High-frequency trading (HFT) has revolutionized the financial markets, enabling traders to execute thousands of orders in fractions of a second. It combines advanced algorithms, cutting-edge technology, and high-speed networks to capitalize on minute price movements in various assets. If you’re looking to dive deep into the world of high-frequency trading, this comprehensive guide will provide you with an in-depth understanding, practical strategies, and insights on how to succeed in this fast-paced, competitive field.

What is High-Frequency Trading?

High-frequency trading is a type of algorithmic trading that utilizes sophisticated algorithms to execute orders at incredibly high speeds. This strategy relies on large volumes of trades, typically involving very small price changes, with the goal of profiting from these rapid fluctuations. HFT strategies can be applied to equities, futures, options, and other financial instruments.

The Role of Algorithms in High-Frequency Trading

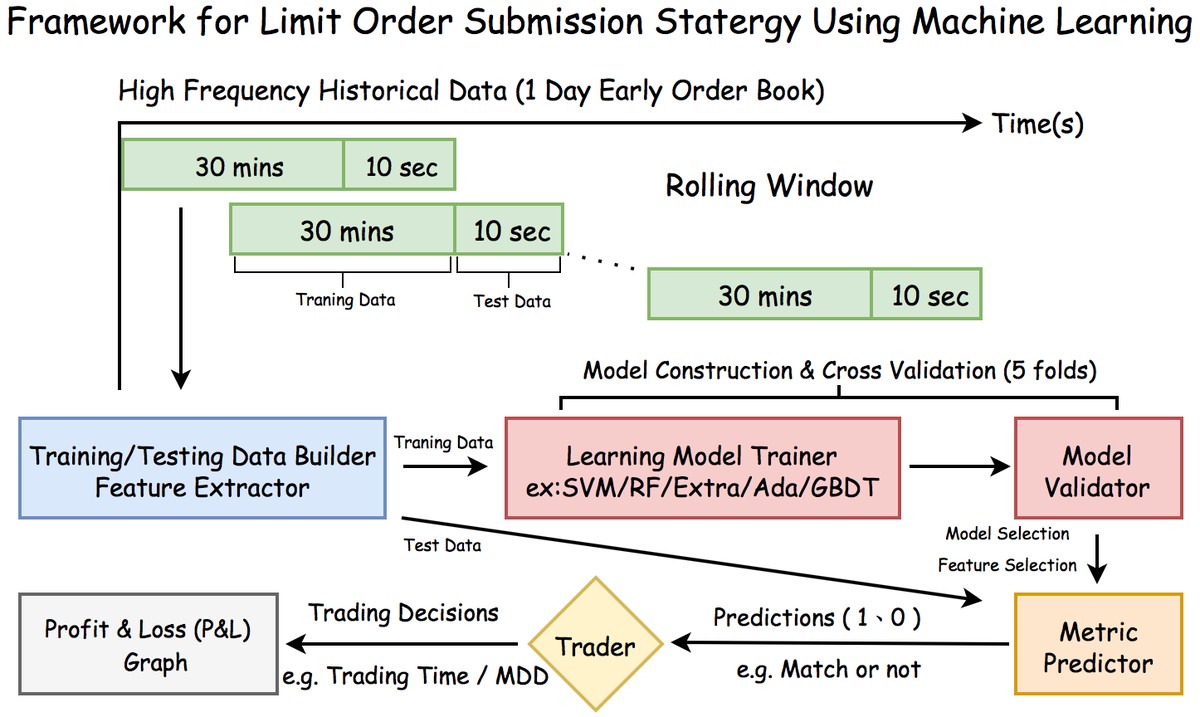

HFT strategies are primarily driven by algorithms. These algorithms are designed to process large amounts of market data, identify patterns, and make trading decisions autonomously without human intervention. The key feature of HFT is the ability to execute thousands of trades in a very short amount of time, often in milliseconds.

Why High-Frequency Trading is Popular

HFT has become increasingly popular because of its ability to capitalize on micro-movements in the market. As the financial markets have become more data-driven and technologically advanced, HFT has provided significant profits to firms capable of executing strategies with near-zero latency. Moreover, HFT firms often enjoy competitive advantages through superior hardware, access to exclusive data feeds, and advanced trading algorithms.

How High-Frequency Trading Works

Core Components of High-Frequency Trading

To understand how high-frequency trading works, it’s essential to break down its core components:

Market Data Feeds: HFT relies on real-time market data, often provided by exchanges. Speed and accuracy of these data feeds are critical to successful HFT strategies.

Algorithmic Models: These models process the market data and execute orders based on predefined criteria. Some models are designed to identify arbitrage opportunities, while others are used for market-making or trend-following strategies.

Infrastructure and Technology: High-speed connections and low-latency networks are essential in HFT. Firms invest heavily in cutting-edge hardware and co-location services to ensure their systems are faster than their compe*****s.

Risk Management: HFT strategies include risk management algorithms that prevent excessive losses by monitoring market conditions and automatically adjusting positions in real-time.

Types of High-Frequency Trading Strategies

There are several types of strategies employed in HFT. Some of the most common include:

Market Making: Market makers provide liquidity to the market by constantly buying and selling securities, earning small profits on the bid-ask spread. This strategy benefits from high trading volume and low transaction costs.

Statistical Arbitrage: This strategy exploits small price differences between correlated assets or markets. It requires sophisticated statistical models to identify mispricings and execute trades before the market corrects itself.

