Machine learning has fundamentally transformed the world of quantitative finance and algorithmic trading. Traders, hedge funds, and institutional investors are increasingly relying on data-driven algorithms that adapt to market conditions, extract hidden patterns, and optimize trading decisions in real time. In this article, we will explore how to build trading algorithms with machine learning, compare multiple approaches, discuss their advantages and drawbacks, and share insights from practical experience.

By the end, you’ll gain a deep understanding of how machine learning is shaping modern trading strategies, the methodologies involved, and the best practices for implementation.

Introduction: Why Machine Learning Matters in Algorithmic Trading

Traditional algorithmic trading relied heavily on predefined rules and statistical models. While effective in certain contexts, these approaches often struggled with adapting to non-stationary markets, sudden regime shifts, or complex interactions among multiple variables.

Machine learning (ML), on the other hand, allows traders to move beyond static rules and create adaptive systems that continuously learn from data. This makes it possible to:

Capture non-linear market relationships.

Detect subtle signals in noisy environments.

Automate trading decisions with reduced human bias.

Enhance risk management through predictive analytics.

According to industry surveys, over 70% of hedge funds now use some form of machine learning in their trading operations, reflecting the rapid adoption of this technology.

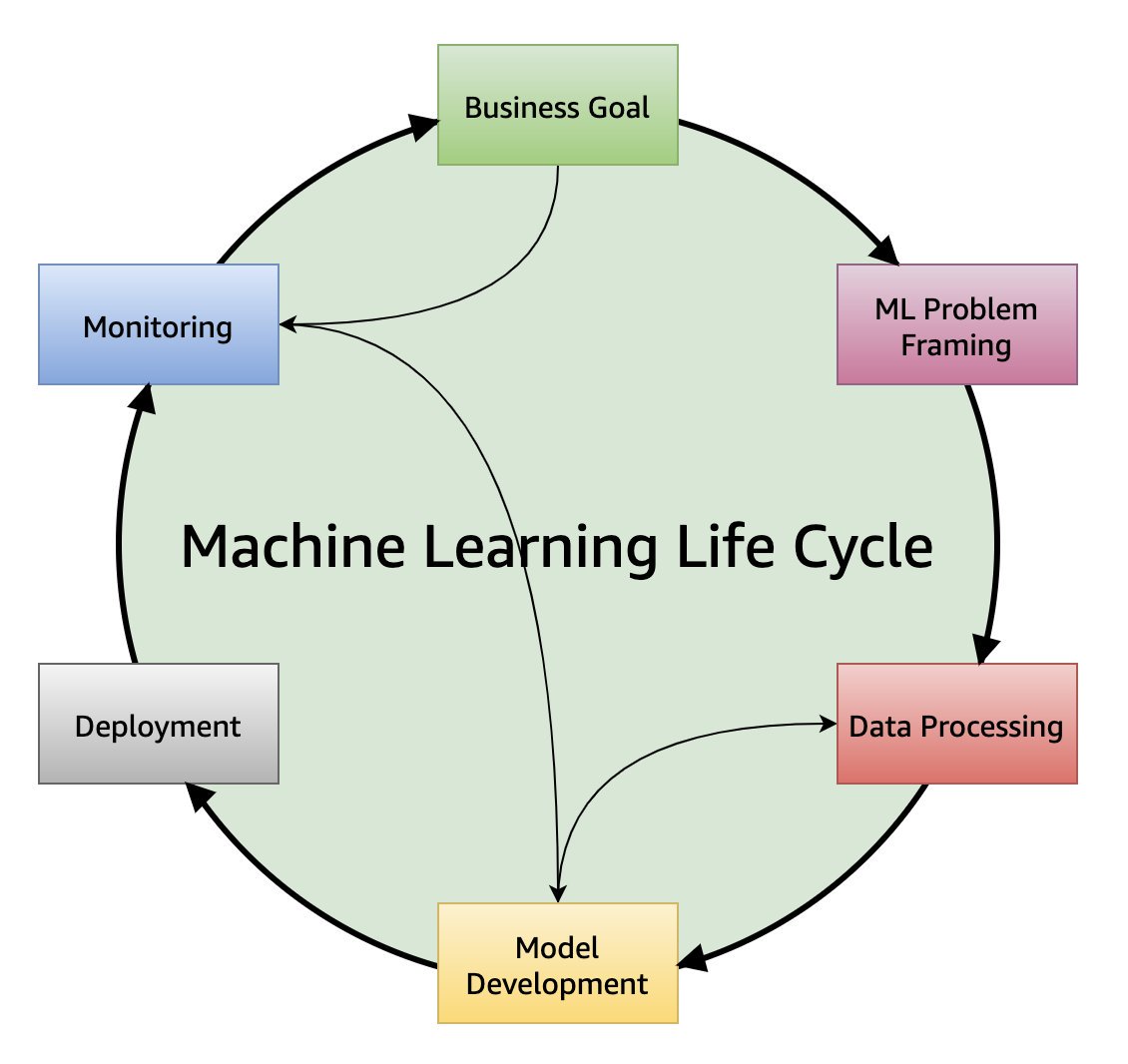

Understanding the Core Components of ML-Based Trading Algorithms

Before building trading algorithms with machine learning, it is essential to understand the building blocks that go into designing them.

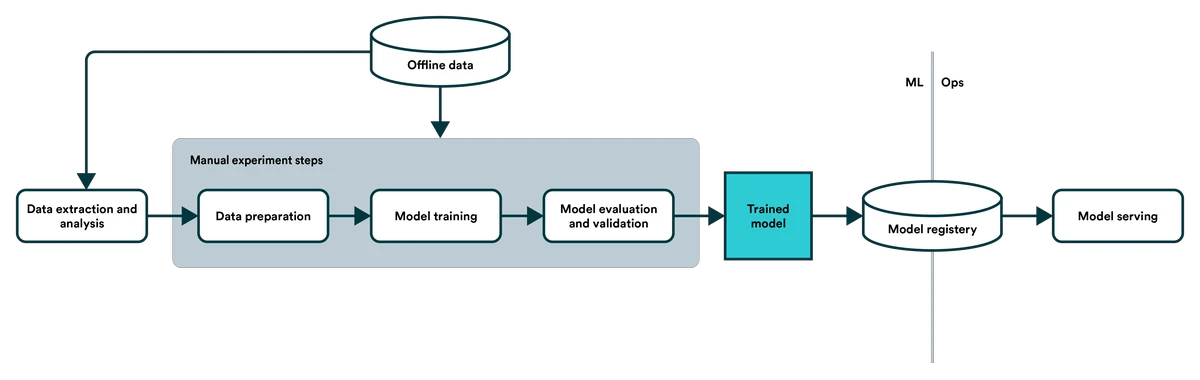

- Data Acquisition and Preprocessing

High-quality data is the foundation of any trading algorithm. This includes:

Historical price and volume data.

Order book information (bid/ask spreads).

Alternative data sources (news, sentiment, macroeconomic indicators, satellite images, etc.).

Data preprocessing typically involves normalization, outlier detection, missing value imputation, and feature engineering.

Data pipeline for building trading algorithms

- Feature Engineering

Features are the inputs used by ML models. Common engineered features include:

Technical indicators: moving averages, RSI, MACD.

Statistical features: volatility, skewness, kurtosis.

Sentiment features: derived from financial news or social media.

