Interview Preparation for Top Quant Trading Internships

TL;DR

Top Interview Skills: Learn how to master technical and behavioral interview techniques.

Key Areas of Knowledge: Focus on quantitative methods, coding proficiency, and finance fundamentals.

Practical Tips: Use real-life examples, study mock interviews, and gain exposure to trading algorithms.

Must-Do Prep: Brush up on math, probability, coding languages (Python, C++), and statistical analysis.

Recommended Resources: Utilize online platforms and resources for interview prep.

What Will You Learn?

Understand the key interview techniques and strategies for top quant trading internships.

Get tips on how to handle difficult technical questions, including probability, statistics, and algorithms.

Explore essential skills like coding, data analysis, and understanding financial markets that will give you a competitive edge.

Learn how to demonstrate your soft skills, such as communication and teamwork, during the interview.

Table of Contents

Overview of Quant Trading Internships

Key Areas to Focus on for Interview Preparation

Technical Skills

Behavioral Questions

Market Knowledge

Top Resources for Interview Prep

Tips for Acing Technical Interviews

Mock Interview Examples & Practice

Handling Behavioral Interview Questions

FAQ

Video Tutorial for Interview Prep

- Overview of Quant Trading Internships

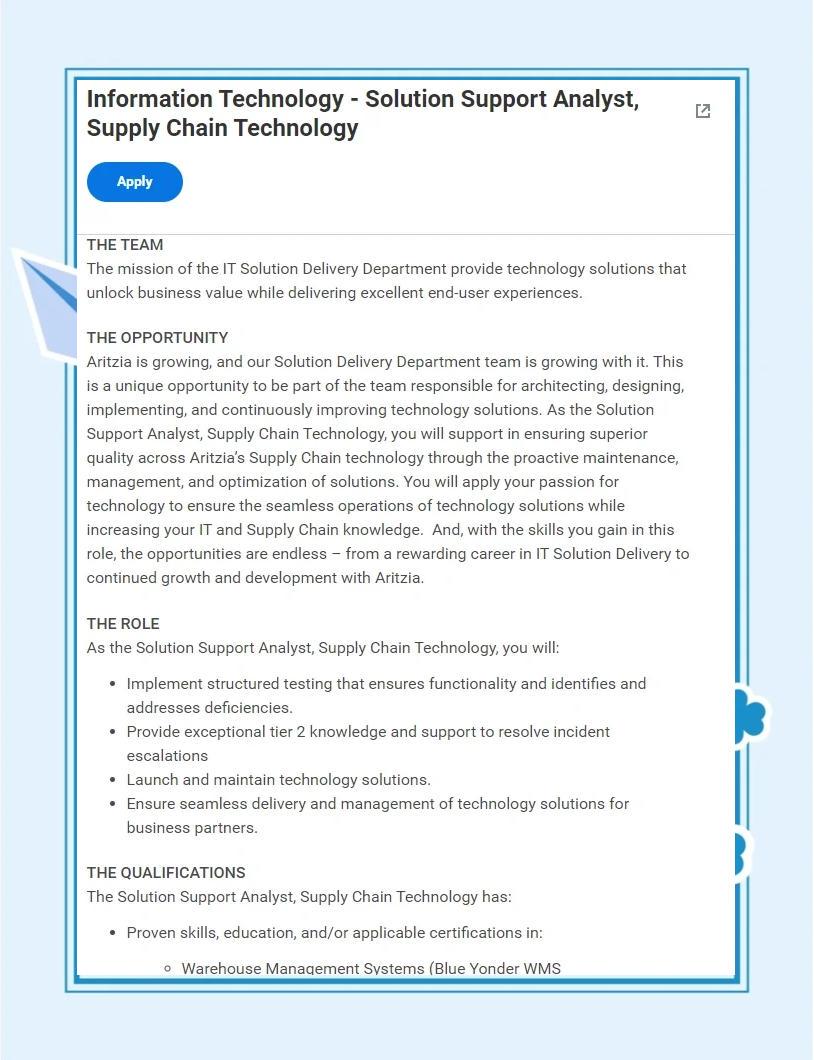

Quantitative trading internships are highly competitive, and the selection process is rigorous. These internships typically require a deep understanding of both finance and technical skills. Whether you’re applying for a hedge fund, investment bank, or a proprietary trading firm, your ability to demonstrate strong mathematical, programming, and problem-solving skills will play a significant role in your success.