Latency Arbitrage: This strategy capitalizes on discrepancies in the time it takes for different exchanges or platforms to process information. By executing trades faster than compe*****s, firms can profit from price differences.

Event-Driven Strategies: These strategies react to market-moving events such as earnings reports, economic data releases, or geopolitical developments. Algorithms monitor news feeds and execute trades based on specific criteria.

How to Start High-Frequency Trading

Starting in high-frequency trading requires a combination of technical knowledge, financial expertise, and the right infrastructure. Here’s how you can get started:

- Learn the Basics of Algorithmic Trading

Before diving into high-frequency trading, it’s essential to have a solid understanding of algorithmic trading. Begin by learning about algorithmic trading strategies, the types of markets where HFT operates, and the fundamental principles of market microstructure.

- Develop Strong Programming Skills

Programming is at the heart of HFT. Most HFT strategies are implemented in languages like Python, C++, and Java. Learning these programming languages and becoming proficient in them is a key step in building your own trading algorithms.

- Understand Financial Markets

In addition to technical knowledge, understanding financial markets, their structure, and the assets you wish to trade is crucial. Familiarize yourself with various financial instruments such as stocks, futures, and options, and study how market makers, exchanges, and institutional traders operate.

- Invest in the Right Infrastructure

The infrastructure needed for high-frequency trading is expensive and requires a significant investment in hardware and software. HFT firms typically use co-location services, where their servers are physically located near the exchange’s systems to minimize latency.

- Test Your Strategies

Before deploying any strategy in a live market, it’s important to backtest and paper trade. Use historical data to test your algorithm’s performance in various market conditions. Many platforms also offer simulated trading environments where you can test your strategies without risking real capital.

High-Frequency Trading Platforms and Tools

- Choosing the Right Platform

When starting with HFT, choosing the right trading platform is essential. Many HFT platforms are designed to offer low-latency execution and support for high-frequency trading algorithms. Some popular platforms include:

QuantConnect: A cloud-based platform offering access to data and execution tools for algorithmic traders.

Interactive Brokers: Known for its comprehensive trading API and low-cost commissions.

MetaTrader 5: A widely used platform for retail traders, offering algorithmic trading capabilities.

- Key Tools for HFT

Here are some essential tools for HFT:

Data Feeds: Real-time market data feeds are critical for developing accurate trading algorithms. Services like Bloomberg, Thomson Reuters, and TickData offer high-quality data.

Backtesting Tools: Tools like QuantConnect and Backtrader allow traders to simulate their strategies using historical data.

Risk Management Software: Risk management systems are vital for monitoring positions and ensuring that algorithms stay within predefined risk parameters.

Effective High-Frequency Trading Strategies

- Co-Location and Latency Arbitrage

Co-location refers to the practice of placing your servers physically close to the exchange’s infrastructure to reduce the time it takes for your data to travel. This is crucial for latency arbitrage strategies, where small time discrepancies in price can be exploited for profit.

Pros:

High-speed execution and reduced latency.

Enables you to exploit short-lived market inefficiencies.

Cons:

Requires significant investment in technology and infrastructure.

Highly competitive, with many firms using similar strategies.

- Statistical Arbitrage

Statistical arbitrage involves identifying and exploiting short-term mispricings between correlated assets. This can be done by developing complex statistical models that predict price movements based on historical data.

Pros:

Can be applied to a wide range of markets and instruments.

Profitable in both trending and volatile markets.

Cons:

Requires extensive data and advanced statistical models.

Involves high transaction costs due to the frequency of trades.

Managing Risks in High-Frequency Trading

High-frequency trading can be highly profitable, but it also comes with substantial risks. Some of the most common risks include:

Market Risk: The possibility that market movements may go against your positions.

Technology Risk: The risk of system failures, latency issues, or software bugs.

Liquidity Risk: The risk that there may not be enough market participants to execute your orders at desired prices.

Risk Management Techniques:

Automated Risk Monitoring: Implement real-time risk management systems that track positions and exposure.

Circuit Breakers: Use algorithms to automatically halt trading if certain risk thresholds are breached.

Diversification: Spread your strategies across multiple assets to minimize risk exposure.

Frequently Asked Questions (FAQs)

- How can I make high-frequency trading profitable?

Profit in high-frequency trading comes from executing a large number of trades and capturing small price movements. To increase profitability, focus on reducing transaction costs, improving execution speed, and continually optimizing your algorithms.

- What is the best programming language for high-frequency trading?

C++ is the most commonly used language in high-frequency trading due to its speed and efficiency. However, Python and Java are also widely used for developing and testing strategies, particularly in research and backtesting.

- Can I start high-frequency trading with a small capital?

Starting with high-frequency trading usually requires significant capital, especially for infrastructure and co-location services. However, you can begin by experimenting with algorithmic trading on smaller platforms and gradually scale as you gain experience and funds.

Conclusion

High-frequency trading offers significant opportunities but also presents substantial challenges. Success in this field requires a deep understanding of both the technology and the financial markets. By mastering algorithmic models, investing in the right infrastructure, and managing risks effectively, you can develop profitable HFT strategies. Whether you’re an aspiring trader or an experienced professional, this guide provides you with the essential knowledge to navigate the world of high-frequency trading.

If you’re ready to explore further or share your thoughts, feel free to leave a comment below, and don’t forget to share this guide with your network!

0 Comments

Leave a Comment