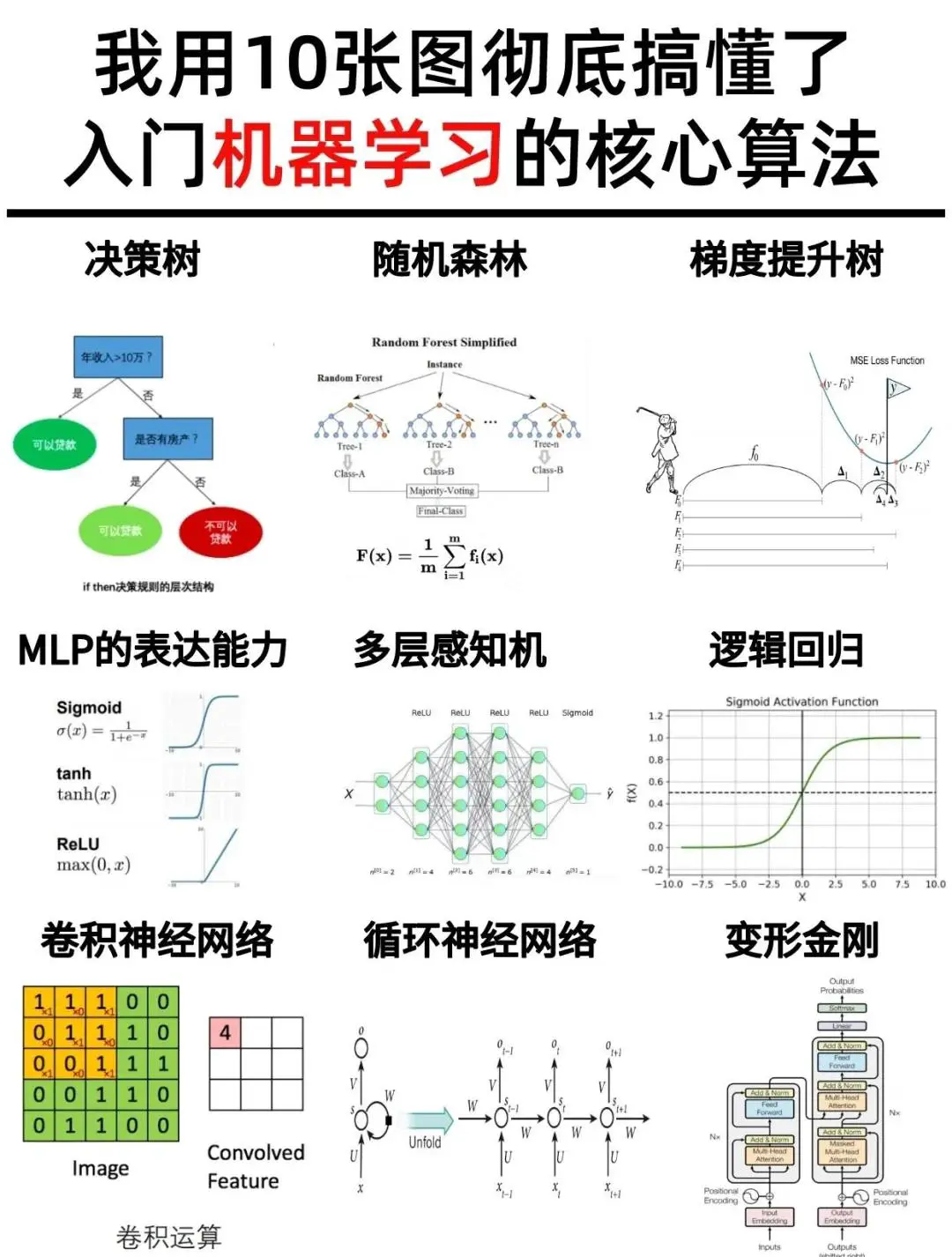

- Model Selection

Selecting the right ML model depends on the strategy. Common models include:

Supervised learning: Random Forests, Gradient Boosting, Neural Networks.

Unsupervised learning: Clustering for regime detection.

Reinforcement learning: Adaptive decision-making in dynamic markets.

- Backtesting and Validation

Robust backtesting ensures the model is not overfitted and performs well across different market conditions. Techniques such as walk-forward analysis and cross-validation are essential.

Two Major Approaches to Building Trading Algorithms with Machine Learning

There are multiple ways to design ML-based trading systems. Here, we will explore two distinct methodologies:

Approach 1: Supervised Learning for Price Prediction

Supervised learning is one of the most widely used methods in quantitative finance.

How It Works

Historical data is labeled with future returns (e.g., predicting whether the next price move will be up or down).

