In the world of trading, time series analysis is a critical tool used to model, forecast, and optimize trading strategies. By analyzing historical price data and other time-dependent variables, traders can predict future market movements with greater accuracy. Whether you’re a beginner or an experienced trader, mastering time series analysis is crucial for success in the financial markets. This article will explore comprehensive time series analysis tools for trading, their applications, benefits, and the best strategies to leverage them effectively.

What is Time Series Analysis in Trading?

Before diving into the tools, let’s define time series analysis. Time series analysis refers to the process of analyzing data points collected or recorded at specific time intervals. In trading, this data often includes price movements, volume, and other market indicators that are collected at fixed intervals (e.g., daily, hourly, or minute-by-minute).

Time series analysis helps traders identify patterns, trends, and seasonality within the data, allowing them to forecast future price movements and optimize their strategies accordingly. For example, by examining past price movements of a stock, traders can identify recurring trends such as upward movements, downward movements, or cycles, and predict where the price might go next.

Why Time Series Analysis is Essential for Trading

- Predicting Future Price Movements

By analyzing historical price data, time series models can forecast future price movements with a high degree of accuracy. This allows traders to make informed decisions, whether they’re engaged in short-term trading, long-term investing, or high-frequency trading.

- Optimizing Trading Strategies

Time series analysis helps refine trading strategies by enabling traders to test different hypotheses about the market. By backtesting strategies using historical data, traders can determine which methods are most effective and adjust their approaches to maximize returns.

- Understanding Market Trends and Cycles

Markets often exhibit trends (bull or bear) and cycles (seasonal or economic), which time series analysis can help identify. Recognizing these patterns enables traders to time their entries and exits more effectively and anticipate market behavior.

- Managing Risks

Using time series analysis tools can also help manage risk by predicting potential volatility and sudden market movements. Traders can adjust their strategies accordingly to avoid large losses and take advantage of opportunities.

Comprehensive Time Series Analysis Tools for Trading

Now, let’s dive into the specific time series analysis tools that traders use to analyze data and improve their trading strategies.

- Moving Averages

Moving averages (MAs) are among the most widely used time series analysis tools in trading. A moving average smooths out price data to identify trends over a certain period.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is calculated by taking the arithmetic mean of a set of prices over a defined number of periods. It’s used to smooth out short-term fluctuations and highlight longer-term trends.

Pros: Easy to understand and implement; useful for identifying trends.

Cons: Lags behind the price action and is less responsive to sudden changes in the market.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) gives more weight to the most recent prices, making it more responsive to recent price movements compared to the SMA.

Pros: More sensitive to recent market conditions and better for short-term traders.

Cons: More prone to whipsaws (false signals) in volatile markets.

- Autoregressive Integrated Moving Average (ARIMA)

The ARIMA model is a more advanced tool used in time series analysis. It’s widely used for forecasting future prices based on past observations. The model takes into account three main components:

AR (Autoregressive): Predicts future values based on previous values.

I (Integrated): Removes trends by differencing the data.

MA (Moving Average): Corrects residual errors.

Advantages of ARIMA

Robust Forecasting: ARIMA is highly effective for stationary data, where the data’s statistical properties don’t change over time.

Widely Used in Financial Markets: ARIMA is extensively used in financial markets for predicting stock prices, interest rates, and other financial indicators.

Disadvantages of ARIMA

Complexity: Requires more in-depth knowledge of time series analysis and model fitting.

Stationarity Requirement: ARIMA works best on stationary data and may need to be adjusted for non-stationary data (like stock prices).

- GARCH Models (Generalized Autoregressive Conditional Heteroskedasticity)

The GARCH model is primarily used to estimate the volatility of returns, which is a critical factor in risk management and options pricing. GARCH models help identify periods of high or low volatility, making them essential for managing market risk.

Advantages of GARCH

Effective Volatility Forecasting: Provides a better understanding of market risk by forecasting future volatility based on past data.

Widely Used in Options Trading: GARCH models are heavily relied upon in options pricing and hedge fund strategies.

Disadvantages of GARCH

Requires Advanced Knowledge: GARCH models are more complex and require a solid understanding of econometrics and statistical modeling.

Data Intensive: The model requires a large amount of high-quality data to be accurate.

