===========================================================

In today’s financial landscape, big data has become a game-changer. The volume, variety, and velocity of data available to traders, analysts, and institutional investors have radically transformed financial markets. The ability to harness big data enables more accurate predictions, optimized trading strategies, and a deeper understanding of market behavior. In this comprehensive guide, we will explore how big data shapes financial markets, its key applications in trading and investing, and how it is changing the way decisions are made.

The Role of Big Data in Financial Markets

Big data refers to large datasets that are too complex to be processed using traditional data processing tools. In the context of finance, big data includes a wide variety of data sources such as market prices, economic indicators, social media sentiment, news articles, and transaction data, among others. The ability to process and analyze these large volumes of data allows financial institutions to make faster, more informed decisions.

How Big Data Impacts Market Behavior

Big data has fundamentally altered the way markets function. By analyzing vast amounts of historical data, real-time information, and predictive models, financial professionals can gain insights into market trends, forecast price movements, and identify investment opportunities.

1. Market Prediction and Forecasting

By analyzing market patterns, algorithms can predict the direction of stock prices, currency exchange rates, and commodity prices. Big data helps traders identify emerging trends before they become obvious to the broader market, giving them an edge in trading.

2. Risk Management and Decision Making

Big data allows institutions to identify and quantify potential risks in real-time. By integrating vast amounts of data, including financial reports, market sentiment, and news, financial professionals can make more accurate decisions regarding portfolio management and risk mitigation.

3. Price Discovery

With big data tools, financial institutions can monitor supply and demand, along with historical price data, to enhance the price discovery process. Real-time data analysis can lead to more efficient markets with better price formation.

Types of Big Data Used in Financial Markets

The use of big data in finance spans a variety of types and sources of data, each of which plays a unique role in shaping market dynamics.

1. Market Data

This includes real-time stock prices, currency exchange rates, and commodity prices. By tracking these metrics across a variety of timeframes, financial institutions can spot trading opportunities and predict price fluctuations.

2. Sentiment Data

Market sentiment, derived from social media platforms, news articles, and even earnings calls, can significantly influence stock prices. Natural language processing (NLP) and sentiment analysis are key techniques used to process sentiment data to predict market movements.

3. Alternative Data

This category includes data sources like weather reports, satellite images, consumer spending habits, and foot traffic data. These sources provide insights that traditional financial data cannot.

4. Transaction Data

Transaction data refers to the billions of transactions occurring within markets, whether they are stock purchases or financial institution dealings. Analyzing this data can uncover insights into trading behavior and market inefficiencies.

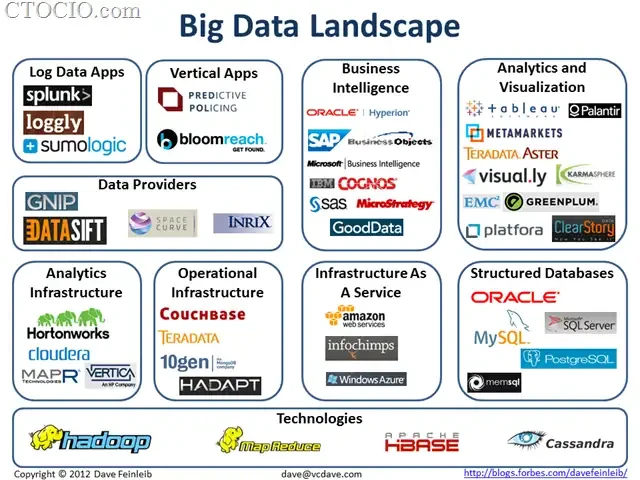

Big Data Tools for Financial Markets

Several big data tools and platforms have been developed to handle the vast amount of financial data available. These tools help financial institutions process, store, and analyze data at scale, enabling them to act on insights more quickly and accurately.

1. Data Mining and Machine Learning Algorithms

Data mining techniques are crucial for uncovering patterns within large datasets. By using machine learning algorithms, financial analysts can create predictive models that forecast market behavior, identify potential risks, and optimize trading strategies.