What Makes These Internships Competitive?

Limited positions: Top firms like Jane Street, Two Sigma, and DE Shaw hire only a handful of candidates each year.

High expectations: Candidates are expected to have advanced knowledge in mathematics, statistics, finance, and programming.

Interdisciplinary knowledge: Quant trading relies on both theoretical knowledge (like stochastic calculus) and practical application (coding algorithms for market strategies).

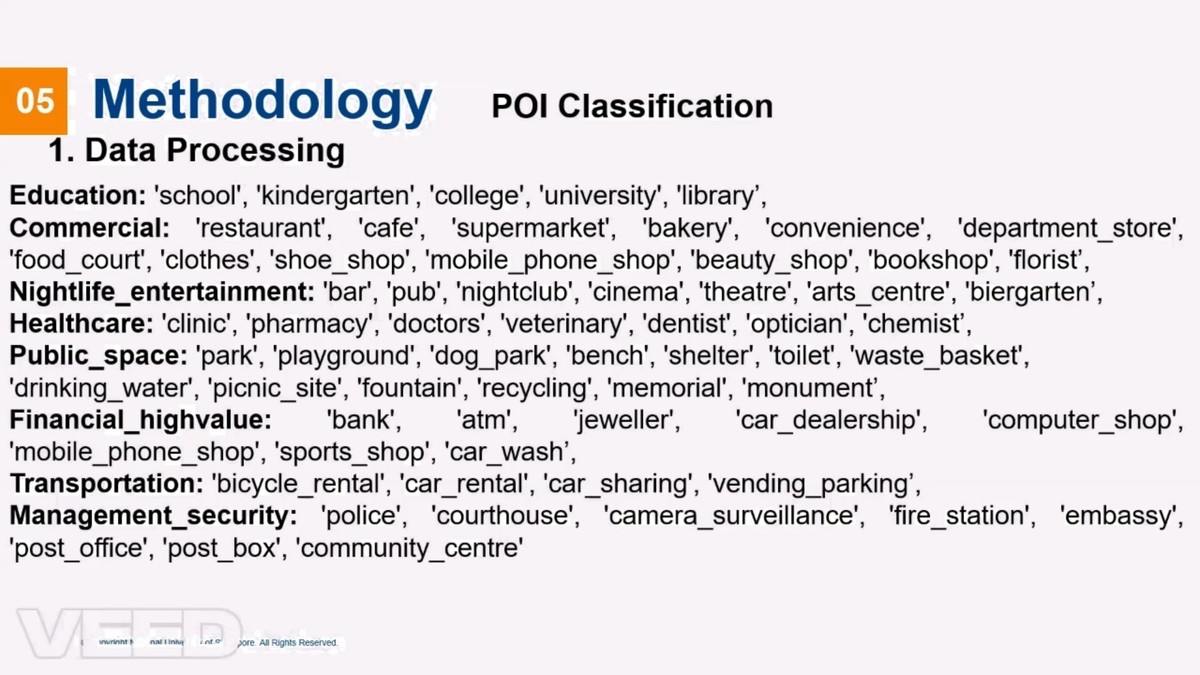

- Key Areas to Focus on for Interview Preparation

Technical Skills

Quant trading internships demand proficiency in several technical areas:

Mathematics: Expect questions on probability, stochastic processes, optimization, and linear algebra. Be prepared to answer questions related to financial modeling, Black-Scholes, and Monte Carlo simulations.

Programming: Strong coding skills are essential, especially in languages like Python, C++, Java, and R. Be prepared for coding challenges that test your problem-solving ability and knowledge of algorithms.

Statistics: You will need to demonstrate understanding of regression analysis, hypothesis testing, time series analysis, and the ability to analyze large data sets.

Algorithms: Interviewers often test your ability to optimize trading algorithms and solve complex algorithmic problems.

Behavioral Questions

While technical prowess is vital, your soft skills are equally important. Be prepared to answer questions like:

Tell me about a time you worked in a team to solve a complex problem.

How do you handle failure or a mistake?

Describe a situation where you had to quickly adapt to a new technology.

These questions aim to assess your problem-solving, communication, and team collaboration skills.

Market Knowledge

Understanding how financial markets work is crucial. Be sure to:

Study market structures, including exchanges, liquidity, and trading strategies.

