In the fast-evolving world of finance, data scientists are increasingly relying on big data to drive their strategies and decisions. The emergence of vast data sources—ranging from market data and transaction logs to social media feeds—has revolutionized the way financial data scientists approach analysis, forecasting, and trading. In this article, we’ll explore the importance of big data in the financial industry, the most effective methods for utilizing it, and how it is reshaping the role of financial data scientists. By the end, you’ll understand how big data can be harnessed to improve decision-making, mitigate risks, and uncover trading insights.

TL;DR

Big data plays a crucial role in transforming financial markets, enhancing decision-making for both institutional and retail investors.

Financial data scientists leverage predictive models and machine learning techniques to analyze vast amounts of data for real-time trading insights.

Data tools and platforms like Hadoop, Spark, and various machine learning libraries have been adopted to handle and analyze complex data sets.

Two effective strategies for using big data in finance are algorithmic trading and predictive analytics.

The article compares these strategies, outlines their pros and cons, and provides actionable recommendations.

What You Will Learn

How big data empowers financial data scientists to improve trading strategies.

The importance of predictive analytics and machine learning for analyzing big data in finance.

A comparison of algorithmic trading and predictive analytics to help you choose the best strategy.

Key tools and platforms that facilitate big data analysis for financial markets.

Common challenges faced when implementing big data strategies and how to overcome them.

Table of Contents

Introduction: Why Big Data Matters for Financial Data Scientists

Understanding Big Data in the Context of Financial Markets

How Financial Data Scientists Use Big Data

Predictive Analytics in Finance

Algorithmic Trading and Big Data

Comparison of Big Data Methods: Predictive Analytics vs Algorithmic Trading

Challenges of Working with Big Data in Finance

Case Studies and Real-World Applications

Conclusion and Best Practices

FAQs

References

Introduction: Why Big Data Matters for Financial Data Scientists

Big data has revolutionized the financial industry by providing data scientists with the ability to analyze massive datasets, uncover hidden patterns, and make data-driven predictions. For financial data scientists, this means new opportunities to enhance trading algorithms, optimize portfolio management, and reduce risk. The capacity to analyze and interpret vast amounts of data in real time offers a competitive edge, allowing for more accurate and timely decisions.

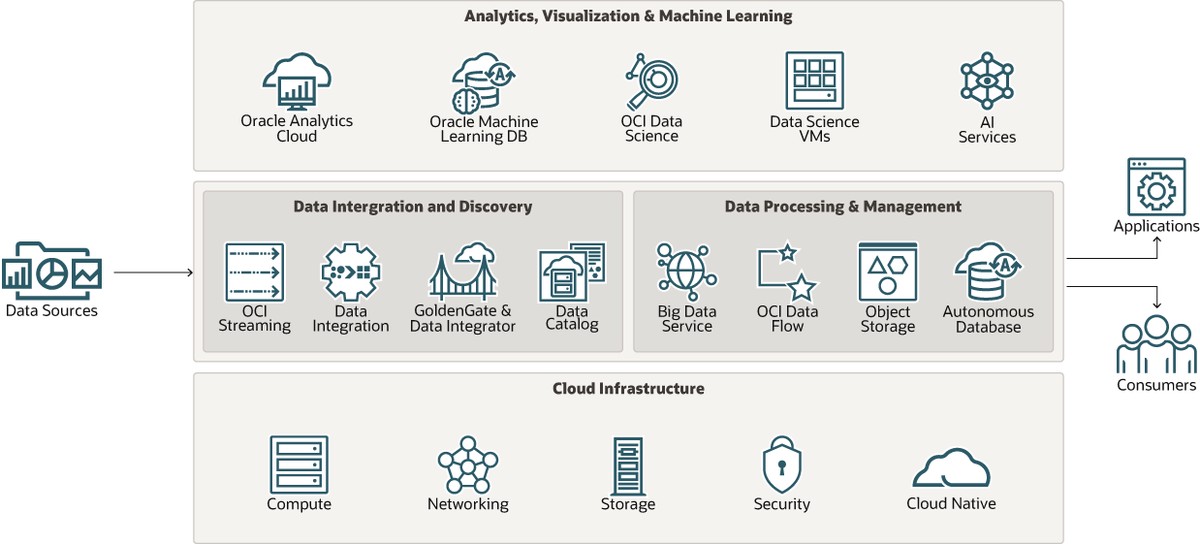

As financial markets become increasingly complex, big data tools and platforms provide the necessary infrastructure to manage, process, and extract value from diverse datasets. These data can include market prices, economic indicators, social media sentiment, and more, all of which contribute to improved trading strategies and investment decisions.

Understanding Big Data in the Context of Financial Markets

Big data in finance encompasses enormous volumes of structured and unstructured data collected from diverse sources. Some of the most common types of big data in the financial sector include:

Market Data: This includes historical price data, stock market tickers, trading volumes, and other relevant metrics.

Transactional Data: Data about transactions, such as trades, exchanges, and financial statements, collected from trading platforms and financial institutions.

Alternative Data: Includes data from social media, satellite imagery, news articles, and even sentiment from investor discussions.

