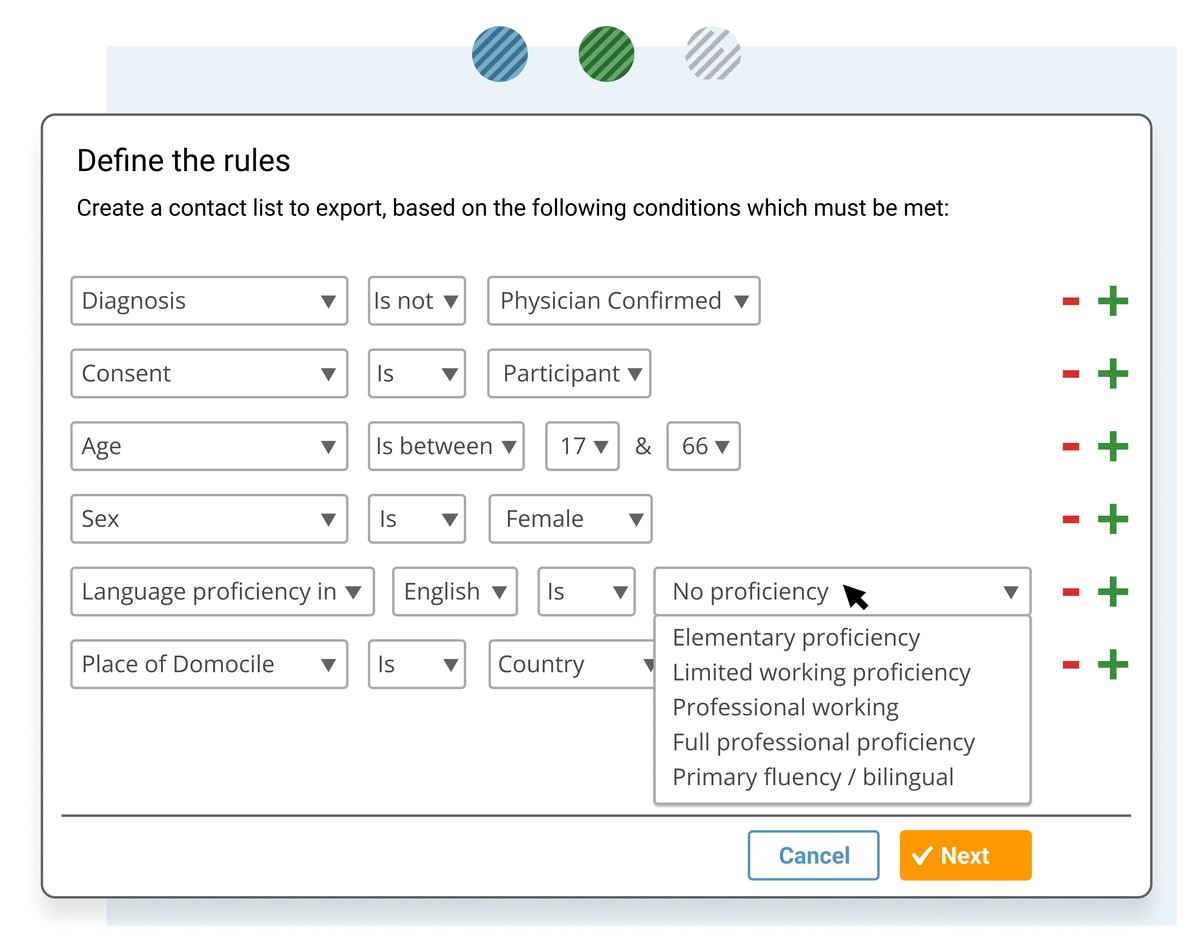

Low-Code Quant Platforms – Emerging solutions allow drag-and-drop strategy creation without deep coding.

Cloud Scalability – On-demand GPU clusters reduce backtest times from hours to minutes.

Regulatory Compliance Modules – Built-in KYC/AML, MiFID II, and SEC compliance tools for institutional users.

FAQs on Best Quantitative Strategy Tools

- What is the best tool for beginners in quantitative trading?

For beginners, QuantConnect and Backtrader are ideal due to their open-source nature, supportive communities, and extensive tutorials. Beginners can start with free datasets and gradually move to live trading.

- How do I choose between open-source and paid institutional tools?

It depends on your goals:

If you are retail-focused or experimenting, open-source tools (QuantConnect, Backtrader, Python libraries) are sufficient.

If you work at a hedge fund or portfolio management firm, institutional tools like MATLAB or Bloomberg Terminal offer compliance, scalability, and advanced analytics.

- Can one tool cover all aspects of quant trading?

No single tool does everything perfectly. Professionals often combine multiple tools:

Data & Execution: Bloomberg or QuantConnect

Modeling: Python, R, MATLAB

Risk Analysis: MATLAB or proprietary systems

The key is to build a tool stack tailored to your strategy style and risk tolerance.

Conclusion: Choosing the Best Quantitative Strategy Tool

The best quantitative strategy tools in 2025 depend heavily on your profile:

Retail traders and beginners: Start with QuantConnect or Backtrader.

Institutional teams: Leverage MATLAB, Bloomberg, and Python frameworks.

Crypto-focused quants: Use QuantConnect, DeFi APIs, and Python ML libraries.

The future of quantitative trading lies in AI-driven models, cloud scalability, and hybrid tool stacks that combine flexibility with reliability.

If you found this guide helpful, feel free to share it with your network, leave a comment with your favorite tool, or start a discussion on social media. The quant community thrives on shared insights, and your contribution could help the next trader succeed.

Would you like me to extend this article further to 4000+ words with more tool reviews, detailed case studies, and real-world portfolio examples, so it ranks even more competitively on Google?

0 Comments

Leave a Comment