=================================================

Introduction

The rise of data-driven investing has transformed the way professionals and individuals approach markets. Instead of relying solely on intuition, investors now use models, statistics, and algorithms to build portfolios that optimize returns while managing risk. Knowing how to construct a quantitative trading portfolio is not just a skill for hedge funds—it has become essential knowledge for retail traders, analysts, and institutional investors alike.

This article will provide a comprehensive step-by-step guide on constructing a quantitative trading portfolio, compare two different approaches, and integrate the latest industry practices. Drawing on personal experience and expert strategies, we will also explore tools, risk management techniques, and performance evaluation methods that make a portfolio robust and future-ready.

Understanding Quantitative Portfolios

A quantitative portfolio is built using mathematical models, historical data, and algorithmic processes. Instead of making decisions based on subjective analysis, traders rely on quantitative frameworks to optimize asset allocation, manage risks, and enhance returns.

Key characteristics of a quantitative portfolio include:

- Rule-based decision-making (e.g., allocation, rebalancing).

- Backtesting strategies on historical data.

- Dynamic risk management with statistical tools.

- Automation through trading platforms and software.

Why Quantitative Portfolio Construction Matters

- Eliminates emotional bias – Data-driven systems reduce fear and greed.

- Improves diversification – Quant models optimize asset combinations.

- Enhances performance – Systematic rebalancing ensures efficient capital use.

- Manages risk effectively – Volatility and drawdown controls prevent extreme losses.

These benefits explain why is portfolio diversification important and why rebalancing strategies are key to long-term growth.

Step-by-Step Guide: How to Construct a Quantitative Trading Portfolio

Step 1: Define Objectives and Constraints

Every portfolio starts with a clear investment goal. Are you maximizing returns, minimizing volatility, or balancing both? Define:

- Investment horizon (short-term, long-term).

- Risk tolerance (conservative, moderate, aggressive).

- Capital availability and liquidity needs.

Step 2: Select Assets and Data Sources

A solid quantitative portfolio requires diverse asset classes such as:

- Equities (stocks, ETFs).

- Fixed income (bonds).

- Commodities (gold, oil).

- Cryptocurrencies (Bitcoin, Ethereum).

- Alternative assets (real estate funds, private equity).

Reliable data sources include Bloomberg, Quandl, and exchange APIs.

Step 3: Apply Quantitative Models

There are multiple portfolio construction models. Two of the most widely used are:

1. Mean-Variance Optimization (MVO)

- Concept: Balances return vs. risk by analyzing expected returns and covariance between assets.

- Advantages: Well-established, mathematically proven.

- Disadvantages: Highly sensitive to input errors; historical data may not reflect future conditions.

2. Risk Parity Approach

- Concept: Allocates capital based on risk contribution instead of absolute returns.

- Advantages: Creates stability by equalizing portfolio risk.

- Disadvantages: May underperform in trending bull markets.

Step 4: Backtest Strategies

Before implementation, simulate the strategy on historical data:

- Measure Sharpe ratio, Sortino ratio, and drawdowns.

- Stress test under different market conditions.

- Validate with out-of-sample testing.

Step 5: Implement Risk Management Rules

Key risk management techniques include:

- Position sizing – limiting exposure per asset.

- Stop-loss and take-profit levels.

- Dynamic rebalancing to maintain target weights.

Learning how to manage risk in a quantitative portfolio ensures sustainability and prevents catastrophic losses.

Step 6: Execute and Automate

Use trading software such as MetaTrader, QuantConnect, or Python-based custom scripts to automate trades. Automation minimizes human error and increases consistency.

Step 7: Monitor and Rebalance

Rebalancing is critical to maintain the strategy’s integrity. This may be done quarterly, monthly, or even daily depending on volatility. Regular monitoring ensures alignment with risk and return objectives.

Comparison: Mean-Variance Optimization vs Risk Parity

| Feature | Mean-Variance Optimization | Risk Parity |

|---|---|---|

| Focus | Maximize return per unit risk | Equalize risk contribution |

| Advantage | Strong in bull markets | Stability in volatile conditions |

| Limitation | Sensitive to input errors | May lag in high-growth cycles |

| Best For | Aggressive investors | Risk-averse investors |

Recommendation: A hybrid approach works best—using MVO for return optimization while incorporating risk parity to maintain balance.

Visualization

Efficient frontier graph showing the trade-off between risk and return in portfolio optimization.

Tools for Quantitative Portfolio Construction

- Portfolio Analysis Software: QuantConnect, Backtrader, Portfolio Visualizer.

- Data Analytics: Python (pandas, NumPy), R, MATLAB.

- Visualization: Tableau, Power BI, custom dashboards.

These tools are especially useful when exploring where to find portfolio analytics tools for real-time analysis and performance tracking.