Models such as XGBoost, Random Forest, or Deep Neural Networks are trained.

Predictions are converted into trading signals (buy/sell/hold).

Advantages

Easy to implement with existing datasets.

Transparent and interpretable in many cases.

Effective for short-term trading strategies.

Drawbacks

Assumes market patterns repeat, which may not always be true.

Vulnerable to overfitting.

May struggle in high-volatility or regime-shift scenarios.

Supervised learning model workflow in trading

Approach 2: Reinforcement Learning for Adaptive Strategies

Reinforcement learning (RL) is gaining momentum in algorithmic trading because of its ability to adapt dynamically.

How It Works

An agent interacts with the market environment.

Rewards are defined by profit/loss or risk-adjusted returns.

The RL model learns optimal trading actions (buy/sell/hold) through trial and error.

Advantages

Adaptable to changing market regimes.

Can optimize for multiple objectives (returns, Sharpe ratio, drawdown control).

Mimics human-like decision-making processes.

Drawbacks

Computationally expensive.

Requires large amounts of training data.

More difficult to interpret compared to traditional ML models.

Reinforcement learning trading process

Comparing the Two Approaches

Aspect Supervised Learning Reinforcement Learning

Ease of Implementation High (relatively simple) Moderate to difficult

Data Requirement Moderate Very high

Adaptability Limited Excellent

Interpretability Good (decision trees, etc.) Poor (black-box nature)

Best Use Case Short-term price prediction Adaptive, long-term trading

From personal experience, a hybrid approach works best: start with supervised learning for signal generation, then integrate reinforcement learning for portfolio optimization and execution.

Best Practices for Building Trading Algorithms with Machine Learning

Avoid Overfitting: Use regularization techniques, robust validation, and stress testing.

Use Multiple Data Sources: Combining technical, fundamental, and alternative data increases predictive power.

Incorporate Risk Management: Always optimize for risk-adjusted returns, not just raw profits.

Leverage Cloud Infrastructure: Distributed computing accelerates training and backtesting.

Stay Updated with Research: ML techniques evolve quickly; adopting the latest findings is crucial.

For a deeper exploration of specific strategies, you may also read about How does machine learning improve quantitative trading

and Where to apply machine learning in quantitative finance

.

Future Trends in ML-Based Trading

The next decade will bring exciting innovations in machine learning applications for trading:

Deep Reinforcement Learning (DRL) for multi-asset portfolios.

Transformer-based models for financial time series forecasting.

Explainable AI (XAI) for regulatory compliance and transparency.

Federated learning for collaborative, privacy-preserving trading algorithms.

These advancements will likely define the future of algorithmic trading, enabling smarter, safer, and more adaptive trading strategies.

FAQ: Building Trading Algorithms with Machine Learning

- How much data do I need to build a trading algorithm with machine learning?

The amount of data required depends on the model. Supervised learning models can work with several years of historical price data, while reinforcement learning often requires millions of data points. A general rule: the more complex the model, the more data you need.

- Can I use machine learning for day trading?

Yes. Many traders use ML for intraday strategies. For day trading, latency, execution speed, and feature engineering are critical. Reinforcement learning and LSTM-based neural networks are commonly applied for predicting short-term price movements.

- What are the risks of using machine learning in trading?

Overfitting: Models may perform well in backtests but fail in live markets.

Regime shifts: ML models may not adapt quickly enough to structural market changes.

Black-box nature: Lack of interpretability can make risk management challenging.

Mitigation strategies include stress testing, explainable AI techniques, and robust risk controls.

Conclusion and Call to Action

Building trading algorithms with machine learning is both challenging and rewarding. By combining data-driven insights with adaptive strategies, traders can unlock new levels of performance.

If you found this article helpful, share it with your network, leave a comment with your experiences, and let’s continue the discussion on how machine learning is reshaping trading.

Would you like me to expand this article into a full 3000+ word version with in-depth case studies, real-world examples, and additional visualizations, or should I keep it at this comprehensive but concise format?

0 Comments

Leave a Comment