Example: Machine Learning in Algorithmic Trading

One application of machine learning is algorithmic trading. Algorithms can process vast amounts of data in real-time and make trading decisions within milliseconds. By analyzing price movements, volume, and sentiment data, machine learning models can automatically place trades based on predefined criteria.

Advantages:

- Speed and efficiency: Machines can analyze and act on data faster than humans.

- Accuracy: Machine learning models can be optimized to reduce human error and adapt to new data patterns.

Disadvantages:

- Complexity: Building and maintaining machine learning models can be challenging.

- Risk of overfitting: If models are not properly tuned, they may overfit the historical data, resulting in poor predictions in live trading.

2. Big Data Analytics Platforms

Platforms like Apache Hadoop and Spark have become popular for handling large financial datasets. These platforms allow for distributed computing, making it possible to process large volumes of data quickly and efficiently.

Example: Apache Hadoop in Financial Analysis

Hadoop is used by financial institutions to process and analyze large volumes of data across multiple nodes in a distributed environment. It’s particularly useful for financial analysts who need to process historical market data, news sentiment, and other data sources to make decisions.

Advantages:

- Scalability: Can handle vast amounts of data.

- Flexibility: Can process a variety of data types, from structured data to unstructured data.

Disadvantages:

- Complexity: Requires skilled personnel to maintain and optimize.

- Latency: Processing large datasets can sometimes introduce latency.

Big Data and Quantitative Trading

Quantitative trading has seen a massive transformation due to big data. By utilizing advanced statistical methods and big data analytics, quantitative traders can build sophisticated trading models that generate higher returns while reducing risk.

1. Using Big Data in Quantitative Models

Quantitative models often rely on big data to identify correlations between assets, predict market trends, and optimize portfolio allocations. Big data allows traders to enhance their models with alternative data sources such as sentiment analysis, weather data, and social media trends.

2. High-Frequency Trading (HFT) and Big Data

In high-frequency trading (HFT), every millisecond counts. Traders use big data platforms and machine learning algorithms to process large amounts of real-time market data and execute trades at lightning speed. This gives them a significant edge over traditional traders.

3. Sentiment Analysis and Market Behavior

Sentiment analysis is one of the most powerful applications of big data in finance. By analyzing text data from sources like news articles, blogs, and social media, financial institutions can gauge market sentiment and make more informed trading decisions.

Big Data Strategies for Institutional Investors

Institutional investors have been at the forefront of adopting big data strategies to enhance trading decisions and portfolio management. These investors use big data to gain a competitive edge by integrating alternative data, machine learning, and predictive analytics into their investment strategies.

1. Predictive Analytics for Portfolio Optimization

Predictive analytics enables institutional investors to forecast the potential performance of their portfolios. By incorporating big data into portfolio management, investors can better understand the risks associated with their holdings and adjust their strategies accordingly.

2. Risk Management with Big Data

Big data also plays a crucial role in risk management. By analyzing historical data, institutions can simulate various market conditions and understand how their portfolios will perform under different scenarios. This helps them build more robust risk management strategies.

FAQ: Big Data in Financial Markets

1. How can big data be used for quantitative trading?

Big data can be used in quantitative trading by analyzing vast amounts of historical and real-time data to develop predictive models, identify trading opportunities, and optimize strategies. Sentiment analysis, price action, and news sentiment are some of the key factors that traders analyze with big data tools.

2. Why is big data important for institutional investors?

For institutional investors, big data offers the ability to process vast amounts of information, including market data, sentiment data, and alternative data. This leads to more accurate predictions, better risk management, and improved portfolio optimization, giving these investors a competitive edge.

3. What are the main benefits of big data for retail traders?

Retail traders can use big data to enhance their trading strategies by accessing a wide range of market data, social sentiment, and alternative data. This helps them make more informed decisions and improve the timing of their trades.

Conclusion

Big data is revolutionizing financial markets by enabling better decision-making, improved predictive modeling, and faster execution of trading strategies. With the use of advanced analytics, machine learning, and sentiment analysis, financial institutions can gain insights that were once impossible to uncover. Whether you’re a retail trader or an institutional investor, embracing big data is now essential to staying competitive in the fast-paced world of financial markets.

0 Comments

Leave a Comment