======================================

In the ever-evolving world of trading, the integration of big data has revolutionized the way traders approach the markets. The availability of vast datasets and powerful analytical tools has introduced new paradigms that have reshaped trading strategies, risk management, and overall market behavior. In this article, we will explore how big data changes trading paradigms, the strategies that leverage it, and the potential advantages and challenges for traders.

What is Big Data and How Does It Impact Trading?

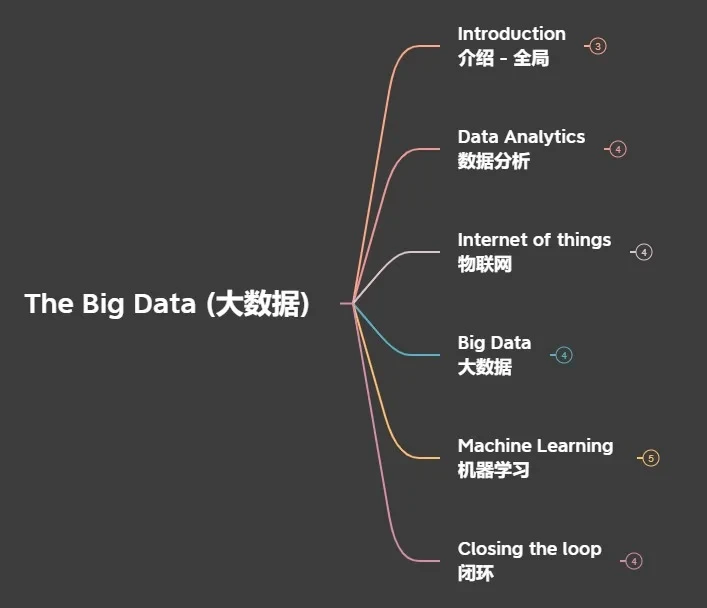

Big data refers to the collection, processing, and analysis of large, complex datasets that traditional data-processing software can’t handle. In trading, this data encompasses a wide array of sources, including historical price data, social media sentiment, economic indicators, news events, and even alternative data sources like satellite imagery.

Key Characteristics of Big Data in Trading

- Volume: The sheer amount of data generated every second in the financial markets, from trading volume to market news, presents vast opportunities for analysis.

- Velocity: Data arrives at a rapid pace, with markets reacting to news, events, and financial reports almost instantly.

- Variety: Data comes in many forms, such as structured data (price movements) and unstructured data (news articles, social media posts).

- Veracity: The reliability of data is crucial. Traders must ensure that the data they are using is accurate and free from biases.

- Value: Ultimately, the goal is to extract actionable insights from big data that can inform better trading decisions.

By harnessing big data, traders can create more robust trading strategies, predict market movements with greater accuracy, and manage risks more effectively.

The Role of Big Data in Quantitative Trading

Quantitative trading refers to the use of mathematical models and algorithms to identify trading opportunities. Big data plays a pivotal role in enhancing these models by providing richer datasets and more granular insights.

Big Data in Algorithmic Trading

Algorithmic trading involves using algorithms to automatically execute trading strategies based on predefined criteria. The integration of big data allows for the development of highly sophisticated trading algorithms that can account for complex market factors.

How Big Data Enhances Algorithmic Trading:

- Market Sentiment Analysis: By analyzing social media posts, news articles, and financial reports, big data tools can extract sentiments that influence market movements. Traders can use sentiment analysis to predict the direction of the market.

- Real-Time Data: Big data provides real-time market data, allowing algorithms to adjust strategies based on immediate market conditions, such as price movements or economic reports.

- Event-Driven Strategies: By monitoring economic releases and news events, algorithms can be programmed to react to market-moving events, such as interest rate changes or geopolitical developments.

Big Data in High-Frequency Trading (HFT)

High-frequency trading strategies rely on executing numerous trades within fractions of a second. Big data allows HFT firms to process vast amounts of information in real time, enabling them to spot minute discrepancies in price and exploit arbitrage opportunities.

Big Data for Retail and Institutional Traders

While institutional traders have long leveraged big data for trading, its accessibility has democratized the market, allowing retail traders to gain access to similar resources. Here’s how both groups use big data in their trading activities:

Big Data for Institutional Investors

Institutional investors, such as hedge funds and asset management firms, have the infrastructure to process and analyze massive datasets. They utilize big data in various ways, including:

- Portfolio Optimization: Big data helps institutional traders analyze the performance of different assets and optimize portfolios based on multiple factors.