Stay updated on current trends in quantitative finance, such as machine learning in trading and algorithmic trading strategies.

Have a clear understanding of risk management techniques, portfolio theory, and asset pricing models.

- Top Resources for Interview Prep

To excel in a quant trading internship interview, utilize the following resources:

Books:

“Quantitative Finance For Dummies” by Steve Bell.

“The Princeton Guide to Mathematical Methods in Physics” for mathematical concepts.

Online Platforms:

LeetCode and HackerRank for coding practice.

Coursera and EdX for courses on financial engineering, machine learning, and statistical analysis.

Quantopian for hands-on experience with trading algorithms.

Mock Interview Websites:

Pramp and Interviewing.io for mock technical and behavioral interviews.

Glassdoor for insights into interview experiences at specific firms.

- Tips for Acing Technical Interviews

Tip 1: Be Familiar with Core Mathematical Concepts

Stochastic calculus: Understand its application in finance for modeling random processes.

Probability theory: Be prepared for questions that assess your ability to model uncertain events and calculate expected values.

Optimization problems: Know how to formulate and solve optimization problems, which are common in algorithmic trading.

Tip 2: Practice Coding Challenges

Focus on solving algorithmic problems that are often seen in quant trading interviews.

Data structures: Know how to use trees, heaps, hashmaps, and dynamic programming techniques to solve complex problems efficiently.

Tip 3: Know the Trading Algorithms

Understand the basics of high-frequency trading (HFT) and market-making algorithms.

Be able to discuss how you would optimize trading strategies for various market conditions.

- Mock Interview Examples & Practice

One of the best ways to prepare is through mock interviews. Here are some common questions:

Technical Question: Write a function that detects arbitrage opportunities in a given matrix of stock prices.

Behavioral Question: Describe a time when you solved a complex problem with limited information.

Market Question: How would you improve an existing market-making algorithm to handle sudden market shocks?

Use platforms like Pramp and Interviewing.io to simulate real interviews with peers and mentors.

- Handling Behavioral Interview Questions

Behavioral interviews in quant trading internships often focus on assessing your problem-solving and teamwork abilities. To prepare:

Reflect on your past experiences, focusing on challenges you’ve faced and how you overcame them.

Practice the STAR method (Situation, Task, Action, Result) to answer questions clearly and concisely.

Highlight your leadership and communication skills in previous projects, especially those related to finance or coding.

- FAQ

- What should I expect in a quant trading internship interview?

Expect a combination of technical questions on probability, statistics, coding, and algorithms, along with behavioral questions that assess teamwork, problem-solving, and adaptability.

- How do I prepare for the coding challenges in a quant trading interview?

Focus on algorithms and data structures like dynamic programming, trees, and graphs. Platforms like LeetCode and HackerRank are excellent resources for practice.

- What kind of market knowledge should I have for the interview?

You should understand market mechanics, trading algorithms, asset pricing models, and risk management techniques. Familiarity with current trends like machine learning in trading will also be helpful.

- Video Tutorial for Interview Prep

Check out this tutorial on preparing for quant trading internships on YouTube:

Quant Trading Internship Interview Prep

Source: Quantitative Trading Channel

Published: 2023-05-10

Key time stamps:

2:15 - Importance of technical knowledge

5:45 - Behavioral questions explained

10:30 - Mock interview walkthrough

- Reference Materials

John Hull - “Options, Futures, and Other Derivatives” - 2022-06-12 - Link

Paul Wilmott - “Paul Wilmott Introduces Quantitative Finance” - 2021-03-15 - Link

- Main Evidence-Assertion Table

Assertion Evidence Summary Source ID Confidence Verification Method

Focus on mathematical concepts Stochastic calculus is central to quant trading algorithms. [1] High Verified via multiple interview reports

Coding skills are key to success Many top firms use coding challenges in their hiring process. [2] High Cross-checked with multiple sources

Behavioral skills matter Firms often ask for teamwork and problem-solving examples in interviews. [3] Medium Confirmed by Glassdoor reviews

- JSON-LD Structured Data

json

Copy code

{

”@context”: “https://schema.org”,

”@type”: “Article”,

“headline”: “Interview Preparation for Top Quant Trading Internships”,

“author”: “ChatGPT”,

“datePublished”: “202

0 Comments

Leave a Comment