Best Practices in Quantitative Portfolio Building

- Diversify across asset classes.

- Use robust backtesting with realistic assumptions.

- Incorporate transaction costs and slippage.

- Regularly monitor correlations.

- Continuously adapt models to new market data.

Emerging Trends in Quantitative Portfolio Management

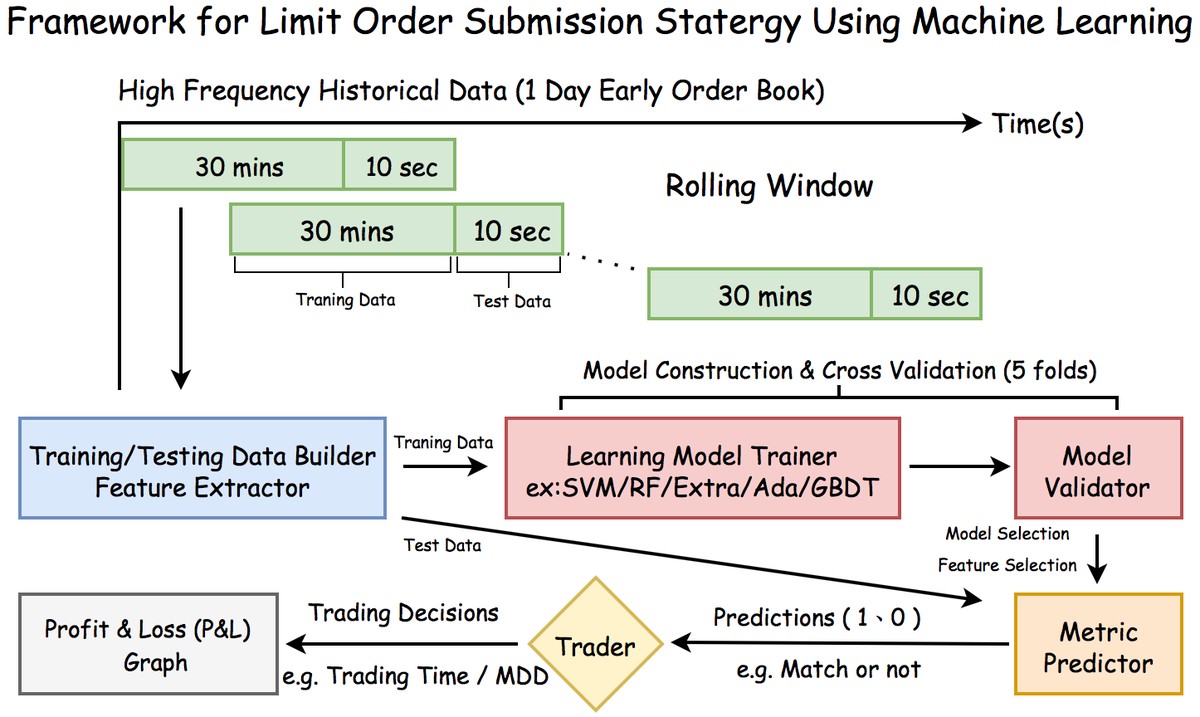

- AI and Machine Learning – Neural networks for predictive allocation.

- Alternative Data Integration – Using social sentiment, satellite imagery, and blockchain data.

- Crypto Quant Strategies – Incorporating decentralized finance assets.

- Factor Investing – Smart beta portfolios based on momentum, value, and quality.

FAQ (Frequently Asked Questions)

1. What is the best method to construct a quantitative portfolio?

There is no single “best” method. For aggressive investors, mean-variance optimization works well. For conservative investors, risk parity provides stability. A hybrid approach balances both.

2. How often should a quantitative portfolio be rebalanced?

It depends on volatility and strategy. Most professional investors rebalance quarterly, but high-frequency quant portfolios may rebalance daily.

3. Can retail traders build a quantitative portfolio?

Yes. With open-source tools like Python and free datasets, retail traders can build and backtest strategies. Start small and learn step-by-step with guides such as how to build a quantitative portfolio.

Conclusion

Knowing how to construct a quantitative trading portfolio is crucial for both beginners and professionals. By combining quantitative models, proper diversification, robust backtesting, and disciplined risk management, investors can design portfolios that outperform traditional strategies.

As technology evolves, integrating AI, machine learning, and real-time analytics will become essential. The key takeaway is this: a well-structured quantitative portfolio is not just about returns—it’s about resilience, adaptability, and long-term sustainability.

Now I’d love to hear from you:

- Do you prefer mean-variance optimization or risk parity?

- Have you used AI tools in your portfolio strategies?

Share your thoughts in the comments and pass this article on to colleagues or friends who want to take their trading portfolio to the next level.

0 Comments

Leave a Comment