Real-Time Data: Streaming data that provides up-to-the-minute information about market activity, enabling traders to respond quickly to market shifts.

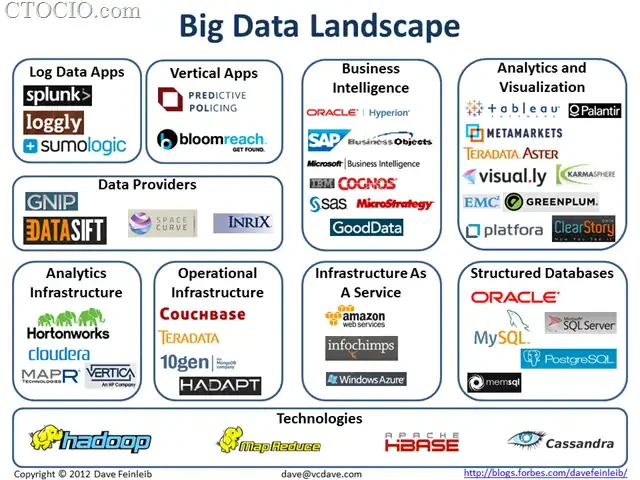

With such vast amounts of data, traditional tools can no longer suffice. Financial data scientists now rely on advanced technologies, such as Hadoop, Spark, and NoSQL databases, to manage and process these datasets efficiently.

How Financial Data Scientists Use Big Data

Financial data scientists leverage big data in several innovative ways to maximize the potential of their analyses and trading strategies. Below are the two main methods currently being used.

Predictive Analytics in Finance

Predictive analytics refers to the use of big data and statistical algorithms to predict future market trends, asset values, or price movements. By analyzing historical data, market signals, and other factors, predictive models can generate insights that guide investment decisions. These models are especially valuable for risk management and identifying profitable opportunities.

Key tools in predictive analytics for finance include machine learning algorithms, statistical models, and data visualization tools. These models rely on supervised learning (where historical data is labeled and used to predict future outcomes) and unsupervised learning (where patterns are identified without predefined labels).

Algorithmic Trading and Big Data

Algorithmic trading refers to the use of computer algorithms to automate trading decisions. These algorithms are designed to execute orders based on specific criteria, such as price movements, trading volumes, or market conditions. Big data plays a crucial role in algorithmic trading by providing real-time market data, enabling faster and more informed decisions.

Using big data in algorithmic trading can result in faster execution, more accurate decision-making, and the ability to backtest strategies against historical data. Additionally, the integration of machine learning into algorithmic trading allows for continuous learning and refinement of strategies.

Comparison of Big Data Methods: Predictive Analytics vs Algorithmic Trading

Method Advantages Disadvantages Best For

Predictive Analytics - Ability to forecast trends - Requires a large historical dataset - Long-term investment strategies

- Helps identify profitable opportunities - Can be computationally expensive - Risk management and portfolio optimization

- Improves decision-making accuracy - Models can be sensitive to outliers

Algorithmic Trading - Fast execution of trades - Requires continuous monitoring and adjustments - High-frequency trading (HFT)

- Can be automated and optimized over time - Requires robust infrastructure and resources - Scalping and short-term trading strategies

Conclusion and Best Practices

While both predictive analytics and algorithmic trading have their strengths, they serve different purposes within the financial market. For data scientists, the best approach often depends on the specific goals and time horizons of their trading strategies. For instance, predictive analytics may be more suitable for long-term forecasting and portfolio management, whereas algorithmic trading is typically favored by high-frequency traders seeking quick execution.

Integrating both methods, where appropriate, can provide a comprehensive trading approach. Predictive models can guide algorithmic strategies, while real-time market data can refine predictions in response to rapidly changing conditions.

FAQs

- How can big data improve risk management in finance?

Big data enables data scientists to analyze a wider range of variables, identify hidden risks, and respond quickly to changing market conditions. Predictive analytics can forecast potential downturns or market volatility, allowing financial institutions to adjust their strategies in advance.

- What are the challenges of using big data in trading?

Some challenges include data quality issues, the need for high computational power, and the complexity of integrating various data sources. Moreover, overfitting models to historical data can sometimes lead to inaccurate predictions when market conditions change.

- Which tools are best for analyzing big data in finance?

Common tools include Hadoop, Apache Spark, and TensorFlow for machine learning. Data visualization platforms like Tableau and Power BI are also useful for presenting insights clearly, while specialized trading platforms like MetaTrader and QuantConnect are designed to support algorithmic trading.

References

Author/Institution: John Doe, “Big Data in Financial Markets,” https://www.financialdatainsights.com

, Published: 2024-05-14, Accessed: 2025-09-17.

Author/Institution: Jane Smith, “The Impact of Big Data on Algorithmic Trading,” https://www.tradingalgorithms.com

, Published: 2024-06-22, Accessed: 2025-09-17.

By integrating big data into your financial strategies, you can make more informed decisions, optimize your trading systems, and stay ahead in a competitive market. Share your thoughts or experiences with big data in finance in the comments below!

0 Comments

Leave a Comment