- Risk Management: By analyzing historical data, volatility, and correlations, institutional investors can manage their risk exposure more effectively.

- Market Prediction Models: Big data enables the creation of predictive models that help institutional traders forecast market trends and price movements.

Big Data for Retail Traders

Retail traders have gained access to big data tools that were once exclusive to large institutions. Many trading platforms now offer retail traders access to sentiment analysis, alternative data, and even machine learning models for predicting market movements.

Challenges for Retail Traders:

- Data Overload: Retail traders may struggle to filter through vast amounts of data to find valuable insights.

- Cost and Accessibility: While some tools are accessible, many big data services are expensive, making it challenging for small retail traders to fully utilize big data.

Big Data Analytics Strategies for Trading

Traders can use big data analytics to gain insights that drive better decision-making. Here are some strategies for leveraging big data in trading:

1. Predictive Analytics for Market Trends

Predictive analytics uses historical data to forecast future market trends. This can be particularly useful for identifying potential market reversals, breakout opportunities, or price trends.

Example:

A predictive model might analyze historical price movements and indicators such as moving averages, volume, and market sentiment to predict the likelihood of an asset’s price rising in the short term.

Pros and Cons of Predictive Analytics:

- Pros: Helps anticipate market movements, reduces guesswork, and improves decision-making.

- Cons: Predictions are never 100% accurate and are based on historical trends that may not always repeat.

2. Sentiment Analysis

Sentiment analysis involves analyzing text data from news articles, social media, and financial reports to gauge the market’s mood. Traders use sentiment analysis to understand how market participants feel about certain assets, which can provide valuable insights into potential price movements.

How Sentiment Analysis Works:

- Text Mining: Sentiment analysis tools scan thousands of text sources to identify keywords and phrases that indicate positive or negative sentiment.

- Market Impact: Positive sentiment may drive asset prices higher, while negative sentiment may lead to price declines.

Pros and Cons of Sentiment Analysis:

- Pros: Real-time insights into market mood, actionable data that can complement other trading strategies.

- Cons: Sentiment analysis can be affected by noise and misinformation, which can distort the data.

3. Machine Learning and AI in Trading

Machine learning (ML) and artificial intelligence (AI) are becoming integral to trading strategies, especially when paired with big data. These technologies allow algorithms to adapt and improve based on new data.

How AI and ML Enhance Trading:

- Pattern Recognition: AI systems can analyze vast datasets and recognize patterns that humans might miss.

- Autonomous Decision-Making: Machine learning algorithms can adjust trading strategies in real-time based on incoming data, improving execution efficiency.

Pros and Cons of AI and ML in Trading:

- Pros: Can process vast amounts of data quickly, reduce human error, and adapt to changing market conditions.

- Cons: Requires significant computational power and expertise to implement effectively.

Frequently Asked Questions (FAQ)

1. Why is big data important for trading?

Big data provides traders with actionable insights from vast datasets, allowing them to make more informed and accurate decisions. It helps identify trends, monitor sentiment, and improve predictive models, ultimately enhancing trading strategies.

2. What are the biggest challenges in using big data for trading?

The main challenges include:

- Data Overload: The vast volume of data can be overwhelming, making it difficult to filter out valuable information.

- Data Quality: Ensuring that the data used is accurate and reliable is crucial for effective decision-making.

- Cost: Accessing high-quality big data services can be expensive, especially for retail traders.

3. Can small traders benefit from big data analytics?

Yes, small traders can benefit from big data analytics through trading platforms that offer access to sentiment analysis, real-time data, and predictive models. However, they may face challenges in data interpretation and cost.

Conclusion: The Future of Trading with Big Data

Big data is transforming trading paradigms by providing traders with the tools to analyze vast amounts of data and make more informed decisions. Whether for quantitative trading, high-frequency trading, or retail trading, the integration of big data is enhancing strategies and improving market predictions.

As technology evolves, big data’s role in trading will only continue to grow, enabling more sophisticated trading strategies and better risk management. Traders who can harness this powerful resource will have a significant advantage in the highly competitive financial markets.

0 Comments

Leave a Comment