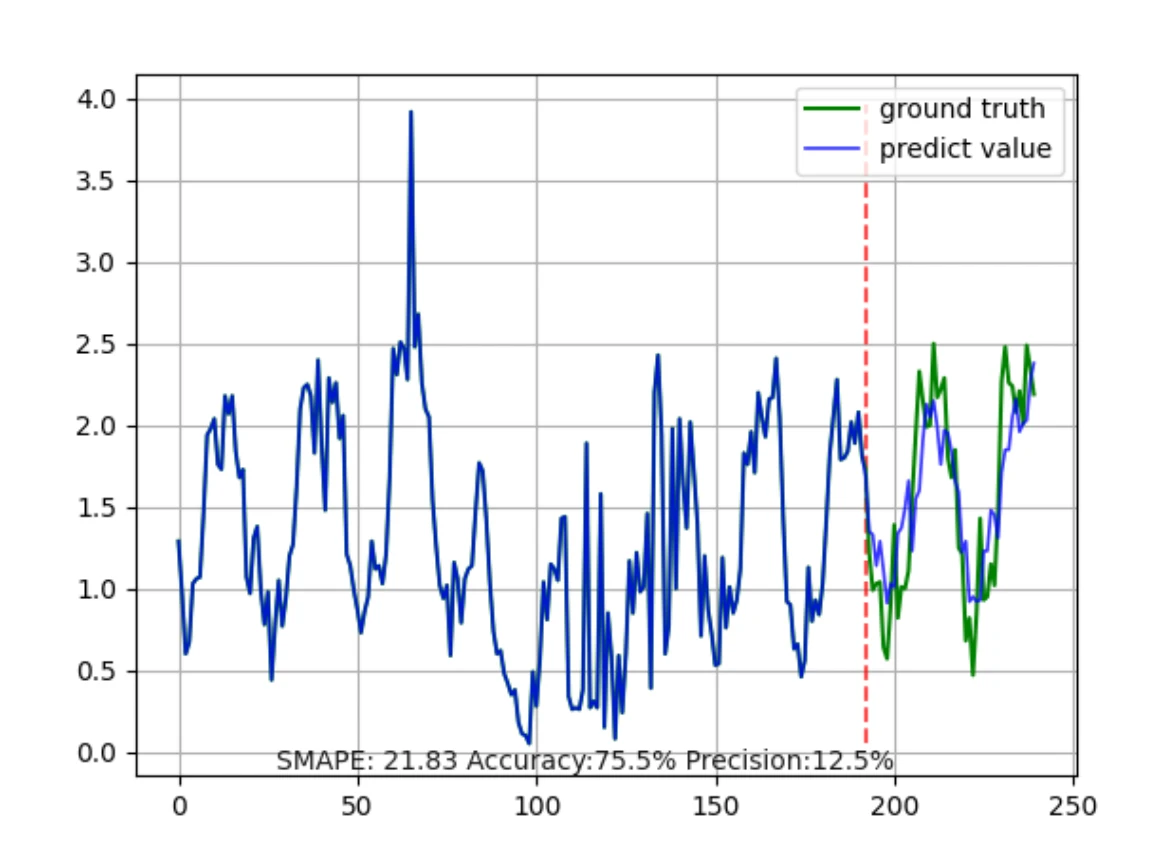

- Machine Learning and AI-Based Models

With advancements in machine learning (ML) and artificial intelligence (AI), these tools have become integral to time series analysis for trading. Algorithms like Random Forests, Support Vector Machines (SVMs), and Deep Learning Neural Networks are capable of analyzing vast amounts of data and identifying hidden patterns that traditional models may miss.

Advantages of ML and AI-Based Models

Superior Accuracy: Machine learning models can process vast datasets and identify complex, non-linear relationships between variables.

Adaptability: These models can adapt and improve over time as they are exposed to more data.

Disadvantages of ML and AI-Based Models

Complexity: These models require expertise in data science, programming, and machine learning to implement and optimize effectively.

Overfitting Risk: There’s a risk that the model may become too specialized to past data and perform poorly on new, unseen data.

- Time Series Decomposition

Time series decomposition involves breaking down a time series into three components: trend, seasonality, and residuals. This process is particularly useful in identifying recurring patterns and understanding the underlying structure of the data.

Advantages of Time Series Decomposition

Clear Insights: Helps traders separate long-term trends from short-term fluctuations and seasonal effects, leading to more informed trading decisions.

Improves Forecasting Accuracy: By understanding the seasonal and trend components, traders can refine their forecasts.

Disadvantages of Time Series Decomposition

Requires Clean Data: Time series decomposition works best with clean, well-structured data. Noisy or irregular data can distort the results.

Limited for Complex Patterns: For very volatile markets, decomposition methods might not fully capture all the complexities.

How to Use Time Series Analysis in Quantitative Trading

- Backtesting Strategies

Time series analysis is commonly used to backtest trading strategies. By using historical price data, traders can simulate how their strategy would have performed in the past. This is an essential part of any quantitative trading approach, as it helps identify the robustness of the strategy.

- Forecasting Market Movements

Time series models, like ARIMA or machine learning models, are used to predict future market movements. Traders use these forecasts to adjust their positions and make decisions about when to buy or sell assets.

- Risk Management

Time series analysis tools like GARCH models help in forecasting market volatility, which is crucial for risk management. Traders use these models to set stop-loss levels, adjust position sizes, and diversify portfolios effectively.

FAQ: Comprehensive Time Series Analysis Tools for Trading

- What are the best time series analysis tools for beginners?

For beginners, it’s recommended to start with moving averages and time series decomposition. These tools are relatively simple to understand and implement, and they provide valuable insights into market trends and seasonality.

- How can I use time series analysis for predicting stock prices?

To predict stock prices, start with tools like ARIMA or machine learning models that forecast future price movements based on historical data. Be sure to backtest your models and account for volatility and seasonality.

- What are the risks of using time series models in trading?

Time series models can be prone to errors such as overfitting, where a model works well on historical data but fails to predict future market movements. Additionally, the complexity of some models, like GARCH or machine learning models, may require extensive data and knowledge to implement correctly.

Conclusion

Mastering time series analysis tools is essential for traders looking to improve their strategies and enhance their market forecasting capabilities. By understanding and leveraging tools like moving averages, ARIMA, GARCH models, and machine learning techniques, traders can gain a significant edge in predicting future price movements, managing risk, and optimizing trading strategies. Start with simple methods and gradually explore more advanced techniques to become a proficient time series analyst in the world of trading.

Are you ready to dive deeper into time series analysis and transform your trading strategies? Let us know how you use time series tools in

0 Comments

Leave a Comment